The US microchips industry has become increasingly anxious over the White House's reckless ban on Huawei Technologies, a major client for many American technology manufacturers, which worry about lost sales and an inevitable decline in their competence in the coming years.

A key feature of the microchips industry is that it is relying on digital devices makers to consume the chips, without which chip producers cannot achieve economies of scale and make a profit to support research and development, industry analysts said.

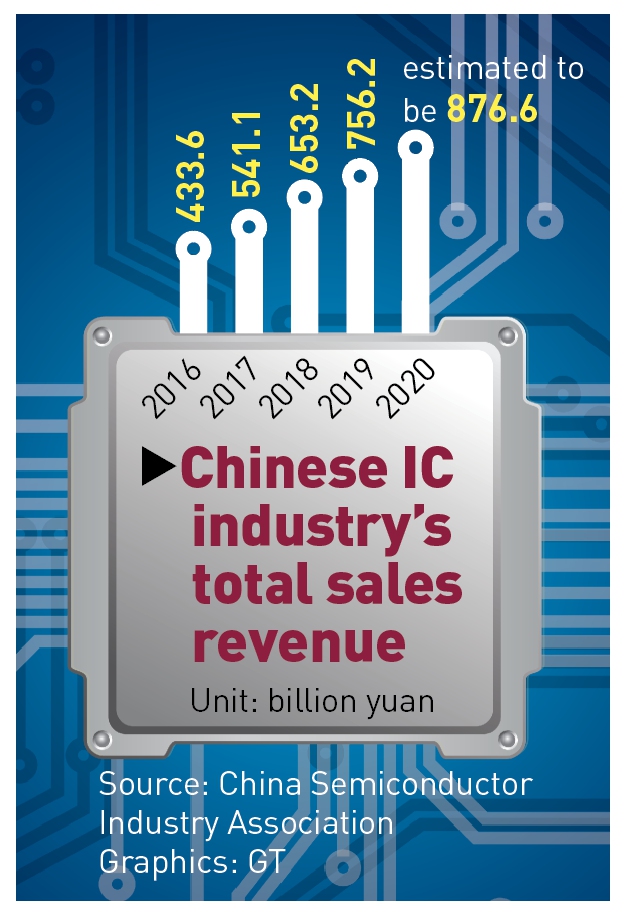

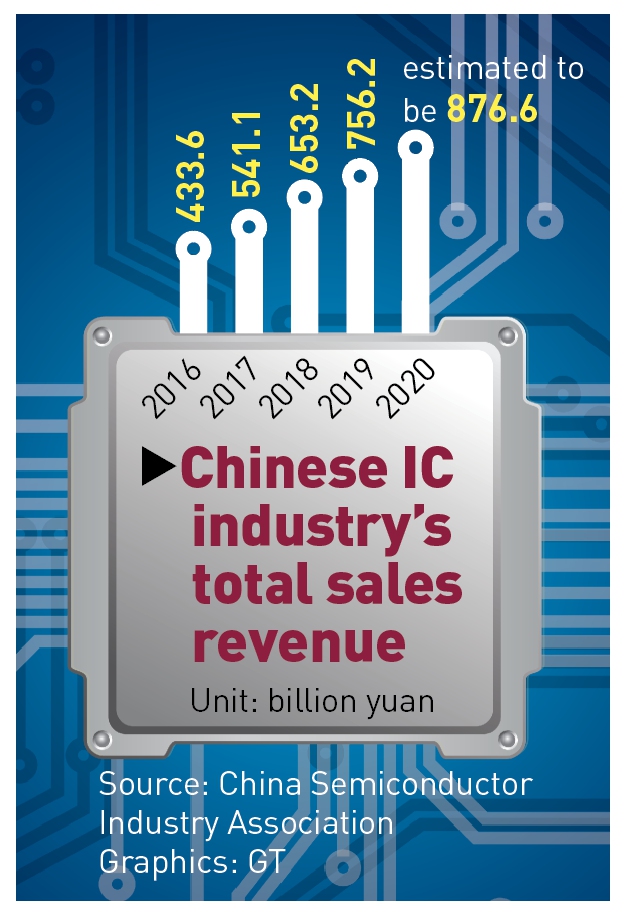

China is the largest chip consumer in the world, with a market scale equal to the total of the US, EU and Japan combined. In the first half of 2020, the rev-enue of China's chip industry rose 16.1 percent to reach 353.9 billion yuan ($51.46 billion). The full-year figure is likely to reach 876.6 billion yuan, ac-cording to data released at the second World Semiconductor Conference, held from Wednesday to Friday.

In addition to boosting the local chip industry, China has also ramped up im-ports to meet growing domestic demand. Wei Shaojun, a microelectronics and nano-electronics professor at Tsinghua University, said that China's chip imports in 2020 are expected to exceed $300 billion for the third consecutive year.

Graphics: GT

Geng Bo, deputy secretary-general of the China Solid State Lighting Alliance, a semiconductor industry association, told the Global Times Thursday that robust demand from Chinese high-tech firms and the vast consumer market have supported the growth of US chipmakers - not only financially but also in terms of feedback and data for their progress.

"Huawei has witnessed rapid growth in its customer-oriented products in re-cent years from smartphones to pads with state-of-the-art technologies, which helped boost the whole microchips industry," said Geng.

Continuation of the bilateral conflict could jeopardize US semiconductor companies' ability to do business in China on an equal footing with their competitors and could dent the estimated $49 billion of revenue that the US semiconductor industry derived from Chinese device manufacturers, according to a Boston Consulting Group report in March.

SEMI, the industry association serving the global electronics design and manufacturing supply chain, released a statement Monday saying the US Commerce Department's decision to significantly expand unilateral restrictions will likely lead to more lost sales, eroding the customer base for US-origin items.

"The new restrictions will also fuel a perception that the supply of US technology is unreliable and lead non-US customers to call for the design-out of US technology. Meanwhile, these actions further incentivize efforts to supplant these U.S. technologies," read the statement.

Previously, Qualcomm was reportedly lobbying the US government to allow it to sell chips to Huawei.

"Qualcomm has a mixed stance on the Huawei ban," Bryan Wong, principal researcher at the Suning Institute of Finance in Nanjing, East China's Jiangsu Province, told the Global Times on Thursday.

The US chipmaker might gain from the ban due to some areas of rivalry with Huawei. But there could be negative side effects for Qualcomm, Wong said, in terms of market response. "Many smartphone vendors like Xiaomi use Qualcomm chips, so if Qualcomm suspends chip supplies, it will lead domestic manufacturers to believe that the US company is unreliable as a supplier," Wong stated.

Concerns are already showing up in Qualcomm's sliding market share and profits in the Chinese market. Chinese market accounted for about 65 percent of the US firm's revenue, according to Wong.

Ma Jihua, a veteran industry analyst, warned of a slowdown in the develop-ment of the global chip industry, from research and development (R&D) to investment to chip manufacturing...

A key feature of the microchips industry is that it is relying on digital devices makers to consume the chips, without which chip producers cannot achieve economies of scale and make a profit to support research and development, industry analysts said.

China is the largest chip consumer in the world, with a market scale equal to the total of the US, EU and Japan combined. In the first half of 2020, the rev-enue of China's chip industry rose 16.1 percent to reach 353.9 billion yuan ($51.46 billion). The full-year figure is likely to reach 876.6 billion yuan, ac-cording to data released at the second World Semiconductor Conference, held from Wednesday to Friday.

In addition to boosting the local chip industry, China has also ramped up im-ports to meet growing domestic demand. Wei Shaojun, a microelectronics and nano-electronics professor at Tsinghua University, said that China's chip imports in 2020 are expected to exceed $300 billion for the third consecutive year.

Graphics: GT

Geng Bo, deputy secretary-general of the China Solid State Lighting Alliance, a semiconductor industry association, told the Global Times Thursday that robust demand from Chinese high-tech firms and the vast consumer market have supported the growth of US chipmakers - not only financially but also in terms of feedback and data for their progress.

"Huawei has witnessed rapid growth in its customer-oriented products in re-cent years from smartphones to pads with state-of-the-art technologies, which helped boost the whole microchips industry," said Geng.

Continuation of the bilateral conflict could jeopardize US semiconductor companies' ability to do business in China on an equal footing with their competitors and could dent the estimated $49 billion of revenue that the US semiconductor industry derived from Chinese device manufacturers, according to a Boston Consulting Group report in March.

SEMI, the industry association serving the global electronics design and manufacturing supply chain, released a statement Monday saying the US Commerce Department's decision to significantly expand unilateral restrictions will likely lead to more lost sales, eroding the customer base for US-origin items.

"The new restrictions will also fuel a perception that the supply of US technology is unreliable and lead non-US customers to call for the design-out of US technology. Meanwhile, these actions further incentivize efforts to supplant these U.S. technologies," read the statement.

Previously, Qualcomm was reportedly lobbying the US government to allow it to sell chips to Huawei.

"Qualcomm has a mixed stance on the Huawei ban," Bryan Wong, principal researcher at the Suning Institute of Finance in Nanjing, East China's Jiangsu Province, told the Global Times on Thursday.

The US chipmaker might gain from the ban due to some areas of rivalry with Huawei. But there could be negative side effects for Qualcomm, Wong said, in terms of market response. "Many smartphone vendors like Xiaomi use Qualcomm chips, so if Qualcomm suspends chip supplies, it will lead domestic manufacturers to believe that the US company is unreliable as a supplier," Wong stated.

Concerns are already showing up in Qualcomm's sliding market share and profits in the Chinese market. Chinese market accounted for about 65 percent of the US firm's revenue, according to Wong.

Ma Jihua, a veteran industry analyst, warned of a slowdown in the develop-ment of the global chip industry, from research and development (R&D) to investment to chip manufacturing...