You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Miscellaneous News

- Thread starter bd popeye

- Start date

I think they did expect it when they go into the war with Ukraine, what they don't expect is EU to follow suite considering majority of their reserves is in Euros.The Russians did not expect the west to go total crazy on the economic front. Too bad for Russia, a good learning experience for China and the "real" international community.

escobar

Brigadier

It does not really matter because everything is still based on the dollar price. All crude benchmarks are based on the dollar price. Just because it is paid in rupee and yuan does not mean the dollar has lost any influence in the oil market.Its a slow process. The West has shown to the entire world that its laws and institutions are fake. Who (non-Western) is going to trust the dollar now?

Even your favourite ally India, is divesting away from the dollar

Pricing in dollar doesn't matter, that's just the effect of petrodollar. The cause is the need to convert local currency to dollar in order to pay for oil. Russia forcing payments of oil, coal and natural gas gives it influence over pricing and indirectly the status of petrodollar. We're seeing OPEC countries realigning themselves away from the US as well, which result is to be seen. if the OPEC shifts the use of payment from dollar to another/multiple currency, then we'll see the reserve status degrade even further.It does not really matter because everything is still based on the dollar price. All crude benchmarks are based on the dollar price. Just because it is paid in rupee and yuan does not mean the dollar has lost any influence in the oil market.

Honestly even without the petrodollar, the dollar will not devolve into toilet paper. After all a lot of debts in dollar still need to be paid and US could still peg their dollar to their manufactured goods, agricultural goods and resources. Its just they won't be able to print their dollar liberally anymore to fuel their expensive military and possibly their tech industry.

Edit: Forgot to mention, that also means they cannot get to amass large amount of debt without high risk of inflation and widening income inequality.

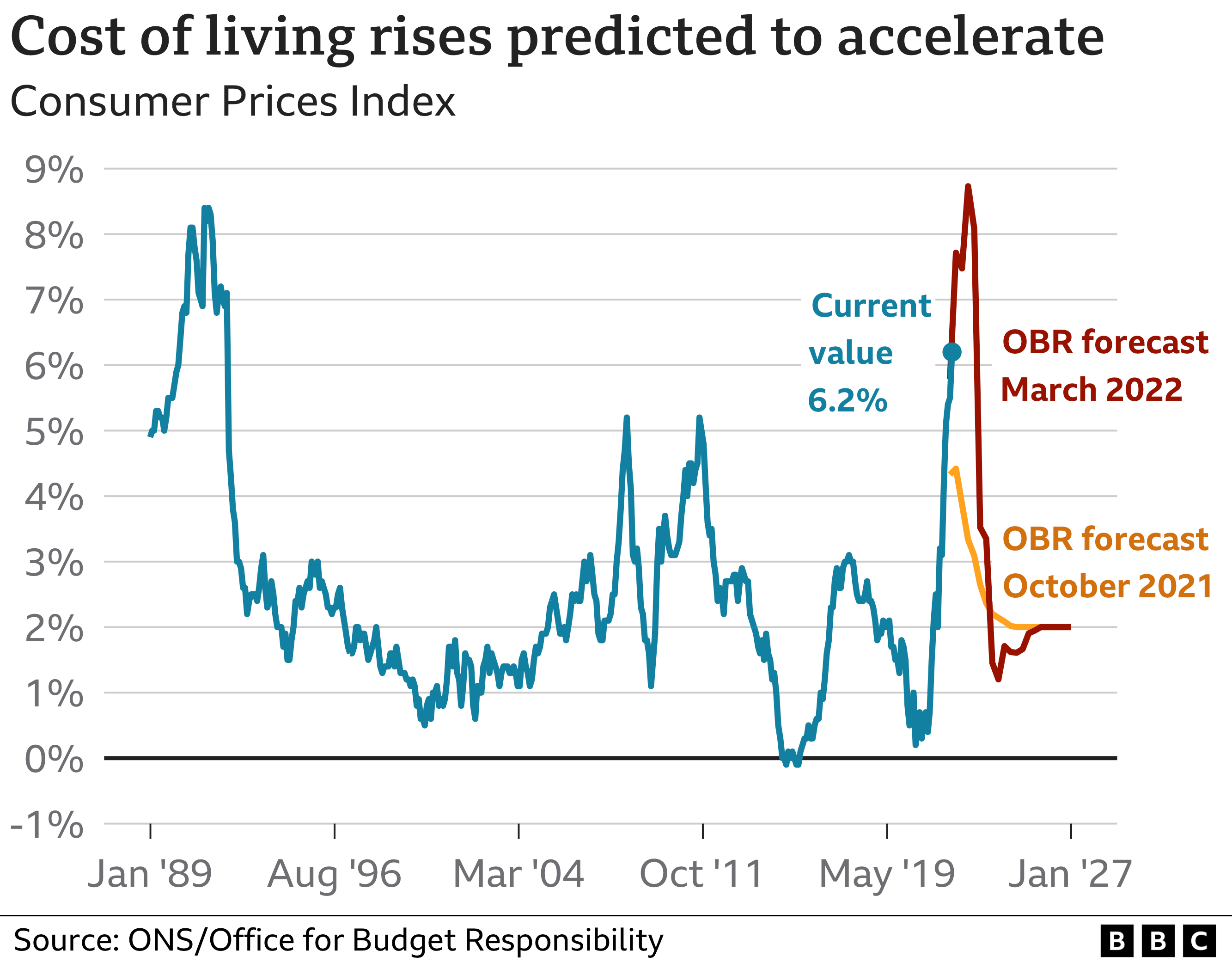

They are way too optimistic about inflation going down, we're only at the beginning of the crisis. Those high PPI and crop failure/food shortages are going to show up in CPI late this year.Inflation in the UK! Let's hope the new "Forecast" is correct!

@KYli Yeah do that and expect higher prices plus China will be grateful instead of exporting deflation the Collective West will have inflation, what kind of economic courses did these people take.

The same economic course that taught them printing to infinity will have no downsides whatsoever and that debt is equals to money.@KYli Yeah do that and expect higher prices plus China will be grateful instead of exporting deflation the Collective West will have inflation, what kind of economic courses did these people take.