alright, looks like Yuan will continue to get more important in Argentina

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Renminbi (RMB)/Yuan Appreciation & Internationalization

- Thread starter supercat

- Start date

Exclusive: Argentina's central bank enables yuan accounts, a great advancement in promoting financial efficiency: envoy

By Yin Yeping Published: Jun 30, 2023 09:45 PM

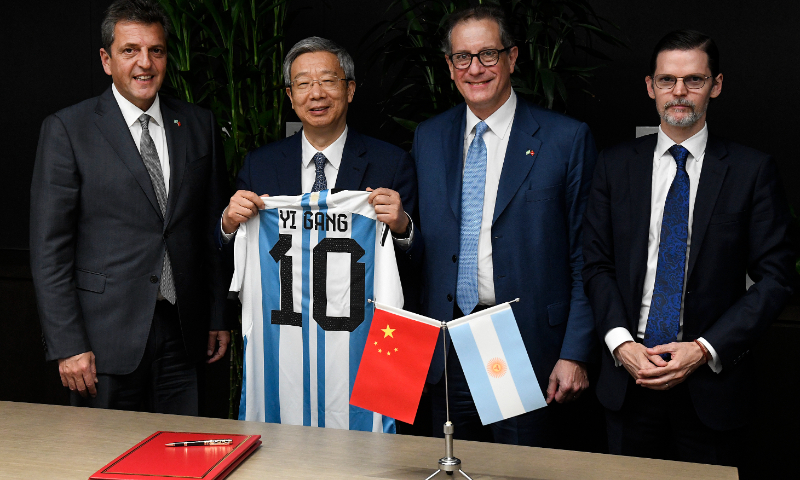

Governor of the People's Bank of China Yi Gang (second from left) meets Argentine Economy Minister Sergio Massa (first from left), Miguel ángel Pesce, President of the Central Bank of Argentina (third from left) and Sabino Vaca Narvaja, Ambassador of Argentina to China. Photo: Courtesy of the Argentine Embassy in Beijing

The enabling of Chinese yuan accounts in the Argentine banking system is a great advancement in reducing exchange rate costs, promoting financial efficiency and currency diversification, Argentine Ambassador to China Sabino Vaca Narvaja told the Global Times in an exclusive written interview on Friday.

The remark was made in response to the latest move by the Central Bank of Argentina to allow the country's commercial banks to open customer accounts in yuan. According to a statement published on its website, the central bank on Thursday said it had granted banks permission to take deposits in yuan, while it increases its yuan sales almost daily to finance imports.

This new measure is aimed at alleviating the scarcity of US dollar reserves and promoting the use of the Chinese currency for international transactions, according to media reports.

"The decision of the Central Bank of Argentina is very important because my country, in addition to supporting the internationalization process of the yuan, is betting on a more diverse monetary system where we do not need to use a third currency for exchange between our countries or with our main trading partners," Narvaja told the Global Times.

This reduces financial costs and promotes the democratization of the currency basket on the international level, the ambassador said.

The move came just three weeks after the recent visit by the Argentine Economy Minister Sergio Massa, to China together with other government representatives in early June, during which a cooperation plan to promote Belt and Road Initiative was signed, which includes, among its 13 working sectors, a central element such as cooperation in monetary and fiscal matters.

During the visit, the People's Bank of China and the Central Bank of Argentina renewed the bilateral local currency swap agreement, with a swap scale of 130 billion yuan per 4.5 trillion pesos and a validity period of three years, as the two countries ramp up efforts to enhance financial cooperation and trade facilitation.

The renewing of the currency swap mechanism has consolidated the path of expanding the use of local currencies, which has been very successful for economic exchanges between Argentina and China, Narvaja said.

Since the activation of this mechanism, announced in the bilateral meeting between the leaders of the two countries during the G20 summit in Bali last November, exchanges using yuan as the currency has grown exponentially, the envoy said.

"This new step announced by the Central Bank of Argentina to enable yuan accounts in the Argentine banking system is a great advancement in this direction of using local currencies, and it adds to many previous actions such as the opening of an electronic open market for spot and futures transactions in yuan," Narvaja said.

Likewise, the recent authorization granted to the Chinese credit card issuer, UnionPay, for the operation of transactions by all its clients in Argentina, allows them to settle with non-residents at the same value as financial dollars. The ambassador said that such moves are extremely relevant both for promoting Chinese tourism and consumption in Argentina and for ensuring traceability.

Narvaja stressed that the expansion of the use of yuan is possible due to the complementary economic nature that China has with most countries in Latin the American region and the spirit of shared work proposed for joint collaboration without any impositions.

"Argentina, like many emerging countries, advocates for a change in the global financial architecture in international organizations so that it is not oriented toward a speculative matrix. That is why we support the reform of the system in all multilateral forums, aiming to direct it toward the real economy and productive system," the ambassador further noted.

The ambassador highlighted the recent words of Brazilian President Lula Da Silva during his recent visit to China when he asked, "Why all countries have to base their trade on the dollar? Why can't we do trade based on our own currencies? Who was it that decided that the dollar was the currency after the disappearance of the gold standard?"

The ambassador said that institutions such as the People's Bank of China, the Asian Infrastructure Investment Bank (AIIB), and the New Development Bank (NDB), are doing a lot to build a fairer financial system.

"Argentina is betting on this new path and has recently joined as a member of the AIIB and formally requested to join the NDB of the BRICS…we firmly believe that a more harmonious and balanced multi-polar world, without any impositions, will be a reality if we work together," he said.

"In this sense, the concrete progress that many emerging countries are making in that direction is a good example."

Putin reveals dedollarization progress in trade with China

Over 80% of transactions between Moscow and Beijing are in rubles and yuan, the Russian president says

© Getty Images / Oleg Elkov

Russia-China trade and economic cooperation is expanding, with over 80% of settlements between the two nations currently made in rubles and yuan, President Vladimir Putin has revealed.

The Russian leader was addressing a virtual summit of the Shanghai Cooperation Organization (SCO) on Tuesday via videolink from Moscow. The 23rd SCO summit is being chaired by Indian Prime Minister Narendra Modi.

The organization was founded in 2001 as an economic and security bloc by the presidents of Russia, China, the Kyrgyz Republic, Kazakhstan, Tajikistan, and Uzbekistan. India and Pakistan became permanent members in 2017.

According to Putin, the volume of trade between Russia and fellow SCO member states reached a record $263 billion in 2022. The figure was up 35% in the first four months of this year, he noted. The share of the ruble in Russia's settlements with the SCO countries exceeded 40%, Putin said.

Trade between Russia and China has continued to accelerate after hitting a historic high of $190.3 billion in annual terms in 2022. Exports and imports have surged at double-digit pace since the beginning of the year. According to customs data, bilateral trade soared to $93.8 billion in January-May, marking a 40.7% increase compared with a year ago. Russian Finance Minister Anton Siluanov recently said that bilateral trade is on track to surpass the target of $200 billion a year earlier than anticipated.

Economic ties have been bolstered by the mutual decision to conduct the majority of transactions in national currencies instead of the US dollar.

Another interesting thought. Contrary to my previous thought, there might be more seriousness to the talk of gold/commodity backed currency for BRICS trading and such

Another good point here by Luke Gromen on commodity vs debts backed by nothing

More things to think about with China, Saudi & Yuan

China pays Saudi in RMB, Saudi has a lot of it and recycle this into Chinese assets, so HKSE becomes a major place of investment

China pays Saudi in RMB, Saudi has a lot of it and recycle this into Chinese assets, so HKSE becomes a major place of investment