Any news on SMEE DUV 28nm ??

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

With the COVID situation in Shanghai, we have to wait until the situation get better.Any news on SMEE DUV 28nm ??

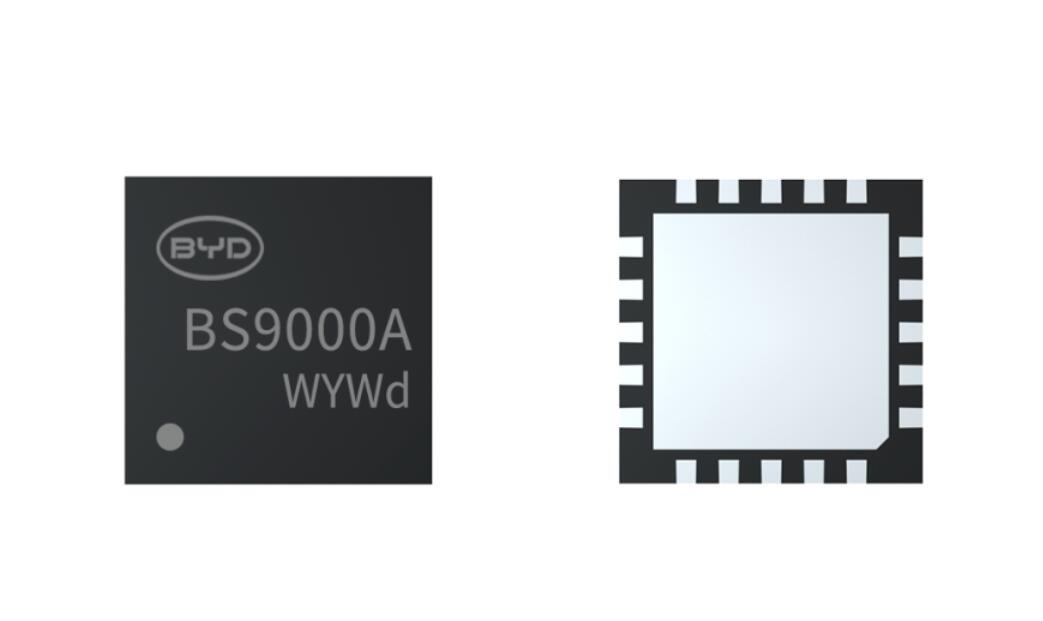

BYD Semiconductor unveils new MCU chip for vehicles

Apr 20, 2022 17:07 GMT+8From windows and seats, to body control and engine control, every innovation in automotive electronics has to be realized through the computing and control functions of MCU chips.

(Image credit: BYD Semiconductor)

BYD (OTCMKTS: BYDDY, HKG: 1211) is the best local car company in terms of vertical integration, producing chips in addition to batteries. Now, the company's semiconductor division has released its latest chips for vehicles.

BYD Semiconductor launched its new BS9000AMXX series of 8-bit MCU chips for vehicles in March, another important breakthrough for the company in the market, it announced today.

If IGBT (insulated-gate bipolar transistor) solves the bottleneck of car electrification, then MCU (microcontroller unit) is the key to solving the car intelligence, BYD Semiconductor said.

BS9000AMXX series is an 8-bit general-purpose MCU, and the chip uses S8051 core with the main frequency of up to 24MHZ, according to BYD Semiconductor.

The chip supports BLDC motor control, up to 24 channels of 12-bit resolution ADC, and up to 26 I/O. It integrates a high-reliability capacitive detection keypad module, including TSSOP28 and QFN20 package forms.

Compared with similar products in the industry, the BS9000AMXX series has a faster computing rate and richer resources, significantly reducing the cost and complexity of automotive software, BYD Semiconductor said.

BYD Semiconductor has more than 10 years of experience in the field of automotive chips and strictly follows the TS16949 standard production control process. BS9000AMXX series MCU products have achieved the AEC-Q100 GRADE1 quality level, according to the company.

BYD Semiconductor was established in October 2004 and BYD directly holds 72.30 percent of the shares and is the controlling shareholder of the company. BYD founder Wang Chuanfu indirectly controls BYD Semiconductor through BYD.

The company entered the industrial MCU field in 2007 and ranked first in China in terms of market share of industrial-grade touch MCUs.

Semiconductor's business then extended across from industrial-grade MCUs to automotive MCUs, and launched the first generation of 8-bit automotive MCUs in 2018 and the first generation of 32-bit automotive MCUs in 2019, with batch loading in BYD's full range of models.

In May last year, BYD Semiconductor announced that its installed base of automotive MCUs exceeded 10 million units. If the industrial-grade MCU chips were counted, the cumulative shipment exceeds 2 billion units.

MCU can implement different control for different application scenarios and is the core of internal computing and processing of automotive electronic systems.

From wipers, windows, seats, security systems, in-car entertainment systems, to body control and engine control, almost all of them are inseparable from MCU chips, and every innovation in automotive electronics has to be realized through the computing and control functions of MCU.

BS9000AMXX series products can meet a variety of application scenarios in automotive electronics, including interior lights, ambient lights, door handles, air conditioning touch panels, various sensor applications, and BLDC motor control, according to BYD Semiconductor.

In an interview titled as "Can semiconductor manufacturing return to the US?" Morris Chang of TSMC thinks that "spending only tens of billions of dollars of money of subsidy" is not going to be enough. "There’s a lack of manufacturing talents to begin with."

This is the second time he speaks out his pessimistic view on such effort since last October.

The interview podcast:

Full transcript of the interview:

Guancha recount in Chinese:

This is the second time he speaks out his pessimistic view on such effort since last October.

Well, 23 million, it’s not exactly very small population. Even today, TSMC has only 50,000 employees in Taiwan. It has a few thousand in other countries. But in Taiwan, yeah, there’s only 50,000.

Now I started in the semiconductor industry in 1955. Now, in the ‘50s and ‘60s, and the very early part of the ‘70s, the U.S. was very strong in manufacturing talents. Now, in a speech that I made in Taiwan about a year ago, I said Taiwan had certain competitive strengths in semiconductor manufacturing, and those strengths mainly almost entirely were people related, talent related. Now, the U.S. in the ‘50s, ‘60s and the early part of ‘70s also had these strengths. But then, of course, talents usually migrated to higher profit occupations. And so, the manufacturing talents in the U.S. started to migrate to design aspects, design profession if they stay in the industry.

Of course, a lot of them went into the finance industry. And 1980 was actually the watermark, the dividing line, when banks started to be deregulated and so on in the ‘70s, then after 1980 a lot of young talents went into the finance industry. You could just tell from where the business school graduates went. They used to go to big industrial companies, the GEs, the IBMs, and so on. Some of them used to go there. But now the big companies couldn’t attract very many business school graduates. Business school graduates went to either consulting houses or to Wall Street.

Anyway, my point is that back in the ‘50s, ‘60s, and the early part of the ‘70s, the U.S. had these manufacturing talents too. But then starting in the ‘70s, the manufacturing talents migrated to higher paying professions—design, if they stay in the semiconductor industry and otherwise, or they migrate to other internet industry and the finance industry. And I really think that’s a good thing, it’s not a bad thing at all.

There’s a lack of manufacturing talents to begin with. I don’t really think it’s a bad thing for the United States, actually, but it’s a bad thing for trying to do semiconductor manufacturing in the U.S. We have actually had a manufacturing plant in Oregon for 25 years—and 25 years, that’s a long time. And we send all kinds of people, we change the managers, change the engineers, we use both America, local engineers, we also send engineers from Taiwan to Oregon to try to improve the performance. But improvement in its performance has happened.

However, the cost difference between Taiwan manufacturing and Oregon manufacturing has remained about the same. The same product, the Oregon cost, is about 50 percent more than the Taiwan cost. Well, of course for us, the Oregon product is still profitable, although not nearly as profitable as the Taiwan product. So still we have maintained it. We started it in 1997. Initially it was chaos, it was just a series of ugly surprises because when we first went in, we really expected the costs to be comparable to Taiwan. And that was extremely naive. But after a few years of trying to make it work, we had to settle down, we had to accept it. And since it was still profitable, of course, we still accepted it, but we didn’t expand it. That was Oregon. We still have about a thousand workers in that factory, and that factory, they cost us about 50 percent more than Taiwan costs.

Now, Arizona: that will be a bigger scale venture, a bigger scale manufacturing than the one in Oregon, much more advanced technology, et cetera. And of course, we did it at the urging of the U.S. government, and we felt that we should do it. Basically, I was already retired at that time the decision was made. So, the decision was made by the current chairman.

But anyway, we think that the recent effort of the U.S. to increase onshore manufacturing of semiconductors, right now you’re talking about spending only tens of billions of dollars of money of subsidy. Well, it’s not going to be enough. I think it will be a very expensive exercise in futility. The U.S. will increase onshore manufacturing of semiconductors somewhat. But all of that will be very high-cost increase, high unit cost. It will be noncompetitive in the world markets where you compete with factories like TSMC.

Right now, I think the U.S. has a very good position in semiconductor technology—design, the U.S. has got most of the design capability in the world, the best design capability in the world. Taiwan has only a little, TSMC has none. But there are a few companies in Taiwan that also do design, but they are not nearly as advanced as some of the US companies.

Now, of course, there are people who point out that maybe Taiwan is not safe. Now, that’s of course another topic. Now, I’m assuming that there will not be any war. Frankly, if there is a war in Taiwan Strait, then I think the United States will have more than chips to worry about. Now, if there’s no war, then I think the effort to increase onshore manufacturing of semiconductors is a wasteful and expensive exercise in futility, if there’s no war. If there is war then, my goodness, we all have a lot more than just chips to worry about.

The interview podcast:

Full transcript of the interview:

Guancha recount in Chinese:

Now, Arizona: that will be a bigger scale venture, a bigger scale manufacturing than the one in Oregon, much more advanced technology, et cetera. And of course, we did it at the urging of the U.S. government, and we felt that we should do it. Basically, I was already retired at that time the decision was made. So, the decision was made by the current chairman.

"Basically, I was already retired at that time the decision was made. So, the decision was made by the current chairman. "

That's quite a statement IMO, I sense he is not very happy with the decision. Maybe as CEO he thinks he would have withstand US pressure...

There is little TSMC can do if the US threatens their tool and materials supply. A stronger leader might have tried to get alternatives elsewhere. Like the Koreans tried to get alternative supplies to Japanese ones. But it would be an uphill battle.

As is the US pushed TSMC into not just the Arizona fab but also into cancelling its planned 16nm expansion in China.

As is the US pushed TSMC into not just the Arizona fab but also into cancelling its planned 16nm expansion in China.

That will be pretty catastrophic for Taiwan. I can see the US coming up with some bullshit legislation mandating that all electronics sold in the US contain chips only made in the US. Of course, the excuse will be national security, but the aim will be to prop up all these fabs currently under construction.Another interesting comment was at the end of the interview he said the good days (of being able to sell to everyone like Huawei equally) are gone.

TMSC's Taiwan based fabs unable to supply the US and Chinese firms (remember, so many tech companies are on the entity list and more will be added in the coming months) and will not be viable. Hsinchu has a bleak future.

- Status

- Not open for further replies.