thats would be pretty dumb consider the security risk. you never know whats inside the ios software, foreign intelligent can potentially access the microphone/camera remotely if they know the target. there is a reason why potus using a wipe down/baremetal iphone.No I don't think so. I think Apple is more important to CCP than YMTC. Just like Huawei CEO's families all use Apple products, Huawei CFO was carryign bunch of Apple products, CCP can't live without Apple products. CCP officials use Apple products. Even Xi Jinping's wife uses Apple phones.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

antiterror13

Brigadier

The S2000 will be a rough equivalent of RTX 3060 and Radeon RX 6700 XT and the S60 will be a little faster than Radeon RX 6500 XT

wowww, not bad at all ... well done China!

I thought chinese investors hold 51% of ARM China@KYli and yet Mr Masayoshi Son had majority share for the new Chinese venture, great play for him and he being Asian know how the world works. IF the world is being split into 2 by geopolitics then split yourself into two and continue doing business, he had the business clout and acumen to do so.

Also, what does this mean for ARM systems in China? Does it mean the IP is now unsanctionable? Could China shift focus to making ARM based desktops and laptops not dependent on windows and x86 like Mac m1?

@sndef888 bro the way I see it, with RISC-V on the horizon and Intel licensing its x86 to others to make itself relevant, the attractive of ARM will lessen especially IF it become more restrictive under America control.I thought chinese investors hold 51% of ARM China

Also, what does this mean for ARM systems in China? Does it mean the IP is now unsanctionable? Could China shift focus to making ARM based desktops and laptops not dependent on windows and x86 like Mac m1?

Chinese chipmaking giant Semiconductor Manufacturing International Corp (SMIC) on Wednesday reported a surge of 137.8 percent in net profits in 2021, buoyed by increased wafer shipments and higher average selling prices.

SMIC recorded net profits of $1.7 billion for the whole of 2021, according to its fiscal filing with the Hong Kong stock exchange.

The company raked in revenues of $5.44 billion last year, up 39.3 percent from the previous year. Its wafer revenues rose by 43.4 percent year-on-year to reach $4.98 billion.

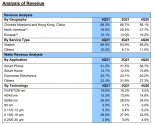

A breakdown of its revenues by application segments showed that smartphones made up 32.2 percent of SMIC's wafer revenues, while wafer revenues resulting from consumer electronics accounted for 23.5 percent and that from smart homes represented 12.8 percent.

In technology terms, SMIC generated 29.2 percent of its wafer revenues from semiconductors of 55-65 nanometers, while chips of 40-45 nanometers contributed 15 percent, and more mature process nodes of 28 nanometers accounted for 15.1 percent.

By comparison, SMIC's revenues from chips of 28 nanometers or smaller stood at 9.2 percent in 2020 and 4.3 percent in 2019, according to the company's 2020 fiscal disclosure.

In another sign of the wafer giant's rising technology profile, SMIC garnered 12,467 patents in the integrated circuit (IC) sphere at the end of last year, including 10,698 invention patents, according to its Wednesday filing. It also had 94 IC layout design rights.

SMIC also warned of the fallout of trade frictions on its businesses. "Economic globalization has encountered ups and downs, and multilateralism has been hit. In particular, the China-US economic and trade friction has adversely affected the production and operation of some enterprises and market expectations," per its Wednesday filing.

If trade tensions between China and the US and other economies continue to escalate, with resultant heightened import and export restrictions, and higher tariffs among other trade barriers, the company may face risks such as shortages or rising prices for production materials.

Additionally, "the US' enhanced export controls targeting Chinese top high-tech companies may restrict the wafer foundry and supporting services provided by the company to certain customers, and the company may face limited production capacity and reduced orders," according to SMIC.

Its shares in Hong Kong closed up 1.76 percent on Wednesday while those on the STAR Market in Shanghai edged up 0.95 percent.

The Shanghai-based chip giant said on Monday that its production and operations remain normal and the company would keep a close eye on the virus situation and vows all-out virus containment.

@Strangelove hahaha, bro remember in 2020 when we see post here saying the end of SMIC. I'm not brave enough to challenge them to a bet being a novice and all BUT what a satisfying Feeling...lol from Black Eyed Peas

Chinese chipmaking giant Semiconductor Manufacturing International Corp (SMIC) on Wednesday reported a surge of 137.8 percent in net profits in 2021, buoyed by increased wafer shipments and higher average selling prices.

SMIC recorded net profits of $1.7 billion for the whole of 2021, according to its fiscal filing with the Hong Kong stock exchange.

The company raked in revenues of $5.44 billion last year, up 39.3 percent from the previous year. Its wafer revenues rose by 43.4 percent year-on-year to reach $4.98 billion.

A breakdown of its revenues by application segments showed that smartphones made up 32.2 percent of SMIC's wafer revenues, while wafer revenues resulting from consumer electronics accounted for 23.5 percent and that from smart homes represented 12.8 percent.

In technology terms, SMIC generated 29.2 percent of its wafer revenues from semiconductors of 55-65 nanometers, while chips of 40-45 nanometers contributed 15 percent, and more mature process nodes of 28 nanometers accounted for 15.1 percent.

By comparison, SMIC's revenues from chips of 28 nanometers or smaller stood at 9.2 percent in 2020 and 4.3 percent in 2019, according to the company's 2020 fiscal disclosure.

In another sign of the wafer giant's rising technology profile, SMIC garnered 12,467 patents in the integrated circuit (IC) sphere at the end of last year, including 10,698 invention patents, according to its Wednesday filing. It also had 94 IC layout design rights.

SMIC also warned of the fallout of trade frictions on its businesses. "Economic globalization has encountered ups and downs, and multilateralism has been hit. In particular, the China-US economic and trade friction has adversely affected the production and operation of some enterprises and market expectations," per its Wednesday filing.

If trade tensions between China and the US and other economies continue to escalate, with resultant heightened import and export restrictions, and higher tariffs among other trade barriers, the company may face risks such as shortages or rising prices for production materials.

Additionally, "the US' enhanced export controls targeting Chinese top high-tech companies may restrict the wafer foundry and supporting services provided by the company to certain customers, and the company may face limited production capacity and reduced orders," according to SMIC.

Its shares in Hong Kong closed up 1.76 percent on Wednesday while those on the STAR Market in Shanghai edged up 0.95 percent.

The Shanghai-based chip giant said on Monday that its production and operations remain normal and the company would keep a close eye on the virus situation and vows all-out virus containment.

597M views12 years ago

REMASTERED IN HD! Music video by Black Eyed Peas performing I Gotta Feeling. (C) 2009 Interscope #TheBlackEyedPeas ...

CC

Is it really zhaoxin though? The poster says it's a domestic manufactured (smic?) 12nm with 12-16 cores and single core speed 3.2-3.5ghz, but zhaoxin doesn't seem to have such a model. He also said they tried production (not sure whether he's referring to kx7000 or this "new" model) with both domestic 14nm and tsmc 7nm, with target of 4ghz.

Either it's fake or he has very very new insider info

Looking through the forum it seems latest rumours are that kx7000 with 8 cores/4ghz will only come out in 2023 sadly

Last edited:

- Status

- Not open for further replies.