I think they can start with a public boycott, some fines maybe and a memo to public officials to stop using Micron products even in private. Small steps I know but ones that are in the right directionI think we need to make some assumptions on how much Americans would be willing to escalate if China bans Micron.

Given the recent news about the US pressuring the Koreans to stop them from selling to China, I think we can say that the maximum response could be a total ban of Korean memory exports to China.

Even if the fabs are in China, if the Chinese government seized them, although justifiable, it would be very bad publicity and send a bad signal to foreign investors

I think the gov should cover its bases first before going for a total Micron ban. Alternatively, China could go for a limited scale ban which would allow both countries to better control the escalation-response ladder

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

Oh come on, I bought them from retail shop, here in Indonesia they dont offer warranty and require any registration.Please blur or delete the image sections which contain your products' Serial Number

Two major problems in this postChinese smartphone makers existence is totally dependent on US whims. Qualcomm monopolizes smartphone IC, and what is not Qualcomm is (Taiwan) Mediatek that will promptly fall in line to whatever decision US will take. Even China's Unisoc depends on TSMC for manufacturing.

Chinese smartphones are not presents in US market, so for US is not a big issue to kill them. Their consumers would not be affected. They don't care about the rest of the world.

Maybe in 2 years time it will be different, but today banning Micron will expose Chine to huge and devastating retaliation.

Us will not retaliate 1 vs 1, they will retaliate 100 vs 1. They can stop Intel, Nvidia, AMD, Qualcomm, etc to sell to China with devastating effect.

The "unfair" ban of Micron by the "ugly and bad" China will provide US the narrative to make this step acceptable to Americans...and US industry will have to accept that. Geopolitics is above economy.

I know this may be controversial here, but IMHO China today is not in a position to provoke US with unilateral chip bans.

1- The US doesn't need any justifications to crack down on Chinese semiconductor corporations. If they can find nothing, they will accuse companies of selling products to PLA or aiding in genocide in Xinjiang. Remember what happened to Huawei and Hikvision. They were literally accused of aiding genocide.

2- Such a ban would kill American corporations. China consumes a quarter of the world's electronics and manufactures more than half of them. Many American tech corporations would lose 90%+ of their manufacturing in case China or US issues a blanket ban. And that would take a decade to recover from.

Semiconductor equipment manufacturer Jingsheng Equipment successfully landed on the Science and Technology Innovation Board. Shareholders include Yuanhe Puhua, China Micro, etc.

Jingsheng shares were listed on the Science and Technology Innovation Board of the Shanghai Stock Exchange. The company's stock code is 688478, the issue price is 32.52 yuan per share, and the issue price-earnings ratio is 129.9 times. As of press time, Jingsheng Equipment has soared 30.07%, to 42.30 yuan per share, with a total market value of 5.853 billion yuan.

According to the data, Jingsheng Equipment is a supplier of special equipment for semiconductors, mainly engaged in the research and development, production and sales of crystal growth equipment. Since its establishment, the company has been committed to new products, new technologies and new processes based on the technical homology of high-temperature and high-vacuum crystal growth equipment, combined with the ability of synergistic optimization of upstream and downstream technologies in the "crystal growth equipment-process technology-crystal material" industry chain Focusing on the semiconductor field, it provides semiconductor-grade monocrystalline silicon furnaces, silicon carbide single crystal furnaces and sapphire single crystal furnaces and other customized crystal growth equipment to semiconductor material manufacturers and other material customers.

Jingsheng shares were listed on the Science and Technology Innovation Board of the Shanghai Stock Exchange. The company's stock code is 688478, the issue price is 32.52 yuan per share, and the issue price-earnings ratio is 129.9 times. As of press time, Jingsheng Equipment has soared 30.07%, to 42.30 yuan per share, with a total market value of 5.853 billion yuan.

According to the data, Jingsheng Equipment is a supplier of special equipment for semiconductors, mainly engaged in the research and development, production and sales of crystal growth equipment. Since its establishment, the company has been committed to new products, new technologies and new processes based on the technical homology of high-temperature and high-vacuum crystal growth equipment, combined with the ability of synergistic optimization of upstream and downstream technologies in the "crystal growth equipment-process technology-crystal material" industry chain Focusing on the semiconductor field, it provides semiconductor-grade monocrystalline silicon furnaces, silicon carbide single crystal furnaces and sapphire single crystal furnaces and other customized crystal growth equipment to semiconductor material manufacturers and other material customers.

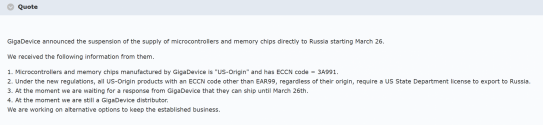

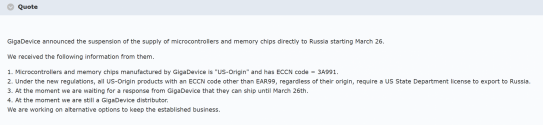

Very interesting,GigaDevice considers their products are of "US origin",thus subject to US law when it comes to export. I wonder which part of their design rely on US input. Can they survive if the US put them on blacklist?China is also on that "ECCN 3A991" list,does GigaDevice needs to obtain US permission in order to sell in China?

US tech titans Tim Cook and Elon Musk are under fire for their business ties to China but they are not the only Western tech executives trying to protect their hard-won Chinese markets in an increasingly hostile political environment at home.

US semiconductor production equipment heavyweights Applied Materials, Lam Research and KLA participated in the 25th China IC Manufacturing Annual Conference and Supply Chain Innovation Forum held in Guangzhou from April 17-19.

Their presence was notable given China’s new focus on tech self-reliance and supply chain security in the face of escalating US sanctions on its tech industry.

China accounted for 26% of semiconductor production equipment sales in 2022, according to data compiled by global industry association SEMI. While Chinese chip equipment makers are not yet competitive in world markets, they have been handed a golden opportunity by US export restrictions.

The event was sponsored and organized by the China Semiconductor Industry Association and other national and regional organizations focused on materials, wafer processing, packaging, testing and finance.

Several domestic and foreign manufacturers, academic and research institutions, and infrastructure providers also participated. In addition to the three big US semiconductor companies, Germany’s Siemens and Zeiss and Japan’s Hitachi and Disco were in attendance.

Topics addressed included integrated circuit (IC) design and electronic design automation (EDA), materials innovation, atomic layer deposition (ALD) and other specialized processing technologies as well as central processing units (CPUs), field programmable gate arrays (FPGAs), systems-on-chip (SOCs), power and compound semiconductors including silicon carbide) automotive ICs and sensors.

The US is urging lithography tool-makers to stop selling to China. Image: Facebook

These are among the areas that Chinese companies need to master in order to build an independent semiconductor industry immune to US sanctions.

Guangdong province is emerging as a new center of semiconductor design and manufacturing with some 40 semiconductor-related projects valued at 500 billion yuan (US$72.6 billion) either underway or in the planning stage. That’s almost 40% more than the $52.7 billion allocated to the US semiconductor industry by the Biden administration’s CHIPS Act.

At the conference, Guangdong Vice Governor Wang Xi noted that the province imports about $145 billion worth of semiconductors each year, representing roughly a third of China’s total chip imports. That potentially massive import substitution opportunity explains why foreign chip-making equipment companies were in attendance.

Wang is a materials scientist and a member of the Chinese Academy of Sciences who previously served as president of the Shanghai Institute of Microsystems and Information Technology, vice chairman of the China Association for Science and Technology and president of the Shanghai Institute of Advanced Research.

He became a member of the Chinese Communist Party (CCP) in 2001 and was appointed vice minister of Science and Technology in 2019. Now, as vice governor and a member of the Standing Committee of the CCP Guangdong Provincial Committee, he is overseeing the creation of a semiconductor industry complex that will complement those in Beijing and Shanghai.

Lam Research, which announced its March quarter results on April 19, wrote in its presentation materials that generally weak demand from memory IC makers was partially offset by “China-related demand across logic and memory.” By region, China accounted for 22% of the company’s sales in the quarter.

On the conference call with analysts, CEO Tim Archer said that the US government had clarified the rules governing exports to China and that this “allows us to ship certain products that we had originally excluded from our expectations.”

Seagate, the world’s largest maker of hard disc drives (HDDs), took the opposite approach and is now paying for it.

On April 19, the Bureau of Industry and Security (BIS) of the US Department of Commerce announced that it had imposed a $300 million penalty on Seagate for shipping about 7.4 million HDDs valued at $1.1 billion to Chinese tech giant Huawei between August 2020 and September 2021 in violation of US export controls. It was the largest single administrative penalty imposed in BIS history; excerpts from the penalty’s announcement follow:

“In August 2020, BIS imposed controls over certain foreign-produced items related to Huawei… Despite this, in September 2020, Seagate announced it would continue to do business with Huawei. Seagate did so despite the fact that its only two competitors had stopped selling HDDs to Huawei, resulting in Seagate becoming Huawei’s sole source provider of HDDs. Subsequently, Seagate entered into a three-year Strategic Cooperation Agreement with Huawei, naming Seagate as ‘Huawei’s strategic supplier’ and granting the company ‘priority basis over other Huawei suppliers.’

“The two other companies capable of making HDDs promptly—and publicly—indicated that they had ceased sales to Huawei. Of the three, only Seagate refused to stop sales and transactions involving Huawei. BIS’s $300 million monetary penalty is more than twice what BIS estimates to be the company’s net profits for the alleged illegal exports to or involving Huawei.”

The BIS has singled out hard disc drive maker Seagate for violating tech sanctions on China. Image: Twitter

The other two HDD makers are Western Digital and Toshiba. According to data storage market research company Trendfocus, Seagate had about 45% of the global HDD market in the first quarter of calendar 2023, followed by Western Digital at 36% and Toshiba at 19%.

But the higher the market share, the bigger the problem as global demand for HDDs is collapsing. Unit shipments dropped about 34% year-on-year at Seagate and by approximately 37% at both Western Digital and Toshiba. This was due both to the long-term trend favoring solid-state drives (SSDs) and the current downturn in the PC and enterprise data storage markets.

SSDs use NAND flash memory instead of rotating discs for data storage. South Korea’s Samsung, the world’s largest maker of NAND flash memory, sold its HDD business to Seagate in 2018. Toshiba affiliate Kioxia, in partnership with Western Digital, is the world’s second-largest maker of NAND flash memory.

Unit shipments of HDDs peaked in 2010 and have since dropped by more than 75%. Since 2012, SSD unit shipments have increased by more than 10 times, overtaking HDDs and reaching price parity at higher and higher levels of storage capacity.

Without rotating discs, spindles and motors, SSDs are lighter and more resistant to vibration than HDDs. Indications are that they will continue to displace HDDs in all but top-end applications – and there, too, if HDDs are not available.

Ironically, the BIS has imposed its largest fine ever in a case involving a legacy product that has little or nothing to do with national security and that is steadily declining in tech industry importance. But the point clearly was to set an example: “This settlement is a clarion call about the need for companies to comply rigorously with BIS export rules…”

Specifically, Seagate used ion beam etch and deposition, physical vapor deposition and laser-based surface inspection equipment – all on the BIS’ export restriction list – to manufacture and test the HDDs. Only the final product was shipped to Huawei.

For the three months to March (the company’s fiscal third quarter), Seagate reported an operating loss of $315 million and a net loss of $433 million. The $300 million fine, therefore, is equivalent to another bad quarter at the bottom of the tech cycle.

also learned its lesson, replacing more than 13,000 imported components with alternatives made in China and redesigning more than 4,000 circuit boards in order to evade US sanctions.

Where did you get this information from?Very interesting,GigaDevice considers their products are of "US origin",thus subject to US law when it comes to export. I wonder which part of their design rely on US input. Can they survive if the US put them on blacklist?China is also on that "ECCN 3A991" list,does GigaDevice needs to obtain US permission in order to sell in China?

View attachment 111515

Can you link to a first-party source (aka directly from GigaDevice?)

Where did you get this information from?

Can you link to a first-party source (aka directly from GigaDevice?)

use translate to english function on Chrome

Read the tweet, the pressure was to stop Koreans from taking the market left void by Micron. So don't sell more to China.I think we need to make some assumptions on how much Americans would be willing to escalate if China bans Micron.

Given the recent news about the US pressuring the Koreans to stop them from selling to China, I think we can say that the maximum response could be a total ban of Korean memory exports to China.

Even if the fabs are in China, if the Chinese government seized them, although justifiable, it would be very bad publicity and send a bad signal to foreign investors

I think the gov should cover its bases first before going for a total Micron ban. Alternatively, China could go for a limited scale ban which would allow both countries to better control the escalation-response ladder

Now, let's say what you are saying is correct.

Again, there is plenty of time to stock up. Samsung & SK have plenty of DRAMs that they are looking to sell right now for anyone that want to place a large order. Go stock up

CXMT is about to IPO, so it should have fresh injection of funding. Let it ramp up production of 19nm DRAMs. It's not like they've been able to move beyond that.

So Chinese desktop/tablet/phone makers end up with slower DRAM and Samsung/SK/Micron all go belly up because they can't sell to China.

since this is a pretty accusation, can you please show a legitimate source for this.Very interesting,GigaDevice considers their products are of "US origin",thus subject to US law when it comes to export. I wonder which part of their design rely on US input. Can they survive if the US put them on blacklist?China is also on that "ECCN 3A991" list,does GigaDevice needs to obtain US permission in order to sell in China?

View attachment 111515

- Status

- Not open for further replies.