Have you ever played the game of Monopoly ?

Imagine that one player can print all the money they want.

Before long, that one player will own everything, and everyone else is broke or in debt.

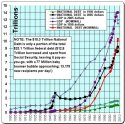

The nation is swimming in debt: about $53 Trillion nation-wide debt (as of the end of year 2007) has never been worse (ever), including as a percentage of the GDP (currently $13.86 Trillion).

The government and Federal Reserve (a quasi-government controlled / privately owned bank system) are printing fiat-funny-money (7please watch the 47 minute video) out of thin air, and then try to lend it to everyone possible, flooding the mail with credit-card applications to everyone (and their pets and children too, literally). Some people will fail to repay their loans and the banks then confiscate real assets, turning paper money printed out of thin air into real assets. The value of the money erodes year after year. A U.S. Dollar from year 1950 is now worth less than 11 cents. Ever heard of compound interest? It's the same for inflation. At only 4.5% inflation, $100 becomes $81.75 in only 5 years. Inflation is another contributing factor to falling median incomes and the shift of most wealth distribution to a mere 1% of the total U.S. population (with 40% of all wealth in the nation; up from 20% in 1976).

YEAR MONTH M3 MONEY Per Year

($Billions)

1950 12 $135.00

1959 12 $299.70 $299.70

1960 12 $315.20 $15.50

1961 12 $340.80 $25.60

1962 12 $371.30 $30.50

1963 12 $405.90 $34.60

1964 12 $442.40 $36.50

1965 12 $482.10 $39.70

1966 12 $505.40 $23.30

1967 12 $557.90 $52.50

1968 12 $607.20 $49.30

1969 12 $615.90 $8.70

1970 12 $677.10 $61.20

1971 12 $776.00 $98.90

1972 12 $885.90 $109.90

1973 12 $985.00 $99.10

1974 12 $1,069.90 $84.90

1975 12 $1,170.20 $100.30

1976 12 $1,309.90 $139.70

1977 12 $1,470.40 $160.50

1978 12 $1,644.50 $174.10

1979 12 $1,808.70 $164.20

1980 12 $1,995.50 $186.80

1981 12 $2,254.50 $259.00

1982 12 $2,460.60 $206.10

1983 12 $2,697.40 $236.80

1984 12 $2,990.60 $293.20

1985 12 $3,208.10 $217.50

1986 12 $3,499.10 $291.00

1987 12 $3,686.50 $187.40

1988 12 $3,928.80 $242.30

1989 12 $4,077.10 $148.30

1990 12 $4,154.70 $77.60

1991 12 $4,210.30 $55.60

1992 12 $4,222.60 $12.30

1993 12 $4,285.60 $63.00

1994 12 $4,369.80 $84.20

1995 12 $4,636.30 $266.50

1996 12 $4,985.50 $349.20

1997 12 $5,460.90 $475.40

1998 12 $6,051.90 $591.00

1999 12 $6,551.50 $499.60

2000 12 $7,117.60 $566.10

2001 12 $8,035.40 $917.80

2002 12 $8,568.00 $532.60

2003 12 $8,872.30 $304.30

2004 12 $9,433.00 $560.70

2005 12 $10,154.00 $721.00

YEAR MONTH M3 MONEY Per Month

2006 (JAN) 1 $10,242.80 $88.80

2006 (FEB) 2 $10,298.70 $55.90

Look at year 2001/2002 (above). M3 Money supply increased by $917 billion in only 1 year !

Between year 1950 and 2005, M3 Money Supply increased from $135 billion to $10.15 trillion.

That's a factor of 75.2 !

But, the nation did not become 75.2 times wealthier in 55 years.

The population grew from 152 million in 1950 to 298 million in year 2005.

That still does not explain the increase of the M3 Money Supply by a factor of 75.2 .

What happened was a whole lot of new money was printed since 1950.

Our money system is a PYRAMID scheme, and all PYRAMID schemes collapse, eventually.

Here's how it works (they don't teach this in any public schools).

The Federal Reserve loans money (with interest) to member banks (which charge more interest).

Up to 90% of each new bank loan is money created out of thin air.

But it gets worse.

For each dollar re-deposited into the fractional (9:1 ratio) bank system (a closed loop monopoly bank system), 9 times more new money can be created out of thin air.

Depending on the size of each loan, that PYRAMID scheme can continue until 90 times more money has been created out of thin air. However, the bank is required to have 10% of their loans in reserves.

For example, let's say the bank has $1111.11 in reserves.

That means the bank can make a loan of 9 times that initial $1111.11, which is $10,000.00 .

90% of each subsequent deposit can then be used for another loan of money created out of thin air . . .

(001) 90% of that $10,000.00 can be loaned again, to create a new loan of $9,000.00

(002) 90% of that $9,000.00 can be loaned again, to create a new loan of $8,100.00

(003) 90% of that $8,100.00 can be loaned again, to create a new loan of $7,290.00

: : : : : :

(088) 90% of that $1.16 can be loaned again, to create a new loan of $1.045

(089) 90% of that $1.045 can be loaned again, to create a new loan of $0.94

: : : : : :

(131) 90% of that $0.013 can be loaned again, to create a new loan of $0.011

(132) 90% of that $0.011 can be loaned again, to create a new loan of $0.01

_______________________

TOTAL SUM = $99,888.89 (of money created out of thin air from initial $1111.11 in reserves).

Thus, from the initial $1111.11 in the bank reserve, $98,888.89 (98.89% of $100,000.00) of more new money could be created out of thin air.

But it still gets worse, because a LOAN = PRINCIPAL + INTEREST.

But the bank creates only the PRINCIPAL for each new loan.

So, where does the INTEREST come from?

One of several things must happen:

1. create more new money to delay the collapse of the PYRAMID (such as the recent government $152 Billion economic stimulus package in FEB-2008). However, this creates more inflation.

2. those with money must spend more money to allow more new money to be created out of thin air.

3. increase productivity.

4. increase products and/or natural resources (e.g. oil, steel, etc.) to sell to other nations to bring money back.

5. the wealthy share their wealth (not likely to any significant extent).

6. increase taxes on the wealthy (however, if the wealthy are taxed too much, they might up and move their wealth and businesses to another country).

7. increase productivity via increased population.

8. increase productivity via illegal immigration (cheap labor).

9. reduce taxes to encourage more spending.

10. reduce interest rates to encourage more spending (but this creates more debt).

11. the government prints up more new money and gives it back to people to stimulate more spending (such as the $152 Billion proposed in FEB-2008).

12. foreclosures.

13. plunder pensions and other systems (e.g. Social Security surpluses).

14. the PYRAMID finally collapses when there is finally too much debt and inflation to delay the inevitable collapse.

It is a PYRAMID scheme, and all pyramid schemes eventually collapse.

As time goes on, this problem can only get bigger and bigger.

The only thing stopping the collapse of this pyramid is a short time-lag by creating more debt and printing more money.

But that time-lag is shrinking every day, as the ability to repay debt becomes more difficult.

Debt will grow larger and larger.

The time it takes to finally collapse fools people.

Printing more money to delay the collapse will make inflation get worse and worse.

It could take decades or centuries, but the inevitable collapse is a mathematical certainty.

Eventually, the debt and inflation will become impossible to deal with.

We will not be able to create more debt to create more money.

We will not be able to spend our way out of the collapse.

We will not be able to print (money) our way out of the collapse (due to inflation).

We will not be able to immigrate our way out of the collapse.

We will not be able to procreate our way out of the collapse.

We will not be able to increase productivity enough to avoid the collapse.

We will not be able to tax (or un-tax) our way out of the collapse.

Look at our current situation and results of this PYRAMID scheme:

* $20 Trillion nation-wide personal debt,

* $9.4 Trillion National Debt,

* plundered pensions (PBGC pensions are $450 Billion in the hole),

* rising foreclosures,

* rising bankruptcies,

* rising unemployment,

* pressure to raise taxes for those that have money (i.e. the wealthy),

* pressures to increase illegal immigration to increase productivity and growth (cheap labor),

* stock market and real-estate bubbles and volatility,

* the M3 Money Supply $135 Billion in year 1950 to $10.15 Trillion by year 2005.

* inflation; a 1950 U.S. Dollar is now worth less than 11 cents,

* the pressure to spend and borrow (i.e. numerous credit card applications in the daily mail),

* bank fees (i.e. to increase reserves for more loans; the banks receive the interest),

* the U.S. Dollar falling against all major international currencies,

* and now, the recently proposed $152 Billion economic stimulus package (proposed FEB-2008) with more created out of thin air, will increase the time-lag to prevent the collapse of the PYRAMID scheme, but it is only a short-term solution and will make things worse, long-term.

For anyone who thinks it is bad now, they haven't seen anything yet.

But this is not taught in public schools (see 47 minute video), and probably not in any universities either.

All of the above are the many manifestations of unchecked greed, and there will eventually be painful consequences for most people when the PYRAMID scheme finally collapses, as all PYRAMID schemes always do.

The SOLUTION - Reform the Monetary System:

1. The federal government controls the monetary system. It shall create the money it needs, interest free. It shall control the money-supply.

2. The federal government shall prohibit usury (interest) by government and member banks (under-cutting anyone else who lends money with interest). If a lot of interest is bad (i.e. usury is immoral), how can a little interest be good? If inflation is bad, how is a little inflation good?

3. This creates a stable money supply with the flexibility for small fluctuations. If inflation is too high, some money in circulation can be removed. If there is deflation, or the population increases, the government can create and spend some money. If they do a bad job of it, the voters know exactly who to hold accountable. Currently, the Federal Reserve is a quasi-government controlled / privately owned bank, and the voters have little (if any) control over it. Why would people borrow from a bank (with interest) when they can borrow from the government, interest free? Thus, there would be little (if any) usury. Usury, predatory lending, and other manifestations of unchecked greed and the other numerous negative side effects would be greatly reduced. If properly managed, without profit and usury as a motive, the U.S. currency would become superior to any other world currency.

4. Theoretically, if managed responsibly, with the central bank in control of the monetary policy (instead of a quasi-government controlled/privately owned bank system), there may be no need for any tax system. That is, inflation and deflation would affect everyone's money an equal percentage. Of course, such a vast change in the monetary and tax systems would require new ways of thinking about money, interest, borrowing, taxation, and monetary policy, and there are many (e.g. politicians and bankers; a.k.a. puppets and puppeteers) that will resist such changes. Since this way of funding the federal government is unlikely any time soon, the least we can do now is to greatly simplify the current, ridiculously complex and regressive tax system (e.g. make it fairer flat 17% income tax on all types of income above the poverty level).