Why will it take so long? MCU are very mature process, I feel like it's something that most companies can replace within a handful of years especially since the effort to go full domestic started back 3-5 years ago.i suggest you all read this to get a sense at current MCU domestication process and how long it will take to get mostly domesticated

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

The original plan of YMTC was to build Fab 1, and eventually expand the site with another two Fabs (2 and 3). Each fab was originally planned to have 100K wafers per month capacity. 300K wafers per month total capacity with all three fabs when the site is complete. If you look at the satellite photos, Fab 1 and Fab 2 have been built and "Fab 3" is still a vacant lot with no building in it.

Fab 2 last I checked seemed to have half the air conditioner units attached to the building operational. I would guess that Fab 1 is fully operational with 100K wafers per month, and Fab 2 likely is operating at half capacity with 50K wafers per month. So my guess would be 150K wafers per month total right now.

View attachment 121731

WOW,

When this is done, does it mean the end for US and Korean memory chip bussiness ?

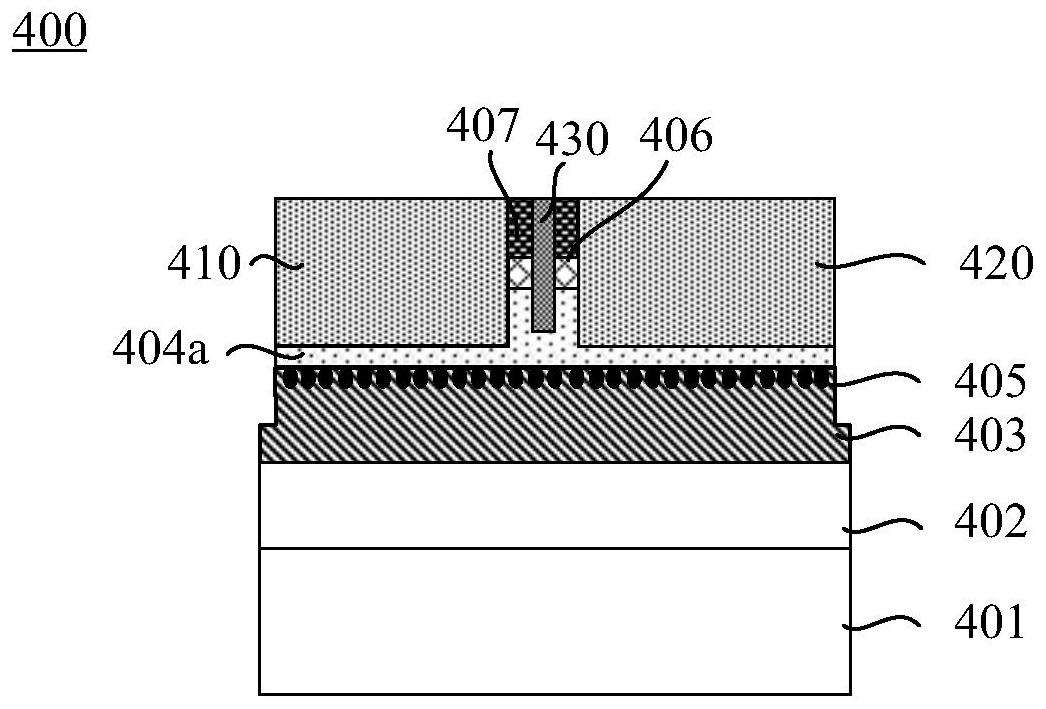

Huawei discloses patent for "Preparation method of semiconductor structure"

Huawei Technologies Co., Ltd. has recently added several pieces of patent information, one of which is titled "Method for Preparing Semiconductor Structures" and the public number is CN117133653A.

The patent abstract shows that embodiments of the present application provide a method for preparing a semiconductor structure, which relates to the field of semiconductor technology and is used to reduce the resistivity of ohmic contacts and improve the consistency of preparing ohmic contacts. The preparation method of the semiconductor structure includes: forming a stacked channel layer and a barrier film on a substrate, etching source grooves and drain grooves on the barrier film, and then wet etching the source The bottoms of the electrode groove and the drain groove are planarized to make the bottoms of the source groove and the drain groove flat, and finally the source electrode and the drain electrode are formed. There is an interval between the source groove and the drain groove, the source electrode is located in the source groove, the drain electrode is located in the drain groove, the source electrode is in ohmic contact with the barrier layer, and the drain electrode is in ohmic contact with the barrier layer.

Huawei pointed out that with the development of semiconductor technology, semiconductor devices with high thermal conductivity, high electron drift rate, high temperature resistance, and stable chemical properties have broad application prospects in high-frequency, high-temperature, and microwave fields. High-power semiconductor devices, such as gallium nitride high electron mobility transistor devices, have unique advantages such as high electron mobility, high two-dimensional electron gas area density, high breakdown electric field, high channel electron concentration and high temperature stability. , which enables it to have higher output power density and is therefore widely used in integrated circuits such as radio frequency/microwave power amplifier circuits. In order to increase the total output power of high-power semiconductor devices, the on-resistance of the device is usually reduced by reducing the ohmic contact resistivity, thereby improving the operating efficiency of the device at high power. Therefore, how to reduce the ohmic contact resistivity and improve the consistency of ohmic contact preparation has become an urgent technical problem that needs to be solved. For this reason, Huawei proposed the above patent.

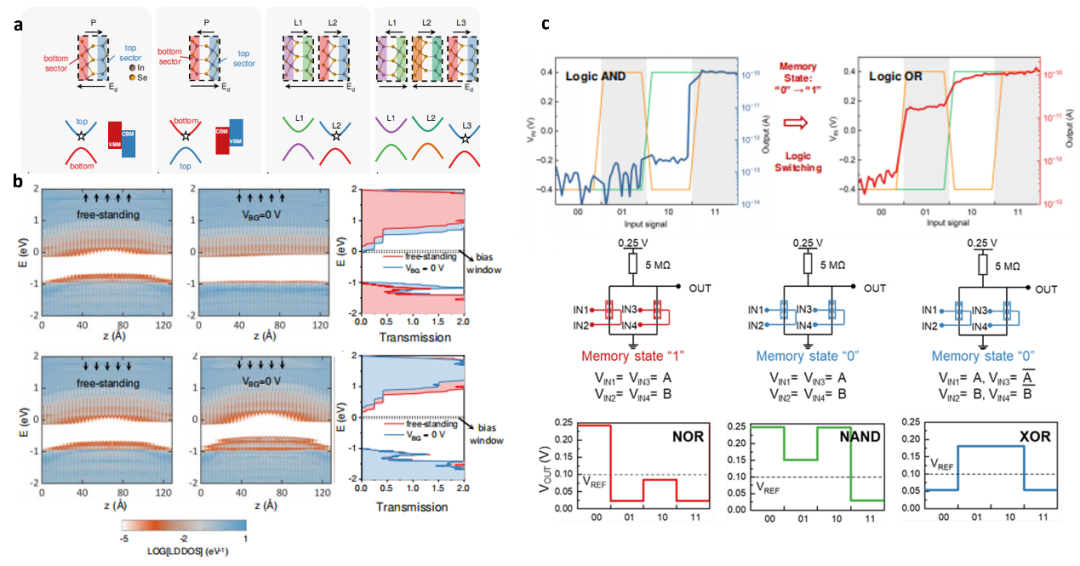

Zhou Peng’s team from the School of Microelectronics of Fudan University cooperated with Beijing Postgraduate University of Posts and Telecommunications to reveal the polarization conductance mechanism in ferroelectric transistors.

Layered ferroelectric semiconductors are both atomically thin and ferroelectric, providing an ideal path for the application of small-size logic and non-volatile storage in in-memory computing technology. However, due to the coupling between ferroelectric electrons and electron reconstruction in ferroelectric channel field effect transistors (FeCFETs), traditional device physics principles cannot be continued, making it difficult to accurately control the polarization-related conductance regulation mechanism in FeCFETs. Therefore, in order to realize advanced logic and memory devices of high-performance layered ferroelectric semiconductors, it is necessary to clarify the fundamental issue of the physical relationship between ferroelectric channel polarization and conductivity.

In response to the challenges in this field, the Zhou Peng/Wang Shuiyuan team from the School of Microelectronics of Fudan University collaborated with Associate Professor Qu He Ruge of Beijing University of Posts and Telecommunications to combine density of states functional theory calculations, quantum transport simulations and experimental demonstrations to reveal FeCFETs for the first time. Polarization-dependent intrinsic effects and external field advantage mechanisms. On November 30, the relevant results were published in Nature Nanotechnology under the title "Asymmetric conducting route and potential redistribution determine the polarization-dependent conductivity in layered ferroelectrics".

Electronic behavior is determined by the redistribution caused by the competition between asymmetric conductive paths caused by the intrinsic Stark effect (built-in electric field) and the electric potential induced by the external field at the gate. The study demonstrates the universality of this mechanism in a wide range of layered ferroelectric families. Based on the new cognitive map, the team designed a strategy to precisely control the conductance threshold of dual-gate FeCFETs by controlling the position of the conductive channel and the thickness of the oxide, and achieved a variety of possible solutions without introducing additional floating gate stacks or physical fields. In-memory (logic) computing (computing in memory) function that switches automatically according to demand without external electric field. Self-switching memory logic based on FeCFETs significantly improves circuit flexibility and reduces hardware design costs, which is particularly important in fields such as digital signal processing, adaptive control, machine vision, and artificial intelligence.

Professor Zhou Peng of the School of Microelectronics, postdoctoral fellow Wang Shuiyuan, and Qu He Ruge of Beijing University of Posts and Telecommunications are the co-corresponding authors. Wang Shuiyuan, Qu He Ruge, and doctoral student Di Ziye are the co-first authors. This work was strongly supported by the Key R&D Program of the Ministry of Science and Technology, the National Natural Science Foundation of China, the State Key Laboratory of Information Photonics and Optical Communications, the Shanghai Municipal Science and Technology Commission, the Education Commission, the Innovation Platform of the Ministry of Education, and the China Postdoctoral Science Foundation.

Juxin Technology's subsidiary invests in Shanghai Judi to deploy automotive audio DSP chips to accelerate the process of domestic substitution

Juxin Technology announced that its wholly-owned subsidiary Zhuhai Yixin plans to jointly invest in Shanghai Judi with Didingrui, Divison and Ruishengtai.

According to reports, Shanghai Judi is a high-tech enterprise specializing in the research and development, design and sales of automotive audio DSP chips. It is committed to providing immersive sound effects, personalized entertainment, high-definition calls, voice interaction enhancement, and comfort for the automotive industry’s in-car audio systems. High-quality sound effects in terms of noise reduction and more. Shanghai Judi defines chips with algorithms and can provide customers with chips and personalized customized algorithm packages.

At present, the automobile industry is ushering in a century-old change of electrification and intelligence. As automobiles become more and more intelligent, smart cockpits are accelerating to become inclusive. According to Jiwei Consulting data, it is expected that by 2025, global and Chinese car cockpit smart Configuration penetration rates will reach 59% and 78% respectively. According to data from IHS Markit, it is expected that by 2030, the global automotive smart cockpit market size will reach 68.1 billion US dollars, and the Chinese automotive smart cockpit market size will reach 166.3 billion yuan.

This has led to an increase in new demands for in-car driving in the "third space". The sound quality experience in the cockpit is one of them, including speakers, power amplifiers, microphones, DSP chips, AVAS, speech recognition, speech synthesis, online music, and video recording. Related demands will increase accordingly.

According to Shangpu Consulting data, the global car audio market size will be approximately 34.5 billion yuan in 2022. It is expected that by the end of 2023, the global car audio market size is expected to reach 45.9 billion yuan, a year-on-year increase of 33.04%.

Among them, automotive audio DSP chips, as the core of audio processing, will also benefit from growth. According to 168Report data, the global automotive audio DSP chipset market is expected to reach US$1.4 billion in 2029, with a compound annual growth rate of 6.5% in the next few years.

However, China, which is at the forefront of vehicle electrification and intelligence, still does not have a highly influential local automotive audio DSP chip company. The market is mainly dominated by TI, NXP Semiconductors, Analog Devices, STMicroelectronics, onsemi, Microchip Technology, Renesas Electronics, Rohm, Cirrus Logic, Qualcomm and other major international manufacturers have a monopoly, with the top five manufacturers having a market share of over 60%.

Taking advantage of the opportunities for the intelligent development of the local automobile industry, domestic automobile supply chain companies have risen rapidly, and a number of powerful companies have emerged in the field of automotive audio DSP chips. Shanghai Judi, in which Juxin Technology has invested this time, is one of the representative companies.

Actions Technology stated that this joint investment with related parties is based on the needs of the company's development strategy. By integrating external resources to lay out the automotive audio field, it will further expand the company's product categories, promote the company's business diversification development, and enhance the company's comprehensive competitiveness and investment The level of income will help the company's sustainable development and create greater value for all shareholders.

Hua Hong Semiconductor advances to more advanced nodes and further enhances future development potential

Hua Hong Semiconductor disclosed the "Announcement on the Signing of a Technology Development Agreement and Related Transactions." According to the announcement, Huahong Grace, a wholly-owned subsidiary of Hua Hong Semiconductor (hereinafter referred to as the "Company"), signed a "Technology Development Agreement" with Huali Micro, whereby Hua Hong Micro granted Hua Hong Grace production and process technology. Exclusive licensing rights and providing supporting technical consulting services to support the construction of Huahong Manufacturing's 12-inch wafer production line.

The signing of this technology development agreement will help accelerate the research and development and mass production of the 40nm characteristic IC process for Huahong Grace's 12-inch production line, and further enhance the technical and market competitiveness of the company's characteristic process.

As the world's leading specialty process wafer foundry, the company adheres to the development strategy of "8-inch + 12-inch" and advanced "featured IC + Power Discrete", and is engaged in embedded/stand-alone non-volatile memory, power devices, analog It continues to innovate in unique process technologies such as power management, logic and radio frequency, and has reached the world's leading level in many fields.

Despite the severe challenges faced by the market this year, Hua Hong Semiconductor has bucked the trend and increased R&D investment, accelerated production capacity construction, and built a moat for sustainable development. In the third quarter of this year, the company’s R&D investment reached 411 million yuan, a year-on-year increase of 32.23%.

At present, the company's fundraising projects are progressing steadily to prepare technical reserves for the growing global new energy vehicle and industrial application markets. The second 12-inch production line - Huahong Wuxi Manufacturing Project is expected to be completed and put into production before the end of 2024, and will gradually form a monthly production capacity of 83,000 pieces in the following three years, laying a solid foundation for the company's mid- to long-term development.

As the company's 12-inch production capacity continues to expand and differentiated specialty processes advance to more advanced nodes, Hua Hong Semiconductor will actively leverage its own advantages to consolidate its leading position in specialty process wafer foundry.

The signing of this technology development agreement will help accelerate the research and development and mass production of the 40nm characteristic IC process for Huahong Grace's 12-inch production line, and further enhance the technical and market competitiveness of the company's characteristic process.

As the world's leading specialty process wafer foundry, the company adheres to the development strategy of "8-inch + 12-inch" and advanced "featured IC + Power Discrete", and is engaged in embedded/stand-alone non-volatile memory, power devices, analog It continues to innovate in unique process technologies such as power management, logic and radio frequency, and has reached the world's leading level in many fields.

Despite the severe challenges faced by the market this year, Hua Hong Semiconductor has bucked the trend and increased R&D investment, accelerated production capacity construction, and built a moat for sustainable development. In the third quarter of this year, the company’s R&D investment reached 411 million yuan, a year-on-year increase of 32.23%.

At present, the company's fundraising projects are progressing steadily to prepare technical reserves for the growing global new energy vehicle and industrial application markets. The second 12-inch production line - Huahong Wuxi Manufacturing Project is expected to be completed and put into production before the end of 2024, and will gradually form a monthly production capacity of 83,000 pieces in the following three years, laying a solid foundation for the company's mid- to long-term development.

As the company's 12-inch production capacity continues to expand and differentiated specialty processes advance to more advanced nodes, Hua Hong Semiconductor will actively leverage its own advantages to consolidate its leading position in specialty process wafer foundry.

Guangzhou Iron and Steel Gas: Plans to invest 390 million yuan to build electronic special gas project in Hefei

Guangzhou Iron and Steel Gas issued an announcement on signing an "Investment Agreement" with the Hefei Economic and Technological Development Zone Management Committee.According to disclosures, in order to expand electronic gas product categories, improve the electronic gas product chain, and enhance the company's market position and brand influence, on December 1, 2023, Guangzhou Iron and Steel Gas and the Hefei Economic and Technological Development Zone Management Committee signed an "Investment Agreement". It is agreed that the company plans to invest 390 million yuan to build Guangzhou Iron and Steel Electronics in Hefei Economic and Technological Development Zone with an annual output of 300 tons of electronic-grade hydrogen bromide, 1,438 tons of high-purity hydrogen, 35.71 tons of high-purity helium, and 20,000 bottles of alkane mixed gas. Special Gas Project (hereinafter referred to as “the project”). The project is planned to start construction in March 2024 and is expected to be completed and put into production in December 2025.

This project mainly includes alkane gas mixing equipment (phosphane, germane, silane, disilane mixed with nitrogen, argon, helium, hydrogen), HBr distillation equipment, SMR hydrogen production equipment and helium distribution equipment, etc. .

Guangzhou Iron and Steel Gas stated that the Guangzhou Iron and Steel Electronic Special Gas Project in the Hefei Economic and Technological Development Zone that the company plans to invest and construct this time will help the company expand its electronic gas product categories, improve the electronic gas product chain, and enhance the company’s market position and brand influence. At the same time, It is conducive to further optimizing the company's main business structure and realizing the diversified development of the company's product structure.

The source of funds for the company's external investment is the company's own funds or self-raised funds, which will not have an adverse impact on the company's normal production and operations, and will not harm the interests of the company and shareholders. This project is still in the planning and implementation stage and will not have a significant impact on the company's financial status and operating results in the short term.

interesting here we have this company 忱芯科技 that has now produced 100th SiC inspection equipment. Good to see domestic SMEs increasing presence in SiC space

more Sic news here

ST Micro and Sanan's JV project here is making good progress in the 8-inch epitaxy production plant in Chongqing

Another company 杭州市临空产业 has invested 10B RMB in new material and device module project for EVs, ESS, PVs & wind turbine.

Looks like it will carry the task of Sic wafer foundry production

Finally, Jingsheng, the Sic substrate wafer equipment supplier has roofed its new production & research center

- Status

- Not open for further replies.