... PART 2HOW THE WEST WAS LOST: A FALTERING WORLD RESERVE CURRENCY

Authored by MATTHEW PIEPENBURG - 30 MARCH 2022

The Western financial system and world reserve currency is now in open decline.

CONTINUE...

OIL MATTERS

Meanwhile, and despite the media’s attempt to paint Putin as Hitler 2.0, the Russian leader knows something the headlines are ignoring, namely: THE WORLD NEEDS HIS OIL.

WITHOUT RUSSIAN OIL, the global energy and economic system IMPLODES, because the system has TOO MUCH DEBT to suddenly go it alone and/or fight back.

See how sovereign debt cripples options and changes the global stage?

Meanwhile Russia, which doesn’t have the same debt to GDP chains around its ankle as the EU and US, can start demanding payment for its oil in RUB rather than USD.

As of this writing, Arab states are in PRIVATE DISCUSSIONS with China, Russia and France to stop selling oil in USD.

Such moves would weaken USD demand and strength, adding more inflationary fuel to a growing inflationary fire from Malibu to Manhattan.

I wonder if Biden, Harris or anyone in their circle of “experts” thought that part through?

Given their strength in optics vs. their weakness as to math, geography and history, it’s quite clear they did not and could not…

NOT TO WORRY?

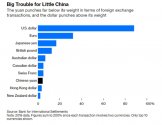

Meanwhile, of course, the WSJ and other Western political news organizations are assuring the world not to worry, as USD FX trading volumes dwarf those of Chinese (Russian) and other currencies.

Fair enough.

BUT FOR HOW LONG?

Again, what many politicians and most journalists don’t understand (besides basic math), is BASIC HISTORY.

Their myopic policies and smooth-tongued forecasts are based on the notion that if it’s not raining today, it can’t rain tomorrow.

But it’s already raining on the US as well as US global financial leadership.

Meanwhile, Russia’s central bank is now in motion to INCREASE GOLD PURCHASES with all the new RUBs (not USDs) it will be receiving from its oil sales.

Investors must track these macro events very carefully in the coming weeks and months.

A MULTI-CURRENCY NEW WORLD

The bottom line, however, is that the world is slowly moving away from a one-world-reserve-currency era to an INCREASINGLY MULTI-CURRENCY SYSTEM.

Once the sanction and financial war genie is OUT OF THE BOTTLE, it’s HARD TO PUT BACK. Trust in the West, and its USD-led currency system, is changing.

By taking the CHEST-PUFFING DECISION to freeze Russian FX reserves, sanction Russian IMF SDR’s and remove its access to SWIFT payments systems, the US garnered short-term headlines to appear “tough” but ushered a path toward longer term consequences which will make it (and its Dollar) weaker.

AS MULTI-CURRENCY OIL BECOMES THE NEW SETTING, the INFLATIONARY WINNERS will, again, be commodities, industrials and certain real estate plays.

GOLD MATTERS

As for gold, it remains the only true neutral reserve asset of global central bank balance sheets and is poised to benefit the most over time as a non-USD denominated energy market slowly emerges.

Furthermore, Russia is allowing payments in gold for its natural gas.

And for those (i.e., Wall Street) who still argue gold is a “pet rock” and “barbarous relic” of the past, it may be time to rethink.

After all, why has the Treasury Department included an entire section in its Russian sanction handbook on gold?

The answer is as obvious as it is ignored.

Chinese banks (with Russian currency swap lines) can act as intermediaries to help Russia use the gold market to “launder” its sanctioned money.

That is, Russia can and will continue to trade globally (Eurasia, Brazil, India, China…) in what boils down to a truly free market of “GOLD FOR COMMODITIES” which not even those thieves at the COMEX can artificially price fix—something not seen in decades.

DE-GLOBALIZATION

Stated simply: The mighty dollar and “globalization” dreams of the West are slowly witnessing an EMERGING ERA OF INFLATIONARY DE-GLOBALIZATION as EACH COUNTRY NOW DOES WHAT IS REQUIRED AND BEST FOR ITSELF rather than Klaus Schwab’s megalomaniacal fantasies.

The cornered US, of course, will likely try to sanction gold transactions with Russia, but this would require fully choking Russia energy sales to the EU, which the EU economy (and citizens) simply can’t afford.

In the meantime, a desperate French president is considering stimulus checks for gas and food. That, by the way, is INFLATIONARY…

HISTORY REPEATING ITSELF

Again, the debt-soaked, energy-dependent West is NOT AS STRONG AS THE HEADLINES WOULD HAVE YOU BELIEVE, which means gold, as it has done for thousands of years, will rise as failed leaders, debt-soaked nations and world reserve currencies fall.

HISTORY, alas, is as important as math, price-discovery and supply and demand. Sadly, the vast of majority of modern leaders know almost nothing of these forces or topics.

If gold could speak in words, it would simply say: “Shame on them.”

But gold does speak in value, and it’s getting the last laugh on the currencies now weakening in our wallets and the debt-drunk leaders NOW SQUAWKING IN OUR HEADLINES.

Last edited: