Big deals with the Saudis:

Saudi-China investment event witnesses deals worth $25bn

The investment conference was attended by top regional heads, including representatives from Saudi Arabian Oil Co., also known as Aramco, Saudi Basic Industries Corp., and ACWA Power.

Updated 12 December 2023

Arab News

December 12, 2023 19:03

1635

RIYADH: Trade and economic ties between Saudi Arabia and China are expected to further strengthen, with the recent investment conference in Beijing witnessing the signing of more than 60 memorandums of understanding and agreements valued at $25 billion.

The China-Saudi Investment Conference on Tuesday witnessed the signing of agreements in various sectors, including energy, agriculture, tourism, mining, and financial services. Additional fields included logistics, infrastructure, technology, and health care, according to a press statement.

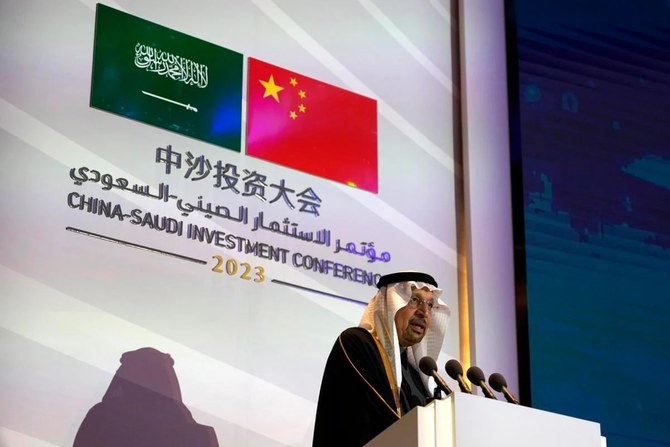

The investment conference was conducted on the sidelines of a visit by Saudi Investment Minister Khalid Al-Falih to China.

A notable deal signed during the conference was in the information and communication technology sector, where the Saudi Esports Federation and Chinese esports tournament operator VSPO signed an MoU to promote opportunities, cooperation, and participation in eSports for $8.5 billion.

Meanwhile, China’s Oriental Energy Co. and the Kingdom’s Ajlan & Bros Holding Group Co. signed another agreement to explore areas of collaboration in manufacturing worth $7.5 billion.

In the energy sector, Saudi Arabia’s Ministry of Investment signed a deal with China’s state-owned CRRC Group to develop opportunities in the Kingdom covering project development and manufacturing of renewable energy and sustainable mobility worth $2 billion.

The investment conference was attended by top regional heads, including representatives from Saudi Arabian Oil Co., also known as Aramco, Saudi Basic Industries Corp., and ACWA Power, the press statement added.

During the conference, nine Chinese companies, including Huawei, Dahua, China Railway Construction Corp., and China Communication Services, received their licenses to open their regional headquarters in Saudi Arabia.

Additional companies that received licenses were China Harbor Engineering Co., China Civil Engineering Construction Corp., BGI Group, Nuctech and iMile.

A day earlier, Saudi Arabia’s stock exchange signed an MoU with the Chinese Shenzhen Stock Exchange to enhance collaboration and explore new opportunities in several areas, including joint listing and financial technology.

In September, the Saudi Tadawul Group and the Shanghai Stock Exchange signed an MoU to bolster cooperation and promote mutual development.

At the time, the agreement focused on dual listings of exchange-traded funds, initiatives related to investor relations and infrastructure development, as well as fintech, environmental and social practices.

In November, the Saudi Central Bank, also known as SAMA and the People’s Bank of China signed a local currency swap agreement worth $6.93 billion.

According to a press statement issued by SAMA, the three-year agreement “has been established in the context of financial cooperation between the Saudi Central Bank and the People’s Bank of China.”

China’s central bank said that the swap agreement can be extended after two years by mutual agreement.