You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

I will move the rare earth to technology thread since it's not directly semi related.

More on 5G RF technology with Memsonics, since the success of this project is so important to China's future 5G dominance

Back in March, memsonics showcased their BAW filters to the public and said it's world leading in some areas and that they had 20 clients

we know they have their production line JV with Silex, but they also plan to have their own production line as discussed here

After announcing this news of start of mass production, they raise a bunch of money (several hundred million RMB)

my guess is that they need this to build their new research center or new fab

one of the investors is 光谷金控

Makes sense for the optical valley investor funds to invest in a project that builds there

Now, Sai Micro itself has also announced new fab in Shenzhen where 1.5B RMB will be invested including 450m from Sai itself

not sure who will be the customer here, but there are also other BAW filter fabless

More on 5G RF technology with Memsonics, since the success of this project is so important to China's future 5G dominance

Back in March, memsonics showcased their BAW filters to the public and said it's world leading in some areas and that they had 20 clients

Look at that importance of supporting high wide & have low power consumption is important for 5G. 20+ customers, very important for domestic RF. I would imagine this includes both phone companies and RF companies (looking to package it into RFFE module)在整个射频前端模组中,滤波器的产值占到了50%以上。到了5G时代,高频率、大带宽、低损耗、大功率容量以及高度集成、更加小型化的滤波器,更是直接影响了5G通信技术的发展。

而李春江带来的滤波器项目,在高频段性能甚至优于国外产品,已拥有20多家客户,这为我国迈进高端射频滤波器的国产化量产吹响号角

we know they have their production line JV with Silex, but they also plan to have their own production line as discussed here

will be in Guanggu (which is the "optics valley" in Wuhan, New Technology Development Zone). Makes sense for them to build not only research center but also production line close to home我们的产品与光谷光电子信息产业链非常贴合”,他介绍,当得知大赛信息时便毫不犹豫报名,并非常期待在光谷获得融资,进行生产线建设和软硬件开发,“目前我们已在光谷考察用地,打算先将研发中心落户武汉,并逐步在汉建设产线,我们有信心在光谷成长为行业制造龙头企业”。

very important. it not only supports 5G, but also 4G and wifi. The demand for this in China is huge. Let's hope they can ramp up production and find as many customers as possible公司回答表示,您好,武汉敏声多款滤波器已实现量产,并达到商业使用标准,已满足公司参股时相关协议的要求。武汉敏声的高端滤波器产品将应用于WiFi、4G、5G的主要频段,智能手机厂商均为武汉敏声的目标客户,感谢您的关注。

After announcing this news of start of mass production, they raise a bunch of money (several hundred million RMB)

my guess is that they need this to build their new research center or new fab

one of the investors is 光谷金控

Makes sense for the optical valley investor funds to invest in a project that builds there

Now, Sai Micro itself has also announced new fab in Shenzhen where 1.5B RMB will be invested including 450m from Sai itself

not sure who will be the customer here, but there are also other BAW filter fabless

I will move the rare earth to technology thread since it's not directly semi related.

More on 5G RF technology with Memsonics, since the success of this project is so important to China's future 5G dominance

Back in March, memsonics showcased their BAW filters to the public and said it's world leading in some areas and that they had 20 clients

Look at that importance of supporting high wide & have low power consumption is important for 5G. 20+ customers, very important for domestic RF. I would imagine this includes both phone companies and RF companies (looking to package it into RFFE module)

we know they have their production line JV with Silex, but they also plan to have their own production line as discussed here

will be in Guanggu (which is the "optics valley" in Wuhan, New Technology Development Zone). Makes sense for them to build not only research center but also production line close to home

very important. it not only supports 5G, but also 4G and wifi. The demand for this in China is huge. Let's hope they can ramp up production and find as many customers as possible

After announcing this news of start of mass production, they raise a bunch of money (several hundred million RMB)

my guess is that they need this to build their new research center or new fab

one of the investors is 光谷金控

Makes sense for the optical valley investor funds to invest in a project that builds there

Now, Sai Micro itself has also announced new fab in Shenzhen where 1.5B RMB will be invested including 450m from Sai itself

not sure who will be the customer here, but there are also other BAW filter fabless

How does Memsonics stack up against these two ?

Huntersun : BAW filter shipments exceeded 100 million pieces

面对高端射频滤波器芯片长期被国外垄断的困境,汉天下自成立之初,就瞄准了解决这一“卡脖子”难题。汉天下的核心产品是应用于4G/5G移动终端的基于MEMS技术的体声波(BAW)滤波器芯片及射频模组。2021年,汉天下BAW滤波器出货首次超过1亿颗,出货品种丰富度进一步提升,自建工厂稳步推进,人才队伍持续升级。

Huntersun's BAW filter shipments already exceed 100 million back in 2021,and we are in 2023 now

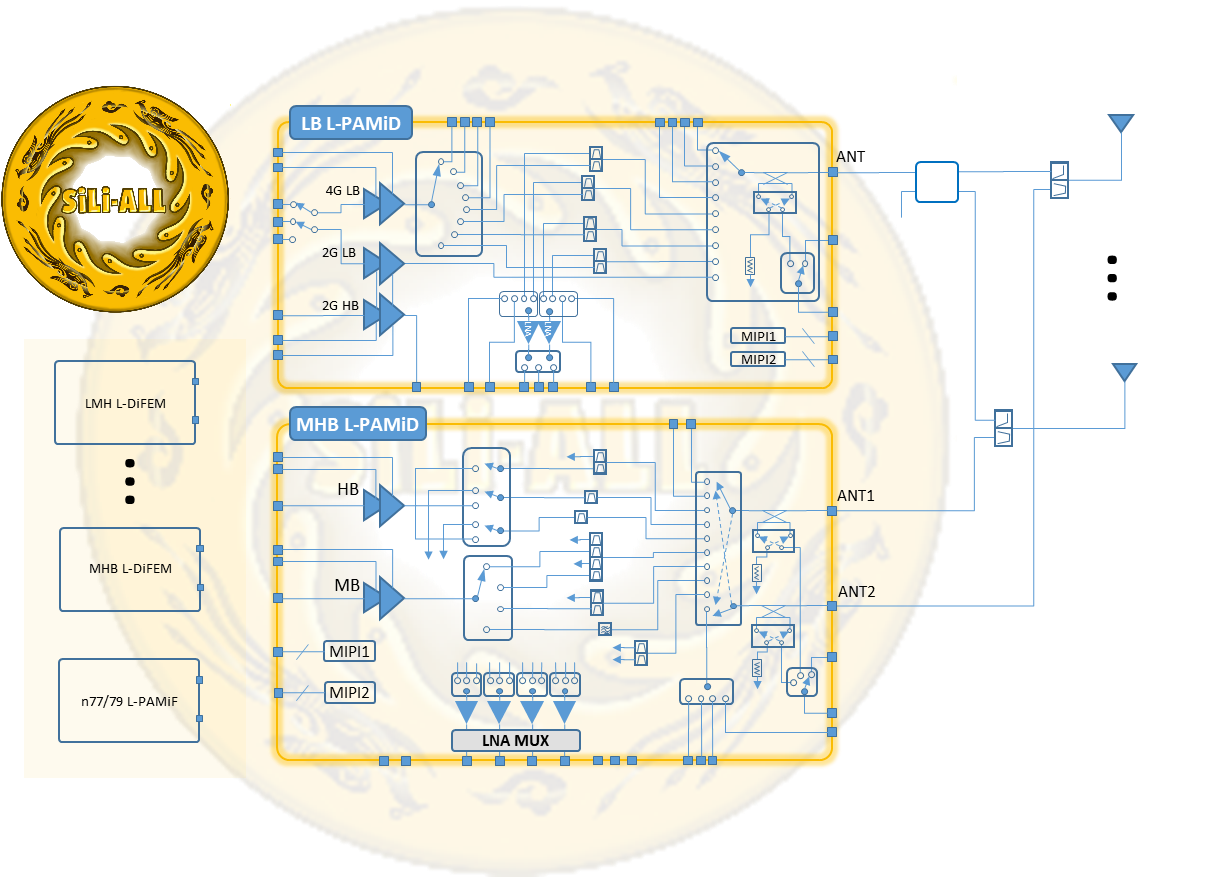

Epicmems launched the "Phoenix Sili-ALL" brand, realizing the breakthrough of the first local self-developed highly integrated (L)-PAMiD module chip

2022年11月4日,作为中国领先的滤波器及射频模组芯片供应商,开元通信技术(厦门)有限公司(以下简称“开元通信”或“公司”)宣布发布第4个子产品系列“凤凰Sili-ALL”品牌。该产品系列为集成了高性能滤波器、双工器、多工器、功率放大器、射频开关、低噪声放大器的(L)-PAMiD模组芯片。依托已经大量出货的“矽力豹Sili-BAW”和“蜂鸟Sili-SAW”成熟滤波芯片技术,经过3年时间的模组产品密集开发,开元通信成为本土首家全自研高集成度(L)-PAMiD模组芯片的量产供应商。

SteelBird

Colonel

This is from Bloomberg, so I only have the title, no content due to pay-wall.

The title says everything, does the West plan to ban China's legacy chip production as well? And how independent is China in legacy chip production?

The title says everything, does the West plan to ban China's legacy chip production as well? And how independent is China in legacy chip production?

US, Europe Growing Alarmed by China’s Rush Into Legacy Chips

Can you provide a link to the article that this graph came from?The stooges in Washington DC did in a few years what the Chinese goverment failed to do in decade. Is just incredible.

View attachment 116725

Fear and uncertainty are powerful forces in market.

This is from Bloomberg, so I only have the title, no content due to pay-wall.

The title says everything, does the West plan to ban China's legacy chip production as well? And how independent is China in legacy chip production?

US, Europe Growing Alarmed by China’s Rush Into Legacy Chips

(Bloomberg) -- US and European officials are growing increasingly concerned about China’s accelerated push into the production of older-generation semiconductors and are debating new strategies to contain the country’s expansion.

President Joe Biden implemented broad controls over China’s ability to secure the kind of advanced chips that power artificial-intelligence models and military applications. But Beijing responded by pouring billions into factories for the so-called legacy chips that haven’t been banned. Such chips are still essential throughout the global economy, critical components for everything from smartphones and electric vehicles to military hardware.

That’s sparked fresh fears about China’s potential influence and triggered talks of further reining in the Asian nation, according to people familiar with the matter, who asked not to be identified because the deliberations are private. The US is determined to prevent chips from becoming a point of leverage for China, the people said.

Commerce Secretary Gina Raimondo alluded to the problem during a panel discussion last week at the American Enterprise Institute. “The amount of money that China is pouring into subsidizing what will be an excess capacity of mature chips and legacy chips — that’s a problem that we need to be thinking about and working with our allies to get ahead of,” she said.

While there’s no timeline for action to be taken and information is still being gathered, all options are on the table, according to a senior Biden administration official. A US National Security Council spokeswoman declined to comment, while a European Commission spokesperson said the agency will take necessary measures to preserve its interests and was working to reduce the region’s dependence on foreign firms for both mature and advanced chips.

The most advanced semiconductors are those produced using the thinnest etching technology, with 3-nanometers state of the art today. Legacy chips are typically considered those made with 28-nm equipment or above, technology introduced more than a decade ago.

Senior EU and US officials are concerned about Beijing’s drive to dominate this market for both economic and security reasons, the people said. They worry Chinese companies could dump their legacy chips on global markets in the future, driving foreign rivals out of business like in the solar industry, they said.

Western companies may then become dependent on China for these semiconductors, the people said. Buying such critical tech components from China may create national security risks, especially if the silicon is needed in defense equipment.

“The United States and its partners should be on guard to mitigate nonmarket behavior by China’s emerging semiconductor firms,” researchers Robert Daly and Matthew Turpin wrote in a recent essay for the Hoover Institution think tank at Stanford University. “Over time, it could create new US or partner dependencies on China-based supply chains that do not exist today, impinging on US strategic autonomy.”

The importance of legacy chips was highlighted by supply shocks that roiled companies at the height of the Covid pandemic, including Apple Inc. and carmakers. Chip shortages cost businesses hundreds of billions of dollars in lost sales. Simple components, such as power management circuits, are essential for products like smartphones and electric vehicles, as well as military gear like missiles and radar.

The US and Europe are trying to build up their own domestic chip production to decrease reliance on Asia. Governments have set aside public money to support local factories, including the Biden administration’s $52 billion for the CHIPS and Science Act.

But domestic producers may be reluctant to invest in facilities that will have to compete with heavily subsidized Chinese plants. The Biden administration and its allies are gauging the willingness of Western companies to invest in such projects before they decide what action to take.

While the US rules introduced last October slowed down China’s development of advanced chipmaking capabilities, they left largely untouched the country’s ability to use techniques older than 14-nanometers. That has led Chinese firms to construct new plants faster than anywhere else in the world. They are forecast to build 26 fabs through 2026 that use 200-millimeter and 300-mm wafers, according to the trade group SEMI. That compares with 16 fabs for the Americas.

Heavy investments have allowed Chinese companies to keep supplying the West, despite rising tensions between Washington and Beijing. China’s chipmaking champion, Semiconductor Manufacturing International Corp., got about 20% of last year’s sales from US-based clients, including Qualcomm Inc., despite being blacklisted by the American government.

“When you think about electrification of mobility, think about the energy transition, the IoT in the industrial space, the roll-out of the telecommunication infrastructure, battery technology, that’s all — that’s the sweet spot of mid-critical and mature semiconductor,” Peter Wennink, chief executive officer of Dutch chipmaking equipment supplier ASML Holding NV, told analysts in mid-July. “And that’s where China without any exception is leading.”

--With assistance from Jillian Deutsch, Gao Yuan, Jane Pong, Katharina Rosskopf and Peter Elstrom.

(Updates with EU’s comment from the fifth paragraph)

This article proves that the US had (and still has) no strategy when it enacted its IC bans on China

A literally toddler would have told them that China would prioritize older nodes, fund massive expansion, lower prices, drive out foreign competitors from that market and then renew its assault for leading edge nodes aided with commercial profits and experience

A literally toddler would have told them that China would prioritize older nodes, fund massive expansion, lower prices, drive out foreign competitors from that market and then renew its assault for leading edge nodes aided with commercial profits and experience

Can you provide a link to the article that this graph came from?

SteelBird

Colonel

The questions are:

(Bloomberg) -- US and European officials are growing increasingly concerned about China’s accelerated push into the production of older-generation semiconductors and are debating new strategies to contain the country’s expansion.

President Joe Biden implemented broad controls over China’s ability to secure the kind of advanced chips that power artificial-intelligence models and military applications. But Beijing responded by pouring billions into factories for the so-called legacy chips that haven’t been banned. Such chips are still essential throughout the global economy, critical components for everything from smartphones and electric vehicles to military hardware.

That’s sparked fresh fears about China’s potential influence and triggered talks of further reining in the Asian nation, according to people familiar with the matter, who asked not to be identified because the deliberations are private. The US is determined to prevent chips from becoming a point of leverage for China, the people said.

Commerce Secretary Gina Raimondo alluded to the problem during a panel discussion last week at the American Enterprise Institute. “The amount of money that China is pouring into subsidizing what will be an excess capacity of mature chips and legacy chips — that’s a problem that we need to be thinking about and working with our allies to get ahead of,” she said.

While there’s no timeline for action to be taken and information is still being gathered, all options are on the table, according to a senior Biden administration official. A US National Security Council spokeswoman declined to comment, while a European Commission spokesperson said the agency will take necessary measures to preserve its interests and was working to reduce the region’s dependence on foreign firms for both mature and advanced chips.

The most advanced semiconductors are those produced using the thinnest etching technology, with 3-nanometers state of the art today. Legacy chips are typically considered those made with 28-nm equipment or above, technology introduced more than a decade ago.

Senior EU and US officials are concerned about Beijing’s drive to dominate this market for both economic and security reasons, the people said. They worry Chinese companies could dump their legacy chips on global markets in the future, driving foreign rivals out of business like in the solar industry, they said.

Western companies may then become dependent on China for these semiconductors, the people said. Buying such critical tech components from China may create national security risks, especially if the silicon is needed in defense equipment.

“The United States and its partners should be on guard to mitigate nonmarket behavior by China’s emerging semiconductor firms,” researchers Robert Daly and Matthew Turpin wrote in a recent essay for the Hoover Institution think tank at Stanford University. “Over time, it could create new US or partner dependencies on China-based supply chains that do not exist today, impinging on US strategic autonomy.”

The importance of legacy chips was highlighted by supply shocks that roiled companies at the height of the Covid pandemic, including Apple Inc. and carmakers. Chip shortages cost businesses hundreds of billions of dollars in lost sales. Simple components, such as power management circuits, are essential for products like smartphones and electric vehicles, as well as military gear like missiles and radar.

The US and Europe are trying to build up their own domestic chip production to decrease reliance on Asia. Governments have set aside public money to support local factories, including the Biden administration’s $52 billion for the CHIPS and Science Act.

But domestic producers may be reluctant to invest in facilities that will have to compete with heavily subsidized Chinese plants. The Biden administration and its allies are gauging the willingness of Western companies to invest in such projects before they decide what action to take.

While the US rules introduced last October slowed down China’s development of advanced chipmaking capabilities, they left largely untouched the country’s ability to use techniques older than 14-nanometers. That has led Chinese firms to construct new plants faster than anywhere else in the world. They are forecast to build 26 fabs through 2026 that use 200-millimeter and 300-mm wafers, according to the trade group SEMI. That compares with 16 fabs for the Americas.

Heavy investments have allowed Chinese companies to keep supplying the West, despite rising tensions between Washington and Beijing. China’s chipmaking champion, Semiconductor Manufacturing International Corp., got about 20% of last year’s sales from US-based clients, including Qualcomm Inc., despite being blacklisted by the American government.

“When you think about electrification of mobility, think about the energy transition, the IoT in the industrial space, the roll-out of the telecommunication infrastructure, battery technology, that’s all — that’s the sweet spot of mid-critical and mature semiconductor,” Peter Wennink, chief executive officer of Dutch chipmaking equipment supplier ASML Holding NV, told analysts in mid-July. “And that’s where China without any exception is leading.”

--With assistance from Jillian Deutsch, Gao Yuan, Jane Pong, Katharina Rosskopf and Peter Elstrom.

(Updates with EU’s comment from the fifth paragraph)

1. Can/do they really ban it?

2. How much percentage can China be independent in legacy chip production? If China really relies on the West in legacy chip production and, one day, they ban it, China will be difficult even in EV production.

3. Is EV the main target that they aim at?

Yellen said that the US only curb China chip at 14nm and lower, looks like her words sound like sh*t!

Last edited:

- Status

- Not open for further replies.