Would this SVB collapse eventually result in the Great Financial Crisis 2.0? What do you guys think?

No.

That is the short answer. We might see a big rally in stocks Monday morning.

================== =================

The long story is rather convoluted. Summarize some basic points, very generally since I am not an expert.

1. Capitalism is and always has been an unstable system, subject to booms and busts, along with financial panics, and debt crisis. However, capitalism always manages to come back. The only real stable economic system is central planning, where it starts off okay, then goes straight to life support, until they finally pull the plug. That is why the Chinese Communist Party, has repeatedly said that they want the market to decide the allocation of inputs.

2. What happened in 2008 with the collapse of Lehman Brothers, was due to "systemic risk." That was how the New York financial industry, banks, investment banks, and insurance company, ran their industry, playing with derivatives. Okay, I don't think I want to explain this part anymore. This already looking like a real long ass post, heh.

3. What happened was credit dried up. Since the bank had to pay some other bank, due to derivative losses, they had to sell assets like stocks to pay. But the market was falling so they kept on selling. It got to a point where those financiers realized that something was wrong, and they decided not to lend money to each other. The defaults caused by the Lehman Brothers collapse, caused a credit crunch, which produced the Great Recession of 2008.

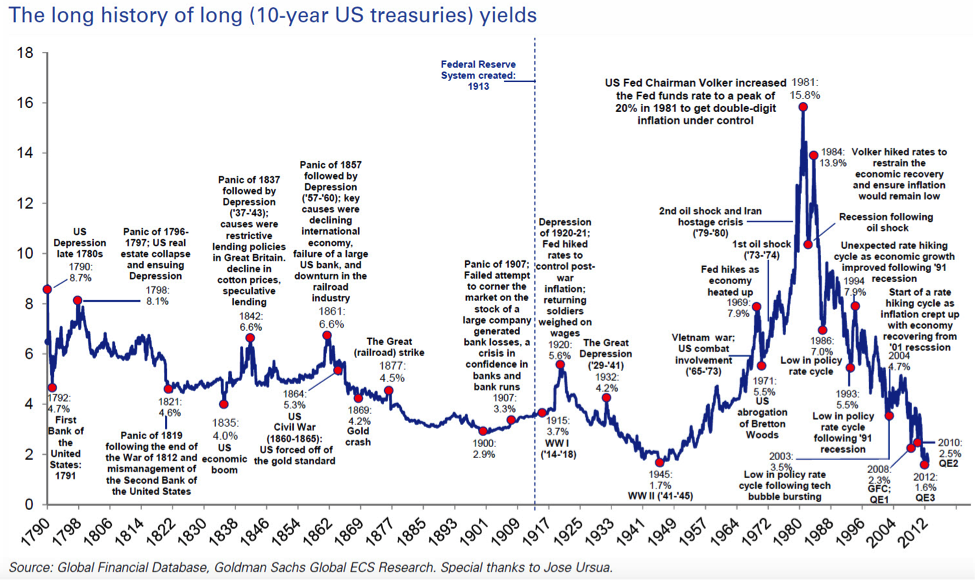

4. What is happening today this time to that Silicone Valley bank, appears to be entirely different. Remember, capitalism was always unstable, with panics and bank runs back in the previous century. The Federal Reserve Bank was created to maintain stability in the system. This crisis at that regional bank, seems tailor made for the role of the Fed. What we have here apparently is a classical bank run from antiquity. Bank need to hold reserves, or assets, to buttress their loans. If everyone withdraws their money all at once, the back has no assets, therefore, it is insolvent.

5. The simple solution is for someone bigger to buy this bank, and recapitalize it, and that problem is solved.

There is more to it, but this is already a long ass post. LOL.