Is always been like that, for some reason memory is the first thing to go in a downturn.Just because the memory guys are hit hard doesn't mean we should expect the same from foundrie.

Do you think this growth has been accelerated by hoarding because the sanctions.

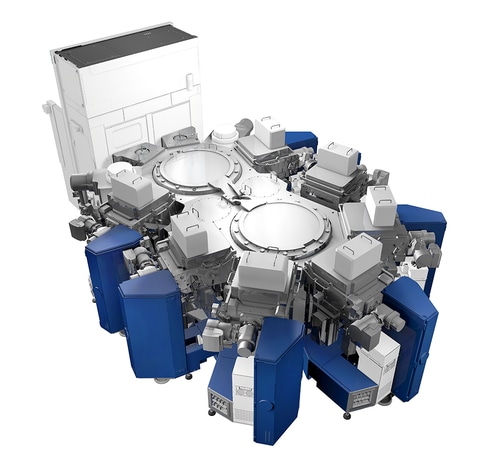

I saw that they have been buying and testing metrology equipment from local players including Optical, SEM and so on, let see, only pressure makes diamonds. There is one new player that will launch a series of metrology equipment for NAND at the end of this year that could probably help them.But what about inspection tools? I'm not convinced there're good domestic alternatives here. I fear this may be the area that may hinder the pace of YMTC's Fab2 expansion.