Don't want to make 5 eyes job too easy /sLastly, I must say that Chinese Internet is just full of nonsense. Chinese people are literally trying to destroying their own domestic companies with rumors like this

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

Adding $1.6 billion to that means they are more than doubling their Capex in Q4. Yes, I think this means accelerated deliveries from ASML and possibly Japanese tool makers. But more likely, this is mostly going in ASML direction.

Smart move. They are buying some more months with that money.

Now ASML / Japan have in their pocket $1.6 billion good reasons to withstand US pressure.

This is down-payment, so they would have to return the money in case of a ban. For sure not something that a firm does gladly.

well. Chinese netzines are extremely negative. most of have stuck in 90's. always try to downgrade own country's achievement. the problem is lack of information or they just don't bother to check.Lastly, I must say that Chinese Internet is just full of nonsense. Chinese people are literally trying to destroying their own domestic companies with rumors like this

i can bet, people like us know more about recent Chinese achievement.

well. Chinese netzines are extremely negative. most of have stuck in 90's. always try to downgrade own country's achievement. the problem is lack of information or they just don't bother to check.

i can bet, people like us know more about recent Chinese achievement.

Much, if not most, of the negativity on the Chinese internet are from overseas sources and not from actual mainland Chinese netizens. When Weibo started displaying ip locations of users, people found that much of the past negative posts and rumor mongering by people claiming to be local insiders were actually posted from Taiwan, US, UK, etc. It has also been observed that whenever Taiwan has a power outage, the amount of toxic discourse on mainland Chinese social media goes way down.

Last edited:

lots of 1450 people are stirring things too.well. Chinese netzines are extremely negative. most of have stuck in 90's. always try to downgrade own country's achievement. the problem is lack of information or they just don't bother to check.

i can bet, people like us know more about recent Chinese achievement.

1450 and the frogs and some people who believe in the west and don't believe in the development of China... I and my friend wared about semiconductor information with them, to the point that my weibo got warned twice...well. Chinese netzines are extremely negative. most of have stuck in 90's. always try to downgrade own country's achievement. the problem is lack of information or they just don't bother to check.

i can bet, people like us know more about recent Chinese achievement.

domestic tool makers have to come out and say that SMIC has not stopped purchasing domestic tools. Mature production line keep procuring new equipments. New production line needs some work.

Is a wild place for sure. A lot of speculative investors.

Bidding procurement still high.

I know were the sentiment come from, some Chinese companies designed their processes around US tools, as US companies depart, if critical process are hurt so will be non critical ones. Like YMTC who designed some process using KLA tools, their CEO maybe didn't wanted to wait the validation of similar tools in China, from RSICSH, Angstrom and Shanghai Jinhce. Who knows.

IMO.

-Chinese equipment manufacturers need to increase production capacity.

-Chinese foundries need to establish closer partnerships with local suppliers, secure supply chains, work-grow with them and design their process around trusted equipment suppliers. I know for sure SMIC has gotten closer to Wanye (not Wayne) enterprise, Jaixin, Naura, AMEC, PNC, SMEE and Etown. Other companies should follow it.

-Although most of China local tools come from the effort of China especial programs( like project 02 and 973) but more needs to be done, Chinese toolmakers need to establish even more closer partnerships with Chinese research institutes to reduce R&D cost and have access to a wider pool of talents, the goverment needs to lessen to cost of R&D at least for a while. The Shanghai Integrated Circuit Equipment Materials Industry Innovation Center is a great start but more needs to be done.

-Redesign manufacturing processes around Chinese-non US tools.

-Tap the talent left by this US companies, a guy who spend a decade repairing AMAT tools, surely know a thing or two.

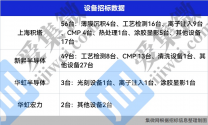

Kind of interesting that SMIC doesn't really do bids anymore. It looks like that for its Beijing Capital fab, almost everything is picking Chinese suppliers. For SN1/SN2, they probably also have fixed suppliers, since only a selected supplier can provide them with the tools they need.View attachment 101567

Is a wild place for sure. A lot of speculative investors.

Bidding procurement still high.

I know were the sentiment come from, some Chinese companies designed their processes around US tools, as US companies depart, if critical process are hurt so will be non critical ones. Like YMTC who designed some process using KLA tools, their CEO maybe didn't wanted to wait the validation of similar tools in China, from RSICSH, Angstrom and Shanghai Jinhce. Who knows.

IMO.

-Chinese equipment manufacturers need to increase production capacity.

-Chinese foundries need to establish closer partnerships with local suppliers, secure supply chains, work-grow with them and design their process around trusted equipment suppliers. I know for sure SMIC has gotten closer to Wanye (not Wayne) enterprise, Jaixin, Naura, AMEC, PNC, SMEE and Etown. Other companies should follow it.

-Although most of China local tools come from the effort of China especial programs( like project 02 and 973) but more needs to be done, Chinese toolmakers need to establish even more closer partnerships with Chinese research institutes to reduce R&D cost and have access to a wider pool of talents, the goverment needs to lessen to cost of R&D at least for a while. The Shanghai Integrated Circuit Equipment Materials Industry Innovation Center is a great start but more needs to be done.

-Redesign manufacturing processes around Chinese-non US tools.

-Tap the talent left by this US companies, a guy who spend a decade repairing AMAT tools, surely know a thing or two.

I dug through the press release a little more. This is from HKSE release

It says here that in Q2, they spent $1.67 billion in Capex followed by $1.82 billion in Q3. We know from other release that they spent $2.5 billion in all of H1. So based on this, the Quarterly Capex looks like:

- 2022 年第三季資本開支爲 1,822.3 百萬美元,相比 2022 年第二季爲 1,672.3 百萬美元。

- 2022 年計劃的資本開支從 50 億美元上調至 66 億美元,主要是為了支付長交期設備提前下單的預 付款。

Q1 $830 million

Q2 $1.67 billion

Q3 $1.82 billion

Q4 $2.3 billion

If I'm reading this correctly, the explanation is for prepayment of early delivery (提前下單) of long term contract. I can only assuming that they are speeding up the delivery of non-Chinese equipments.

Maybe, I'm reading too much into this, but on the Q2 earnings release, they described this about their product offering

and in Q3, they described it like this向全球客户提供0.35微米到14纳米不同技术节点的晶圆代工与技术服务

this is the first time they've used FinFET rather than 14nm has the most advanced process they do. It's been 14nm since 2019. I think they are finally moved on to really producing N+1 process in Q3. For the past 3 years, they've been raising yield on 14nm and maybe 12nm + trialed production of N+1 chips.向全球客户提供0.35微米到FinFET不同技术节点的晶圆代工与技术服务

Earnings call at 8:30-9:30AM Hong Kong time. Hopefully, I will be able to read the transcript tomorrow my time.

I guess once you have validated certain suppliers, if price isn't a factor (which I assume to be the case here) there isn't really much of a benefit in having a bidding process since that means lost time. Its safe to say they have a blank check or close to it in terms of financial support for expansion and advanced node development so in that case since the priority is placed on rollout so it would make sense to just continue placing orders with the existing vendors even if it means your financial efficiency is reduced.Kind of interesting that SMIC doesn't really do bids anymore. It looks like that for its Beijing Capital fab, almost everything is picking Chinese suppliers. For SN1/SN2, they probably also have fixed suppliers, since only a selected supplier can provide them with the tools they need.

- Status

- Not open for further replies.