If a country that lacks advanced tech that desires it but can't have it and isn't trying to so called "steal" more advanced tech, then that country is failing in its duties...I wonder what would happen to countries with the "If China can do it, we can do it too!" mentality once the shackle of SME sanctions applied on China breaks. It would also serve a severe blow to the perception regards to effectiveness of sanctions, especially to China. No matter how loud one screams of "Stealin' IP", whether true or not, the end result matters, and will surface and screams back "in your face, b%tch!"

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

China already had significant levels of semiconductor and IC chip related tech to intermediate levels before Trump began the trade war... Silicon smelting, wafer production and the equipment to do both of them, photoresists making, photomask making, etching etc... China's biggest lag had always been in producing lithography machines of satisfactory quality... Following Trump's trade war, China really ramped efforts at improving its production share and also the qualitative aspects... Trump's trade war and Biden's late 2022 restrictions are definitely not enough time for China to have miraculously reached the levels that it has reached since them without having had a strong foundational base before they began...Until recently, the same applied to China. It was the Huawei bans in 2019 that gave initial incentive and momentum to develop complete supply chains for chips. But even that didn't rally the country to action. Not until the 2022 bans from Biden that affected the entire Chinese technology industry, did Chinese companies get serious about the need to be self-reliant.

Blame it on historical short-term thinking and greed from Chinese electronics makers, if you will; but practically speaking, it isn't like China had the ability to actually invest heavily in this twenty years ago, or even ten years ago - its industries were still immature, it didn't have enough capital, and there were too many lower hanging fruits.

This is why I believe the US embargo on chips was planned well in advance, as opposed to being a knee jerk reaction to Huawei spying or its violation of US sanctions on Iran decades ago, as mainstream media would have you believe. The US was always going to suppress China, but they wanted to profit for as long as possible and weren't sure how long it'd take for China to get its house in order. It was Xi's Made in China 2025 campaign and tangible progress in China's technological development that caused the US to act. Their analysts saw the acceleration of China's technological achievements and knew it was "now or never."

Basically, the US was waiting for China to prove that it can actually innovate, because if it couldn't, then the US would've been able to profit off of China forever and basically treat it like a drug addict.

But China proved that it can innovate, so the US cracked down because it saw its own technological empire threatened.

A semiconductor equipment and parts company, Zhongke Aier received strategic investment

According to news from Weibo, recently, Zhongke Aier (Beijing) Technology Co., Ltd. (hereinafter referred to as "Zhongke Aier") received strategic investment, led by China Electronics Research and Investment Fund, Pioneer Holdings, Weil shares, Jiangsu Xinchao, etc. Institutional co-investment.

Founded in 2008, Zhongke Aier is an enterprise engaged in R&D, manufacturing and sales of semiconductor-grade ultra-high purity and high-purity pipe valve parts. Full industrial chain operation capability of R&D, production, and gas system product integration.

Tianyancha news shows that Zhongke Aier has completed multiple rounds of financing. Investors include Core Kinetic Energy Investment, Qianyi Investment, Fengyuan Capital, Qianhai CSSC Smart Ocean Fund, Hubble Investment, Shenzhen Capital, Novartis Capital, SDIC Entrepreneurship, Sunrise AXA Capital, Aurui Duanxin, Xinchuang Capital, etc.

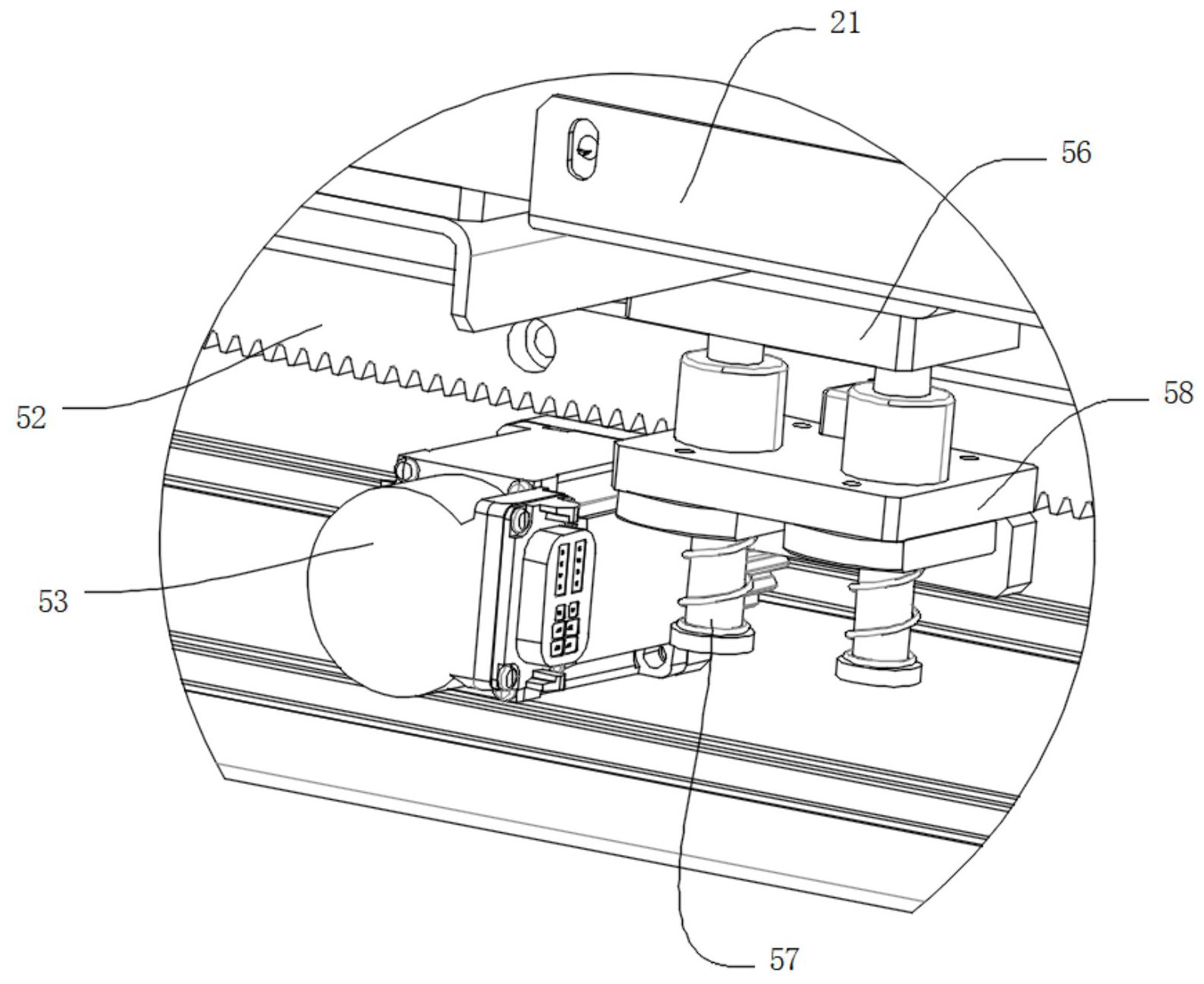

Gona Semiconductor's "Wafer Cassette Handling Device and Method" Patent Announcement.

Shanghai Guona Semiconductor Technology Co., Ltd. has announced the patent of "wafer box handling device and method". The application publication date is July 11, and the application publication number is CN116417389A.

The patent abstract shows that the present invention discloses a wafer box handling device and method, wherein the wafer box handling device includes a traveling mechanism that moves along a guide rail under the action of a driving mechanism, and the driving mechanism is provided with a device for detecting the displacement of the traveling mechanism The first displacement detection part; also includes a synchronous movement mechanism, the synchronous movement mechanism includes gears and racks for meshing transmission, the racks are fixed on the guide rails, the gears are installed on the floating mechanism, and the floating mechanism is installed on the traveling mechanism and can be connected with the walking mechanism. The mechanism moves synchronously; the floating mechanism can drive the gear to float relative to the rack, and the gear is provided with a second displacement detection part for detecting its displacement; the synchronous movement mechanism includes a verification part for verifying whether the gear is skipping teeth; the displacement The correction mechanism, the displacement correction mechanism is used to correct the displacement of the first displacement detection part or the second displacement detection part according to the verification result of the verification part.

It is reported that the wafer cassette handling device and method of the present invention can verify and correct the traveling displacement to ensure the accuracy of the traveling displacement

Suzhou Xinleixin's annual production of 100,000 pieces of integrated circuit diamond substrate production project signed an agreement with Taihu.

Anhui Taihu Economic Development Zone Investment Development Co., Ltd. and Suzhou Xinleixin Semiconductor Technology Co., Ltd. held a signing ceremony for the "annual production of 100,000 integrated circuit diamond substrate production projects " .

With a total investment of 200 million yuan, the project will start construction in August 2023 and be put into operation before the end of November 2023.

According to Tianyan Check, Suzhou Xinleixin Semiconductor Technology Co., Ltd. was established in November 2022. The legal representative is Min Kang, with a registered capital of 10 million yuan. The business scope includes semiconductor lighting device manufacturing , semiconductor discrete device manufacturing , intelligent basic manufacturing equipment manufacturing , Manufacturing of electronic components and electromechanical components , etc.

JCET's 5G millimeter wave RF front-end module and AiP module products have achieved mass production

In terms of communication applications, in response to the commercial needs of 5G millimeter waves, JCET has taken the lead in introducing 5G millimeter wave L-PAMiD products and testing mass production solutions to customers, and 5G millimeter wave antenna AiP module products have also entered mass production.In addition, JCET has also cooperated with customers in recent years on the development of automotive millimeter-wave radar transceiver chips and AiP SoC products with integrated antennas, providing more customers with 4D millimeter-wave radar advanced packaging solutions.

Millimeter wave is the key technology to give full play to the excellent performance of 5G

Millimeter wave has the advantages of large frequency broadband capacity, easy combination with beamforming, and ultra-low latency, which is conducive to further improving 5G connection speed and releasing the potential of 5G applications.

The GSMA predicted in the "Research on the Socio-Economic Benefits of 5G Services in Millimeter Wave Bands" that from 2020 to 2034, the contribution of millimeter wave 5G to global GDP will grow exponentially, and in 2034 it will contribute 5,650 billion to global GDP. One hundred million U.S. dollars.

With the rapid development of millimeter wave technology in communication, intelligent driving and other application fields, the market demand for RF front-end modules is increasing day by day, and the highly coupled integration of RF circuits and antenna components is becoming more and more critical.

Jingsheng Electromechanical expects net profit in the first half of the year to exceed 2 billion

Jingsheng Electromechanical released a performance forecast. It is estimated that the net profit attributable to shareholders of listed companies in the first half of 2023 will be about 2.052 billion to 2.293 billion yuan, a year-on-year increase of 70% to 90%.

The main reason for the performance change is that during the reporting period, the company focused on the dual-engine sustainable development strategy of "advanced materials and advanced equipment", further strengthened the coordinated industrial layout of "equipment + materials", and built a three-dimensional business and product system with reasonable gradients. Various businesses have achieved rapid development.

It is worth noting that on June 28, Jingsheng Electromechanical stated that it has successfully developed an 8-inch monolithic silicon carbide epitaxial growth equipment with an internationally advanced level.

Jingsheng Electromechanical said that the 8-inch monolithic silicon carbide epitaxy equipment is compatible with 6-inch and 8-inch silicon carbide epitaxy production. The control problems such as temperature field uniformity and flow field uniformity in cavity design have been solved, and a mature and stable 8-inch silicon carbide epitaxy process has been realized.The main reason for the performance change is that during the reporting period, the company focused on the dual-engine sustainable development strategy of "advanced materials and advanced equipment", further strengthened the coordinated industrial layout of "equipment + materials", and built a three-dimensional business and product system with reasonable gradients. Various businesses have achieved rapid development.

It is worth noting that on June 28, Jingsheng Electromechanical stated that it has successfully developed an 8-inch monolithic silicon carbide epitaxial growth equipment with an internationally advanced level.

Jingsheng Electromechanical is strategically positioned in the advanced material and advanced equipment market, and develops a series of key equipment around the three major semiconductor materials of silicon, sapphire and silicon carbide, and its business also extends to the field of compound semiconductor materials.

In terms of silicon carbide, according to previous reports, Jingsheng Electromechanical 8-inch N-type SiC substrates will be produced in small batches; the company has formed a purchase intention with customer A (company announcement), and will give priority to providing silicon carbide substrates to it from 2022 to 2025 The total is not less than 230,000 pieces; it is planned to build an annual production capacity of 400,000 pieces of 6-inch conductive + insulating silicon carbide substrates in Yinchuan, Ningxia, and it is planned to start trial production in 2022.

In terms of silicon carbide, according to previous reports, Jingsheng Electromechanical 8-inch N-type SiC substrates will be produced in small batches; the company has formed a purchase intention with customer A (company announcement), and will give priority to providing silicon carbide substrates to it from 2022 to 2025 The total is not less than 230,000 pieces; it is planned to build an annual production capacity of 400,000 pieces of 6-inch conductive + insulating silicon carbide substrates in Yinchuan, Ningxia, and it is planned to start trial production in 2022.

More customized products for the Chinese market will be launched in the future under the condition of legal compliance, Rivera said, noting that they will not be discounted compared with the international version, as their overall performance is basically the same.

In addition to chipmakers like Intel and Nvidia, startups such as Wave Computing, Groq, Cambricon Technologies, and Bitmain Technologies also joined the competition by successfully launching AI chips and hardware systems. According to incomplete statistics, over 30 AI chip makers are engaged in the AI model field, said the Yicai Global report.

In addition to chipmakers like Intel and Nvidia, startups such as Wave Computing, Groq, Cambricon Technologies, and Bitmain Technologies also joined the competition by successfully launching AI chips and hardware systems. According to incomplete statistics, over 30 AI chip makers are engaged in the AI model field, said the Yicai Global report.

Nyeh, in future Beijing should made rule that chips used in public use like govt owned computer cluster should either be fabbed in China or designed using Chinese EDA.More customized products for the Chinese market will be launched in the future under the condition of legal compliance, Rivera said, noting that they will not be discounted compared with the international version, as their overall performance is basically the same.

In addition to chipmakers like Intel and Nvidia, startups such as Wave Computing, Groq, Cambricon Technologies, and Bitmain Technologies also joined the competition by successfully launching AI chips and hardware systems. According to incomplete statistics, over 30 AI chip makers are engaged in the AI model field, said the Yicai Global report.

- Status

- Not open for further replies.