You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

couple of more things on gallium

CSIS out with report on importance & national security threat around it

Given this is what Raytheon is saying, using national security ground to ban its export is pretty reasonable

I've found that Suzhou Nawei (苏州纳维) is the top producer in the world for 2-inch GaN substrate. Now consider that GaN substrate typically aren't used for RF chips, I think this is more for power applications. But still, they'd want to dominate this more. Not sure if they will allow its export or only have it provide local firms Either way, will need to see if they can grow this to 4/6-inch more consistently

Says here they produce 50k wafers per year of GaN. Still some work to mass produce 4/6 inch substrate

GaN Industrial chain in China

Innoscience chips already used in Lidar, data center, 5G communication, high density fast chargers, wireless chargers, car charger, LED light.

more from innoscience. It's got sme new products to show. I mean of all the companies, you have to be the most bullish for Innoscience future. It already has an advantage over the market. If they can trip up all its competitors, then it can become utterly dominant here

Just in Q1, it shipped 50 million GaN chips w/ 150m RMB in revenue, 4x last year (on the flip side, see how this is still not that much compared to the revenue Guobo makes from its military orders & RF chips?. I find this revenue number a little suspicious. seems on the low side)

Looks like there are more players now, but Innoscience had 16% market share last year in power GaN chips. If it's increasing by 4x in revenue YoY for Q1, then it should really be gaining market share this year

They are like the boy who cried wolf -- keep screaming about national security concerns and now a real national security concern has arrived.

i find often 2 years in China for these big projects from start of construction to low rate production, so maybe a little faster than what you are stating here. Of course, could always be delayed by equipment delivery delaysIt typically takes 2 years to build the factory building shell, 1 year to move machine tools in, and another year to ramp up the production line to full production.

Definitely. Ga is typically your industry where economic value does not come close to show its security importance. I'm really surprised that wolfspeed claims they will not have problem getting supplies. Let's see. 2% of production in 2020 was from countries outside of China, Ukraine & Russia. No idea where they think they are getting all the Gallium fromThey are like the boy who cried wolf -- keep screaming about national security concerns and now a real national security concern has arrived.

Definitely. Ga is typically your industry where economic value does not come close to show its security importance. I'm really surprised that wolfspeed claims they will not have problem getting supplies. Let's see. 2% of production in 2020 was from countries outside of China, Ukraine & Russia. No idea where they think they are getting all the Gallium from

According to Bard (recently started to give useful answers):

In 2018, global gallium consumption was estimated to be 340 tons. The top consumers of gallium are China, Japan, the United States, and Europe. The main uses of gallium are in the production of light-emitting diodes (LEDs), laser diodes, and gallium arsenide (GaAs) semiconductors."

Here is a breakdown of gallium consumption for semiconductors by application (excluding LEDs):

- Gallium arsenide (GaAs) transistors: 100 tons

- Gallium arsenide lasers: 50 tons

- Other gallium-based semiconductors: 75 tons

I guess military applications will be the last one to suffer, eventually it will be a problem mainly for LEDs....but they are already made in China anyhow, so the real impact is not clear at this point. The needed quantity of Gallium per wafer is very small and military applications don't require high volume of wafers.

Last edited:

View attachment 116233

Intel's CEO threatened the White House that if we are not allowed to sell chips to the Chinese, we won't build those chip factories in the United States..

If there is no order from China, there is no need to build the world's largest chip manufacturing base..

This is just the beginning. LMAO

I'm afraid they won't listen to him, although they should. Intel is the posterchild of the US semiconductor company and Gelsinger is the posterchild of the US CEO....but the ball is already rolling, it can't be stopped, not by this administration.

The need for gallium varies with the process in question. For GaN on silicon carbide for example you only need a tiny amount of gallium which is added thinly on top of the silicon carbide wafer with a CVD process. But GaA is often done with actual gallium arsenide single crystals and wafers.

Last edited:

According to Bard (recently started to give useful answers):

I guess military applications will be the last one to suffer, eventually it will be a problem mainly for LEDs....but they are already made in China anyhow, so the real impact is not clear at this point. The needed quantity of Gallium per wafer is very small and military applications don't require high volume of wafers.

Thanks for the numbers. here are some to think about

2021 production

China 420t

Japan 3t

Korea 2t

Russia 5t

So just 5t out of 430t are accessible to Western companies if China does a full sanction on this.

Also China exported 94t raw Ga in 2022. Not sure how many ton of GaA and GaN wafers it exported

Here are other things to think about

So, you can extract Ga from different bauxite production, but ones outside China may have low Ga content & it may be really hard to extract them without the experience of doing so like Chinese alumina refineries. On top of that, keep in mind that Chinese refineries get them naturally as part of a very energy intensity industry to produce alumina (that's the main money maker). So any factories outside China would get lower yield (maybe really low yield) trying to extract Ga from bauxite without an end user (since what do they do with all that Alumina if China is the biggest consumer of that?). Much higher cost may not be an issue, who knows.Primary low-purity (99.99%-pure) gallium prices in China increased by an estimated 25% in 2021, to $345 per kilogram in October from approximately $275 per kilogram at yearend 2020. This followed a 96% increase in China’s primary low-purity gallium prices in 2020, to $275 per kilogram in December from $140 per kilogram in January. The increases in China’s gallium prices resulted from several issues. Environmental restrictions placed on Chinese bauxite production in 2019 compelled the country’s alumina refineries to import bauxite with lower gallium content from abroad, which increased gallium extraction costs. When the global COVID-19 pandemic reduced gallium demand in early to mid-2020, Chinese gallium producers slowed or shut down operations. Chinese gallium supply was scarce when gallium demand resumed in the second half of 2020, and gallium prices increased significantly in the last quarter of 2020, continuing through 2021.

But Chinese report does claim that 68% of recoverable Ga is physically in China. Clearly, China also imports bauxite from other countries (so it's not just emptying out its own stash)

so most of these foreign Ga producers closed their business several years ago. Only one with a little capacity is Japan, which apparently also has high purity type (the good stuff). Meaning you have to rebuild the skill set & the bauxite production to produce Ga. How long does that take?The remaining primary low-purity gallium producers outside of China most likely restricted output owing to a large surplus of primary gallium that began in 2012. These producers included Japan, the Republic of Korea, and Russia. Germany and Kazakhstan ceased primary production in 2016 and 2013, respectively. However, owing to the increase in gallium prices in 2020 and 2021, Germany announced that it would restart primary gallium production by the end of 2021. Hungary and Ukraine were thought to have ceased primary production in 2015 and 2019, respectively. High- purity refined gallium production in 2021 was estimated to be about 225,000 kilograms, a 5% increase from that in 2020. China, Japan, Slovakia, and the United States were the known principal producers of high-purity refined gallium. The United Kingdom ceased high-purity refined gallium production in 2018. Gallium was recovered from new scrap in Canada, China, Germany, Japan, Slovakia, and the United States. World primary low-purity gallium production capacity in 2021 was estimated to be 774,000 kilograms per year; high-purity refined gallium production capacity, 325,000 kilograms per year; and secondary high-purity gallium production capacity, 273,000 kilograms per year.

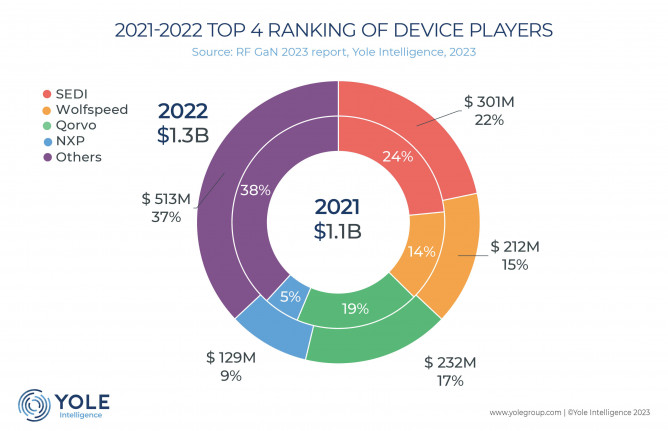

again, here is the breakdown of the top GaN RF producers

Based on the #s you provided. over 225t were needed for Ga semiconductors. That number is likely higher now due to natural growth of GaA & GaN market. Let's say 300t is needed for that. 5t of production was available from last yr. Germany unlikely have restarted production of it due to the energy intensive nature of Ga & its energy issues.

take a look at the GaA chart. Most of the wafers are produced by Japanese manufacturers. I don't know if they even understand how much capacity exists in China (hint a lot)

So for all of America's limited raw Ga import, it likely relied on quite a bit of GaA wafer import for Japan. Qorvo & Skywork are the largest GaA players. Without Japanese GaA wafers, I really wonder where their input is coming from?

good point. GaN substrate likely finished outside of China. GaA substrate is the big question. Do you sacrifice GaA wafer production in favor of GaN-on-Si/Sic or try to keep up as much of your GaA RF production as possible. GaA RF chips looks to be a $6B business for American firms. Keep in mind that Qorvo overall revenue in 2021 was only $4B, so this is large part of that.The need for gallium varies with the process in question. For GaN on silicon carbide for example you only need a tiny amount of gallium which is added thinly on top of the silicon carbide wafer with a CVD process. But GaA is often done with actual gallium arsenide single crystals and wafers.

So if you loose that, you have to downsize & reduce R&D. Remember, issue is not cutting off US defense industry Ga. That's not possible. But how it would affect companies supporting them and their product development (R&D) & production costs

Last edited:

From Nexchip's stock info material, 2024 DDIC market still expects just 12.7% of market to be sub 45nm. But expect this to be rapidly growing going forward. This tells me that although SMIC is behind Samsung & TSMC, it hasn't lost access to huge portion of pie. Although, this may be the highest revenue portion. Being able to produce 28-40nm DDIC chip from this year or next means SMIC will be able to compete with TSMC on the highest end DDIC market

another part from Nexchip

It expects to concentrate on 90/110/150nm process in its 12-inch plant. 55nm risk production just started

It's parent company Powerchip concentrates on 350nm to 25nm, so as a whole, they concentrate on mature chips.

Nexchip focused on developing MCU, CIS,, PMIC, Mini LED chips for 28 & 40nm segment. Again, major demand from Chinese industries in this segment.

That's why TSMC & UMC continue to add capacity. We may not like the increased competition on SMIC, but it also means less import from Korea.

Yes, South Korea is losing a lot of market share in sales of chips to China in part because of China now being able to make their own display controller chips which used to be imported. Some are contracted in general purpose foundries such as SMIC or Hua Hong, and there are dedicated foundries for display controller chips like Nexchip. In addition YMTC is undercutting South Korean NAND IDMs at the same time the industry is in a major slump and memory prices are crashing. China is still severely behind in DRAM technology however and there is no foreseeable solution for that given that the market is switching to EUV and China is banned from buying those machine tools. It would require some major change in technology in DRAM architecture to change this situation.

- Status

- Not open for further replies.