Well it's only Ne that's controlled by Russia and Ukraine. Argon is from air liquefaction and is commonly produced. Fluorine is extracted. I am not sure if they're selling the full formulated gas including Ne, or just high purity Ar/F2 mix that is blended on site.How nice of China to be saving the butts of the combined West, so they have enough excimer gas to make chips after they stopped being able to buy from Ukraine and stopped purchases from Russia. Man, China is just way too soft. They should push these dolts into at least weakening some of the sanctions on Chinese semiconductors if they wanted to get the gas.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

With regards to Russia not being allowed to buy Loongson processors something has not been explained properly methinks.

I suspect Russia is not allowed to buy space grade or military grade versions of the chips because China does not export those. Russia probably wanted space grade semiconductors for their satellites after being cut from supply by the West after 2014. But I do not see China banning exports of the civilian grade stuff.

I suspect Russia is not allowed to buy space grade or military grade versions of the chips because China does not export those. Russia probably wanted space grade semiconductors for their satellites after being cut from supply by the West after 2014. But I do not see China banning exports of the civilian grade stuff.

With regards to Russia not being allowed to buy Loongson processors something has not been explained properly methinks.

I suspect Russia is not allowed to buy space grade or military grade versions of the chips because China does not export those. Russia probably wanted space grade semiconductors for their satellites after being cut from supply by the West after 2014. But I do not see China banning exports of the civilian grade stuff.

Could be the case or a combination of cases, but I think is due more because the Chinese goverment is in a hurry to replace computers with US components with ones with Chinese made components inside, if they start sharing their stockpile of domestics processors and components with a another huge nation like Russia, who is also in hurry to replace their US made CPUs and other components, that will delay Chinese goverment plans of domestic substitution in the Chinese goverment sector, that is massive, include huge companies who are one of the biggest in the world.

Last edited:

This sounds like an interesting thing to do. Basically commoditizing chips and other ic products. It's also smart, because exchange just increases transparency and encourages companies from other countries to also participate. It would allow china to lead trading in this industry if successful.

rumors about it, it has 8nm process at the same time as SMIC in early 2022... but until now, they are still silent.sorry, what do you mean by this?

It's likely Samsung semicon revenues will keep going down for awhile as a new competitor from CN rises up??

---

Tech war: Huawei’s stealth chip production plan becomes a guessing game for industry insiders as US sanctions keep it hemmed in

Huawei’s in-house chip design unit HiSilicon has the ability to design advanced chips but it is a different undertaking to fabricate chips

Huawei’s once-lucrative smartphone business has been hobbled by US trade sanctions that have cut off its access to advanced chips

The chip production plans of Huawei Technologies Co have become the subject of fresh speculation within the semiconductor industry after the tech giant filed a patent application for advanced lithography late last year, a key technology used to produce cutting-edge chips. Many analysts say the odds that Huawei, whose once-lucrative smartphone business has been hobbled by US trade sanctions that have cut off its access to advanced chips, can build a US-free chip production line are small.

While Huawei’s in-house chip design unit HiSilicon has the ability to design advanced chips, it is a completely different undertaking to fabricate chips at high scale. For example, China’s top chip maker Semiconductor Manufacturing International Corp is only able to produce 14-nanometre node chips at scale – well behind the cutting edge of industry leader Taiwan Semiconductor Manufacturing Company.

Nevertheless, speculation about Huawei’s chipmaking efforts has continued to flow ever since the firm was barred by US sanctions from procuring the services of foundries that use US-origin technologies to fabricate its chip designs. Discussion flared this week after a tech influencer implied in a post on Chinese social media that Huawei was close to achieving mass production of 12-nm and 14-nm chips while a breakthrough in advanced nodes was still some distance away.

One former senior technician at Huawei, who asked not to be identified due to the sensitivity of the matter, told the Post that rumours about Huawei fabricating 14-nm chips were credible given “three years of continuous effort”.

He said that Huawei has been investing in more advanced chipmaking technology but did not provide any details regarding the location and capacity of said production and what types of semiconductors it might be going to produce for Huawei.

Huawei declined to comment on its chip supply progress. However, another Huawei engineer who also declined to be identified due to the sensitivity of the matter, told the Post that he was doubtful Huawei could manage a local chip-making supply chain given that a single chip production line typically involves over 300 individual suppliers.

There have been several media reports that Huawei has teamed up with other parties to produce chips. Huawei has joined with Fujian Jinhua Integrated Circuit Co. (JHICC), a DRAM memory chip maker, to refit its production facilities to make processors and other logic chips, according to a September Nikkei report, which cited anonymous sources.

According to an April Financial Times report, Washington launched an investigation into memory chip maker Yangtze Memory Technologies Corp (YMTC), China’s top memory chip maker, over suspicions that it was supplying components to Huawei in contravention of sanctions.

There was no public information about the probe but YMTC was later added to a US trade blacklist. Pengxinwei IC Manufacturing Co, a Shenzhen-based fab with new facilities near Huawei’s campus, could help Huawei bypass US restrictions, according to a September Bloomberg report. Pengxinwei was added to the US trade blacklist along with YMTC in December. “Huawei is definitely progressing with its chip-making efforts, but questions over whether said production can reach 14-nm is anyone’s guess”, said Yang Guang, a senior principal analyst covering the telecoms sector at research firm Omdia.

Yang added that a breakthrough in 28-nm legacy node technology seems more plausible for Huawei. This would help Huawei safeguard revenue from its bread-and-butter telecoms equipment business and its nascent electric vehicle (EV) businesses, which rely on more legacy semiconductor technologies. Speculation about Huawei’s plans has increased since the China National Intellectual Property Administration (CNIPA) on November 15 revealed an application for a patent on extreme ultraviolet (EUV) lithography by Huawei, which was filed in May 2021. This could, theoretically, be applied to produce 7-nm chips.

Huawei also filed a patent application last April for chip packaging technology, according to CNIPA, which can improve chip performance. Dutch firm ASML Holdings currently has a near monopoly position in the production of advanced EUV lithography machines. China’s Shanghai Micro, China’s leading lithography equipment maker which is well behind ASML technically, was also added to the US trade blacklist in December, further clouding China’s hopes for a breakthrough in lithography systems.

Wang Tao, head of Huawei’s ICT infrastructure, said at a conference last April that Huawei was trying to address its chip problems by looking at basic theories, software and code in chip packaging, namely using existing technologies to improve performance. Ken Hu Houkun said at the same event that Huawei had no plan to build its own foundries.

---

Tech war: Huawei’s stealth chip production plan becomes a guessing game for industry insiders as US sanctions keep it hemmed in

Huawei’s in-house chip design unit HiSilicon has the ability to design advanced chips but it is a different undertaking to fabricate chips

Huawei’s once-lucrative smartphone business has been hobbled by US trade sanctions that have cut off its access to advanced chips

The chip production plans of Huawei Technologies Co have become the subject of fresh speculation within the semiconductor industry after the tech giant filed a patent application for advanced lithography late last year, a key technology used to produce cutting-edge chips. Many analysts say the odds that Huawei, whose once-lucrative smartphone business has been hobbled by US trade sanctions that have cut off its access to advanced chips, can build a US-free chip production line are small.

While Huawei’s in-house chip design unit HiSilicon has the ability to design advanced chips, it is a completely different undertaking to fabricate chips at high scale. For example, China’s top chip maker Semiconductor Manufacturing International Corp is only able to produce 14-nanometre node chips at scale – well behind the cutting edge of industry leader Taiwan Semiconductor Manufacturing Company.

Nevertheless, speculation about Huawei’s chipmaking efforts has continued to flow ever since the firm was barred by US sanctions from procuring the services of foundries that use US-origin technologies to fabricate its chip designs. Discussion flared this week after a tech influencer implied in a post on Chinese social media that Huawei was close to achieving mass production of 12-nm and 14-nm chips while a breakthrough in advanced nodes was still some distance away.

One former senior technician at Huawei, who asked not to be identified due to the sensitivity of the matter, told the Post that rumours about Huawei fabricating 14-nm chips were credible given “three years of continuous effort”.

He said that Huawei has been investing in more advanced chipmaking technology but did not provide any details regarding the location and capacity of said production and what types of semiconductors it might be going to produce for Huawei.

Huawei declined to comment on its chip supply progress. However, another Huawei engineer who also declined to be identified due to the sensitivity of the matter, told the Post that he was doubtful Huawei could manage a local chip-making supply chain given that a single chip production line typically involves over 300 individual suppliers.

There have been several media reports that Huawei has teamed up with other parties to produce chips. Huawei has joined with Fujian Jinhua Integrated Circuit Co. (JHICC), a DRAM memory chip maker, to refit its production facilities to make processors and other logic chips, according to a September Nikkei report, which cited anonymous sources.

According to an April Financial Times report, Washington launched an investigation into memory chip maker Yangtze Memory Technologies Corp (YMTC), China’s top memory chip maker, over suspicions that it was supplying components to Huawei in contravention of sanctions.

There was no public information about the probe but YMTC was later added to a US trade blacklist. Pengxinwei IC Manufacturing Co, a Shenzhen-based fab with new facilities near Huawei’s campus, could help Huawei bypass US restrictions, according to a September Bloomberg report. Pengxinwei was added to the US trade blacklist along with YMTC in December. “Huawei is definitely progressing with its chip-making efforts, but questions over whether said production can reach 14-nm is anyone’s guess”, said Yang Guang, a senior principal analyst covering the telecoms sector at research firm Omdia.

Yang added that a breakthrough in 28-nm legacy node technology seems more plausible for Huawei. This would help Huawei safeguard revenue from its bread-and-butter telecoms equipment business and its nascent electric vehicle (EV) businesses, which rely on more legacy semiconductor technologies. Speculation about Huawei’s plans has increased since the China National Intellectual Property Administration (CNIPA) on November 15 revealed an application for a patent on extreme ultraviolet (EUV) lithography by Huawei, which was filed in May 2021. This could, theoretically, be applied to produce 7-nm chips.

Huawei also filed a patent application last April for chip packaging technology, according to CNIPA, which can improve chip performance. Dutch firm ASML Holdings currently has a near monopoly position in the production of advanced EUV lithography machines. China’s Shanghai Micro, China’s leading lithography equipment maker which is well behind ASML technically, was also added to the US trade blacklist in December, further clouding China’s hopes for a breakthrough in lithography systems.

Wang Tao, head of Huawei’s ICT infrastructure, said at a conference last April that Huawei was trying to address its chip problems by looking at basic theories, software and code in chip packaging, namely using existing technologies to improve performance. Ken Hu Houkun said at the same event that Huawei had no plan to build its own foundries.

People have to evaluate quality of article before posting them here. Scmp as a whole is pretty low in quality. In this case, they cannot event figure out that smic is producing 12 nm chips for Huawei when there is no one else in china capable of it.It's likely Samsung semicon revenues will keep going down for awhile as a new competitor from CN rises up??

---

Tech war: Huawei’s stealth chip production plan becomes a guessing game for industry insiders as US sanctions keep it hemmed in

Huawei’s in-house chip design unit HiSilicon has the ability to design advanced chips but it is a different undertaking to fabricate chips

Huawei’s once-lucrative smartphone business has been hobbled by US trade sanctions that have cut off its access to advanced chips

The chip production plans of Huawei Technologies Co have become the subject of fresh speculation within the semiconductor industry after the tech giant filed a patent application for advanced lithography late last year, a key technology used to produce cutting-edge chips. Many analysts say the odds that Huawei, whose once-lucrative smartphone business has been hobbled by US trade sanctions that have cut off its access to advanced chips, can build a US-free chip production line are small.

While Huawei’s in-house chip design unit HiSilicon has the ability to design advanced chips, it is a completely different undertaking to fabricate chips at high scale. For example, China’s top chip maker Semiconductor Manufacturing International Corp is only able to produce 14-nanometre node chips at scale – well behind the cutting edge of industry leader Taiwan Semiconductor Manufacturing Company.

Nevertheless, speculation about Huawei’s chipmaking efforts has continued to flow ever since the firm was barred by US sanctions from procuring the services of foundries that use US-origin technologies to fabricate its chip designs. Discussion flared this week after a tech influencer implied in a post on Chinese social media that Huawei was close to achieving mass production of 12-nm and 14-nm chips while a breakthrough in advanced nodes was still some distance away.

One former senior technician at Huawei, who asked not to be identified due to the sensitivity of the matter, told the Post that rumours about Huawei fabricating 14-nm chips were credible given “three years of continuous effort”.

He said that Huawei has been investing in more advanced chipmaking technology but did not provide any details regarding the location and capacity of said production and what types of semiconductors it might be going to produce for Huawei.

Huawei declined to comment on its chip supply progress. However, another Huawei engineer who also declined to be identified due to the sensitivity of the matter, told the Post that he was doubtful Huawei could manage a local chip-making supply chain given that a single chip production line typically involves over 300 individual suppliers.

There have been several media reports that Huawei has teamed up with other parties to produce chips. Huawei has joined with Fujian Jinhua Integrated Circuit Co. (JHICC), a DRAM memory chip maker, to refit its production facilities to make processors and other logic chips, according to a September Nikkei report, which cited anonymous sources.

According to an April Financial Times report, Washington launched an investigation into memory chip maker Yangtze Memory Technologies Corp (YMTC), China’s top memory chip maker, over suspicions that it was supplying components to Huawei in contravention of sanctions.

There was no public information about the probe but YMTC was later added to a US trade blacklist. Pengxinwei IC Manufacturing Co, a Shenzhen-based fab with new facilities near Huawei’s campus, could help Huawei bypass US restrictions, according to a September Bloomberg report. Pengxinwei was added to the US trade blacklist along with YMTC in December. “Huawei is definitely progressing with its chip-making efforts, but questions over whether said production can reach 14-nm is anyone’s guess”, said Yang Guang, a senior principal analyst covering the telecoms sector at research firm Omdia.

Yang added that a breakthrough in 28-nm legacy node technology seems more plausible for Huawei. This would help Huawei safeguard revenue from its bread-and-butter telecoms equipment business and its nascent electric vehicle (EV) businesses, which rely on more legacy semiconductor technologies. Speculation about Huawei’s plans has increased since the China National Intellectual Property Administration (CNIPA) on November 15 revealed an application for a patent on extreme ultraviolet (EUV) lithography by Huawei, which was filed in May 2021. This could, theoretically, be applied to produce 7-nm chips.

Huawei also filed a patent application last April for chip packaging technology, according to CNIPA, which can improve chip performance. Dutch firm ASML Holdings currently has a near monopoly position in the production of advanced EUV lithography machines. China’s Shanghai Micro, China’s leading lithography equipment maker which is well behind ASML technically, was also added to the US trade blacklist in December, further clouding China’s hopes for a breakthrough in lithography systems.

Wang Tao, head of Huawei’s ICT infrastructure, said at a conference last April that Huawei was trying to address its chip problems by looking at basic theories, software and code in chip packaging, namely using existing technologies to improve performance. Ken Hu Houkun said at the same event that Huawei had no plan to build its own foundries.

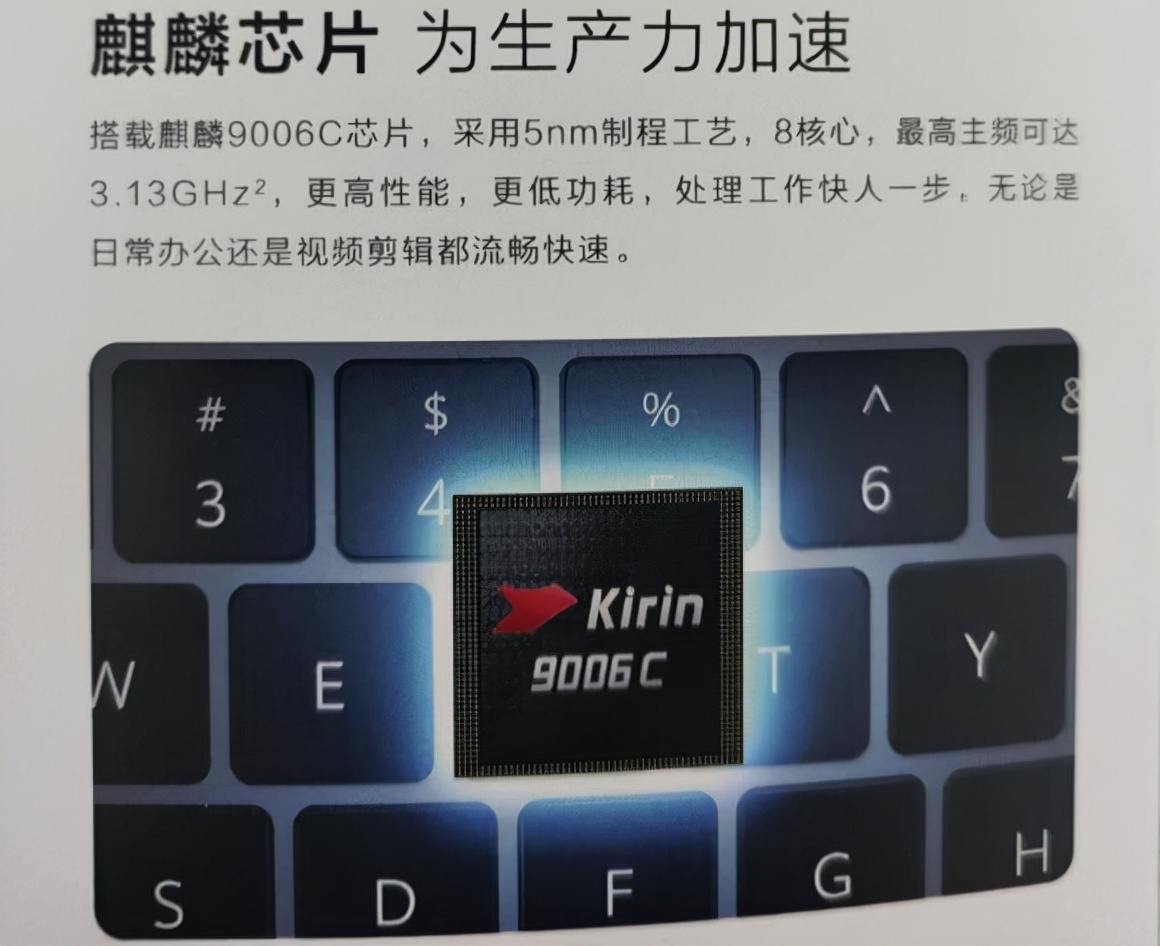

Sir remember Huawei Kirin 9006C 5nm chips.People have to evaluate quality of article before posting them here. Scmp as a whole is pretty low in quality. In this case, they cannot event figure out that smic is producing 12 nm chips for Huawei when there is no one else in china capable of it.

Unexpectedly, the new 5nm Kirin Kirin 9006C came out. Who is OEM for Huawei?

Due to changes in the international situation and changes in the US semiconductor market rules, Huawei's Kirin chips were forced to suspend production after September 2020.

As we all know, the Kirin chip is Huawei's self-developed chip, which has been applied to Huawei mobile phones before. After the production of Kirin chips was discontinued, the output of Huawei's mobile phones was inevitably affected, which led to a decline in mobile phone sales.

Zhongguancun Online reported on December 3 that Huawei's new MateBook still uses the Kirin chip, and it is the Kirin 9006C that has never appeared before.

It should be noted that this processor, named Kirin 9006C, uses a 5nm process. Not to mention the performance of this chip, the use of the 5nm process alone is surprising enough.

You know, looking at the world, only TSMC and Samsung can achieve mass production of 5nm process , but these two foundries are unlikely to produce advanced 5nm process chips for Huawei at this time.

So, the question is, who is it that made the Kirin chip for Huawei? There are divergent opinions on this issue on the Internet. Although there is no exact statement at present, there are also two speculations.

The first is that Kirin 9006C is a chip previously produced by TSMC ;

There is one thing to say that the appearance of the Kirin 9006C at this time is really a bit abrupt. After all, after the Huawei 9000 chip, Huawei has not launched a new Kirin chip, and there is currently no foundry that can produce 5nm chips for Huawei.

Given that Huawei's current chip inventory is still a mystery, it is not clear how many Kirin chips Huawei has, and how many Kirin chips are in stock. Therefore, the Kirin 9006C is likely to be a chip produced by TSMC and Huawei during the cooperation.

The second argument is that Kirin 9006C is transformed from Kirin 9000 ;

This argument is not a vacancy. From the perspective of parameters, the Kirin 9006C and the Kirin 9000 chip have certain similarities.

Kirin 9006C and Kirin 9000 both use 5nm process and also have a 3.13GHz Cortex-A77 super core. Although the GPU is different, the difference is not big. The GPU of Kirin 9006C is Mali-G78 MP22, while Kirin 9000 is Mali-G78 MP24. Therefore, from the perspective of parameters, the Kirin 9006C is likely to be a modified version of the Kirin 9000.

No matter how the Kirin 9006C came about, its advent is a good thing for Huawei. It can not only enhance the competitiveness of Huawei's products, but also increase Huawei's market influence.

In recent years, the strength of Huawei's Kirin chips has never disappointed consumers, and the self-developed Kirin chips have become a competitive advantage of Huawei products in the market. According to reports from Zhongguancun Online, Kirin 9006C is a product with stronger performance and lower power consumption. Huawei's new MateBook adopts this chip, which will inevitably enhance product competitiveness.

In addition, Huawei's current situation is very difficult, especially for HiSilicon Kirin chips. As mentioned in the previous article, Huawei HiSilicon has not launched new products since Kirin 9000. In addition, the inventory of products equipped with Kirin chips is decreasing. Huawei or Said that the market influence of Huawei HiSilicon Kirin chips is gradually weakening.

Although Kirin 9006C is not a chip for smart phone products, as a member of the Kirin family, its advent will inevitably usher in a large wave of attention, thereby enhancing the competitiveness of Huawei and Huawei HiSilicon in the market.

Not only that, although Huawei HiSilicon Kirin chips are no longer in production, Huawei has not given up HiSilicon, and has not disbanded the HiSilicon team. But it should be noted that if you want to maintain the normal operation of Huawei HiSilicon, you need to invest a lot of money. After Kirin 9006C enters the market, it can increase economic income to a certain extent and reduce Huawei's pressure.

Lol my god, ok, first, TSMC is not a brand. There is no TSMC branded end product. NVIDIA, AMD, Apple are all fabless. They are utterly incomparable to SMIC as they fabricate 0 chips. I'm not aware of a Google fabbed chip that is widely sold. If you need some emotional validation from SMIC, it isn't happening, because then they'll just refer to it as a sweatshop using low price labor operating foreign tools outputting foreign designs. Which is, boiled down, what TSMC does.Yes, I know that most of the world runs on low end chips. But if I can give an example, the world also runs on farmers growing food for us, no food, everyone dies within a year. But nobody ever grows up wanting to be a farmer, or a coal miner, no offense to those jobs intended, even if they're the bedrock of humanity. Everyone wants to be an astronaut, scientist, movie star, pilot... Someone pushing the boundaries.

China really needs to shrug the reputation of being a low end manufacturer and move up the value chain. Everyone knows about brands like Apple, Tesla, NVIDA, AMD, Google, TSMC, because they're the best of the best, pushing the field forwards, nobody cares about the hundreds of companies that do everyday jobs like mine for metal, making their plastic and paves their roads.

Again, SMIC is meant to go head to head with TSMC, not be a workhorse for mature technologies. Let other fabs be the workhorse.

The issue is that EUV will take years, probably way past 2025.

Doesn't mean much if they're not cost competitive enough to bring into market. Again, this shortsightness isn't good, sure SMIC can fill limited orders of 7nm within China for a high cost, but China has to go beyond the domestic market and conquer the global market. Nothing less than mass produced low cost 7nm CPUs and GPUs that undercut Intel and NVDA will do the job.

What they're doing now? You can clearly see that the latest round of sanctions have really kicked the industry into high gear, not the relaxed attitude of post 2018 bans. Fabs are finally actually working hand in hand with domestic suppliers instead of begrudgingly like before, the equipment manufacturers are talking with each other, universities are cooperating with R&D projects to cover up shortcomings.

Also wishful thinking here, but with the amount of money and talent China, it's also not impossible for some state company like SMEE to begin R&D on entirely new lines of semiconductor technology altogether, not just retreading old ground. New materials, new architecture etc etc. Like what China did with EVs, jumping over old ICE tech. Like I have said, China may need mature chips to survive, but to thrive, they need to look to the future.

Fabrication of mature node chips is utterly incomparable to coal mining or farming. The entire Japanese and European semiconductor industry focuses on mature node chips for industrial and automotive applications, as well as half the entire US semiconductor industry. Infineon, TI Analog Devices, Microchip and Renesas are well known names here.

I advise you to actually understand the semiconductor industry even at a most rudimentary level first before commenting anything other than questions, with question marks.

- Status

- Not open for further replies.