You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

Sounds like a “make work” bribe job for white American failsons as sop for white American elites, not unlike xiaomi paying white American “auditors”Taiwan chip giant TSMC seeks geopolitical analyst amid US-China tensions

Two points I want to make. China won't have an impact on EUV sales even in the long term. My chart in the article on DUV backlog includes EUV data, but that chart was used in my Semiconductor Deep Dive Marketplace newsletter that people subscribe to, as opposed to these free articles on Seeking Alpha.Like discussed in the article sanctions on immersion lithography sales to SMIC and other major Chinese semiconductor industry players could have a major impact on ASML's sales. If, for whatever reason, they sanction sales of immersion lithography to China this will provide SMEE a major impetus to not only produce their own machines but also to massively ramp up their production.

@tinrobert mentioned how SMEE had ordered EUV machines from ASML and they were never delivered. CXMT, which is the leading Chinese DRAM manufacturer, also had EUV on its product development roadmap at one point. CXMT's CEO at one point visited ASML to discuss the purchase of equipment. I would not be surprised if sales of EUV equipment were discussed at one point. CXMT, as well as the other Chinese DRAM vendors, have all had friction with Micron. CXMT might end up in a US sanctions list as well. In the case of YTMC I think any sanctions they apply to them will have much less impact since YMTC manufacture V-NAND which uses lower resolution processes with multiple layers.

I doubt the sanctions on SMEE will have any major impact. SMEE is an integrator much like ASML. They assemble products and add the secret sauce to get it all to work together. Their supply chain AFAIK uses no US origin hardware components. In fact all their major components should have Chinese origin.

The numbers SMIC has released on wafer revenue by technology are more obfuscated than they used to be on the past. FinFET/28nm include the 14nm and lower resolution processes i.e. 10nm. IIRC FinFET used to be specifically enumerated in SMIC's reports reports but not any more.

I also agree with one of the commenters that a supply glut over the next two years is definitively possible. Not only from all the new Chinese and other fab construction but also that if, for whatever reason, COVID-19 subsides and people get back to work and children back to school worldwide then hardware sales will drop off a cliff.

I have some doubts about the future success of the Nikon machine. Few companies bothered with the transition towards FinFET. Those which did all have EUV roadmaps. Even Intel now claims they will use EUV. How easy would it be to integrate Nikon and ASML lithography machines in the same production pipeline? The market leaders are transitioning towards 3nm production in the future and that will only happen with EUV. Nikon might at best get some of the companies which did not bother transitioning to EUV yet. In a market like China, Nikon could also find some success given they can't even buy EUV machines. So vendor lock-in by ASML would be much weaker in China than other markets. However if the US does indeed sanction immersion DUV sales this would basically kill any future prospects for Nikon in my opinion.

In the medium term I do not think China will have an impact on EUV sales for ASML. Since China cannot get EUV machines for their own foundries they will just have to purchase services or chips abroad. So the machines will still get sold just not to China. What would cause a major impact on EUV machine sales would be a blanket ban on sales of EUV produced chips to China. This cannot possibly happen, I think, given all the manufacture industry that is in China for all sorts of electronics components. This isn't like putting sanctions on Iraq in the 1990s where back then they couldn't even import a Sony PlayStation 2 console because that had too much compute performance and was classed as a "supercomputer". The US has struggled with this dilemma all along. They use blacklists to sanction some Chinese entities but they can never do a blanket ban because it would impact the world supply market and especially their own companies. Among others you would decimate world smartphone, tablet, personal computer, and server production. This means the sanctions will be weak.

Anyway it is DUV that ASML needs to worry about in China, and putting SMEE on the verified list is a way to quiet ASML, because they are not happy having the U.S. tell them what to do about EUV. Thats the same as TSMC, Samsung, and SK hynix being told they have to divulge details of their customers. People in China are familiar with this, but it's starting to happen in N. America with school mask mandates and truck drivers in Canada.

The other thing is the oversupply of chips coming. I pointed out and referenced it in this article that back in June I detailed my thesis that all this semiconductor equipment sold in 2021 and all foundries being built in 2020-2023 will give rise to an oversupply of logic chips made at foundries, and the market crash will last two years, based on what happened in 2000, which these data this year are replicating. Logic chips will be cheap, but memory chip units and prices won't be, so companies like Micron, Samsung, and SK will benefit as memory is used in conjunction with logic chips.

Thanks for supplying details of semiconductor equipment. But it would be really valuable to me as an analyst and to others, to get details of customers of these systems and how much revenues these companies made in sales.Capcon receives another large-scale purchase order for advanced packaging equipment from ASE Kaohsiung Plant

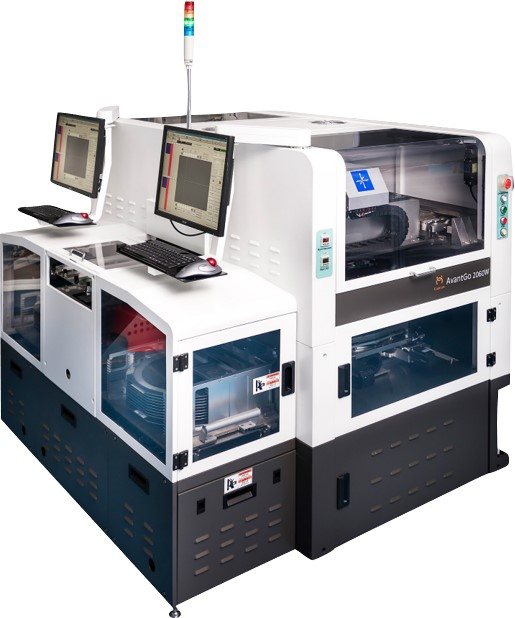

Capcon (Huafeng Technology) has received another large-scale equipment purchase order from ASE Kaohsiung Plant. This time, the equipment purchased by ASE is the AvantGo2060W wafer-level package placement machine. AvantGo 2060W can be said to be "high light when it comes out", and the device has been favored by ASE as soon as it came out. Up to now, Capcon (Huafeng Technology) advanced packaging equipment has provided production capacity for ASE for many years.

Capcon (Huafeng Technology) wafer level packaging machine AvantGo 2060W supports processes including WLFO, InFO, COWOS, M-seris, eWLB, 2.5D/3D-TSV, it has ultra-high precision multi-bonding heads, and the accuracy can reach +/-5um@3σ, can reach +/-3um@3σ in high-precision mode (single-head working mode); supports up to 70mm chip front and back mounting, Face up/Face down can be switched freely, supports robotic arms (Cassette, Foup), Wafer, Tape Reel, Waffle Tray Feeder. The hourly capacity is 5000-11500pcs, and the UPH is up to 12k (Face up).

Nice try Biden.Thanks for supplying details of semiconductor equipment. But it would be really valuable to me as an analyst and to others, to get details of customers of these systems and how much revenues these companies made in sales.

@tokenanalyst maybe ixnay a little, buddy.Thanks for supplying details of semiconductor equipment. But it would be really valuable to me as an analyst and to others, to get details of customers of these systems and how much revenues these companies made in sales.

CIA up in here. @tinrobert don't rendition me, bro.Nice try Biden.

The Chinese article also says that it is expected that CXMT will start manufacturing 17nm DDR5/LPDDR5 DRAM this year.

It is hard to get sales numbers for Chinese semiconductor equipment since these companies typically do not have the same kind of requirement to release information to investors we see with companies which have shares in Western stock markets. SMIC is traded in the Hong Kong stock exchange that is why it is much easier to get information on their financial performance.

It is hard to get sales numbers for Chinese semiconductor equipment since these companies typically do not have the same kind of requirement to release information to investors we see with companies which have shares in Western stock markets. SMIC is traded in the Hong Kong stock exchange that is why it is much easier to get information on their financial performance.

How good is that?The Chinese article also says that it is expected that CXMT will start manufacturing 17nm DDR5/LPDDR5 DRAM this year.

- Status

- Not open for further replies.