A

azn_cyniq

Guest

He just finished his lunch in India and he's ready to have some fun!New sleepy?

He just finished his lunch in India and he's ready to have some fun!New sleepy?

What an asinine comparison. Primary products and manufactured goods are things that can be produced. Allowing prices to vary makes sense because it allows for the economic system to accommodate the inherently variability of their supply. You cannot produce more space-time. It's already there; that's it. These two things are not comparable on even the most basic material level, let alone economically or politically.“They are not doing a big bang on prices in 1980s so therefore they will never remove price controls”

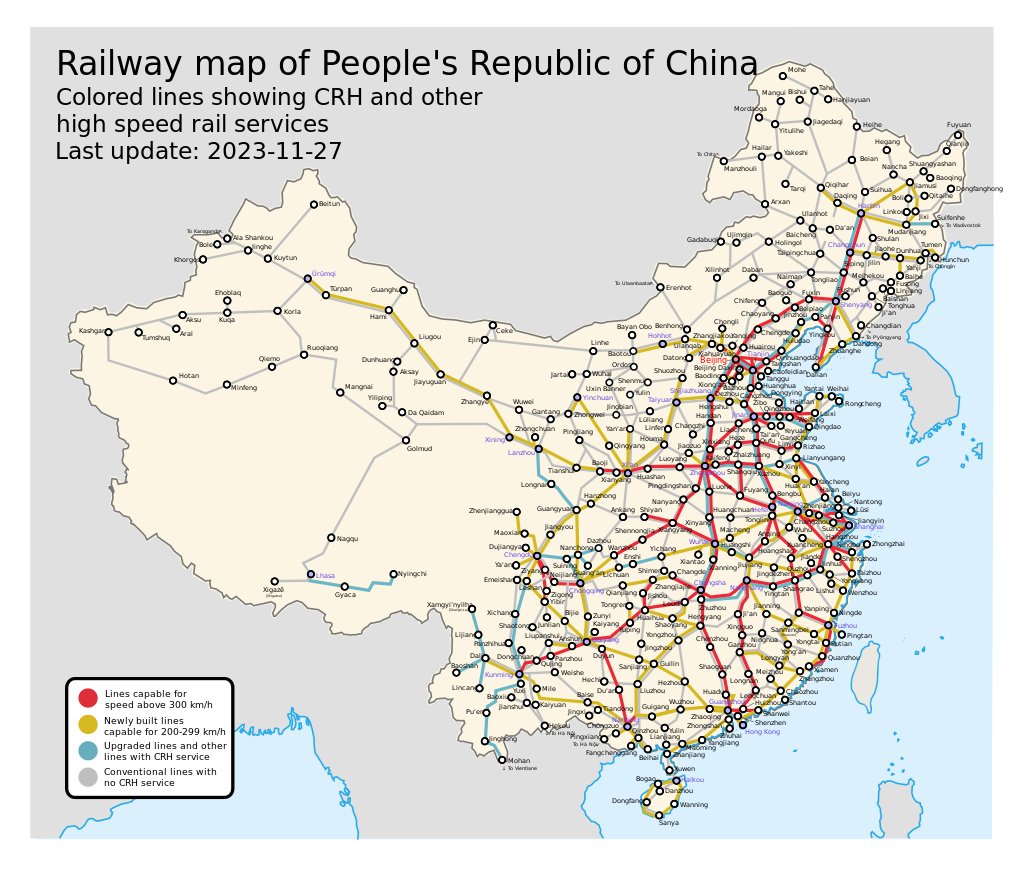

And what are banks doing with their saving accounts? They have two options - investing in the same intangible stock market or make shadow lending to CCP related oligarchsOK, you two told US where the US 'sheeple' invest in? In the intangible stock market that makes the rich even richer and doesn't create any real value for the society. But, where do people in Chinese people invest in? In bank savings that eventually get them built stuff like this below.

Thought so, but it's getting boring, all the same mantra here about the growing economy as the world is laughing at China as company valuations are making lower extremes 4th year in a row and Chinese entrepreneurs are begging USA to spare them from blacklisting. It's a sad story for China because if you are weak and clueless your enemy feels it and becomes bolder.He just finished his lunch in India and he's ready to have some fun!

And what are banks doing with their saving accounts? They have two options - investing in the same intangible stock market or make shadow lending to CCP related oligarchs

HIGH-QUALITY DEVELOPMENT

The heads of the four big lenders all attached great importance to the role of financial institutions in promoting the country's high-quality development.

By the end of September, ABC's outstanding loans to strategic emerging industries had exceeded 1.9 trillion yuan, a jump of more than 54 percent from the beginning of this year.

Meanwhile, as of the end of October, BOC's outstanding sci-tech loans had surged 34.08 percent from the beginning of 2023.

In the next step, CCB will actively support high-end, intelligent and green development of the manufacturing industry, and private businesses. It will customize supply-chain financial service solutions for micro, small and medium-sized enterprises, Tian said.