7 is too much. 6.5% is what I estimated a few months ago, and probably the upper limit for 2023. 6% is probably most realistic given the current state of world growthChina will likely grow 6.5-7% this year. Massive year of growth for China.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economics Thread

- Thread starter Norfolk

- Start date

China is successfully diversifying away from western markets to emerging markets in ASEAN, Africa and Latin America. It is in China's interest for countries in these regions to grow prosperous so they can buy more and more Chinese goods.

The Brazilian Government has just announced that it has finalized 15 bilateral trade agreements with China, valuing R$50 billion (69 billion RMB) including a satellite manufacturing partnership..

in another deal between China and Brazil

Alibaba's CiaNiao has signed deal with Brazilian postal service for cooperation to more quickly send products into Brazil and probbly Latin America I think

This to me is a case of Chinese e-commerce battling American ones.

Will involved 8 flights a week between China and Brazil

automated distribution centers in Brazil, Chile & Mexico

express delivery network spanning over 1,000 Brazilian cities

Alibaba's CiaNiao has signed deal with Brazilian postal service for cooperation to more quickly send products into Brazil and probbly Latin America I think

This to me is a case of Chinese e-commerce battling American ones.

Will involved 8 flights a week between China and Brazil

automated distribution centers in Brazil, Chile & Mexico

express delivery network spanning over 1,000 Brazilian cities

I google and see that QR cargo is operating 1 weekly hkg to Brazil in 2022. also Ethiopian airlines also operate cargo from.xiamen to Brazil. Any other airlines involved?in another deal between China and Brazil

Alibaba's CiaNiao has signed deal with Brazilian postal service for cooperation to more quickly send products into Brazil and probbly Latin America I think

This to me is a case of Chinese e-commerce battling American ones.

Will involved 8 flights a week between China and Brazil

automated distribution centers in Brazil, Chile & Mexico

express delivery network spanning over 1,000 Brazilian cities

Really insightful article,

Moving factories from China to Mexico is one of the few hot topics in an otherwise listless market, US investment bankers say.

As American hostility to China rises, US corporations scramble to assure the public as well as inquisitive congressional committees that they are moving operations out of the Middle Kingdom to friendlier venues.

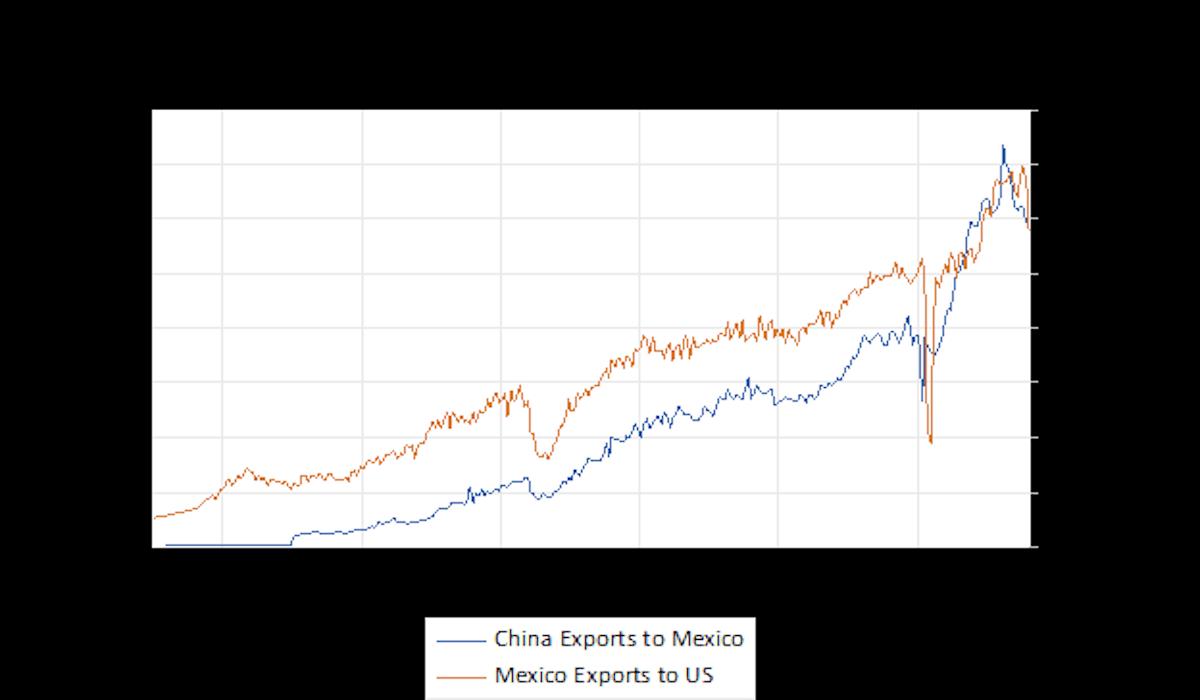

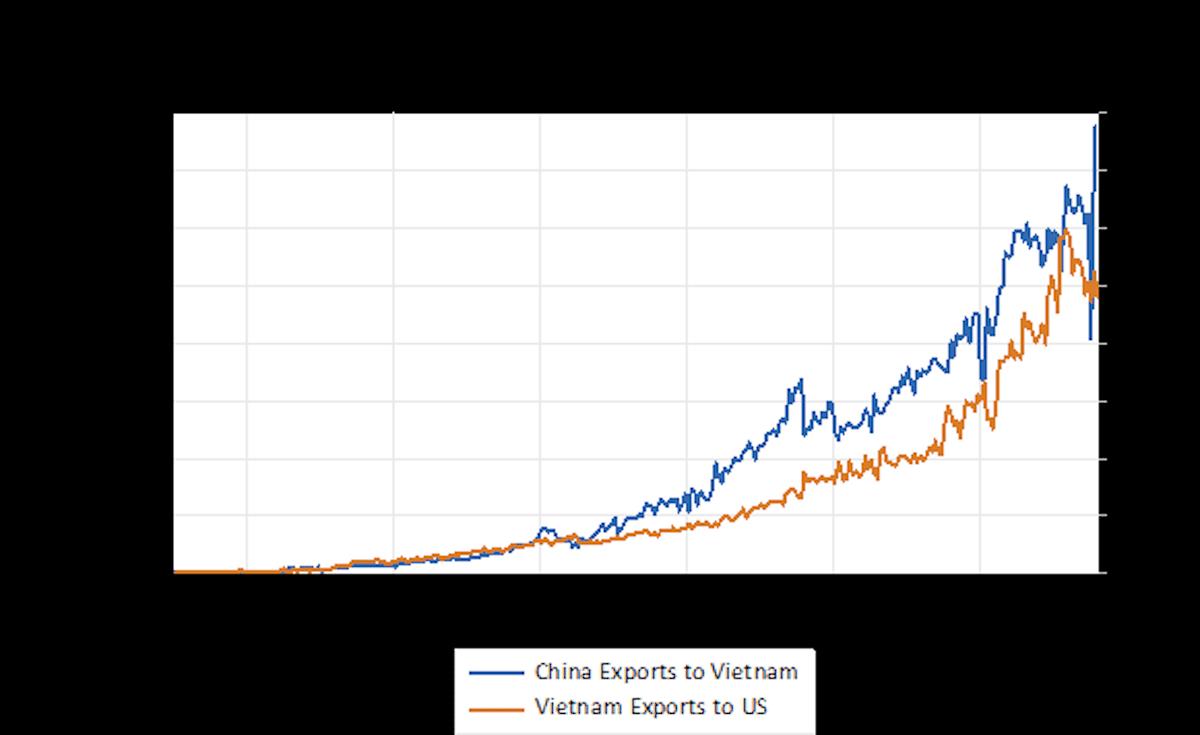

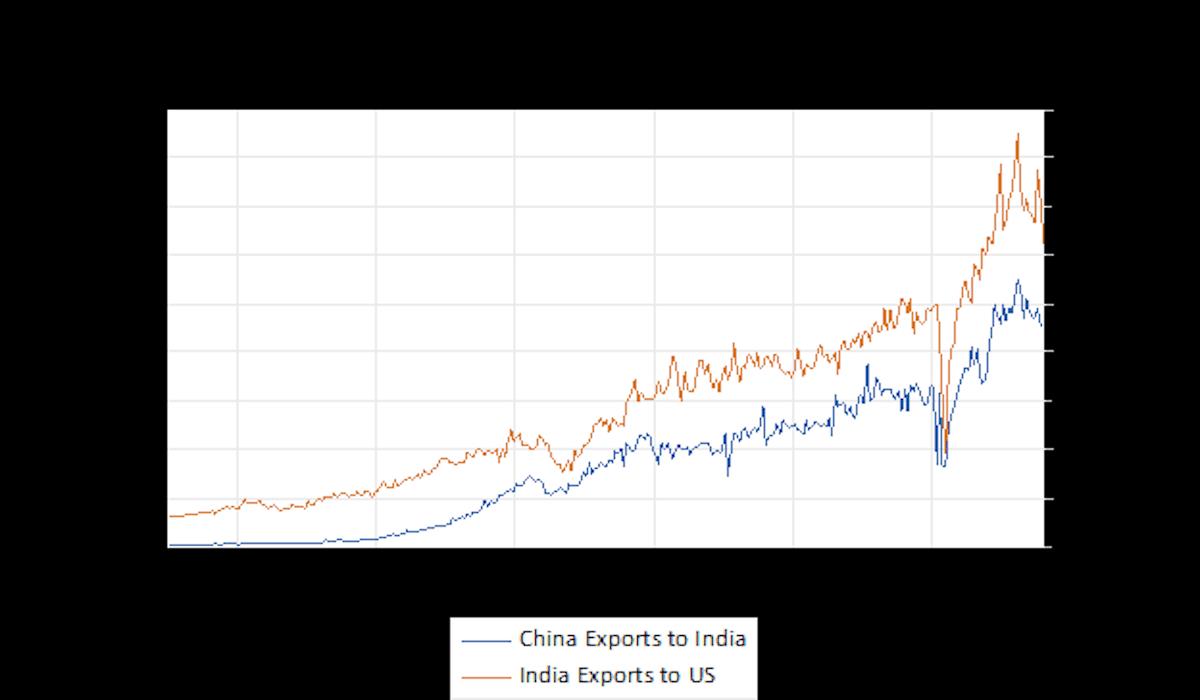

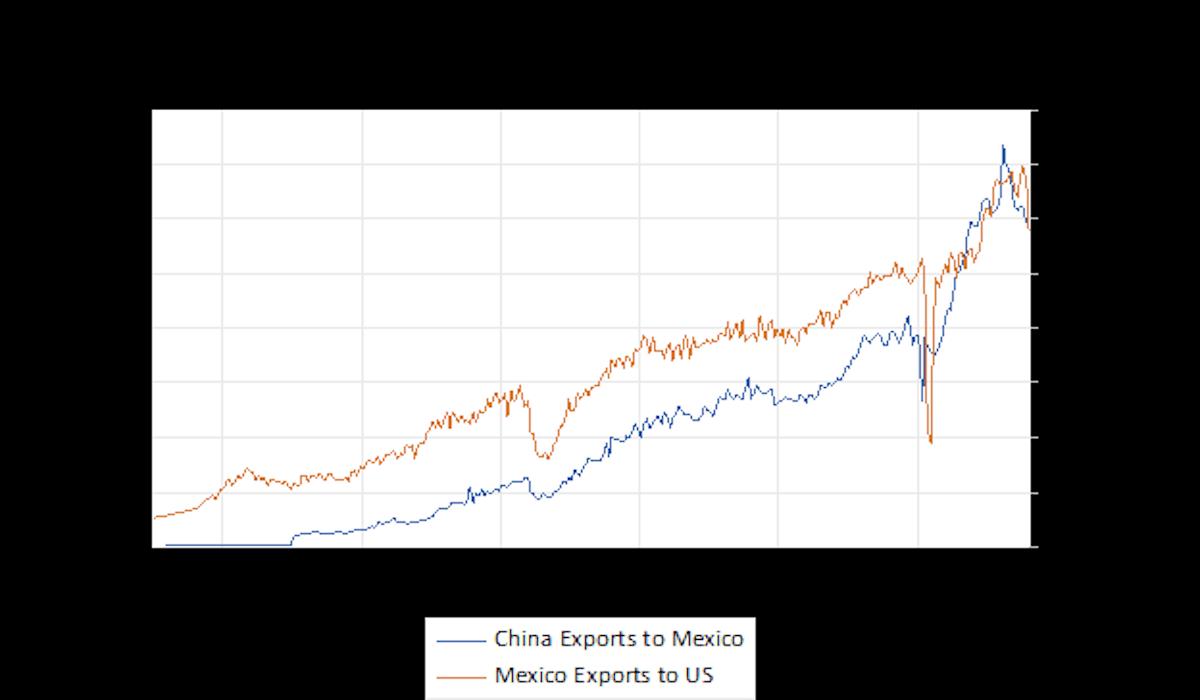

It's all a pantomime for political consumption. US imports from Mexico, Vietnam, India and other“friend-shoring” venues depend on imports of Chinese components, according to an Asia Times study of international trade data. China's exports to non-Japan Asia and Latin America are booming, and Chinese companies are investing billions of dollars in Mexico.

The charade permits American politicians to flaunt success in decoupling from China, and gives corporate leaders a chance to display their patriotism – while America's indirect dependence on China's industrial power increases.

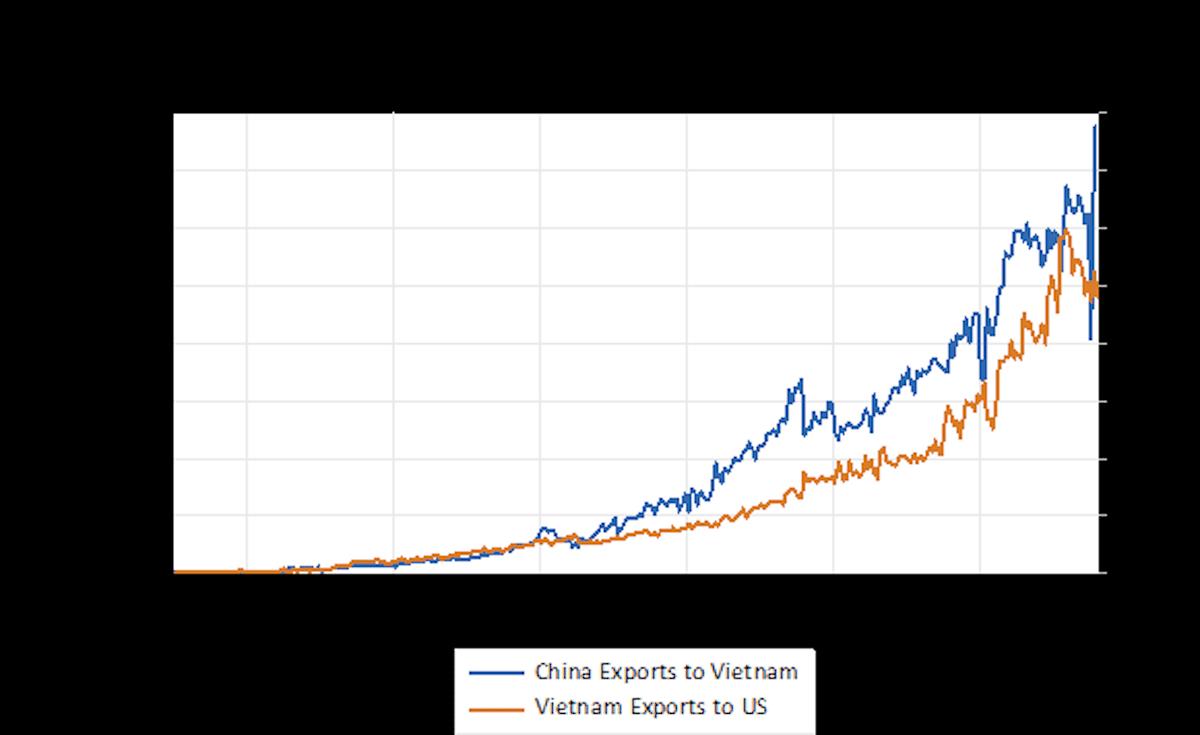

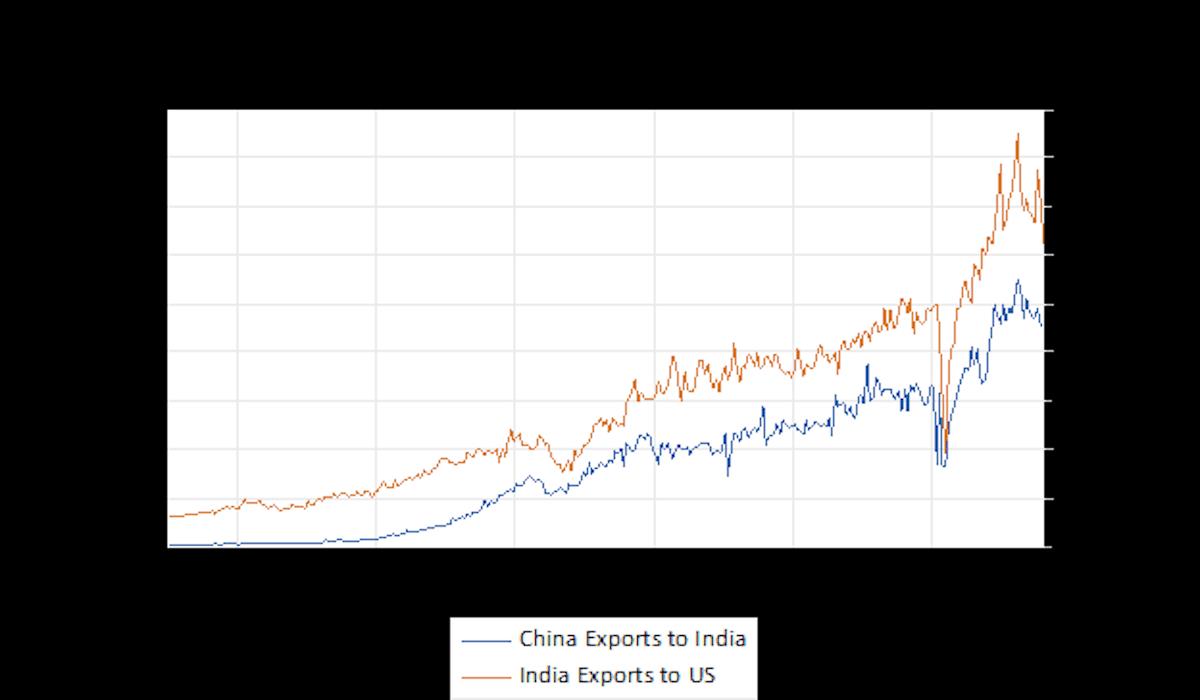

“Friend-shoring” venues including India, Vietnam and Mexico show a lockstep relationship between imports from China and exports to the United States. Econometric analysis confirms that this relationship isn't simply the result of a rising trend in both measures.

After correcting for the trend and for serial correlation, regression analysis shows a strong predictive relationship between these countries' imports from China and their exports to the United States.

China's share of international trade is rising steadily. Its export volume (as calculated by the netherlands central planning bureau ) rose 25% since 2018 while the industrial nations' export volume stagnated.

Visual impressions, to be sure, can be misleading. It's possible that Chinese exports to Mexico, India and Vietnam rose at the same time that those countries' exports to the United States were rising, simply because trade, in general, was rising. Was it simply a coincidence?

Econometric analysis shows that it's extremely unlikely that the link between Chinese exports to“friend-shoring” countries and their exports to the US was coincidental.

The regression below conducted with the Eviews econometrics platform includes a trend variable (expressed as a second-degree polynomial) to control for the overall growth of trade. It also includes the autoregressive variable AR(1) and the moving average error variable MA(1).

These variables control for serial correlation, namely the tendency of a trending series to keep moving in the same direction. Think of two balls bouncing down a hill. Their descent is independent (both are controlled by the force of gravity), even though they appear correlated. The autoregressive and moving average variables correct for this effect.

Even after including a trend variable and correcting for serial correlation, the t-statistic (the coefficient divided by the standard error) for China's exports to Mexico lagged two months is about 13. Econometrics typically considers a t-statistic of 2 to be highly significant.

Econometric results don't constitute proof, but they do indicate that it is extremely improbable that China's exports to Mexico are not linked to Mexico's imports from China.

Indonesia is really taking advantage of its nickle resources. Good to see a gov't doing that

CATL is expanding a nice big battery factory there

Either way, good to see indonesia grow with Chinese investment

CATL is expanding a nice big battery factory there

Also going to talk to byd in May for a plant thereSeto said officials will hold talks with Chinese EV company BYD Group in May on potential investment.

Either way, good to see indonesia grow with Chinese investment

Not sure, I think the plan is to ramp it up. I need to look into Brazilian market a little more. There is a major competition between Didi owned 99 and Uber right now in the ride hailing market alsoI google and see that QR cargo is operating 1 weekly hkg to Brazil in 2022. also Ethiopian airlines also operate cargo from.xiamen to Brazil. Any other airlines involved?

just as I expected. From David Goldman. He has been on this more than anyone else. But to be fair, I think a large part of the surplus is just Chinese products taking over from Western/Japanese/Korean products in Global south. After all, if all Chinese goods are going through ASEAN countries to get to US, why are these other countries seeing collapsing exports?

other people are getting it too. The entire friendshoring is nonsensical. Does anyone really think that if a war breaks out, China isn't going to block shipments from surrounding Asian countries if the west really pisses China off? Southeast Asia have now oriented their economy around China and Chinese supply chain. China's trade with global south continue to increase. Now, the Europeans don't realize that they are receding into complete irrelevance by acting as NATO mouth piece.

so this is the level of current Chinese solar market dominance. Keep in mind that some of that other capacity for cell and modules are simply chinese companies setting up in other countries. So in terms of tech, China has this entire supply chain covered.

I've often talked about to not focus too much on semiconductor and this is part of the reason. China has a good chance of completely controlling wind power and hydrogen supply chain in the next 10 years. Same with shipbuilding, EVs, batteries and others.

I've often talked about to not focus too much on semiconductor and this is part of the reason. China has a good chance of completely controlling wind power and hydrogen supply chain in the next 10 years. Same with shipbuilding, EVs, batteries and others.