And people are worried we can get access to Synapsys software. hahahahahaaI will tell you a funny story, back when I was a kid maybe 12 or 13 our family purchased very first computer a Packard Bell Pentium I at 75Mhz with one gig harddrive and 16mb ram running Windows 95.

I was very interested in cgi and animation and mspaint and corel painter I had outgrown. Few years later we upgraded to Windows 98 and this was at height of dot com bubble and every company was giving free samples, I got Discrete to mail me a CDROM with 3D Studio Max 3 on it as a fully functional 30 day timed trial...

This software retailed for $3500 USD, back then this was a lot of money more than my father monthly salary at the time, and as a young teenager my allowance was only $30 a month.

So after a month I thought I was smart and tried to uninstall and reinstall 3ds max to reset the timer. Didnt work.

So I decided to completely reformat the computer and reinstall Windows 98, but to my shock and surprise it still recognized the software had already been on the machine before. Even though I had not yet connected the computer online, since back then it was the sqeaky dial up modem from AOL discs...

Eventually I found out it was a French antipiracy software called "cdilla" that installed on my machine and wrote a sequence of numbers to the service sector of the harddrive that survives reformatting (back then I didnt know how to do a bit by bit low level reformat)

The full version of 3ds max 3 used a physical dongle that you had to keep plugged into the back of the computer motherboard via a rs232 serial port...

I tried to find a crack from the search engine altalavista but nothing ever came up... no one had published a workaround

I had given up all hope but during a family trip back to China over the summer I was browsing software selection (all pirated) on the streets with my cousin and lo and beheld I came across full working version of 3ds max and it was only 10 Chinese yuan... I told my parents I just saved enough from this to have covered our entire costs of vacation back home

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

Not long ago, a handful of domestic companies successfully developed 5G RF BAW filters and said they already started supplying some Chinese mainstream smartphone makers.They have found a solution regarding their RF problem.

Radio frequency for phones: Huawei doesn’t need U.S.

Donald Trump and others in D.C. are completely certain Huawei needs parts from America. That’s total hubris. Huawei designs its own custom chips for mobile, led by the Kirin 980 & 990. Screens, power supplies, and just about everything are available outside the US.

The one major exception – until now – was RF (radio frequency) parts. 5G phones must support over two dozen frequency bands. They must filter out unwanted signals, perform error correction, and amplify what often will be very weak signals, all at very high 5G speeds.

The problem is mostly solved. The top of the line Mate 30 only requires 2 US parts. Huawei and suppliers like Murata Japan will soon be able to replace those as well. Chinese universities and military suppliers already produce state of the art chips.

Skyworks, Qorvo, Qualcomm, and Broadcom, $200B of US companies, had been dominant. They will inevitably lose some orders. If the Huawei blockade becomes permanent or other Chinese phone companies switch to alternate suppliers, these companies will suffer. See

Susquehanna analyst Christopher Rolland reports, “After discussions with Huawei, we believe the company has found alternatives to most U.S. RF solutions, … There is a Chinese teardown of the Mate 30 5G making its rounds and garnering a lot of attention in the handset supply chain. In conclusion, the flagship handset uses very few American RF components (perhaps just a few QRVO and SWKS parts in the antenna tuning switch). To address 5G, the handset reportedly utilizes a Murata FEM. To address 4G, the handset reportedly utilizes a combination of both Murata and HiSilicon! While there is some debate about the components in the HiSilicon FEM, and where HiSilcon actually has the technical capabilities to do their own filtering, the part still garners its marking. We believe HiSilicon has been manufacturing a design of their own power amplifiers through Win Semi for some time now, but the full FEM would represent an increase in capabilities.”

“We expect China to be the biggest 5G smartphone market next year, but the trade war is likely to exclude US RF suppliers,” according to a research note from KeyBanc. “Feedback from Asia indicates Huawei plans to ship 100M 5G smartphones in 2020, which would represent over one third of the company’s shipments. With the U.S. entity ban list, we believe Huawei has most aggressively moved to non-U.S. sources of supply for RF, while other OEMs such as Oppo/Vivo and Xiaomi have also taken measures to increasingly source from non U.S.-suppliers, but to a more moderate shift as compared to Huawei. On the modem front, Huawei will use its internal HiSilicon-based Kirin 5G modem, while other Chinese OEMs are expected to use Mediatek’s 5G modem, which is expected to be ready by the end of the year.”

The trade war is also accelerating Huawei’s push towards internal ASICs and away from third-party FPGAs, according to KeyBanc. “Feedback from Asia indicates Huawei has been able to redesign its 5G base station in the baseband and the radio head or active antenna unit (AAU) to minimize the use of FPGAs. In some instances, we believe Huawei will only require the use of one XLNX FPGA in its base station,” according to the firm. “Huawei (is) aggressively transitioning its 5G base station platforms away from XLNX and toward HiSilicon ASICs

Chinese companies made breakthroughs in 5G radio frequency chip filters

03-18 17:20Edited by Li Panpan

Chinese companies are making breakthroughs in the 5G radio frequency chip filters to join the supplier list along with international giants.

Chinese listed analog chip companies Fuman Microelectronics(富满微) and Vanchip Tech(唯捷创芯)said their 5G RF chips have started supplies to Chinese mainstream mobile phone and ODM manufacturers. Industry observers call it a major indicator of technological progress by Chinese semiconductor companies.

According to statistics, the market value of the current global RF device market is about $15 billion; filters account for $8.1 billion. China used to depend heavily on imports for such products.

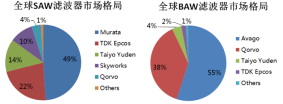

Mid-to-high-end filters can be mainly divided into surface acoustic waves (SAW) and bulk acoustic waves (BAW). Japan’s Murata mainly dominates the SAW filter market, and the BAW filter market is dominated by Broadcom, Skyworks, Qorvo, and Qualcomm, with extensive patents. Compared to them, the global market share of Chinese companies is tiny.

BAW filters have the advantages of high frequency and large bandwidth, slight insertion loss, large out-of-band attenuation, and are not sensitive to temperature changes, therefore being widely used.

MEMS company MEMSonics(武汉敏声) led BAW development in China. Last August, it started to build an 8-inch RF filter production line with Sai Microelectronics(赛微电子), the parent company of Silex, the world’s largest MEMS foundry and it is expected to be put into production by the end of 2022, with a production capacity of about 2,000 pieces per month.

With more than 100 technical patents, MEMSonics said that it can bypass AVAGO’s patent barriers with similar technology. It mastered the whole process of the high Scandium-doped Aluminum Nitride, the most challenging part of developing BAW filters.

Other Chinese companies have also made breakthroughs in the aluminum nitride material system.

Earlier in 2021, startup Ultratrend Technologies (奥趋光电) launched a self-developed sapphire-based aluminum-scandium-nitrogen thin-film template product. Its founder, Wu Liang, said it cooperates with leading downstream enterprises in China to manufacture a high-performance 5G FBAR/BAW/SAW filter.

Wu Liang added China’s overall industry ecosystem is still weak, and Chinese companies still depend to a considerable extent on overseas suppliers in simulation and design tools and production equipment. ”

As for the SAW filters, most Chinese companies’ products are with lower frequencies, for it is not as technically challenging as BAW.

However, the price war makes it difficult for them to increase gross profit and lengthens the payback period of early investment. With the upstream core materials controlled by Japanese companies such as Sumitomo Chemical and Shin-Etsu Chemical, the profits made by Chinese filter manufacturers reflow to Japanese companies through high-priced substrates.

Industry leader Murata leads in high-end SAW filter technology. Its IHP-SAW technology can achieve 2.5-3GHz and even higher frequency performance, way better than the traditional SAW filters with less than 1.8GHz.

Chinese companies are also working on high-end technology in SAW. Gao Yang’s team from Southwest University of Science and Technology and Ou Xin’s team from Shanghai Institute of Microsystems and the Chinese Academy of Sciences have made significant progress. And Gao Yang’s team established a joint laboratory of intelligent microsystems with OnMicro(昂瑞微), an active player in the Chinese 5G RF chip field.

The day china have independence on silicon chip technologies is the day Taiwan economy falls.From FocusTaiwan, I'm really felt the High from the effect of Copium and Hopium of this article...lol Justifying the sale of the Family Jewel is Because of CHYNNA.Well I have news for them, history will judge them harshly and will be condemn for being traitors of the Han race.

U.S.-led chip alliance aimed at curbing China influence: Analyst

08/21/2022 05:52 PM

Listen

Unsplash photo for illustrative purpose only

Taipei, Aug. 21 (CNA) A United States-led proposed chip alliance is aimed not only at boosting chip production but is also seen as a U.S. move to counter China's growing influence in the global chip market, a Taiwanese economic analyst said Sunday.

The Chip 4 alliance is a proposed alliance of semiconductor powerhouses in the U.S., Taiwan, Japan, and South Korea to enhance cooperation on the design and production of sophisticated semiconductors.

As a preliminary meeting of the alliance is reportedly expected to take place at the end of August or in early September, Taiwan's Ministry of Economic Affairs has proposed to continue collaborating with the U.S. on supply chain resilience and industrial cooperation as well as semiconductor supply security.

Roy Lee (李淳), deputy executive director of the Taiwan WTO & RTA Center at the Chung-Hua Institution for Economic Research, said that the ministry's proposal to cooperate on supply chain security was made with Taiwan's needs in mind.

Although Taiwan is strong in semiconductor foundries, it relies on the U. S. and Japan for the supply of equipment and materials, Lee said, adding that there are areas where the three countries are reliant on each other.

If the U.S. aims only to bring semiconductor production back home, it actually only needs to negotiate with individual countries, said Lee.

As such, it is believed that the U.S. may want to work with Taiwan, Japan, and South Korea to impose controls on semiconductor exports and technology outflows and thus form an anti-China group to exclude China from global semiconductor supply chains, Lee explained.

However, the U.S. proposal might put a certain amount of pressure on South Korea due to its economic ties with China, its biggest trade partner, so Washington wanted to first talk with Seoul to see whether it will join the Chip 4, said Lee.

China, including Hong Kong, accounts for almost 60 percent of the total exports of South Korean chips, according to a report in The Korea Herald, South Korea's largest English-language daily, which presents a dilemma for South Korea in having to choose between the technology of the U.S. and the market of China.

Regarding the pros and cons of Taiwan's participation in the Chip 4 alliance, Lee suggested that Taiwan should participate, given the close semiconductor links between Taiwan and the U.S., especially regarding supply chains and intelligence gathering.

Last month, the U.S. Congress passed the CHIPS Act of 2022 to strengthen domestic semiconductor manufacturing, design, and research. In addition, Washington has also been promoting the Chip 4 alliance and announced a ban on exports of advanced electronic design automation (EDA) software tools for 3-nm and other advanced chips to China in efforts to curb the development of China's chip industry.

You have a point bro, BUT IF China do achieved self sufficiency especially on DUVL and EUVL, I may see TSMC and other Taiwanese Tech company incorporated themselves in the Chinese economy. Right now they're hostage cause ASML is a monopoly and the American control a certain critical component, one piece can clog the whole process. So I'm certain the eventual reunification in Semiconductor sector can be achieved by 2026 IF the expected Chinese EUVL are being mass produced.The day china have independence on silicon chip technologies is the day Taiwan economy falls.

The American expected this as they are lurking on this forum and had read most of @Loveleenkr post...lol, joking aside the Chip Act is a product of that concern, they know that IF China had achieved FULL SPECTRUM IC independence, the Taiwanese and SK will migrate cause China aside from being the huge market, producing there will also be cheaper with local supply chain easily accessible, proximity and sanction proof.

Last edited:

It would be a real triumph when SMIC buys up the TSMC facilities on TaiwanYou have a point bro, BUT IF China do achieved self sufficiency especially on DUVL and EUVL, I may see TSMC and other Taiwanese Tech company incorporated themselves in the Chinese economy. Right now they're hostage cause ASML is a monopoly and the American control a certain critical component, one piece can clog the whole process. So I'm certain the eventual reunification in Semiconductor sector can be achieved by 2026 IF the expected Chinese EUVL are being mass produced.

The American expected this as they are lurking on this forum and had read most of @Loveleenkr post...lol, joking aside the Chip Act is a product of that concern, they know that IF China had achieved FULL SPECTRUM IC independence, the Taiwanese and SK will migrate cause China aside from being the huge market, producing there will also be cheaper with local supply chain easily accessible, proximity and sanction proof.

Bro we can also include the Koreans....lolIt would be a real triumph when SMIC buys up the TSMC facilities on Taiwan

Korea’s Exports Close to Stalling as Global Economy Cools

- Semiconductor sales fall, while exports to China drop as well

- Pressure is building on a key barometer of the global economy

12 hours ago — South Korea's early exports barely rose in August as geopolitical risks and central bank tightening weigh on the world economy.

broadsword

Brigadier

It would be a real triumph when SMIC buys up the TSMC facilities on Taiwan

Not gonna happen with DPP governing.

Yup they prefer selling it to the American for a song...lolNot gonna happen with DPP governing.

Or better yet, it could force them to buy local equipment, materials and software.Tech war: Taiwanese veteran who helped China’s memory chip progress says US-led Chip 4 Alliance could backfire on member countries -report

Non paywall:

Xinxingji launched the first self-developed intelligent layout planning tool AmazeFP

On August 22, 2022, Digital Realization EDA advanced solution provider Xinxingji Technology Co., Ltd. (hereinafter referred to as "Xinxingji") announced the launch of the first self-developed digital realization EDA product - AmazeFP intelligent layout planning tool.

AmazeFP combines machine learning technology with a layout planning engine. While taking into account performance, power consumption and area (PPA), it provides highly intelligent congestion awareness, convenient data flow analysis and automatic macro cell alignment functions, effectively solving the current digital chips. In the back-end design stage, the layout planning nodes are faced with problems such as high demand for experience value, long manual time-consuming, single data flow structure analysis method, and poor convergence in the later positioning of design problems. Reduce the number of iterations, thereby saving R&D costs for large-scale designs and speeding up time-to-market.

AmazeFP: Highly intelligent floorplanning tool

After the chip design enters the back-end design process, it will enter the stages of layout planning, standard cell placement, clock tree generation, routing, and optimization. With the continuous progress of advanced technology, the scale of design is expanding, and each design link takes longer. For example, a GPU module layout planning scheme may take dozens of iterations and weeks to be initially finalized. Module developers are also under huge time target pressure when dealing with the requirements of optimizing PPA, and chip layout planning, as the first step in the chip back-end design process, plays an important role as a cornerstone. Excellent layout planning can not only achieve better PPA, but also remove obstacles in advance for the subsequent steps of the design process, accelerate design convergence, and ensure smooth and high-quality project tapeout.

Integrating machine learning technology, with intelligent congestion awareness model, embedded data flow steering engine, automatic arrangement and alignment of macro cells and other new-generation digital implementation EDA software features, make AmazeFP superior in the process of layout planning.

▪ The machine learning technology adopted by AmazeFP quickly obtains high-quality macro cell layout ideas on the basis of timing, area, and power consumption factors, and provides preliminary layout planning;

▪ The intelligent congestion awareness model can greatly improve the accuracy of congestion prediction, and adjust the macrocell position accordingly to ensure the overall bypassability of the chip;

▪ The built-in data flow steering engine can automatically plan the placement of grouped macro cells, reduce the overall wiring length between modules, and accelerate the timing closure of the critical path of macro cells;

▪ The automatic alignment function can automatically generate a grid alignment window according to the macro cell selected by the user, which greatly saves the user's time for manually adjusting and aligning the macro cells.

AmazeFP Practical Use Cases

Case 1 is a video codec design module. The design includes 44 macro cells and the operating frequency is 1.5GHz. As shown in Figure 1, the left picture shows the manually placed macrocell layout determined by the engineer after several adjustments and iterations. The overall time is about three days. The right picture shows AmazeFP automatically after designing the data flow structure and routing congestion perception The placed macrocell layout has an overall runtime of 30 minutes. According to these two layout plans, after all the placement and routing work is completed, comparing the timing results, the global Setup WNS and Setup TNS of AmazeFP are improved by 4.8% and 9.1% respectively compared with the manual layout plan, of which the Reg2Reg Setup WNS is improved by 54.6% %, Reg2Reg Setup TNS improved by 86.1%. At the same time, the layout scheme provided by AmazeFP saves 5.7% of static power consumption.

- Status

- Not open for further replies.