Hendrik_2000

Lieutenant General

Goto the site it has neat interactive graph you hover the mouse over the bar and it give you the breakdown of the ships

China has significantly upgraded its littoral combat capabilities with 41 Type 056 corvettes commissioned since 2014. More on China's naval modernization efforts with our latest feature:

The Expansion of the PLAN

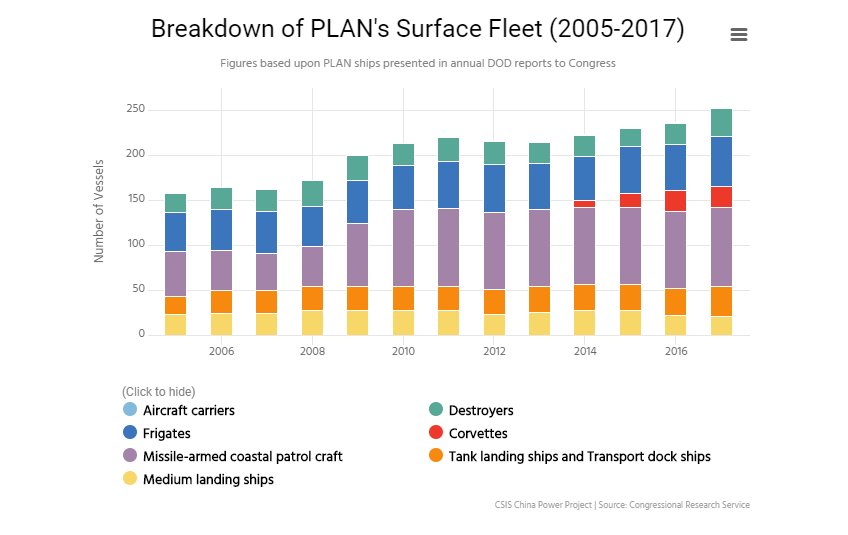

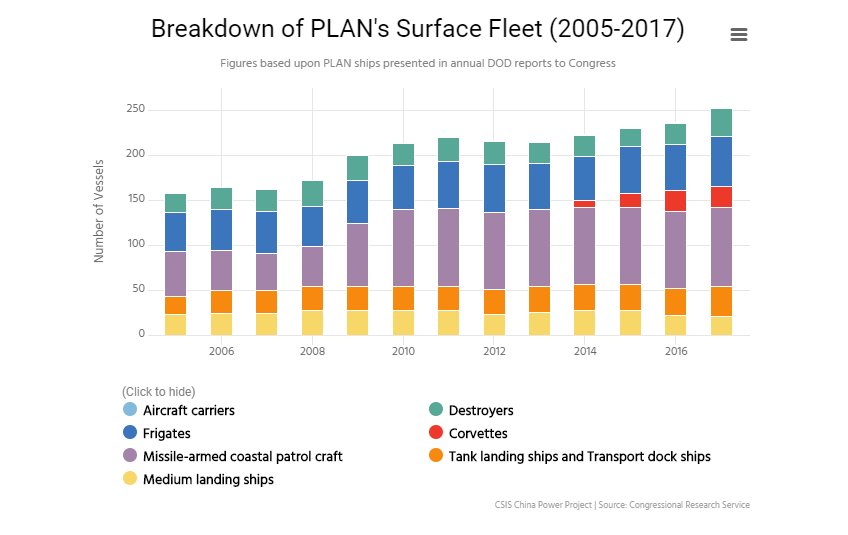

The modernization of the People’s Liberation Army Navy (PLAN) has resulted in a growth in fleet size and capabilities. Research conducted by suggests that China’s surface fleet in 1996 consisted of 57 destroyers and frigates, but only three of these vessels carried short ranged surface-to-air missiles (SAM), making them virtually “defenseless against modern anti-ship cruise missiles (ASCM).” Three quarters of its roughly 80 attack submarines belonged to the Soviet Romeo-class that entered service in the 1950s.

Over the last few decades, China’s navy has rapidly expanded. As of 2018, the Chinese Navy consists of over , making it larger than the comprising the deployable battle force of US Navy. The fleet sizes of other leading nations are comparatively smaller. The British Royal Navy consists of 75 ships and the Royal Australian Navy has a fleet of ships.

New ships are being put to sea at an impressive rate. Between 2014 and 2018, China more submarines, warships, amphibious vessels, and auxiliaries than the number of ships currently serving in the individual navies of Germany, India, Spain, and the United Kingdom. Eighteen ships were commissioned by China in 2016 alone and at least another 14 were added in 2017. By comparison, the US Navy 5 ships in 2016 and 8 ships in 2017. Should China continue to commission ships at a similar rate, it could have 430 surface ships and 100 submarines within the .

According to the (DoD), a significant focus of the PLAN’s modernization is upgrading and “augmenting its littoral warfare capabilities, especially in the South China Sea and East China Sea.” In response to this need, China has ramped up production of Jiangdao-class (Type 056) corvettes. Since being first commissioned in 2013, more than 41 Type 056 corvettes had entered service by mid-2018.

The capabilities of the Chinese Navy are growing in other areas as well. has reported that based on contemporary standards of ship production, over 70 percent of the PLAN fleet in 2017 was considered “modern,” up from less than 50 percent in 2010. China is also producing larger ships capable of accommodating advanced armaments and onboard systems. The Type 055 cruiser, for instance, is planned to enter service in 2019-20 and weighs roughly 5,000 tons more than the Type 052D destroyer that entered service in 2014. The Type 055 is slated to carry large cruise missiles and be capable of escorting an aircraft carrier into blue waters.

China is also leading the world in terms of the overall tonnage of ships it has put to sea. The collective tonnage of the ships launched by China between 2014-2018 was an impressive 678,000 tons — larger than the aggregate tonnages of the of India and France combined. Importantly, the PLAN’s total tonnage remains less than half that of the US navy, a gap estimated at roughly . This difference is largely attributed to the US fielding 11 aircraft carriers, each displacing approximately 100,000 tons.

Expanding Shipbuilding Capability

The rapid expansion of the PLAN has been undergirded by China’s growing shipbuilding capability. During mid-1990s, favorable market conditions and joint ventures with Japan and South Korea enabled China to its shipbuilding facilities and operational techniques. According to the, the modernization and expansion of these shipyards has “increased China’s shipbuilding capacity and capability for all types of military projects, including submarines, surface combatants, naval aviation, and sealift assets.”

These advances have also facilitated China’s transition into a commercial shipbuilding superpower. Merchant shipbuilding production rose from just 1 million gross tons in 1996 to a high of 39 million gross tons in 2011, which was more than double the output of Japan in the same year. In 2018, China surpassed South Korea as the global leader in shipbuilding orders. Through the first 11 months of 2018, China’s shipbuilding industry captured an impressive of the global market.

China has significantly upgraded its littoral combat capabilities with 41 Type 056 corvettes commissioned since 2014. More on China's naval modernization efforts with our latest feature:

The Expansion of the PLAN

The modernization of the People’s Liberation Army Navy (PLAN) has resulted in a growth in fleet size and capabilities. Research conducted by suggests that China’s surface fleet in 1996 consisted of 57 destroyers and frigates, but only three of these vessels carried short ranged surface-to-air missiles (SAM), making them virtually “defenseless against modern anti-ship cruise missiles (ASCM).” Three quarters of its roughly 80 attack submarines belonged to the Soviet Romeo-class that entered service in the 1950s.

Over the last few decades, China’s navy has rapidly expanded. As of 2018, the Chinese Navy consists of over , making it larger than the comprising the deployable battle force of US Navy. The fleet sizes of other leading nations are comparatively smaller. The British Royal Navy consists of 75 ships and the Royal Australian Navy has a fleet of ships.

New ships are being put to sea at an impressive rate. Between 2014 and 2018, China more submarines, warships, amphibious vessels, and auxiliaries than the number of ships currently serving in the individual navies of Germany, India, Spain, and the United Kingdom. Eighteen ships were commissioned by China in 2016 alone and at least another 14 were added in 2017. By comparison, the US Navy 5 ships in 2016 and 8 ships in 2017. Should China continue to commission ships at a similar rate, it could have 430 surface ships and 100 submarines within the .

According to the (DoD), a significant focus of the PLAN’s modernization is upgrading and “augmenting its littoral warfare capabilities, especially in the South China Sea and East China Sea.” In response to this need, China has ramped up production of Jiangdao-class (Type 056) corvettes. Since being first commissioned in 2013, more than 41 Type 056 corvettes had entered service by mid-2018.

The capabilities of the Chinese Navy are growing in other areas as well. has reported that based on contemporary standards of ship production, over 70 percent of the PLAN fleet in 2017 was considered “modern,” up from less than 50 percent in 2010. China is also producing larger ships capable of accommodating advanced armaments and onboard systems. The Type 055 cruiser, for instance, is planned to enter service in 2019-20 and weighs roughly 5,000 tons more than the Type 052D destroyer that entered service in 2014. The Type 055 is slated to carry large cruise missiles and be capable of escorting an aircraft carrier into blue waters.

China is also leading the world in terms of the overall tonnage of ships it has put to sea. The collective tonnage of the ships launched by China between 2014-2018 was an impressive 678,000 tons — larger than the aggregate tonnages of the of India and France combined. Importantly, the PLAN’s total tonnage remains less than half that of the US navy, a gap estimated at roughly . This difference is largely attributed to the US fielding 11 aircraft carriers, each displacing approximately 100,000 tons.

Expanding Shipbuilding Capability

The rapid expansion of the PLAN has been undergirded by China’s growing shipbuilding capability. During mid-1990s, favorable market conditions and joint ventures with Japan and South Korea enabled China to its shipbuilding facilities and operational techniques. According to the, the modernization and expansion of these shipyards has “increased China’s shipbuilding capacity and capability for all types of military projects, including submarines, surface combatants, naval aviation, and sealift assets.”

These advances have also facilitated China’s transition into a commercial shipbuilding superpower. Merchant shipbuilding production rose from just 1 million gross tons in 1996 to a high of 39 million gross tons in 2011, which was more than double the output of Japan in the same year. In 2018, China surpassed South Korea as the global leader in shipbuilding orders. Through the first 11 months of 2018, China’s shipbuilding industry captured an impressive of the global market.