That's amazing. I recall many environmentalists opposing the south to north water diversion project when it was first proposed.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

News on China's scientific and technological development.

- Thread starter Quickie

- Start date

in 5g base station etc,would require alot bandwidth and dsp processing capability, so perhap dedicated dsp chips or dedicated ASIC or high performance FPGA. something like thisThe answer is rather simple to be honest of what kind of chips are needed and where they are going to come from.

All anyone has to do it rip apart a Huawei 5G base station or antenna.

Those things will not need the best chips at 7nm. Only cell phones need those best chips, because they are smaller and faster.

There is no doubt Huawei will replace all American parts in its telecom equipment, including the chips.

The Chinese semi-conductor industry is a couple of generations behind TSMC and Samsung, but those are the chips the 5G base station and antenna would need in all probability. You do not need such as fast chip in that equipment.

Notice that article long on the fear screaming, and short on technical details, to the point none were presented at all. The technical details are like the truth, whether for or against. Since they did not bother with that in the article, just another baseless hit piece.

not sure what huawei is using, but here is list from other vendor

Last edited:

found this, it says huawei use 7nm 5g chips in its base station, which is manufactured by TSMC. so it does affect its base station if i remember correctly 5g does require high performance chips due to its bandwidth + superior DSP/soc processing.

i guess huawei has to figure out switch 7nm to 14nm for SMIC, that is if Trump doesn't ban SMIC first. other options are samsung, maybe. i heard samsung have some EU/Japan supply line without US tech.

i guess huawei has to figure out switch 7nm to 14nm for SMIC, that is if Trump doesn't ban SMIC first. other options are samsung, maybe. i heard samsung have some EU/Japan supply line without US tech.

The report said Huawei’s inventory of 5G base station chips is sufficient until 2021. Huawei uses its Tiangang chips, developed in-house, for baseband chips contained in its 5G base station AAU and BBU. These chips are manufactured with 7nm process technology and primarily by TSMC.

The imagery has captured scenes of war, unforgiving weather and even an abattoir as the assault has continued. In March, Huawei faced slaughter on the chopping board, warned Eric Xu, one of its rotating chairmen, as the US threatened tougher sanctions. A month later, it was a seed caught in a storm. By the time the US government discharged another salvo, the Chinese vendor saw itself as a fighter plane riddled with bullets, trying not to crash.

The world's biggest maker of network equipment has always had a penchant for drama, but this time its contributions do not exaggerate Huawei's predicament. Frustrated that initial sanctions restricting supplies of US components had such a limited impact on the Chinese vendor, the US has gone directly for the jugular in its latest attack. Under new rules, semiconductors made with any US equipment or design expertise will be unavailable to Huawei. By cutting off vital chip supplies from TSMC, a Taiwanese foundry that relies on US manufacturing tools, the US aims to bleed Huawei dry.

Experts are unanimous in depicting the latest measures as a grave threat to the Chinese behemoth. Just how grave is where they disagree. At least one thinks Huawei can survive for only a year if the rules are fully applied. Others are more optimistic about the company's prospects. Yet regardless of its fate, the prevailing view is that a US campaign to stunt China's technological development will ultimately fail.

How long can this keep going on?

For Huawei, the doomsday scenario comes from New Street Research. "As things stand, Huawei has 12 months left to live," wrote analysts for the company in a report this week. The dilemma is the lack of alternatives to US manufacturing tools used by foundries including TSMC and even SMIC, a Chinese company that has been viewed as a potential fallback if the Taiwanese manufacturer is blocked.

Huawei's dependence on TSMC is hard to overstate. According to estimates prepared by The Information Network, and first published on Seeking Alpha, the Chinese firm is currently TSMC's second-biggest customer, after Apple, accounting for about 15% of its revenues. In 2019, that would have been roughly $5.2 billion, about half of what Huawei spent annually on US components before emergency stockpiling last year. Among other things, Huawei relies on TSMC for certain 5G chips as well as microprocessors used in network servers.

SMIC has never seemed an ideal substitute, purely because it is thought to lag TSMC in chip-building technology. One of the goals in this game is to shrink the size of transistors, measured in nanometers (nm), so that more can be crammed into a chip, boosting performance and efficiency. Huawei's new TIANGANG chip (a type of application-specific integrated circuit, or ASIC) for basestations uses 7nm manufacturing technology deployed by TSMC, according to Stefan Pongratz of market-research firm Dell'Oro. SMIC, he says, has been investing in 14nm technology. "The transition would likely impact the power efficiency and/or computing performance of the ASICs and the overall RAN [radio access network] performance," said Pongratz in an email.

Chinese funding should eventually produce a more competitive SMIC. Earlier this month, the Shanghai-based company was reported to have planned a sale of shares that could raise about $3 billion. This move, according to New Street Research, should help to "scale out production" and give China a stronger asset. But a shift from TSMC to a more capable SMIC could take too long for Huawei. "To port over any designs to a Chinese foundry would take time and to bring them up to TSMC levels would take years," says Earl Lum of EJL Wireless Research. China is probably about three to five years behind TSMC, reckons New Street Research.

The other problem is SMIC's apparent use of manufacturing tools made by US companies such as Applied Materials, Lam Research and Teradyne. This would make the Chinese foundry subject to the same restrictions that now threaten TSMC's relationship with Huawei. What remains unclear at this early stage is if these new rules are much harder to bypass than the initial blockade on US components, which Huawei's suppliers dodged by relying on their non-US facilities. "One of the key unknowns surrounding this latest change is whether or not there will be any loopholes that can be exploited if, for example, TSMC sends the chips directly to non-Chinese contract manufacturers for integration," says Pongratz.

For China, the only safeguard with an absolute guarantee is to invest in its own manufacturing tools. "The tool development can happen but will, again, take time," says Lum. The speediest path to manufacturing independence could be to reverse-engineer equipment currently provided by a range of European, Japanese and US firms, a tactic Huawei previously used to enter the network equipment market, according to its critics. "At first sight, this will take five to ten years for most tools," say analysts at New Street Research.

While the new US rules will not take effect for 120 days, no company has the inventory needed to survive over such a long period. In the meantime, many Huawei-reliant countries and service providers – already shaken by the US campaign – will be carrying out an urgent risk assessment. "Regardless of the overall outcome, some of the damage will likely be irreversible," says Pongratz. "This latest effort by the US government to curb the rise of Huawei could be one more reason for these operators on the fence to revisit the 5G supplier landscape."

Despite this warning, the Dell'Oro analyst is less convinced than New Street Research that the latest US attack will destroy China's biggest vendor. "I am very skeptical this will be enough to take out Huawei," he tells Light Reading. "In short, I believe these restrictions will have some, albeit limited, success in curbing the rise of Huawei."

Last year's upheavals confirmed the Chinese firm is a master of adaptation, exploiting loopholes and stockpiling inventory while simultaneously preparing for a future without US suppliers. Spending on research and development, which already dwarfed that of its European and US rivals, soared from $14.3 billion in 2018 to $18.6 billion last year. This year it plans to invest $20 billion. And notwithstanding its claim to have full independence from the Chinese state, it clearly expects China's government to intervene if the US keeps punching.

Last edited:

cont

This obviously threatens a retaliation that could extend to other economic sectors and spheres of geopolitical influence. "The worst-case Chinese response is to take over Taiwan and shut down the majority of US semiconductor companies, which would be an even larger issue leading to armed conflict," says Lum. Unlikely as that may be, tensions have already mounted during the coronavirus pandemic. To New Street Research, the recent crackdown in Hong Kong is a demonstration of Chinese muscle linked to the "new cold war" between China and the US in which Huawei is embroiled.

Another danger for the US is that its efforts to block Chinese firms have unintended and negative consequences for US industry. Besides attacking Huawei, the US government has also recently added Fiberhome, a smaller Chinese vendor, to its trade blacklist. Lum says this move increases the likelihood it will re-include ZTE, a Chinese rival to Huawei that previously came off the list after its payment of hefty fines. "The US strategy is to clearly shut down all Chinese telecom companies to US technology," he explains. "All this is doing is to hurt US companies and move business to Europe, Japan and elsewhere."

Just as NeoPhotonics, Lumentum and other component suppliers to Huawei sought loopholes in the initial rules, companies may simply try to evade the latest US regulations. Nelson Dong, a senior partner at US law firm Dorsey & Whitney, previously spelled out the risks. "This move may well force the global semiconductor industry to look away from US suppliers of semiconductor design tools and semiconductor production equipment and even to create new rival companies in other countries, including China itself," he said in a statement sent by email.

There is precedent for this, too. Once dominant in the satellite technology sector, the US suffered a decline after imposing stricter export controls on the technology, says Dong. Those controls prompted many customers to avoid US suppliers, which ultimately lost billions of dollars in sales to their international rivals. More stringent controls in the semiconductor market could trigger "tectonic shifts within the microelectronics industry for decades to come," writes Dong.

China is already doubling down on technology investments. Last October, long before coronavirus and the recent escalations, it was reported to have set up a $29 billion state-backed semiconductor fund that will help it assert technology independence from the US. There can be little doubt that discussions about semiconductor manufacturing tools have now taken place in Chinese government circles.

There isn't true wealth but in people

These Chinese moves will not produce results quickly enough to save Huawei, according to New Street Research. Moreover, its prediction is that China will lose a technology battle to the US fought over the next five to ten years. "China won't be able to have competitive chips on that kind of timeframe, and will have nascent ecosystems, totally subscale to those in place in the US," write analysts in their report. "With an experience and a scale disadvantage, China cannot win."

But in the longer term, it probably will. "There isn't true wealth but in people," said Jean Bodin, a sixteenth-century French philosopher quoted by New Street Research, which points out that China's vast resources of human capital will ultimately be the only thing that matters. "The next fight will be on education and economic growth. Can the US win that one?"

Revenues ($M)

Source: Companies. Notes: Currency conversions use today's exchange rates; figures for Huawei and ZTE include their device businesses.

This population imbalance is already a critical factor in today's telecom and technology markets. With its 1.4 billion people, China last year accounted for about 17% of total sales at Apple, the largest US gadget maker. It is responsible for as much as 60% of the 4G infrastructure market, according to Börje Ekholm, the CEO of Sweden's Ericsson, who thinks it will similarly dominate tomorrow's 5G sector. If this estimate is accurate, then limited access to China denies Ericsson and Finland's Nokia a bigger share of mobile industry revenues than Huawei misses due to restrictions in the US, Europe and parts of the Asia-Pacific.

In future, its human capital combined with its investments in digital technology will make China the dominant global force in artificial intelligence, explaining US efforts to upset Huawei, according to Kaan Terzioglu, a senior industry executive who previously led Turkish mobile operator Turkcell but is today a co-CEO at Veon. "Who do you think will have more success in training tech intelligence?" Terzioglu rhetorically asked Light Reading at last year's Mobile World Congress, before he had switched jobs. "Whoever has more data. Whoever is more digitalized today and has a bigger population. China is much more digitalized than the US."

In the research and development battle, in particular, the human capital imbalance will be hard for the US to counter. Last year, Huawei and ZTE together employed more than 124,000 people in R&D, a figure that equals about 63% of the entire combined workforce at Ericsson and Nokia. "There are so many people in China to hire," Lum told Light Reading during a conversation earlier this year. "It doesn't matter that everyone you are hiring isn't an Einstein. One of them will be."

Disentangling US technology from Chinese products will reduce security risks and stop China from ripping off US innovation, say defenders of US policy moves. Amid a virus-triggered backlash against China, critics of this isolationism are becoming harder to find. But the successor to the current system of global supply chains, partnerships and trade is a balkanized world of incompatible standards, concentrated risk and potential resource constraints. It is one in which a rapprochement between China and the US is even harder to envisage. In that environment, a technology arms race fought over decades is unlikely to produce a US victor.

in 5g base station etc,would require alot bandwidth and dsp processing capability, so perhap dedicated dsp chips or dedicated ASIC or high performance FPGA. something like this

not sure what huawei is using, but here is list from other vendor

Huawei used dedicated ASIC, which is cheaper to make and runs cooler. Nokia used FPGA and paid for it, causing their base stations to be more expensive and runs hotter.

Their best hope is to get SMIC's 7mn process running so they can transfer the production of these chips to SMIC.

Thanks for this, I am not an engineer, so there is just a bunch of numbers and specs, lol.in 5g base station etc,would require alot bandwidth and dsp processing capability, so perhap dedicated dsp chips or dedicated ASIC or high performance FPGA. something like this

not sure what huawei is using, but here is list from other vendor

I read one of those article quickly, Samsung has a chip at 28nm and Qualcomm modem at 14nm.

That really shows how aggressive Huawei was, have their own design house HiSilicone, design the 7nm chip, for a base station, that maybe no one else was doing.

Wasn't Huawei already ahead even with 14nm or 28nm in their radio gear? And they push forward like this.

Then we add in the fact, this week they finished building a stand alone 5G network.

That is not reported in the Liberal media, just how Hauwei is doomed!

Doomed!

Bwahahahahaha!

Last edited:

yea, but SMIC also use US manufacture tools like applied materials, so Trump could go after SMIC after huawei start shift its fab to SMIC like he did with TSMC. maybe thats why Huawei want to work with samsung in short term, long term they want become something like Samsung where it can fab its own chips.Huawei used dedicated ASIC, which is cheaper to make and runs cooler. Nokia used FPGA and paid for it, causing their base stations to be more expensive and runs hotter.

Their best hope is to get SMIC's 7mn process running so they can transfer the production of these chips to SMIC.

Hendrik_2000

Lieutenant General

Via broadsword translated from Vincent post. I don't have a clue how is this thing work Maybe some member can explain it in layman term

Pretty big news from 武汉光电工业技术研究院有限公司 (based in Wuhan)

光电工研院 武汉光电工业技术研究院有限公司 Yesterday

今年年底,国家02专项光刻机项目二期将迎验收节点,相继攻克曝光及双工作台系统等难关后,国内针对以光源为代表的光刻机核心组件的研发力度依旧不减,一批核心专利先后“冒尖”,光源研发思路进一步拓展。

作为光刻机核心组件之一,已知紫外光刻光源的商用方案分为同步辐射型光源、放电等离子体型光源和激光等离子体(LPP)型光源。其中LPP-EUV因功率可拓展、极紫外辐射收集效率高等特性成为当今工艺制程最先进的极紫外光刻机光源主流选择。

但事实上,LPP-EUV仍存弊端。其通过激光照射金属靶材形成等离子体,进而产生EUV辐射的过程中,大量的金属碎屑会对极紫外光收集镜等光学元件造成污染,从而影响LPP-EUV光源的长期运行稳定性。

为解决上述问题,以ASML为核心的上下游利益链厂商,以及致力于光刻产业链国产替代的国内厂商和科研院所各显手段。

今年2月底,ASML下游厂商台湾积体电路制造股份有限公司就发布了极紫外辐射源装置专利(1)。

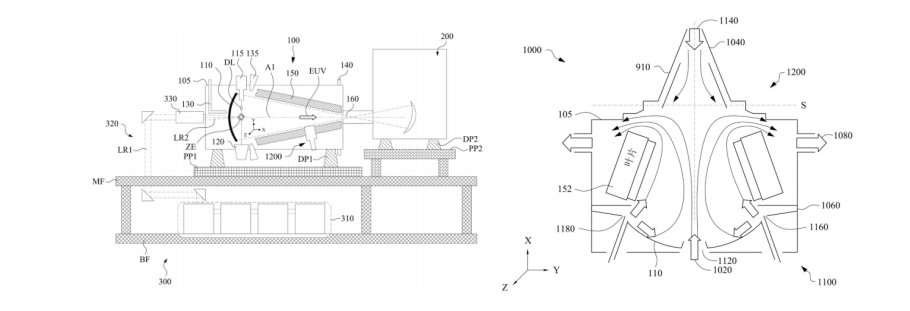

左图为极紫外辐射源/极紫外辐射源装置的示意图;右图为清洁气体排放口示意图

该装置在腔室中提供三个或更多个清洁气体排放口,借助气体流通形成的均匀气流带走因激光撞击靶材产生的金属残余物,有效避免收集镜上污染区域累积,从而增加了极紫外光收集镜的寿命和极紫外光微影系统的生产量,并降低了收集镜的维护成本。

中国科学院上海光学精密机械研究所则在今年7月公布的专利中(2),为光源系统设置了磁镜装置,利用磁镜装置所产生的非均匀磁场对等离子体进行约束,从而抑制LPP所产生的碎屑对光学元件造成的污染。(Chinese Academy of Sciences Shanghai Guangxue Precision Machinery Institute in July this year filed a patent for using magnetic fields to reduce the particles created in the LPP-EUV production process)

左图是基于等离子体约束的LPP-EUV光源系统结构示意图;右图是磁镜装置结构示意图

与此同时,在非均匀磁场的作用下,大量带电粒子被限制在磁镜装置中剧烈运动,增强了等离子体中的粒子碰撞效应,LPP-EUV光源的功率输出能力也得到了进一步提升。

双光束路线或引领国产光刻机制程突破

事实上,除了LPP-EUV光源,探索光刻光源国产化过程中,以中国科学院、华中科技大学为代表的多家科研院所和半导体厂商亦进行了不少另辟蹊径的探索。其中双激光束技术路线的出现,有效规避了国外专利封锁和主流EUV光源研发难题,让光刻机光源突破光学衍射极限成为可能,不用刻意追求短波长也能达到10nm以内的光刻制程。

7月初,中科院研究团队就在Nano Letters上发表题为《超分辨率激光光刻技术制备5nm间隙电极和阵列》的论文(3)。实验室环境下,研究团队在无机钛膜光刻胶上,采用双激光束(波长为405nm)交叠技术,实现1/55衍射极限的突破(NA=0.9),达到了最小5nm特征线宽,一时引发热议。(A Chinese Science Academy team published a paper in Nano Letters that demonstrated a capability to produce 5nm wires using twin lasers)

Industrial Research Flash News | Domestic lithography light source patent "takes the edge", new ideas outside the LPP-EUV route

Original Optoelectronics Industrial Research Institute Wuhan Optoelectronic Industrial Technology Research Institute Co., Ltd. Yesterday

At the end of this year, the second phase of the national 02 special lithography machine project will welcome the acceptance node. After successively overcoming the difficulties of exposure and dual-stage system, the domestic research and development efforts for the core components of the lithography machine represented by the light source are still unabated. The core patents successively "topped", and the light source research and development ideas were further expanded.

Domestic light source-related patent applications over the years: In recent years, lithography machine light source-related patent applications have remained active

As one of the core components of the lithography machine, known commercial solutions for ultraviolet lithography light sources are divided into synchrotron radiation light sources, discharge plasma light sources and laser plasma (LPP) light sources. Among them, LPP-EUV has become the mainstream choice for the most advanced extreme ultraviolet lithography machine light source in today's process due to its expandable power and high extreme ultraviolet radiation collection efficiency.

But in fact, LPP-EUV still has drawbacks. In the process of irradiating a metal target with a laser to form plasma, and then generating EUV radiation, a large amount of metal debris will pollute the optical components such as the extreme ultraviolet light collector, thereby affecting the long-term stability of the LPP-EUV light source.

In order to solve the above problems, the upstream and downstream benefit chain manufacturers with ASML as the core, as well as the domestic manufacturers and scientific research institutes dedicated to the domestic substitution of the lithography industry chain have shown their respective methods.

At the end of February this year, ASML downstream manufacturer Taiwan Semiconductor Manufacturing Co., Ltd. issued a patent for extreme ultraviolet radiation source device [1] .

The picture on the left is a schematic diagram of an extreme ultraviolet radiation source/extreme ultraviolet radiation source device; the picture on the right is a schematic diagram of a clean gas discharge port

The device provides three or more clean gas discharge ports in the chamber, and the uniform air flow formed by the gas circulation takes away the metal residues generated by the laser hitting the target, effectively avoiding the accumulation of contaminated areas on the collecting mirror, thereby increasing The lifetime of the extreme ultraviolet light collection mirror and the production volume of the extreme ultraviolet light lithography system, and reduce the maintenance cost of the collection mirror.

The Shanghai Institute of Optics and Fine Mechanics of the Chinese Academy of Sciences published a patent in July this year [ 2 ] , which set up a magnetic mirror device for the light source system, and the non-uniform magnetic field generated by the magnetic mirror device is used to confine the plasma, thereby suppressing the LPP The generated debris contaminates the optical components.

The left picture is a schematic diagram of the structure of the LPP-EUV light source system based on plasma confinement; the right picture is a schematic diagram of the structure of the magnetic mirror device

At the same time, under the action of the non-uniform magnetic field, a large number of charged particles are restricted to violent movement in the magnetic mirror device, which enhances the particle collision effect in the plasma, and the power output capability of the LPP-EUV light source has also been further improved.

The dual-beam route may lead the breakthrough of domestic lithography mechanism

In fact, in addition to the LPP-EUV light source, in the process of exploring the localization of lithography light sources, many scientific research institutes and semiconductor manufacturers, represented by the Chinese Academy of Sciences and Huazhong University of Science and Technology, have also conducted many other explorations. Among them, the emergence of the dual laser beam technology route effectively avoided foreign patent blockade and mainstream EUV light source research and development problems, making it possible for the light source of the lithography machine to break through the optical diffraction limit, without deliberately pursuing a short wavelength lithography process within 10nm.

In early July, the research team of the Chinese Academy of Sciences published a paper on Nano Letters entitled "Super-resolution laser lithography to prepare 5nm gap electrodes and arrays" [ 3 ] . In the laboratory environment, the research team used dual laser beams (wavelength of 405nm) overlap technology on the inorganic titanium film photoresist to achieve a breakthrough of 1/55 diffraction limit (NA=0.9), reaching the minimum 5nm characteristic line width , Sparked heated discussion for a while.

Pretty big news from 武汉光电工业技术研究院有限公司 (based in Wuhan)

光电工研院 武汉光电工业技术研究院有限公司 Yesterday

今年年底,国家02专项光刻机项目二期将迎验收节点,相继攻克曝光及双工作台系统等难关后,国内针对以光源为代表的光刻机核心组件的研发力度依旧不减,一批核心专利先后“冒尖”,光源研发思路进一步拓展。

作为光刻机核心组件之一,已知紫外光刻光源的商用方案分为同步辐射型光源、放电等离子体型光源和激光等离子体(LPP)型光源。其中LPP-EUV因功率可拓展、极紫外辐射收集效率高等特性成为当今工艺制程最先进的极紫外光刻机光源主流选择。

但事实上,LPP-EUV仍存弊端。其通过激光照射金属靶材形成等离子体,进而产生EUV辐射的过程中,大量的金属碎屑会对极紫外光收集镜等光学元件造成污染,从而影响LPP-EUV光源的长期运行稳定性。

为解决上述问题,以ASML为核心的上下游利益链厂商,以及致力于光刻产业链国产替代的国内厂商和科研院所各显手段。

今年2月底,ASML下游厂商台湾积体电路制造股份有限公司就发布了极紫外辐射源装置专利(1)。

左图为极紫外辐射源/极紫外辐射源装置的示意图;右图为清洁气体排放口示意图

该装置在腔室中提供三个或更多个清洁气体排放口,借助气体流通形成的均匀气流带走因激光撞击靶材产生的金属残余物,有效避免收集镜上污染区域累积,从而增加了极紫外光收集镜的寿命和极紫外光微影系统的生产量,并降低了收集镜的维护成本。

中国科学院上海光学精密机械研究所则在今年7月公布的专利中(2),为光源系统设置了磁镜装置,利用磁镜装置所产生的非均匀磁场对等离子体进行约束,从而抑制LPP所产生的碎屑对光学元件造成的污染。(Chinese Academy of Sciences Shanghai Guangxue Precision Machinery Institute in July this year filed a patent for using magnetic fields to reduce the particles created in the LPP-EUV production process)

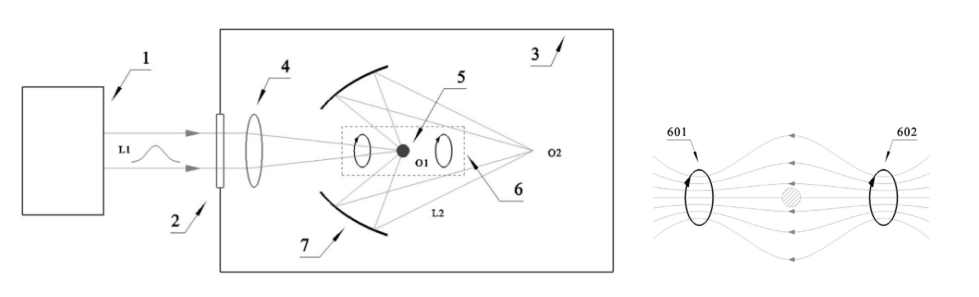

左图是基于等离子体约束的LPP-EUV光源系统结构示意图;右图是磁镜装置结构示意图

与此同时,在非均匀磁场的作用下,大量带电粒子被限制在磁镜装置中剧烈运动,增强了等离子体中的粒子碰撞效应,LPP-EUV光源的功率输出能力也得到了进一步提升。

双光束路线或引领国产光刻机制程突破

事实上,除了LPP-EUV光源,探索光刻光源国产化过程中,以中国科学院、华中科技大学为代表的多家科研院所和半导体厂商亦进行了不少另辟蹊径的探索。其中双激光束技术路线的出现,有效规避了国外专利封锁和主流EUV光源研发难题,让光刻机光源突破光学衍射极限成为可能,不用刻意追求短波长也能达到10nm以内的光刻制程。

7月初,中科院研究团队就在Nano Letters上发表题为《超分辨率激光光刻技术制备5nm间隙电极和阵列》的论文(3)。实验室环境下,研究团队在无机钛膜光刻胶上,采用双激光束(波长为405nm)交叠技术,实现1/55衍射极限的突破(NA=0.9),达到了最小5nm特征线宽,一时引发热议。(A Chinese Science Academy team published a paper in Nano Letters that demonstrated a capability to produce 5nm wires using twin lasers)

Industrial Research Flash News | Domestic lithography light source patent "takes the edge", new ideas outside the LPP-EUV route

Original Optoelectronics Industrial Research Institute Wuhan Optoelectronic Industrial Technology Research Institute Co., Ltd. Yesterday

At the end of this year, the second phase of the national 02 special lithography machine project will welcome the acceptance node. After successively overcoming the difficulties of exposure and dual-stage system, the domestic research and development efforts for the core components of the lithography machine represented by the light source are still unabated. The core patents successively "topped", and the light source research and development ideas were further expanded.

Domestic light source-related patent applications over the years: In recent years, lithography machine light source-related patent applications have remained active

As one of the core components of the lithography machine, known commercial solutions for ultraviolet lithography light sources are divided into synchrotron radiation light sources, discharge plasma light sources and laser plasma (LPP) light sources. Among them, LPP-EUV has become the mainstream choice for the most advanced extreme ultraviolet lithography machine light source in today's process due to its expandable power and high extreme ultraviolet radiation collection efficiency.

But in fact, LPP-EUV still has drawbacks. In the process of irradiating a metal target with a laser to form plasma, and then generating EUV radiation, a large amount of metal debris will pollute the optical components such as the extreme ultraviolet light collector, thereby affecting the long-term stability of the LPP-EUV light source.

In order to solve the above problems, the upstream and downstream benefit chain manufacturers with ASML as the core, as well as the domestic manufacturers and scientific research institutes dedicated to the domestic substitution of the lithography industry chain have shown their respective methods.

At the end of February this year, ASML downstream manufacturer Taiwan Semiconductor Manufacturing Co., Ltd. issued a patent for extreme ultraviolet radiation source device [1] .

The picture on the left is a schematic diagram of an extreme ultraviolet radiation source/extreme ultraviolet radiation source device; the picture on the right is a schematic diagram of a clean gas discharge port

The device provides three or more clean gas discharge ports in the chamber, and the uniform air flow formed by the gas circulation takes away the metal residues generated by the laser hitting the target, effectively avoiding the accumulation of contaminated areas on the collecting mirror, thereby increasing The lifetime of the extreme ultraviolet light collection mirror and the production volume of the extreme ultraviolet light lithography system, and reduce the maintenance cost of the collection mirror.

The Shanghai Institute of Optics and Fine Mechanics of the Chinese Academy of Sciences published a patent in July this year [ 2 ] , which set up a magnetic mirror device for the light source system, and the non-uniform magnetic field generated by the magnetic mirror device is used to confine the plasma, thereby suppressing the LPP The generated debris contaminates the optical components.

The left picture is a schematic diagram of the structure of the LPP-EUV light source system based on plasma confinement; the right picture is a schematic diagram of the structure of the magnetic mirror device

At the same time, under the action of the non-uniform magnetic field, a large number of charged particles are restricted to violent movement in the magnetic mirror device, which enhances the particle collision effect in the plasma, and the power output capability of the LPP-EUV light source has also been further improved.

The dual-beam route may lead the breakthrough of domestic lithography mechanism

In fact, in addition to the LPP-EUV light source, in the process of exploring the localization of lithography light sources, many scientific research institutes and semiconductor manufacturers, represented by the Chinese Academy of Sciences and Huazhong University of Science and Technology, have also conducted many other explorations. Among them, the emergence of the dual laser beam technology route effectively avoided foreign patent blockade and mainstream EUV light source research and development problems, making it possible for the light source of the lithography machine to break through the optical diffraction limit, without deliberately pursuing a short wavelength lithography process within 10nm.

In early July, the research team of the Chinese Academy of Sciences published a paper on Nano Letters entitled "Super-resolution laser lithography to prepare 5nm gap electrodes and arrays" [ 3 ] . In the laboratory environment, the research team used dual laser beams (wavelength of 405nm) overlap technology on the inorganic titanium film photoresist to achieve a breakthrough of 1/55 diffraction limit (NA=0.9), reaching the minimum 5nm characteristic line width , Sparked heated discussion for a while.

Last edited:

I am really suspicious about something here ...Their best hope is to get SMIC's 7mn process running so they can transfer the production of these chips to SMIC.

Why would a box like a base station need the fastest chip possible?

There is no reason why, this sounds like a real time experiment.

3G and 4G worked without 7nm, and probably 5G too.

Well ... guess what ... who is building the first stand alone 5G network in the world?

Maybe all those boxes with 7nm chips not even for export?

Hendrik_2000

Lieutenant General

(cont)

a while.

The left picture is a schematic diagram of the double-beam overlap processing technology; the right picture is an electron microscope picture of a 5nm slit electrode

Similarly, in Optics Valley, China, the relevant team of Wuhan Optoelectronics National Research Center issued a patent as early as 2018 [ 4 ] , proposing a dual-beam micro-nano optics manufacturing method, which modulates auxiliary light and matches self-developed photoresist to make visible light The manufacturing achieves a feature size of 10 nm or less and a resolution of 50 nm.

Device diagram of dual-beam optical micro-nano manufacturing method applied to single-focus laser direct writing

At present, the technology is being industrialized relying on Wuhan Optoelectronics Industrial Research Institute. Based on the dual-beam super-resolution nanolithography technology, the team has achieved high-precision direct writing lithography with a minimum line width of 9nm and a minimum line spacing of 52nm, and a 9nm dual-beam super-resolution The direct-write lithography machine has achieved commercial sales. The dual-beam super-resolution projection lithography experimental prototype was also tested in 2019, and the research and development of large-scale engineering prototypes is being carried out to rapidly promote the industrialization process.

"Through upstream mergers and acquisitions and introducing customers as shareholders to open up the upstream and downstream of the industry and create a community of interests in the industry chain, ASML has grown from obscurity to the overlord of lithography machines. We also invite all parties to carry out technical cooperation with an open mind, hoping to go out A different route to localization of light sources."

With the continuous development of technologies such as the Internet of Things and 5G, semiconductor demand will continue to grow in the future. According to IBS data, in 2018, Chinese IC design companies demand about 80.5 billion yuan in wafer manufacturing, accounting for 19.7% of the global foundry scale of 408 million yuan, and the demand will rise to 30.5% in 2025.

Relevant research institutions believe that under such a pattern, it is imperative to realize the localization of lithography machines. At present, there is a big gap between the domestic and foreign top lithography mechanisms, and the national system cannot break through the EUV route diffraction limit in a short time. Under this background, the development of the super-resolution technology route based on dual-beam technology may be a bright spot. Domestic substitution of engraving machines brings dawn.

references

[1] Yang Ji. Extreme ultraviolet radiation source device: China, 110837208 [P]. 2020-02-25.

[2] Zhang Zongxin. LPP-EUV light source system based on plasma confinement: China, 111399346 [P]. 2020-07-10.

[3] Liang Qin, Yuanqing Huang, Feng Xia. Nano Letters 2020, 20, 7, 4916-4923.

[4] Gan Zongsong. A manufacturing method of dual-beam micro-nano optics: China, 1083279550 [P]. 2018-07-13.

a while.

The left picture is a schematic diagram of the double-beam overlap processing technology; the right picture is an electron microscope picture of a 5nm slit electrode

Similarly, in Optics Valley, China, the relevant team of Wuhan Optoelectronics National Research Center issued a patent as early as 2018 [ 4 ] , proposing a dual-beam micro-nano optics manufacturing method, which modulates auxiliary light and matches self-developed photoresist to make visible light The manufacturing achieves a feature size of 10 nm or less and a resolution of 50 nm.

Device diagram of dual-beam optical micro-nano manufacturing method applied to single-focus laser direct writing

At present, the technology is being industrialized relying on Wuhan Optoelectronics Industrial Research Institute. Based on the dual-beam super-resolution nanolithography technology, the team has achieved high-precision direct writing lithography with a minimum line width of 9nm and a minimum line spacing of 52nm, and a 9nm dual-beam super-resolution The direct-write lithography machine has achieved commercial sales. The dual-beam super-resolution projection lithography experimental prototype was also tested in 2019, and the research and development of large-scale engineering prototypes is being carried out to rapidly promote the industrialization process.

"Through upstream mergers and acquisitions and introducing customers as shareholders to open up the upstream and downstream of the industry and create a community of interests in the industry chain, ASML has grown from obscurity to the overlord of lithography machines. We also invite all parties to carry out technical cooperation with an open mind, hoping to go out A different route to localization of light sources."

With the continuous development of technologies such as the Internet of Things and 5G, semiconductor demand will continue to grow in the future. According to IBS data, in 2018, Chinese IC design companies demand about 80.5 billion yuan in wafer manufacturing, accounting for 19.7% of the global foundry scale of 408 million yuan, and the demand will rise to 30.5% in 2025.

Relevant research institutions believe that under such a pattern, it is imperative to realize the localization of lithography machines. At present, there is a big gap between the domestic and foreign top lithography mechanisms, and the national system cannot break through the EUV route diffraction limit in a short time. Under this background, the development of the super-resolution technology route based on dual-beam technology may be a bright spot. Domestic substitution of engraving machines brings dawn.

references

[1] Yang Ji. Extreme ultraviolet radiation source device: China, 110837208 [P]. 2020-02-25.

[2] Zhang Zongxin. LPP-EUV light source system based on plasma confinement: China, 111399346 [P]. 2020-07-10.

[3] Liang Qin, Yuanqing Huang, Feng Xia. Nano Letters 2020, 20, 7, 4916-4923.

[4] Gan Zongsong. A manufacturing method of dual-beam micro-nano optics: China, 1083279550 [P]. 2018-07-13.