It looks like they will ban hsbc and standard chartered to some extent, in both China and Hong Kong. They are like spying agencies on the assets and investment plans of their clients. Therefore they are national security issues.Making Frankfurt another major trading house for offshore renminbi is a better method. Stop investing in UK from high speed railroad, to nuclear plants, discourage Chinese tourists and Chinese students from going to UK, and weaken the UK financial sectors by undermining HSBC and Standard Chartered in HK. All five eyes are lost cause so no need to invest in them anymore. All major Chinese technology companies should avoid them also.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

News on China's scientific and technological development.

- Thread starter Quickie

- Start date

AssassinsMace

Lieutenant General

from Stranagor (PAKISTAN DEFENSE FORUM)

Chinese Chipmaker SMIC Rakes in Record USD84.6 Billion on its Shanghai Star Market Debut

LAI SHASHA

DATE: 17 MINUTES AGO

/ SOURCE: YICAI

![[IMG] [IMG]](https://img.yicaiglobal.com/cdn/news/chinese-chipmaker-smic-rakes-in-record-usd846-billion-on-its-shanghai-star-market-debut/6553791553339392.jpg)

Chinese Chipmaker SMIC Rakes in Record USD84.6 Billion on its Shanghai Star Market Debut

(Yicai Global) July 16 -- Semiconductor Manufacturing International Corp. raised CNY591.8 billion (USD84.6 billion) on its Shanghai debut, an all-time high for the bourse’s Nasdaq-style Star Market, as China’s biggest chipmaker’s stock soared up to three and a half times the issue price.

SMIC hit CNY95 (USD13.58) this morning before settling down to close at CNY82.92 (USD11.85) this afternoon, still triple its offer price of CNY27.46.

The worldwide push to develop fifth-generation mobile networks and the Internet of Things is driving up demand in the semiconductor field, Chairman and Executive Director Zhou Zixue said on July 6.

The Star Market listing is part of a much-heralded welcoming home of so-called ‘concept stocks,’ or Chinese companies that are listed abroad. In May last year SMIC delisted from the Nasdaq and New York stock exchanges, citing low trade volumes and its objection to the blacklisting of telecoms giant Huawei Technologies by the US government. SMIC remains listed on the Hong Kong bourse.

SMIC’s secondary listing will most probably encourage other Hong Kong-listed semiconductor firms to also float on the mainland stock markets, analysts said. Chinese chipmakers that have listed in Hong Kong have low trading volumes due to a dearth of foreign investors. Their market value will rise if they list on the mainland, which will greatly help their financing.

SMIC plans to use around 40 percent of the funds raised to upgrade its 12-inch chip SN1 project, which mainly develops and mass produces the firm’s 14-nanometer or below technologies, to 35,000 chips a month from the current 6,000, the Shanghai-based firm said in its prospectus.

As of the close of markets yesterday, the most valuable semiconductor firms listed on the mainland stock markets were Shanghai-based Will Semiconductor with a market value of CNY199.1 billion (USD28.5 billion), LONGi Green Energy Technology with CNY183.5 billion and Advanced Micro-Fabrication Equipment China with CNY143.3 billion, according to financial data provider Wind Information.

SMIC ranked fifth among global semiconductor foundries in terms of market share in the first quarter, with 4.5 percent, according to market survey agency Topology Research. It still lags far behind rival Taiwan Semiconductor Manufacturing Company in its product mix. SMIC’s 14-nanometer wafer shipment contributed less than 10 percent of the firm’s total operating revenue in the first quarter, while TSMC’s more advanced 7-nm wafer shipment took up 35 percent of its total sales and the 16-nm wafer made up 19 percent.

SMIC’s Hong Kong stock [HKG:0981] by contrast did not do well today, crashing more than three and a half times to close at HKD28.75 (USD3.70).

Chinese Chipmaker SMIC Rakes in Record USD84.6 Billion on its Shanghai Star Market Debut

LAI SHASHA

DATE: 17 MINUTES AGO

/ SOURCE: YICAI

![[IMG] [IMG]](https://img.yicaiglobal.com/cdn/news/chinese-chipmaker-smic-rakes-in-record-usd846-billion-on-its-shanghai-star-market-debut/6553791553339392.jpg)

Chinese Chipmaker SMIC Rakes in Record USD84.6 Billion on its Shanghai Star Market Debut

(Yicai Global) July 16 -- Semiconductor Manufacturing International Corp. raised CNY591.8 billion (USD84.6 billion) on its Shanghai debut, an all-time high for the bourse’s Nasdaq-style Star Market, as China’s biggest chipmaker’s stock soared up to three and a half times the issue price.

SMIC hit CNY95 (USD13.58) this morning before settling down to close at CNY82.92 (USD11.85) this afternoon, still triple its offer price of CNY27.46.

The worldwide push to develop fifth-generation mobile networks and the Internet of Things is driving up demand in the semiconductor field, Chairman and Executive Director Zhou Zixue said on July 6.

The Star Market listing is part of a much-heralded welcoming home of so-called ‘concept stocks,’ or Chinese companies that are listed abroad. In May last year SMIC delisted from the Nasdaq and New York stock exchanges, citing low trade volumes and its objection to the blacklisting of telecoms giant Huawei Technologies by the US government. SMIC remains listed on the Hong Kong bourse.

SMIC’s secondary listing will most probably encourage other Hong Kong-listed semiconductor firms to also float on the mainland stock markets, analysts said. Chinese chipmakers that have listed in Hong Kong have low trading volumes due to a dearth of foreign investors. Their market value will rise if they list on the mainland, which will greatly help their financing.

SMIC plans to use around 40 percent of the funds raised to upgrade its 12-inch chip SN1 project, which mainly develops and mass produces the firm’s 14-nanometer or below technologies, to 35,000 chips a month from the current 6,000, the Shanghai-based firm said in its prospectus.

As of the close of markets yesterday, the most valuable semiconductor firms listed on the mainland stock markets were Shanghai-based Will Semiconductor with a market value of CNY199.1 billion (USD28.5 billion), LONGi Green Energy Technology with CNY183.5 billion and Advanced Micro-Fabrication Equipment China with CNY143.3 billion, according to financial data provider Wind Information.

SMIC ranked fifth among global semiconductor foundries in terms of market share in the first quarter, with 4.5 percent, according to market survey agency Topology Research. It still lags far behind rival Taiwan Semiconductor Manufacturing Company in its product mix. SMIC’s 14-nanometer wafer shipment contributed less than 10 percent of the firm’s total operating revenue in the first quarter, while TSMC’s more advanced 7-nm wafer shipment took up 35 percent of its total sales and the 16-nm wafer made up 19 percent.

SMIC’s Hong Kong stock [HKG:0981] by contrast did not do well today, crashing more than three and a half times to close at HKD28.75 (USD3.70).

A good summary from FairAndUnbiased (PAKISTAN DEFENSE FORUM)

TSMC is a monster in foundry. Even Samsung and Intel can't compare with them in that.

Compare SMIC to GloFo or UMC, and it becomes alot closer. Even GloFo's 14 nm process is licensed from Samsung and UMC's 14 nm process is licensed from IBM, while SMIC is developing it independently.

My prediction: by 2030, SMIC will be competing for 2nd with Samsung Foundry and have a strong lead over GloFo. SMIC has some captive customers like Huawei, like how GloFo rode AMD to glory and then started going down after AMD dumped them for TSMC. GloFo is no longer developing 7 nm and they're selling their EUV machines.

If SMIC gets 7 nm capabilities (even if its only a slight improvement from 14 nm and using multipattern immersion lithography) then there's a large chance it will at least be 3rd behind TSMC and Samsung.

The bigger question is, will Tsinghua Unigroup open a foundry business with their fabs, or are they going to keep it all internal?

its official, The partnership ended in a divorced, Huawei shift its attention to SMIC.

from cnTechPost

TSMC says no plans to continue supplying Huawei after Sept 14

2020-07-16 17:16:23 GMT+8 | cnTechPost

0

TSMC has no plans to continue supplying Huawei after September 14, the company said today in an investor meeting on its second-quarter results.

The new restrictions on Huawei announced by the U.S. Commerce Department on May 15 will officially take effect on September 15.

TSMC today released its financial results for the second quarter of fiscal 2020, which ended June 30.

According to the results, TSMC's Q2 revenue was NT$310.699 billion (US$10.540 billion). This represents an increase of 28.9% from $240.999 billion in the same period of the previous year.

Net profit was NT$120.822 billion (US$4.099 billion), up 81.0% from the same period a year earlier.

It was previously reported that TSMC had made a submission to the U.S. to continue supplying Huawei after the grace period, and TSMC didn't make a comment on this.

Huawei, for its part, has begun to lay out suppliers within the mainland, shifting its chip production to the mainland's largest manufacturer, SMIC.

from cnTechPost

TSMC says no plans to continue supplying Huawei after Sept 14

2020-07-16 17:16:23 GMT+8 | cnTechPost

0

TSMC has no plans to continue supplying Huawei after September 14, the company said today in an investor meeting on its second-quarter results.

The new restrictions on Huawei announced by the U.S. Commerce Department on May 15 will officially take effect on September 15.

TSMC today released its financial results for the second quarter of fiscal 2020, which ended June 30.

According to the results, TSMC's Q2 revenue was NT$310.699 billion (US$10.540 billion). This represents an increase of 28.9% from $240.999 billion in the same period of the previous year.

Net profit was NT$120.822 billion (US$4.099 billion), up 81.0% from the same period a year earlier.

It was previously reported that TSMC had made a submission to the U.S. to continue supplying Huawei after the grace period, and TSMC didn't make a comment on this.

Huawei, for its part, has begun to lay out suppliers within the mainland, shifting its chip production to the mainland's largest manufacturer, SMIC.

That's peak TSMC there, huge increases coming from large Huawei volume orders in order to catch the deadline. After that, it can go downhill all the way.

Please note that the global smartphone market is in the negative --- except for China's. That means lower sales, lower figures for flagship chips and phones --- except in China's.

Please note that the global smartphone market is in the negative --- except for China's. That means lower sales, lower figures for flagship chips and phones --- except in China's.

Hi Tam

I think TSMC 5nm will keep them going , or maybe its 7nm also if SMIC 7nm is delayed. I remember our SDF esteem member Tidalwave once said about banning TSMC 5nm for at least 2 years in China to give SMIC time to keep up. Well for me his wished had been answered in a different way, this pandemic is a disaster for TSMC , it needs a lot of sales to recoup its huge investment in a time of market uncertainty. A boon for SMIC ,with state support and resources now being allocated and being anointed as a State Champion, it had given them the momentum to catch up, Hopefully it will.

I think TSMC 5nm will keep them going , or maybe its 7nm also if SMIC 7nm is delayed. I remember our SDF esteem member Tidalwave once said about banning TSMC 5nm for at least 2 years in China to give SMIC time to keep up. Well for me his wished had been answered in a different way, this pandemic is a disaster for TSMC , it needs a lot of sales to recoup its huge investment in a time of market uncertainty. A boon for SMIC ,with state support and resources now being allocated and being anointed as a State Champion, it had given them the momentum to catch up, Hopefully it will.

Yup, momentum keep on coming, SMIC jiayou!!!

from cnTechPost

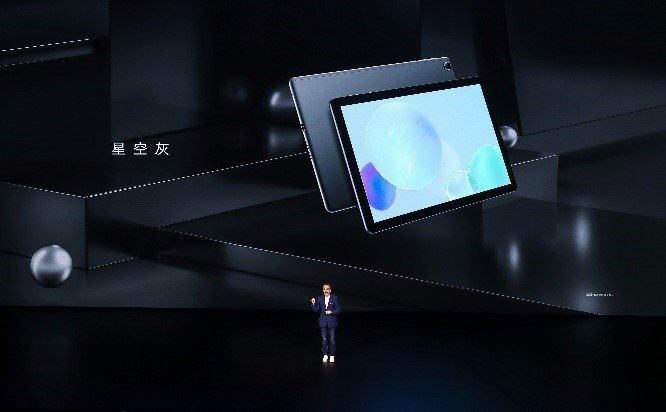

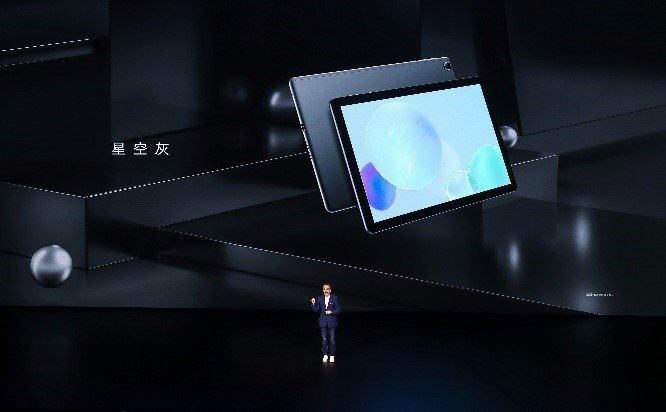

Honor launches tablets with SMIC-made chipsets, starting at $157

2020-07-16 17:05:35 GMT+8 | cnTechPost

1

Honor today announced the Honor Tablet 6 and X6, powered by the Kirin 710A processor made by Chinese chip maker Semiconductor Manufacturing International Corporation (SMIC). The devices are priced from 1,099 yuan ($157).

The Honor Tablet 6 comes with a 10.1-inch screen with 1920×1200 resolution and contrast ratio of 1000:1.

The Honor Tablet 6 is 7.55mm thick and weighs 460g.

Honor says the Honor Tablet 6 series comes with a newly upgraded HUAWEI Histen 6.1 sound with better low frequencies and richer sound quality.

The Honor Tablet 6 series comes with a new MagicUI 3.1 system that supports "Parallel Vision" and Honor Magic-Pencil.

The Huawei Education Center App and the Children's Playground App are also pre-installed on the Honor X6 series.

The Honor Tablet 6 is priced from 1,299 yuan and the Honor Tablet X6 (1,200×800 resolution) is priced from 1,099 yuan.

from cnTechPost

Honor launches tablets with SMIC-made chipsets, starting at $157

2020-07-16 17:05:35 GMT+8 | cnTechPost

1

Honor today announced the Honor Tablet 6 and X6, powered by the Kirin 710A processor made by Chinese chip maker Semiconductor Manufacturing International Corporation (SMIC). The devices are priced from 1,099 yuan ($157).

The Honor Tablet 6 comes with a 10.1-inch screen with 1920×1200 resolution and contrast ratio of 1000:1.

The Honor Tablet 6 is 7.55mm thick and weighs 460g.

Honor says the Honor Tablet 6 series comes with a newly upgraded HUAWEI Histen 6.1 sound with better low frequencies and richer sound quality.

The Honor Tablet 6 series comes with a new MagicUI 3.1 system that supports "Parallel Vision" and Honor Magic-Pencil.

The Huawei Education Center App and the Children's Playground App are also pre-installed on the Honor X6 series.

The Honor Tablet 6 is priced from 1,299 yuan and the Honor Tablet X6 (1,200×800 resolution) is priced from 1,099 yuan.