proelite

Junior Member

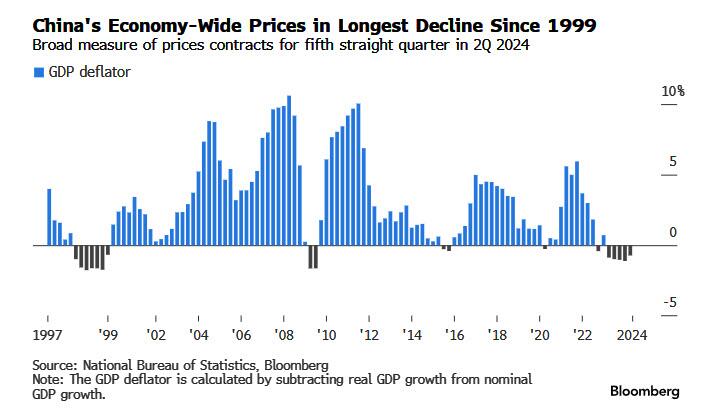

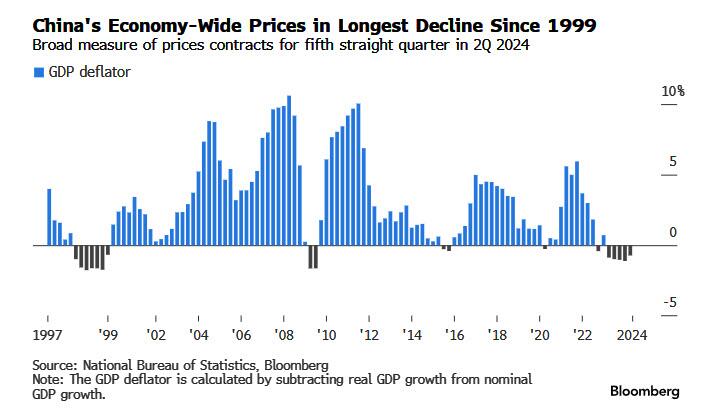

Ye, looking at the old years it looks like deflation sucks I remember 2015, and the economy sucked that year

So this graph is telling me we're at the end of a 25-year-old cycle.

Ye, looking at the old years it looks like deflation sucks I remember 2015, and the economy sucked that year

So this graph is telling me we're at the end of a 25-year-old cycle.

Coincidentally, real estate market was formally liberalized in 1998:

It is instrumental to read what happened to the financial system in 1998 and how massive of a fiscal package was done to resolve the non performing loans in the banking system:

Ergo, sitting on hands while doing nothing today, while facing the continued real estate market implosion, is not going to cut it.

The longer this drags on the bigger the package is necessary.

None of these issues, by the way, are in anyway contradictory to the highly successful "Industrial Upgrade Theme" that takes up 99% of the mindshare of people in this thread.

Coincidentally, real estate market was formally liberalized in 1998:

It is instrumental to read what happened to the financial system in 1998 and how massive of a fiscal package was done to resolve the non performing loans in the banking system:

Ergo, sitting on hands while doing nothing today, while facing the continued real estate market implosion, is not going to cut it.

The longer this drags on the bigger the package is necessary.

None of these issues, by the way, are in anyway contradictory to the highly successful "Industrial Upgrade Theme" that takes up 99% of the mindshare of people in this thread.

When have I ever said that it was ALL retirement driven?A + H + ADR, as clearly stated in Exhibit 5

Hey @doggydogdo & @Michaelsinodef is this rEtIrEmEnT driven too?

Cycles don't happen themselves - look at TSF growth in 2015 vs 2016 and 2020 vs 2021

Also, I'm in agreement with Glenn here as wellWhen have I ever said that it was ALL retirement driven?

Don't fucking go strawmanning.

Ps. I remember pretty clearly that you said it wasn't really worth posting on this forum and that you would stop, why ya back?

The dividends from the industrial investment in the past five years have not kicked in yet and the costs from a big real estate bubble burst had been contained pretty well and at any rate those costs are rapidly receding as the bubble unwinds.

China electricity usage increased 7% last year and is on track to grow 8% growth this year. What failing economy grows 7+% two years in row?

Any "huge" package gets us back into the imbalance that was created after 2008.

When have I ever said that it was ALL retirement driven?

Ps. I remember pretty clearly that you said it wasn't really worth posting on this forum and that you would stop, why ya back?

Also, I'm in agreement with Glenn here as well

??When you refused to acknowledge employment weakness in Beijing is due to economic weakness.

?