With this YTMC basically either reached or surpassed the leading edge NAND companies in terms of density. Samsung is still not manufacturing their higher density variants for example. I think only Micron and SK Hynix have over 200 layers actually shipping. Plus this product has much better I/O capabilities than any of those.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

TF Micro is doing packaging for 5nm AV chips. I assume this is for the CPU. Looks like it has quite a bit client list here.

Another fab that says it is not at all effected by the new sanctions.

Alpha power solution got investment/funding from Shanghai free trade zone for SiC Power module R&D

It has joined hands with international automotive chip giants including Infineon, NXP, STMicroelectronics, and Bosch. Domestic partners include BYD, Silan Microelectronics, and automotive electronics designer AutoChips, covering processors, power management, and battery management, the company added.

Another fab that says it is not at all effected by the new sanctions.

Alpha power solution got investment/funding from Shanghai free trade zone for SiC Power module R&D

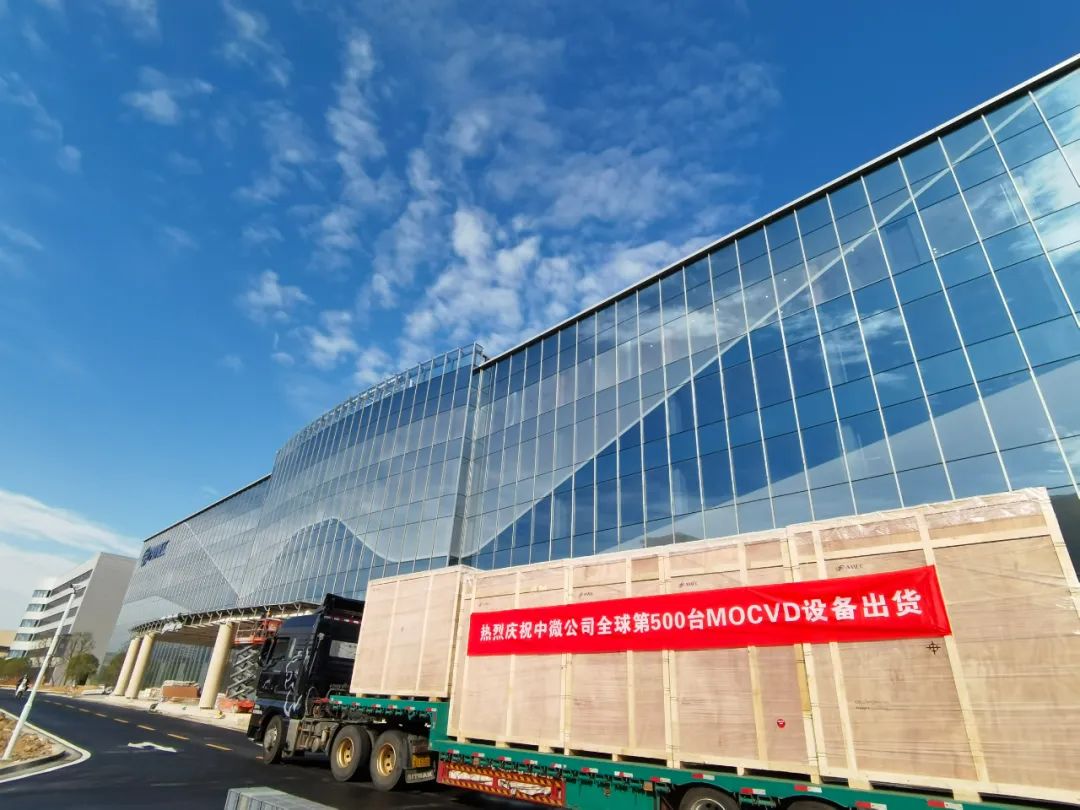

China Micro's 500th MOCVD equipment in the world was successfully delivered

Jiwei.com news, on October 25, China Micro Semiconductor Equipment (Shanghai) Co., Ltd. (hereinafter referred to as "China Micro Company") announced that the world's 500th MOCVD equipment was successfully shipped to domestic LED epitaxial wafer and chip R&D and production manufacturers .

Source: China Micro Corporation

According to the company's news, the 500th MOCVD equipment shipped in this batch is the Prismo UniMax launched by China Micro in June 2021, which is mainly used for the mass production of gallium nitride-based Mini LED epitaxial wafers. At present, a series of MOCVD equipment developed by Zhongwei has been fully put into mass production on major LED production lines in the industry. Prismo UniMax is a new generation of MOCVD equipment series.

In 2013, Zhongwei released the mass-produced MOCVD equipment Prismo D-BLUE independently developed and manufactured in China. Since then, China Micro has successively launched Prismo A7, Prismo HiT3, Prismo UniMax and Prismo PD5 products in 2017, 2020, 2021 and 2022.

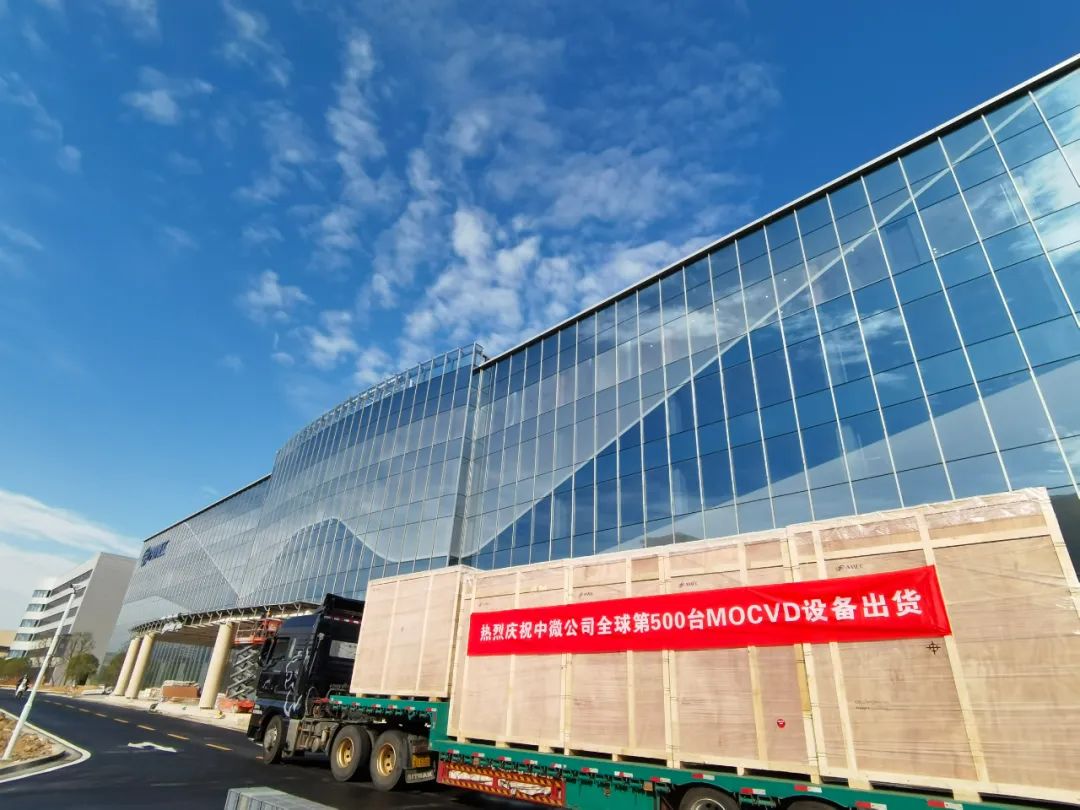

China Micro's 500th MOCVD equipment in the world was successfully delivered

Jiwei.com news, on October 25, China Micro Semiconductor Equipment (Shanghai) Co., Ltd. (hereinafter referred to as "China Micro Company") announced that the world's 500th MOCVD equipment was successfully shipped to domestic LED epitaxial wafer and chip R&D and production manufacturers .

Source: China Micro Corporation

According to the company's news, the 500th MOCVD equipment shipped in this batch is the Prismo UniMax launched by China Micro in June 2021, which is mainly used for the mass production of gallium nitride-based Mini LED epitaxial wafers. At present, a series of MOCVD equipment developed by Zhongwei has been fully put into mass production on major LED production lines in the industry. Prismo UniMax is a new generation of MOCVD equipment series.

In 2013, Zhongwei released the mass-produced MOCVD equipment Prismo D-BLUE independently developed and manufactured in China. Since then, China Micro has successively launched Prismo A7, Prismo HiT3, Prismo UniMax and Prismo PD5 products in 2017, 2020, 2021 and 2022.

AMEC and NAURA are really China's two leading SEM companies. It looks like AMEC will grow revenue to over 5 billion yuan (>$700 million) and NAURA to over 15 billion yuan (>$2 billion) this year. Both are profitable and profits for both grow even faster than revenue, which bode well for more investment in R&D.

TSMC, Samsung face difficulty in ramping up 3nm chip production

Monica Chen, Hsinchu; Willis Ke, DIGITIMES AsiaTuesday 25 October 2022Credit: DIGITIMES

Both TSMC and Samsung Electronics are seeing their production scale for 3nm chips constrained due to difficulty in having good control of orders from big clients, and their capacity utilizations for sub-7nm process nodes are also being affected by the latest US semiconductor trade sanctions against China, according to industry sources. TSMC has moved to encourage its employees to take vacations and spend more time with families, the sources added.

TSMC was originally set to start volume production of 3nm chips for both Apple and Intel in the second half of 2022. But as Intel reportedly will continue to delay its launch of new CPUs for at least one year, TSMC is unlikely to fulfill orders from the US chipmaker this year, leaving Apple as the only client for its N3 (3nm) technology used to build new Mac and iPad processors, the sources said.

TSMC's N3E (3nm enhanced) technology slated for volume production in 2023 will also mainly serve new iPhone APs and MaC chipsets. Other fabless clients like AMD, Nvidia, MediaTek, Qualcomm and Broadcom are expected to successively enter 3nm era only after 2024, depending on their market conditions, the sources continued.

TSMC has projected that the 3nm process will trim its gross margin by 2-3 percentage points in 2023 due to cost increases. This, coupled with high inflation, rising construction costs for overseas fabs, Intel's delay in 3nm wafer starts, and sluggish consumer electronics market demand, will certainly impact the foundry's business performance, sources noted.

TSMC has recently suspended production of advanced AI GPU chips for Chinese startup Biren Technology to ensure compliance with US regulations, and it is also evaluating whether to fulfill 7/5nm chip orders from other Chinese IC designers including Bitman Technology, T-Head Semiconductor and Horizon Robotics in accordance with the new US restrictions on China-bound advanced chips.

Apparently in response to the ongoing semiconductor market downturn and impacts of US trade sanctions on China, TSMC's CEO CC Wei has recently released an internal message encouraging colleagues to take vacations at the moment to recharge themselves, and then come back to continue working hard.

While it is hard for TSMC to find more 3nm clients for the moment, it's even more difficult for Samsung to do so. In late June this year, Samsung landed its first 3nm chip order from China startup PanSemi, a maker of Bitcoin mining chips, but it also has no choice but to halt volume production for the Chinese client so as not to violate US regulations, the sources said.

Among the few 3nm process clients of Samsung, Google has decided to have its 3nm APs for its Pixel series handsets manufactured by the Korean maker due mainly to low foundry quotes. For Samsung, the Google orders, despite reaching just millions units, can more or less fill its production capacity, although it has to lose money to fulfill the orders.

Meanwhile, Samsung has also scaled back production of 5/4/3nm APs for its own flagship smartphones due to high costs and yield issues, and will adopt more Qualcomm offerings as part of its efforts to win more orders from the US mobile SoC specialist to bolster its capacity utilization for advanced process nodes.

Industry sources said that China's top foundry SMIC and other domestic peers are expected to stay put at the 28nm chip era as their R&D momentum is being greatly deterred by the US restrictions on China-bound exports of advanced manufacturing equipment and related software tools and services.

For TSMC and Samsung, their capacity utilization for sub-7 process nodes are being more or less affected as they could hardly deliver advanced chips to Chinese clients before the US restrictions are lifted. In addition, Chinese chip designers will also be ruled out as their future potential clients for 3nm process technology, which will make it longer for TSMC and Samsung to recoup their huge investments in the process segment.

Tools, tools, tools, nothing but tools.

The industry that East Asians are so proud of is nothing more than a glorified sweatshop for U.S. companies to use.

As I said, I agree with you that the equipment used to make the most sophisticated chips are more important than the chips themselves, but East Asians, read China and Japan, do make the equipment that you speak of and the Japanese do so particularly well in all categories.Tools, tools, tools, nothing but tools.

The industry that East Asians are so proud of is nothing more than a glorified sweatshop for U.S. companies to use

China and Japan, yes but they have a minimal market share of the foundry market even in Asia.As I said, I agree with you that the equipment used to make the most sophisticated chips are more important than the chips themselves, but East Asians, read China and Japan, do make the equipment that you speak of and the Japanese do so particularly well in all categories.

The processes and the foundries is dominated by South Korea and Taiwan and because US made tools dominate those they have become basically high tech sweatshops. The U.S. goverment doesn't even consider their companies and even their governments to be wise enough to make decisions on their own.

Japan SME industry has been steadily losing market share and technological supremacy to their western counterparts since the rise of the SK and Taiwan foundry model, their lithography industry declined pretty fast. So I hope they are smart enough to take this opportunity to promote their products and no follow the US in the same path.

China was going down with this model with every single Chinese factory following the Taiwanese model until US sanctions hit the industry like meteorites starting in 2019.

The only reason why the Chinese semiconductor tools industry is growing is because the sanctions, before that every single Chinese toolmaker was going down the path of extinction. it was said before the sanctions that working for a Chinese semiconductor equipment maker was a dead end job. I think if the Americans have waited just 8-10 years in the future to pull out the plug after all the domestic toolmakers have died down or changed industry the damage would have been much worse

Last edited:

TSMC, Samsung face difficulty in ramping up 3nm chip production

Monica Chen, Hsinchu; Willis Ke, DIGITIMES AsiaTuesday 25 October 2022

Credit: DIGITIMES

Both TSMC and Samsung Electronics are seeing their production scale for 3nm chips constrained due to difficulty in having good control of orders from big clients, and their capacity utilizations for sub-7nm process nodes are also being affected by the latest US semiconductor trade sanctions against China, according to industry sources. TSMC has moved to encourage its employees to take vacations and spend more time with families, the sources added.

TSMC was originally set to start volume production of 3nm chips for both Apple and Intel in the second half of 2022. But as Intel reportedly will continue to delay its launch of new CPUs for at least one year, TSMC is unlikely to fulfill orders from the US chipmaker this year, leaving Apple as the only client for its N3 (3nm) technology used to build new Mac and iPad processors, the sources said.

TSMC's N3E (3nm enhanced) technology slated for volume production in 2023 will also mainly serve new iPhone APs and MaC chipsets. Other fabless clients like AMD, Nvidia, MediaTek, Qualcomm and Broadcom are expected to successively enter 3nm era only after 2024, depending on their market conditions, the sources continued.

TSMC has projected that the 3nm process will trim its gross margin by 2-3 percentage points in 2023 due to cost increases. This, coupled with high inflation, rising construction costs for overseas fabs, Intel's delay in 3nm wafer starts, and sluggish consumer electronics market demand, will certainly impact the foundry's business performance, sources noted.

TSMC has recently suspended production of advanced AI GPU chips for Chinese startup Biren Technology to ensure compliance with US regulations, and it is also evaluating whether to fulfill 7/5nm chip orders from other Chinese IC designers including Bitman Technology, T-Head Semiconductor and Horizon Robotics in accordance with the new US restrictions on China-bound advanced chips.

Apparently in response to the ongoing semiconductor market downturn and impacts of US trade sanctions on China, TSMC's CEO CC Wei has recently released an internal message encouraging colleagues to take vacations at the moment to recharge themselves, and then come back to continue working hard.

While it is hard for TSMC to find more 3nm clients for the moment, it's even more difficult for Samsung to do so. In late June this year, Samsung landed its first 3nm chip order from China startup PanSemi, a maker of Bitcoin mining chips, but it also has no choice but to halt volume production for the Chinese client so as not to violate US regulations, the sources said.

Among the few 3nm process clients of Samsung, Google has decided to have its 3nm APs for its Pixel series handsets manufactured by the Korean maker due mainly to low foundry quotes. For Samsung, the Google orders, despite reaching just millions units, can more or less fill its production capacity, although it has to lose money to fulfill the orders.

Meanwhile, Samsung has also scaled back production of 5/4/3nm APs for its own flagship smartphones due to high costs and yield issues, and will adopt more Qualcomm offerings as part of its efforts to win more orders from the US mobile SoC specialist to bolster its capacity utilization for advanced process nodes.

Industry sources said that China's top foundry SMIC and other domestic peers are expected to stay put at the 28nm chip era as their R&D momentum is being greatly deterred by the US restrictions on China-bound exports of advanced manufacturing equipment and related software tools and services.

For TSMC and Samsung, their capacity utilization for sub-7 process nodes are being more or less affected as they could hardly deliver advanced chips to Chinese clients before the US restrictions are lifted. In addition, Chinese chip designers will also be ruled out as their future potential clients for 3nm process technology, which will make it longer for TSMC and Samsung to recoup their huge investments in the process segment.

Tools, tools, tools, nothing but tools.

The industry that East Asians are so proud of is nothing more than a glorified sweatshop for U.S. companies to use.

You cannot blame them. For the past 30 years globalization meant that appropriate division of labor is the most efficient way and boosted profits for all parties involved.

One has to be careful about following the theory of comparative advantage too greatly, although given their populations it is to a certain extent understandable, but if the Netherlands, a smaller country population wise than them has ASML, why don't they themselves also have more prominence with regards to semiconductor manufacturing equipment? That is in part of rhetorical question since your comment than I am tagging actually answers it...You cannot blame them. For the past 30 years globalization meant that appropriate division of labor is the most efficient way and boosted profits for all parties involved.

- Status

- Not open for further replies.