You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor thread II

- Thread starter vincent

- Start date

US approves annual permits for TSMC to import semiconductor equipment into China plant

China's AI chip self-sufficiency rate stands at 104% in 2028

Demand for AI chips in China is expected to more than double (138 percent) in three years from 37 billion U.S. dollars this year to 88 billion dollars in 2028. In the process, Chinese companies will likely increase their share.

Bernstein expects a shortage of AI semiconductors in China from 2026 to 2027, but expects the supply and demand balance to be balanced starting in 2028. The share of Chinese companies is expected to surge from 58% ($16 billion) last year to 93% ($82 billion) in 2028.

Chinese companies are expected to expand their supply capacity to $16 billion in 2025, $19 billion in 2026, $39 billion in 2027, and $91 billion in 2028. As a result, it is estimated that the self-sufficiency rate will reach 104 percent in 2028.

Demand for AI chips in China is expected to more than double (138 percent) in three years from 37 billion U.S. dollars this year to 88 billion dollars in 2028. In the process, Chinese companies will likely increase their share.

Bernstein expects a shortage of AI semiconductors in China from 2026 to 2027, but expects the supply and demand balance to be balanced starting in 2028. The share of Chinese companies is expected to surge from 58% ($16 billion) last year to 93% ($82 billion) in 2028.

Chinese companies are expected to expand their supply capacity to $16 billion in 2025, $19 billion in 2026, $39 billion in 2027, and $91 billion in 2028. As a result, it is estimated that the self-sufficiency rate will reach 104 percent in 2028.

Nexperia, Wingtech set for fresh face-off in January with US$8 billion at stake

The two sides will face off before the Dutch Enterprise Chamber on January 14, a court representative told the Post on Tuesday, speaking on condition of anonymity.

The hearing aims to determine whether there were valid reasons to doubt the sound management of Nexperia before the chamber’s ruling in early October, according to a Nexperia spokesman who also declined to be named.

Wingtech, however, is escalating its counterattack. The company is preparing a “multi-track legal strategy” that – aside from the chamber hearing – includes filing objections against the administrative order of the Dutch Ministry of Economic Affairs and lodging an appeal before the Dutch Supreme Court, Wingtech said in a statement to the Post on Tuesday.

Crucially, the strategy involves preparations for bilateral investment treaty (BIT) international arbitrations. Wingtech intends to seek compensation equivalent to the full value of Nexperia – around US$8 billion – if the issue is not settled by April 15, the statement said, with the company urging Beijing to continue supporting its fight to regain control of Nexperia Netherlands.

Wingtech further said that, even if its control over Nexperia Netherlands were restored, it would still seek compensation for “significant losses caused by the Dutch government’s improper conduct”. This includes supply-chain disruptions, damage to customer relationships, impact on employee morale, and reputational harm, which the firm considers “profound and long-lasting”, according to the statement.

great video. i guess the things they showed and explained are already known by their competitors.

Veritasium did a video on EUV lithography. Very detailed explanation and actual walkaround of an EUV machine in ASML. Great stuff! It goes through all the practical and physics challenges to make EUV commercially viable.

After watching this, if China has been able to make EUV this year and is able to produce chips with it in a couple of years. It will be gargantuan achievement.

It hard to believe how all these physics challenges and scientific papers which eventually became a product then became the focal point of global geopolitics and new the cold war.

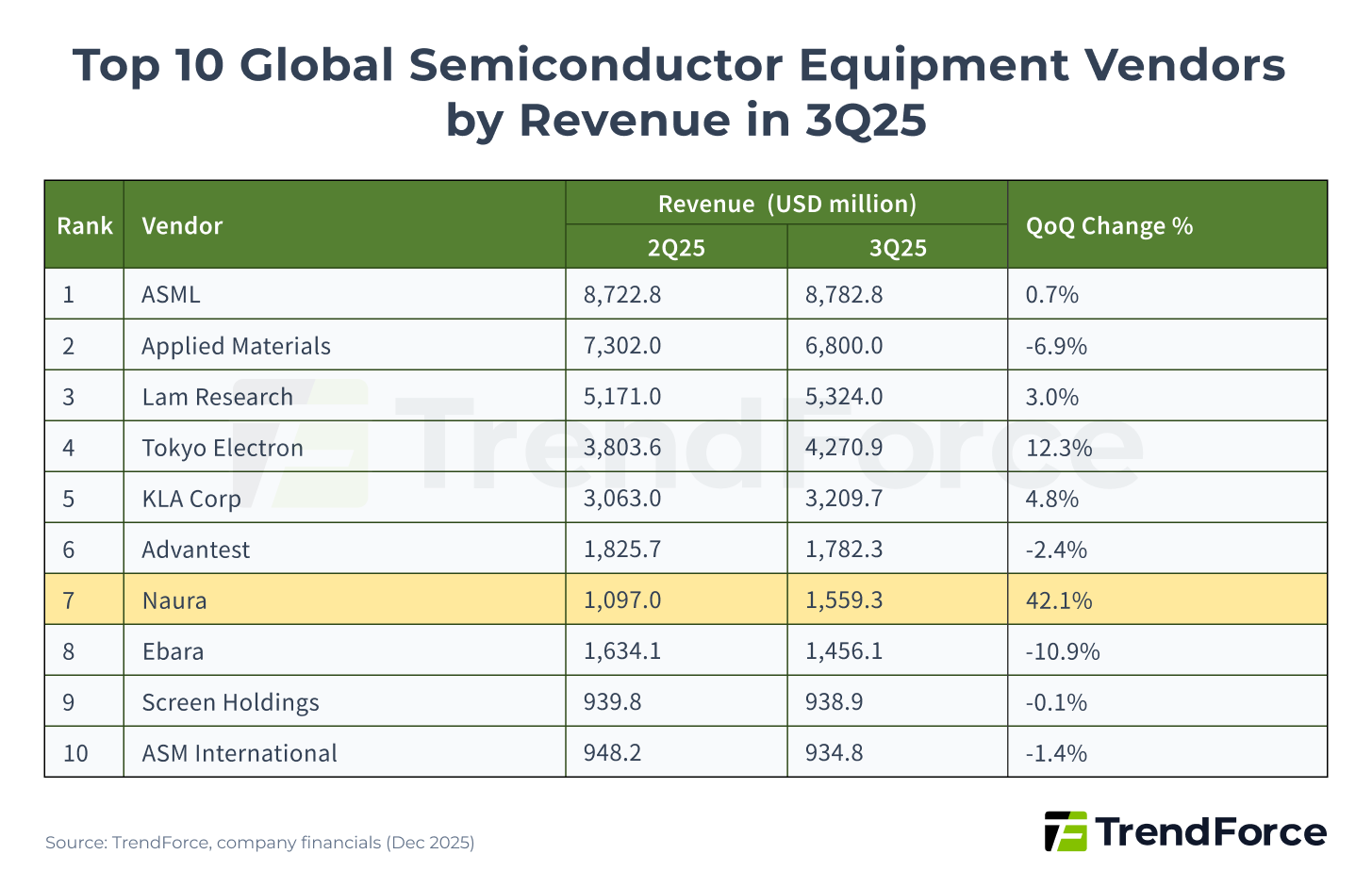

this is the full article if anyone wants to read it.How credible are these self-sufficiency rates Trendforce recently came out with?

NAURA, AMEC, SiCarrier, Piotech, ACMR

View attachment 167278

IME CAS Achieved Major Progress in High-Density 3D DRAM Research

A research team from the National Key Laboratory of Integrated Circuit Manufacturing Technology at the Institute of Microelectronics of Chinese Academy of Sciences (IME CAS), in collaboration with the Beijing Superstring Academy of Memory Technology(SAMT) and Shandong University, has proposed a novel dual-gate 4F² 2T0C memory cell architecture.

By adopting an in-situ metal self-oxidation process, the technology enables self-aligned integration of the read and write transistors within a 4F² memory cell. Combined with multi-level storage techniques, it can further increase storage density.

Nanjing University of Science and Technology Reported New Results in Power Semiconductor

Recently, a joint research team from the School of Microelectronics (School of Integrated Circuits) at Nanjing University of Science and Technology proposed a new switching-loss prediction method based on multilayer backpropagation artificial neural networks (ANNs).

The approach leverages regression relationships between static parameters of SiC MOSFETs—such as threshold voltage, leakage current and on-resistance—and switching losses. Without the need for complex physical modeling or parameter extraction, switching losses can be rapidly and accurately predicted using only measured data or static parameters from datasheets.

HKU, Wuhan University and CAS Jointly Made Major Progress in 4H/3C-SiC Composite Substrates and Devices

Recently, a team led by researcher Liu Xinyu from the High-Frequency and High-Voltage Center of IME CAS, in collaboration with the University of Hong Kong, Isabers Group, Wuhan University and the Institute of Physics CAS, successfully developed large-area 4H/3C-SiC single-crystal composite substrates, breaking the specific on-resistance limit of low-voltage (<600 V) 4H-SiC devices.

SUSTC Research Team Achieved Key Results in High-Speed IC Design

Recently, the team led by Pan Quan at the School of Engineering and National Demonstration Microelectronics College, Southern University of Science and Technology (SUSTC), achieved further breakthroughs in high-speed communication and optoelectronic IC design.

1. A 56 Gbaud, 7.3-Vppd Linear Modulator Transmitter Based on AMUX Inherent Feed-Forward Equalization and a Breakdown-Voltage Tripler

The work proposes a half-rate linear transmitter monolithically integrating a 2:1 analog multiplexer (AMUX) and a linear driver for optical modulators. By exploiting the timing relationship between the clock and half-rate data streams, the AMUX inherently implements a feed-forward equalizer (FFE), which can be reconfigured into two-tap or three-tap modes by adjusting clock delay.

To further enhance output voltage swing and linearity, the authors propose a novel “breakdown-voltage (BV) tripler” topology for the linear driver. By stacking three heterojunction bipolar transistors (HBTs) and using the amplified input signal to bias the bases of the top two HBTs, the driver achieves three times the output swing of conventional cascode topologies while maintaining good reliability.

Fabricated in a 130-nm SiGe BiCMOS process, the proposed linear driver achieves 17.1 dB DC gain, a 39.1 GHz 6-dB bandwidth, and 1.6% total harmonic distortion (THD) at 6-Vppd, 1-GHz sine-wave output. The complete transmitter (AMUX + driver) delivers a maximum output swing of 7.3 Vppd at 56-Gb/s NRZ operation, and when the inherent FFE is enabled, supports up to 112-Gb/s PAM-4 transmission at a 4.2-Vppd swing—representing a key breakthrough for next-generation high-speed optical interconnects.

A research team from the National Key Laboratory of Integrated Circuit Manufacturing Technology at the Institute of Microelectronics of Chinese Academy of Sciences (IME CAS), in collaboration with the Beijing Superstring Academy of Memory Technology(SAMT) and Shandong University, has proposed a novel dual-gate 4F² 2T0C memory cell architecture.

By adopting an in-situ metal self-oxidation process, the technology enables self-aligned integration of the read and write transistors within a 4F² memory cell. Combined with multi-level storage techniques, it can further increase storage density.

Nanjing University of Science and Technology Reported New Results in Power Semiconductor

Recently, a joint research team from the School of Microelectronics (School of Integrated Circuits) at Nanjing University of Science and Technology proposed a new switching-loss prediction method based on multilayer backpropagation artificial neural networks (ANNs).

The approach leverages regression relationships between static parameters of SiC MOSFETs—such as threshold voltage, leakage current and on-resistance—and switching losses. Without the need for complex physical modeling or parameter extraction, switching losses can be rapidly and accurately predicted using only measured data or static parameters from datasheets.

HKU, Wuhan University and CAS Jointly Made Major Progress in 4H/3C-SiC Composite Substrates and Devices

Recently, a team led by researcher Liu Xinyu from the High-Frequency and High-Voltage Center of IME CAS, in collaboration with the University of Hong Kong, Isabers Group, Wuhan University and the Institute of Physics CAS, successfully developed large-area 4H/3C-SiC single-crystal composite substrates, breaking the specific on-resistance limit of low-voltage (<600 V) 4H-SiC devices.

SUSTC Research Team Achieved Key Results in High-Speed IC Design

Recently, the team led by Pan Quan at the School of Engineering and National Demonstration Microelectronics College, Southern University of Science and Technology (SUSTC), achieved further breakthroughs in high-speed communication and optoelectronic IC design.

1. A 56 Gbaud, 7.3-Vppd Linear Modulator Transmitter Based on AMUX Inherent Feed-Forward Equalization and a Breakdown-Voltage Tripler

The work proposes a half-rate linear transmitter monolithically integrating a 2:1 analog multiplexer (AMUX) and a linear driver for optical modulators. By exploiting the timing relationship between the clock and half-rate data streams, the AMUX inherently implements a feed-forward equalizer (FFE), which can be reconfigured into two-tap or three-tap modes by adjusting clock delay.

To further enhance output voltage swing and linearity, the authors propose a novel “breakdown-voltage (BV) tripler” topology for the linear driver. By stacking three heterojunction bipolar transistors (HBTs) and using the amplified input signal to bias the bases of the top two HBTs, the driver achieves three times the output swing of conventional cascode topologies while maintaining good reliability.

Fabricated in a 130-nm SiGe BiCMOS process, the proposed linear driver achieves 17.1 dB DC gain, a 39.1 GHz 6-dB bandwidth, and 1.6% total harmonic distortion (THD) at 6-Vppd, 1-GHz sine-wave output. The complete transmitter (AMUX + driver) delivers a maximum output swing of 7.3 Vppd at 56-Gb/s NRZ operation, and when the inherent FFE is enabled, supports up to 112-Gb/s PAM-4 transmission at a 4.2-Vppd swing—representing a key breakthrough for next-generation high-speed optical interconnects.

China’s Big Fund Phase III Backs IC Substrate Maker AKM Meadville

Recently, Guotou Jixin (Beijing) Equity Investment Fund (Limited Partnership) (“Guotou Jixin”), an investment vehicle under the Phase III China Integrated Circuit Industry Investment Fund Co., Ltd. (the “Big Fund Phase III”), has taken an equity stake in IC substrate maker AKM Meadville (Xiamen).

According to Tianyancha, AKM Meadville completed an industry and commence registration change on December 11. While its former shareholder AKM Meadville (Panyu) exited, new shareholders joined, including Guotou Jixin, CN Investment, Guangzhou Industrial Investment Group (GIIG), North Industries Technology (NORINCO), Shenzhen Yuanzhi Xinghuo Private Equity Fund, and Guofengtou Xinzhi Equity Investment Fund. Among them, Guotou Jixin, CN Investment are both affiliated with the Big Fund Phase III.

Founded in 2019 with a registered capital of CNY 4.5 billion, AKM Meadville is a well-known Chinese manufacturer in the packaging substrate and high-end PCB segments. The company focuses on IC substrate, substrate-like PCB, high-layer-count and any-layer HDI, rigid-flex and flexible PCB, SMT and assembly service, as well as power battery module technologies. Its products are widely used in smartphones, consumer electronics, automotive electronics, and 5G application, positioning AKM Meadville to be among the world’s top 20 PCB manufacturers.

AKM Meadville is one of the relatively few companies that the Big Fund Phase III has invested in. Launched in May 2024, the Big Fund Phase III has a registered capital of RMB 344 billion, with a strategic focus on advanced manufacturing, high-end chip design, critical materials and equipment, and wide bandgap semiconductors—key “chokepoint” areas—while emphasizing the efforts to bolster industrial chains and achieve industrial chain coordination.

The investment in AKM Meadville not only signals the Big Fund Phase III’s recognition of the company’s technological capabilities, but also underscores its confidence in the long-term development of China’s IC packaging substrate industry.

According to Tianyancha, AKM Meadville completed an industry and commence registration change on December 11. While its former shareholder AKM Meadville (Panyu) exited, new shareholders joined, including Guotou Jixin, CN Investment, Guangzhou Industrial Investment Group (GIIG), North Industries Technology (NORINCO), Shenzhen Yuanzhi Xinghuo Private Equity Fund, and Guofengtou Xinzhi Equity Investment Fund. Among them, Guotou Jixin, CN Investment are both affiliated with the Big Fund Phase III.

Founded in 2019 with a registered capital of CNY 4.5 billion, AKM Meadville is a well-known Chinese manufacturer in the packaging substrate and high-end PCB segments. The company focuses on IC substrate, substrate-like PCB, high-layer-count and any-layer HDI, rigid-flex and flexible PCB, SMT and assembly service, as well as power battery module technologies. Its products are widely used in smartphones, consumer electronics, automotive electronics, and 5G application, positioning AKM Meadville to be among the world’s top 20 PCB manufacturers.

AKM Meadville is one of the relatively few companies that the Big Fund Phase III has invested in. Launched in May 2024, the Big Fund Phase III has a registered capital of RMB 344 billion, with a strategic focus on advanced manufacturing, high-end chip design, critical materials and equipment, and wide bandgap semiconductors—key “chokepoint” areas—while emphasizing the efforts to bolster industrial chains and achieve industrial chain coordination.

The investment in AKM Meadville not only signals the Big Fund Phase III’s recognition of the company’s technological capabilities, but also underscores its confidence in the long-term development of China’s IC packaging substrate industry.

At present, China’s IC substrate sector is led by players such as Shennan Circuits (SCC), Fastprint Technology, Redboard Technology, and AKM Meadville, all of which have demonstrated robust growth momentum.

In recent years, driven by the localization push alongside the rapid development of artificial intelligence and high-speed networking, PCB-related products have maintained a high level of market prosperity. In particular, segments such as 18-layer-and-above PCB and advanced HDI boards have seen burgeoning growth. In this context, the packaging substrate industry has gradually picked up, with leading companies delivering notable performance gains.

The Guangxi High-end Semiconductor Chemical Materials Production Base project, with a total investment of 5 billion yuan, has commenced construction.

According to news from Guangxi Industrial Park, on December 29, 2025, the project to build a high-end semiconductor chemical materials production base with an annual output of 700,000 tons officially commenced construction. This project innovatively adopts a "chain leader + fund + base" model, using leading enterprise Anxin Electronics as the engine to integrate resources . It provides full-cycle capital support through a special industrial investment fund, relies on specialized industrial parks to achieve industrial cluster development, drives the upgrading of the semiconductor and high-end fine chemical industries in the China-Malaysia Qinzhou Industrial Park, and helps Guangxi build a high-level cooperation hub for the high-end semiconductor materials industry facing ASEAN.

According to reports, this project is the first chain-leading project to settle in the high-end semiconductor materials industrial base of the China-Malaysia Qinzhou Industrial Park, and is also a major project of the autonomous region. The project has a planned total investment of 5 billion yuan , boasts high technological content, broad market prospects, and strong industrial driving force. Its core products cover categories such as electronic-grade sulfuric acid, electronic-grade hydrochloric acid, electronic-grade ammonia, electronic-grade hydrogen peroxide, and electronic-grade solvents. The project has introduced a top-tier professional technical team, mastering all the key process technologies for the stable mass production of G5-grade ultra-high purity wet electronic chemicals. This will effectively fill the gap in the development of the domestic high-end semiconductor electronic chemicals industry and is a major innovative project to break through foreign technological monopolies and promote import substitution of high-end semiconductor chemical materials. The project will be implemented in three phases. The first phase involves an investment of 1.45 billion yuan and is expected to be fully operational by the end of 2027. At that time, it will have an annual production capacity of 60,000 tons of electronic-grade sulfuric acid, 10,000 tons of electronic-grade hydrochloric acid, 10,000 tons of electronic-grade ammonia, 10,000 tons of electronic-grade hydrogen peroxide, and 40,000 tons of electronic-grade solvents, with an estimated annual output value of over 1 billion yuan. The second and third phases will expand production based on the first phase and develop new products, with the product series covering the main categories of wet electronic chemicals.

According to reports, this project is the first chain-leading project to settle in the high-end semiconductor materials industrial base of the China-Malaysia Qinzhou Industrial Park, and is also a major project of the autonomous region. The project has a planned total investment of 5 billion yuan , boasts high technological content, broad market prospects, and strong industrial driving force. Its core products cover categories such as electronic-grade sulfuric acid, electronic-grade hydrochloric acid, electronic-grade ammonia, electronic-grade hydrogen peroxide, and electronic-grade solvents. The project has introduced a top-tier professional technical team, mastering all the key process technologies for the stable mass production of G5-grade ultra-high purity wet electronic chemicals. This will effectively fill the gap in the development of the domestic high-end semiconductor electronic chemicals industry and is a major innovative project to break through foreign technological monopolies and promote import substitution of high-end semiconductor chemical materials. The project will be implemented in three phases. The first phase involves an investment of 1.45 billion yuan and is expected to be fully operational by the end of 2027. At that time, it will have an annual production capacity of 60,000 tons of electronic-grade sulfuric acid, 10,000 tons of electronic-grade hydrochloric acid, 10,000 tons of electronic-grade ammonia, 10,000 tons of electronic-grade hydrogen peroxide, and 40,000 tons of electronic-grade solvents, with an estimated annual output value of over 1 billion yuan. The second and third phases will expand production based on the first phase and develop new products, with the product series covering the main categories of wet electronic chemicals.

Youre right. Here is my article from Nov 30, 2025 showing Naura and AMEC in the top 10 -