I cant see how that contradict my point. Most are still internal circulation. No need to measure economy to another currency 100%. I was agreeing with you.This is categorically and objectively false you imbecile.

Sinopec and PetroChina imports petroleum in USD from Non-Russian sources (and in USD from all sources before the war) - when the price of oil goes up in USD terms, Sinopec and Petrochina have to raise prices or lose money. Your argument here would be akin to claiming that gasoline/polyethylene/polypropylene prices in China do not fluctuate when global oil prices move.

When COFCO imports soybeans from the US it pays for it in USD, your argument here would be as stupid as to claiming that soybean and therefore beef prices in China do not fluctuate when global soybean prices move.

When ENN Energy imports LNG using a J-curve based off of Brent, or straight up with a processing fee added onto Henry Hub, your argument would be as dumb as to claiming that natural gas prices in China do not fluctuate when natural gas prices globally fluctuate.

When Baowu steel imports coking coal or iron ore from Australia they do so in USD, your argument would be as dumb as to claim that when iron ore or coking coal prices fluctuate in USD that steel prices in China do not move.

I specifically made a point here to address the idiocy of your original statement - you are the one who started comparing entire economies.

Because everyone is just *dying* to move to Hegang.

...and unless we are in a world where RMB is a globally accepted currency, USD/RMB conversion rates matter especially considering how big of a component international trade matters. You want to sell EVs to Europe? You sell in Euros in *2024*. You want to sell Sany excavators to SE Asia? You sell in USD in *2024*.

The claim that "inflation in other currencies do not impact inflation in China" is so farfetched from reality that you need to check into an mental hospital.

To invert this claim, do you also claim that when cheaper Chinese EVs hit Europe it doesn't cause deflationary forces in Europe? Because that's the level of stupidity embedded in @Biscuits' assumption.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economics Thread

- Thread starter Norfolk

- Start date

Likewise, I agree with your point as well.I cant see how that contradict my point. Most are still internal circulation. No need to measure economy to another currency 100%. I was agreeing with you.

If he bothered to read my posts, I never compared the entirety of the Chinese economy with that of the US economy. I am merely pointing out the ludicrous nature of the claim that "inflation in other currencies do not impact China".

Perhaps take a look at the actual data before making snide comments?Because everyone is just *dying* to move to Hegang.

Attachments

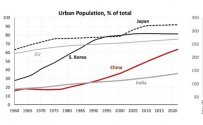

Perhaps take a look at the actual data before making snide comments?

Why don't you take a look at what's happening there and then comment:

That was the whole discussion with the other guy from before, you and him claiming forex can be transferred 1:1 to compare economy sizes. So you now deny ever having such a retarded opinion? Good.Likewise, I agree with your point as well.

If he bothered to read my posts, I never compared the entirety of the Chinese economy with that of the US economy.

Again with the strawmanning. I said that the nominal gdp of China cannot be compared directly with the nominal GDP of countries/places that use other currencies. Nominal gdp is indeed ludicrous because it disregards inflation.I am merely pointing out the ludicrous nature of the claim that "inflation in other currencies do not impact China".

Ever considered not ignoring macro statistical trends in favor of cherry picking? It might not make you smarter, but it can make you sound less retarded.Why don't you take a look at what's happening there and then comment:

Who do you get your analysis from anyways? Serpentza? Aping an ape does not exactly render you into a flattering image.

I was talking about the inflation of other currencies not affecting China's nominal, RMB denominated GDP, nitwit. Stop twisting words.

I said that the nominal gdp of China cannot be compared directly with the nominal GDP of countries/places

What the fuck are you actually saying? "inflation in other currencies not affecting China's nominal RMB GDP"? Or that China's GDP cannot be compared directly with GDP of other countries?

Make up your fucking mind. Do you even understand the definition of the words you are using?

Ever considered not ignoring macro statistical trends in favor of cherry picking? It might not make you smarter, but it can make you sound less retarded.

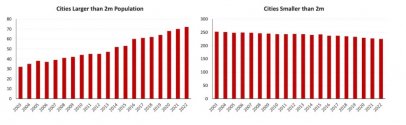

Here's Overbom's post from Oct 2022:

Is not back to the table. We just need to slow down real estate collapse. Too fast and it could create systemic risks for the Chinese economy. For example -45% YTD decline is absolutely dangerous. Even -25% is stretching things. IMO the "safe" level is annual -10/15% decrease of sales.

-45% and next thing you know you could have a collapse of local government property taxes. So better to try slow down the decline

And here's the data for 2023:

Keep in mind in Dec 2022 everyone was sick AF in their homes so the YoY comp is a joke.

But sure, I am 'cherrypicking'.

Do you have a memory of a goldfish?

Last edited:

Nominal gdp is indeed ludicrous because it disregards inflation.

Nominal GDP is by definition the calculation of GDP that *includes* the impact of inflation. Go back to high school and learn the fucking difference between Nominal and Real GDP.

Also, FYI. Import/Export in China represents over 40 trln RMB and majority of this is priced in USD. So tell me again how inflation in USD doesn't impact China's nominal GDP? (as a free remedial lesson in Macroeconomics 101, GDP = C + I + G + NX)

/

Last edited:

Price levels are representative of productivity in an economy, even in sectors that don’t experience substantial productivity growth as firms compete for workers - . Adjusting for price levels in GDP comparisons is silly; it’s adjusting by which the mechanism for economic development plays out.

Retail sales numbers are not inflation adjusted. China's retail sales growth of 7.2% with 0.2% inflation is about the same growth in real terms as a country with 10% nominal retail sales growth and 3% inflation.Let me remind you again how how I was attacked for being "overly conservative" when I forecasted 8% retail sales in 2023 a year ago - 7.2 is below 8.

I wasn't part of that discussion a year ago, but it would be silly to talk about retail sales growth without taking the inflation context into consideration. Nobody in Argentina is celebrating their 100+% retail sales growth in 2023 when they had 200+% inflation.

Last edited: