the bonding pad to bonding pad "connection" is not soldered together. The bonding is achieved through van Der Waal force.A flip chip type of interconnect is interesting. I don't know the details but I envision something like patterning an interchip communication only bond pad on the edge of a chip which attaches to another bond pad on the edge of another chip, then soldered together and packaged. The chips collectively talk to the outside world through other bond pads on one or both of the chips.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

antiterror13

Brigadier

Actually this suggests something else. Because UFS 3.1 is the standard used by Android smartphones. Apple iOS devices use NVMe.

Correct, and NVMe is far superior to UFS

antiterror13

Brigadier

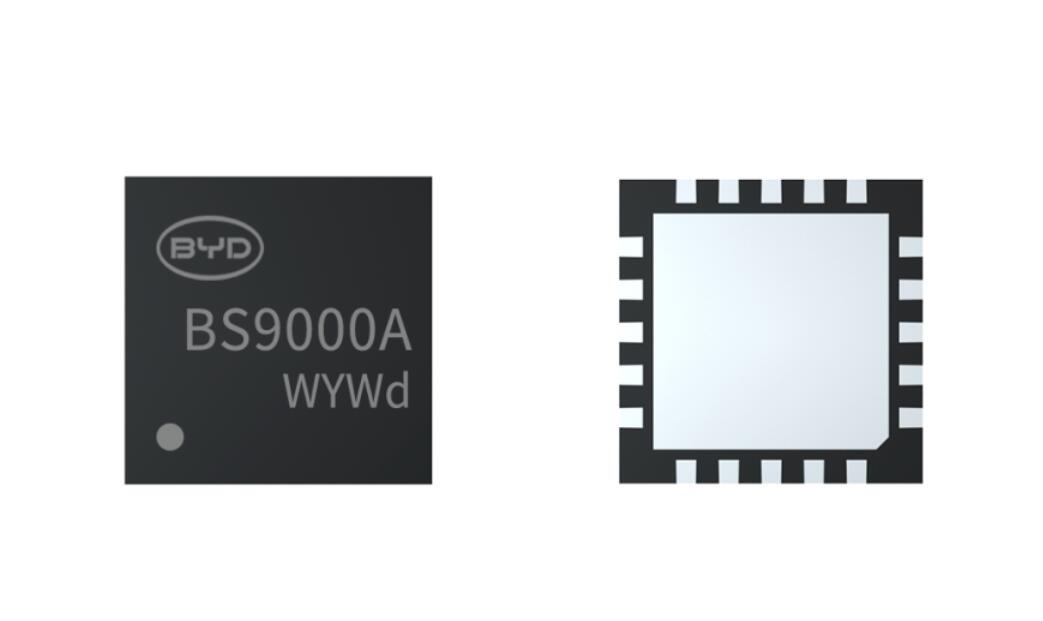

BYD Semiconductor unveils new MCU chip for vehicles

Apr 20, 2022 17:07 GMT+8

(Image credit: BYD Semiconductor)

BYD (OTCMKTS: BYDDY, HKG: 1211) is the best local car company in terms of vertical integration, producing chips in addition to batteries. Now, the company's semiconductor division has released its latest chips for vehicles.

BYD Semiconductor launched its new BS9000AMXX series of 8-bit MCU chips for vehicles in March, another important breakthrough for the company in the market, it announced today.

If IGBT (insulated-gate bipolar transistor) solves the bottleneck of car electrification, then MCU (microcontroller unit) is the key to solving the car intelligence, BYD Semiconductor said.

BS9000AMXX series is an 8-bit general-purpose MCU, and the chip uses S8051 core with the main frequency of up to 24MHZ, according to BYD Semiconductor.

The chip supports BLDC motor control, up to 24 channels of 12-bit resolution ADC, and up to 26 I/O. It integrates a high-reliability capacitive detection keypad module, including TSSOP28 and QFN20 package forms.

Compared with similar products in the industry, the BS9000AMXX series has a faster computing rate and richer resources, significantly reducing the cost and complexity of automotive software, BYD Semiconductor said.

BYD Semiconductor has more than 10 years of experience in the field of automotive chips and strictly follows the TS16949 standard production control process. BS9000AMXX series MCU products have achieved the AEC-Q100 GRADE1 quality level, according to the company.

BYD Semiconductor was established in October 2004 and BYD directly holds 72.30 percent of the shares and is the controlling shareholder of the company. BYD founder Wang Chuanfu indirectly controls BYD Semiconductor through BYD.

The company entered the industrial MCU field in 2007 and ranked first in China in terms of market share of industrial-grade touch MCUs.

Semiconductor's business then extended across from industrial-grade MCUs to automotive MCUs, and launched the first generation of 8-bit automotive MCUs in 2018 and the first generation of 32-bit automotive MCUs in 2019, with batch loading in BYD's full range of models.

In May last year, BYD Semiconductor announced that its installed base of automotive MCUs exceeded 10 million units. If the industrial-grade MCU chips were counted, the cumulative shipment exceeds 2 billion units.

MCU can implement different control for different application scenarios and is the core of internal computing and processing of automotive electronic systems.

From wipers, windows, seats, security systems, in-car entertainment systems, to body control and engine control, almost all of them are inseparable from MCU chips, and every innovation in automotive electronics has to be realized through the computing and control functions of MCU.

BS9000AMXX series products can meet a variety of application scenarios in automotive electronics, including interior lights, ambient lights, door handles, air conditioning touch panels, various sensor applications, and BLDC motor control, according to BYD Semiconductor.

For this ones, 90nm lithography is more than sufficient, even 350 nm is no problem

antiterror13

Brigadier

After the US sanction on Huawei, tsmc lost ~$1.8B of Huawei's business only to gain $2.1B from other US customers. And since stop selling to Huawei, tsmc had one record quarter after another. So I don't understand your view that Hsinchu's future is bleak.

Until anyone can catch up to tsmc's technology capability and capacity, their future is anything but bleak.

If your view is short term, YES, you are CORRECT

They already are losing to Chinese market and it may be gone forever, trust and being reliable are very important in any business

The Chinese market is far bigger than the US and I don't see Chinese companies would use high tech US software or hardware ... they still do now (but less and less) as they have no alternatives yet, but it is just a matter of time to replace them

Necessity is the mother of invention ..... my friend

See what happened to CNC Machine, AWACS, Satellites, Rocket, GPS, Space station, Supercomputer, etc, etc

Last edited:

antiterror13

Brigadier

If a Chinese company owns Imagine Technologies, does that mean China owns all the tech in that company?

Yes and No. Even The Chinese company own Imagine, but Imagine is the UK company that has to comply with all UK laws and rules

So, in hypotactically scenario that the UK could ban transferring tech to foreigner .... but I don't see this as this company is nowhere as advanced as the Chinese ones in China ... far from it

I don't dispute anything you said. I'm in complete agreement. It IS just a matter of time for China semiconductor to catchup and even lead. But, I think we may have different view on what "short term" means. : )If your view is short term, YES, you are CORRECT

They already are losing to Chinese market and it may be gone forever, trust and being reliable are very important in any business

The Chinese market is far bigger than the US and I don't see Chinese companies would use high tech US software or hardware ... they still do now (but less and less) as they have no alternatives yet, but it is just a matter of time to replace them

Necessity is the mother of invention ..... my friend

See what happened to CNC Machine, AWACS, Satellites, Rocket, GPS, Space station, Supercomputer, etc, etc

Oh, by the way, I think you all misinterpret my post in response to @Topazchen. What I tried to point out was the US market is still very big and heavily reliant on tsmc, and case in point that US companies swooped in and filled the void left by the lose of Huawei business.

tsmc's top-10 customers accounts for ~80% of their business. 7 of 10 are US companies. With new Intel business, tsmc will make even more $ from the Us. Unless someone can catchup to tsmc in terms of capability and capacity, there's no way that US government will stop tsmc from selling to US customers (which was what @Topazchen said).

I was merely disputing the validity assumption that "Uncle Sam will stop tsmc from selling to both US and China". Doing so would kill off the US fabless companies, of course unless someone (Intel?) can replace tsmc (and this will not be any time soon). So,

1. if US market remains big, tsmc's future would be fine;

2. if China market surpasses US, tsmc could always switch allegiance and start selling to the China market (this of course unless SMIC can catch up to tsmc).

Either way, I just don't see how tsmc's future would be bleak...unless assumption I provided comes true.

Last edited:

antiterror13

Brigadier

I don't dispute anything you said. I'm in complete agreement. It IS just a matter of time for China semiconductor to catchup and even lead. But, I think we may have different view on what "short term" means. : )

Oh, by the way, I think you all misinterpret my post in response to @Topazchen. What I tried to point out was the US market is still very big and heavily reliant on tsmc, and case in point that US companies swooped in and filled the void left by the lose of Huawei business.

tsmc's top-10 customers accounts for ~80% of their business. 7 of 10 are US companies. With new Intel business, tsmc will make even more $ from the Us. Unless someone can catchup to tsmc in terms of capability and capacity, there's no way that US government will stop tsmc from selling to US customers (which was what @Topazchen said).

I was merely disputing the validity assumption that "Uncle Sam will stop tsmc from selling to both US and China". Doing so would kill off the US fabless companies, of course unless someone (Intel?) can replace tsmc (and this will not be any time soon). So,

1. if US market remains big, tsmc's future would be fine;

2. if China market surpasses US, tsmc could always switch allegiance and start selling to the China market (this of course unless SMIC can catch up to tsmc).

Either way, I just don't see how tsmc's future would be bleak...unless assumption I provided comes true.

Correct, but China is the biggest market for the US chips companies that you mentioned above too

"Bleak" probably not a good word, thats not from me anyway. What I can see is that TSMC won't be longer as dominant as now, in future (~10 years), it will just be another big Fab manufacturer, SMIC will catch up in 10 yrs time, perhaps to like 60-75% of TSMC. Intel and Samsung probably would be as big as or near TSMC in 10 yrs time

GF may end up bought up by EU government or German

Interesting what would happen to Japan, whether Japan would have advanced Fab manufacturer in 10-15 yrs ? same thing to India

Last edited:

BYD Reaches Cooperation With Local Chip Startup Horizon Robotics.

Shenzhen-based electric vehicle maker , which will provide its self-driving “Journey 5” computer chip for certain BYD models set to be launched next year, significantly enhancing their autonomous driving capabilities.BYD models equipped with the Journey 5 chip will be available by mid-2023 at the earliest. This partnership marks a breakthrough in actual business cooperation between the two companies following BYD’s investment in Horizon, with BYD becoming the first car company to announce it will use the Journey 5 chip in its vehicles. The two companies will deepen their cooperation in the future, and Horizon Robotics’ Journey series chips will be available across a wider range of BYD models.

Yeah. I was responding to "bleak". it's definitely not an appropriate adjective.Correct, but China is the biggest market for the US chips companies that you mentioned above too

"Bleak" probably not a good word, thats not from me anyway. What I can see is that TSMC won't be longer as dominant as now, in future (~10 years), it will just be another big Fab manufacturer, SMIC will catch up in 10 yrs time, perhaps to like 60-75% of TSMC. Intel and Samsung probably would be as big as or near TSMC in 10 yrs time

GF may end up bought up by EU government or German

Interesting what would happen to Japan, whether Japan would have advanced Fab manufacturer in 10-15 yrs ? same thing to India

I think SMIC definitely has chance to catchup per your assessment. But in order for that to happen they need to outspend and out innovate tsmc. I'm not too please to see SMIC is only planning to invest $5B in Capex this year; not much of a difference from last year..and the RD expense is decreasing because of "slower RD activities". Many of us are cheering on SMiC, but their current plan is definitely not meeting our expectations.

tsmc plans to spend $44B this year; actual spending by year end may be even higher.

We need SMIC to spend more! I see SMIC surpassing GF and UMC in a few years, but it need to have more output in 28nm & below. Based on its financial report, its shipping only ~30K wafers/month of 28nm & below. SMIC needs to gain a bigger share of the advance nodes, period. Do you know SMIC's current share (5.3%) of foundry business is lower than what they had in 2006 (6.8%)? Unless SMIC master 7nm soon, the gap with tsmc will only get bigger. 28nm wafers costs $3000, 3nm wafers costs more than $15,000. And in a year tsmc will have more wafer output than smic 28/14/7nm. So, you see, SMIC can't challenge tsmc until it spends more $ and produce more profitable advanced wafers. It seems SMIC is focused on making money in the old nodes and not focusing on trying to catch tsmc.

By the way, regarding Japan, they do have advanced fabs. They don't have advanced logic fabs, but they do have leading edge memory fabs. Micron and Koxia are currently producing more advanced DRAM and 3D-NAND than CXMT & YMTC.

Well, there are many no-solder wafer bonding methods, one coming to mind being YMTC Xtacking. I do not know the details for the Huawei particular process.the bonding pad to bonding pad "connection" is not soldered together. The bonding is achieved through van Der Waal force.

- Status

- Not open for further replies.