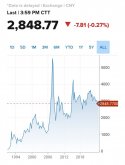

Why are stocks a no?investment products are needed. property is no more, stocks nopee, bonds very low yield. so where do you invest?? bonds?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economics Thread

- Thread starter Norfolk

- Start date

Stocks of the big 4 state banks pay out ~7% dividend at current market prices and are arguably closest to TBTF.investment products are needed. property is no more, stocks nopee, bonds very low yield. so where do you invest?? bonds?

By comparison, rental yield on real estate in China is ~ 1.5-2%.

Chinese treasury bonds are also ~2%.

Gold produces bad returns over time. The point is to generate a return on investment, not to simply protect it.If you are going to hold that money for a long time just buy gold. At least it does not lose value long term like paper money.

I'd be interested to hear @abenomics12345 take on the matter. How should the government stimulate investment into productive assets?

supercat

Colonel

China's power consumption in the first 7 months of 2024 grew 7.7% year-over-year.

China's power consumption in the first 7 months of 2024 grew 7.7% year-over-year.

That is on top of 7% growth in 2023. We have idiots telling us China's economy is collapsing.

The same people are also telling us that the US economy is doing better than China's when American consumption of electricity contracted 1% in 2023.

proelite

Junior Member

Just something that I realized, can low wage growth, high youth unemployment, and consumer pessimism in China be fully attributed to the yuan carry trade? I read on Reuters that Chinese companies are parking more than 500 billion USD overseas to earn 5% YOY over the riskier returns on investment in China. If you think about it, the average business growth is below 5%.

Last edited:

Wage and consumer market growths are beating growth. Youth employment on par with America (neither good nor bad, the more important reason is why they are employed, because they're forced to in order to pay rent or because they're enrolled in education?)Just something that I realized, can low wage growth, high youth unemployment, and consumer pessimism in China be fully attributed to the yuan carry trade? I read on Reuters that Chinese companies are parking more than 500 billion USD overseas to earn 5% YOY over the riskier returns on investment in China. If you think about it, the average business growth is blow 5%.

So described in objective terms, the economy remains booming, with particular strengths being the internal market and wage growth. Real Estate performed the worst, due to controlled demolition of financial bubbles. Total growth also slowed somewhat, expected due to weakening economies outside China. Strengths can be attributed to the complete ecosystem inside China, ability to implement new developments with scale and precision that is unmatched in other economies. Another factor is that the more educated 90s-00s generation is starting to hit the job market.

Wage and consumer market growths are beating growth. Youth employment on par with America (neither good nor bad, the more important reason is why they are employed, because they're forced to in order to pay rent or because they're enrolled in education?)

So described in objective terms, the economy remains booming, with particular strengths being the internal market and wage growth. Real Estate performed the worst, due to controlled demolition of financial bubbles. Total growth also slowed somewhat, expected due to weakening economies outside China. Strengths can be attributed to the complete ecosystem inside China, ability to implement new developments with scale and precision that is unmatched in other economies. Another factor is that the more educated 90s-00s generation is starting to hit the job market.

A country whose electricity consumption is growing at 7% a year off a base that is already twice as large as the next country is certainly growing pretty fast. It is very hard to grow a large base which is evident in the US but China is growing 7% a year when its consumption is already 200% that of the US. There is no way this much extra energy is not translating into a lot of growth. Unless China suddenly became 7% more inefficient using electricity the last two years then that extra usage came from more economic activity.

I am not looking pass the pain from the deliberately engineered deflating of the property bubble. But compared to the sub-prime crisis that hit the US in 2008 when electricity demand collapsed 4.2% **, China's dealing with this bubble had been immaculate. It is hard not to bet the future on the people who had engineered this soft landing for an epochal bubble burst.

The worst in the property collapse is pretty much behind them now too.

And winds in the new industrial drivers that old real estate money is now funding is only starting to pick up. That means an avalanche of cars, aircraft, chips, drones and much more coming.

**

Demand for electricity dropped by 4.2% in 2009. This was the greatest decline in a single year in at least 60 years and, with 2008, the only time electricity demand has fallen in consecutive years since 1949.

Last edited: