SMIC Q1 2025

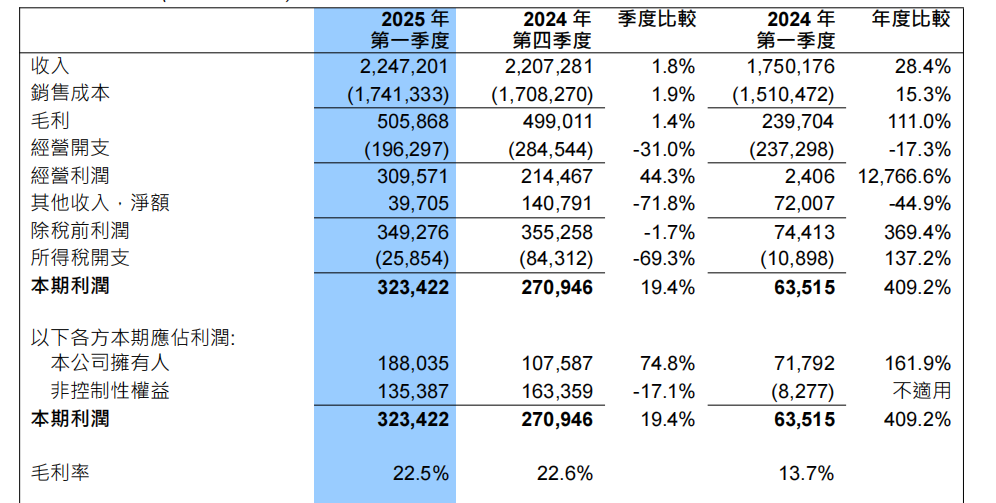

Here is the financial report:

Capacity of 432K wpm at 12" equivalent, it is an increase of 11K wpm (12") in the last quarter. In the last quarter of 2024 the increase was of 28Kwpm, so it is a bit slowed down, but the cumulative of last 2 quarters (6 months) is 28+11 = 39K wpm in half a year

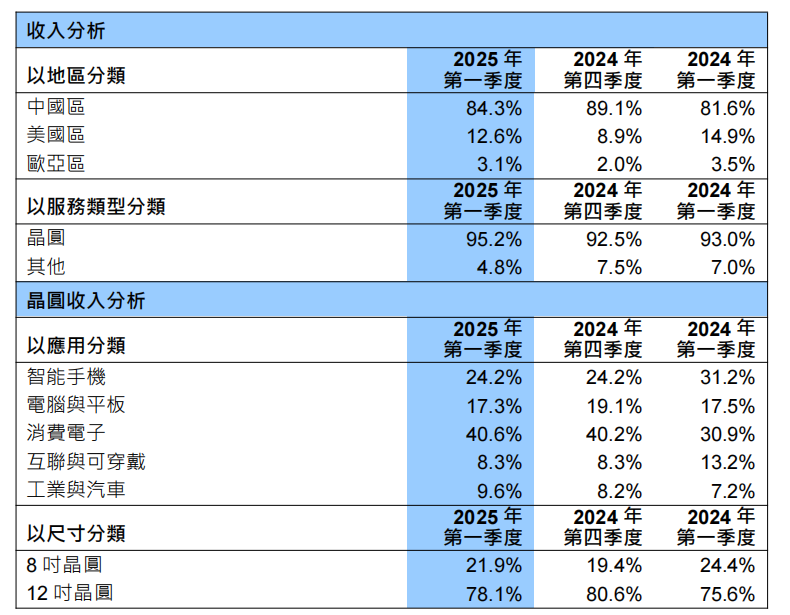

Fun fact, there is an increase in market share by US

IMHO this could be due to stockpiling before tariffs....noteworthy that forecasts for next quarter are going down, we can expect US market share will be sensibly lower next quarter.

Here is the financial report:

Monthly capacity increased to 973,250 standard logic 8-inch equivalent wafers in 1Q25 from 947,625 standard logic 8-inch equivalent wafers in 4Q24

Capacity of 432K wpm at 12" equivalent, it is an increase of 11K wpm (12") in the last quarter. In the last quarter of 2024 the increase was of 28Kwpm, so it is a bit slowed down, but the cumulative of last 2 quarters (6 months) is 28+11 = 39K wpm in half a year

Fun fact, there is an increase in market share by US

IMHO this could be due to stockpiling before tariffs....noteworthy that forecasts for next quarter are going down, we can expect US market share will be sensibly lower next quarter.

Last edited: