You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor thread II

- Thread starter vincent

- Start date

Jinhong Gas: Electronic-grade dichlorosilane successfully completed trial production

Jinhong Gas issued an investor relations activity record announcement stating that electronic-grade dichlorosilane is the core planned product of the company's convertible bond-funded project, "New High-end Electronic Special Materials Project." Currently, the product has successfully entered the trial production stage, and the project is expected to have an annual production capacity of 200 tons after reaching full capacity. The company is making every effort to promote the testing, certification, and subsequent implementation of this product by semiconductor clients.

In the semiconductor industry, nitrous oxide is typically used as a deposition dielectric material in key thin-film deposition processes; high-purity carbon dioxide is mainly used in cleaning technologies and immersion lithography. To date, the company's nitrous oxide and high-purity carbon dioxide have been successfully adopted by some leading semiconductor companies, and the company will continue to work towards adopting them with high-quality semiconductor clients.

Qinghe Crystal and Tiantong Technology join forces to pave a breakthrough in the high-end development of piezoelectric heterogeneous integration.

In a landmark move to accelerate innovation in the post-Moore’s Law era, Qinghe Crystal and Tiantong Jingmei (a subsidiary of Tiantong Technology, global leader in piezoelectric materials) have entered a deep strategic collaboration to pioneer piezoelectric heterogeneous integration.

Combining Tiantong Jingmei’s world-class piezoelectric single crystal and wafer technologies with Qinghe Crystal’s proprietary low-damage surface activation and high-precision bonding processes, the partnership bridges the critical gaps between materials, equipment, and application development — solving long-standing industry bottlenecks.

Together, they are building a fully integrated value chain:

Piezoelectric Crystal → Wafer → Heterogeneous Integration Equipment → Functional Thin-Film Wafer

The collaboration aims to significantly improve yield, performance, and stability of next-generation piezoelectric devices for 5G/6G RF systems, high-frequency MEMS, medical ultrasound, and quantum sensors while establishing core IP and manufacturing standards.

This is the first end-to-end industrial alliance of its kind in China, setting a new benchmark for cross-domain synergy in advanced semiconductors. The partners will establish a joint R&D center to drive commercialization and position China at the forefront of globally competitive, independent piezoelectronics.

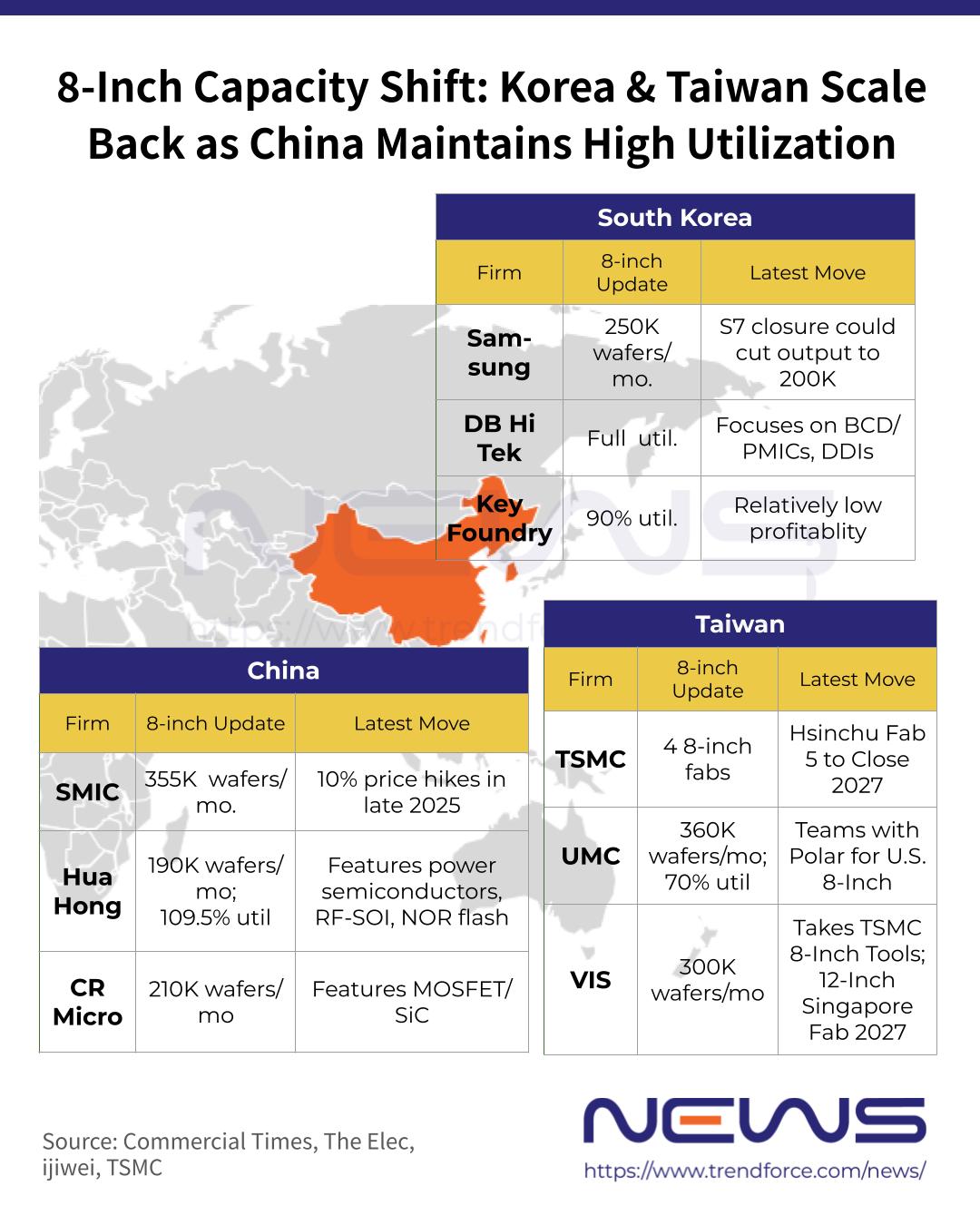

...TSMC, Samsung shift to advanced nodes; China's SMIC, Hua Hong seize 8-inch demand

As top foundries pivot to cutting-edge chips, Chinese rivals move to capture legacy-node orders

Samsung, SK hynix cut NAND output to drive profits amid AI-fueled demand

Memory giants favor DRAM investments as AI-era NAND shortages lift prices across devices

broadsword

Brigadier

China races to build HBM gear ecosystem amid US curbs, targets HBM3 ramp

Local vendors rush to fill HBM tooling gaps as Beijing leans on homegrown etch and packagingBy

Published 2026.01.20

As China's memory semiconductor corporations, including CXMT, prepare to begin mass production of high bandwidth memory (HBM) this year, they are said to be tightening the reins to build a semiconductor equipment ecosystem needed for HBM manufacturing. With U.S. restrictions expected to be the biggest obstacle to securing advanced semiconductor equipment for China's HBM production, they appear to be going all-in on internalizing equipment.

According to the industry on the 20th, Chinese semiconductor equipment corporations Naura Technology, Maxwell and U-Precision are accelerating efforts to develop equipment specialized for HBM from tools previously used in DRAM manufacturing. Because HBM is produced by stacking multiple DRAMs, advanced processes different from conventional commodity DRAM fabrication—such as etching to create channels for stacking semiconductors and packaging to bind them into a single chip—are applied, requiring equipment optimized for these steps. China's memory semiconductor industry is also shifting away from investment centered on commodity DRAM to focus its capabilities on dedicated processes and facility expansion for HBM production.

As China embarks on massive investment to secure leadership in the artificial intelligence (AI) industry, HBM is essential to run advanced AI Semiconductor chips. However, with HBM designated as a restricted item under U.S. advanced semiconductor industry controls, supply has faced difficulties. Currently, only three corporations—Samsung Electronics, SK hynix and Micron—mass-produce and supply HBM. In China, some say the HBM supply crunch is hampering growth in the AI industry.

Not only CXMT but also YMTC, the No. 1 NAND flash corporation in China, has jumped into HBM development. CXMT plans to mass-produce fourth-generation HBM (HBM3) this year and is assessed to have the technology to supply samples to domestic AI Semiconductor corporations such as Huawei. YMTC is said to have begun developing Through Silicon Via (TSV) used in HBM. TSV is a technology that drills microscopic holes in the chip to connect the top and bottom chips with electrodes and stack them to achieve high capacity and high bandwidth.

With U.S. restrictions expected to make it difficult to procure semiconductor equipment for HBM mass production, China's semiconductor equipment industry has begun work to build its own ecosystem. In particular, China is said to be focusing on processes such as etching and packaging needed in semiconductor manufacturing. Etching to precisely drill consolidation channels between DRAM chips for stacking, and packaging based on that to make a single chip, are known to have the greatest impact on HBM process Production yield.

A semiconductor industry official said, "Chinese semiconductor equipment corporations have internalized a considerable portion of DRAM process equipment, excluding extreme ultraviolet (EUV) lithography tools that draw ultra-fine circuits," adding, "However, for making HBM from commodity DRAM, areas such as etching and packaging still require technological reinforcement."

To that end, corporations such as Naura Technology, Maxwell and U-Precision are rolling out HBM-specialized equipment one after another. Naura Technology, the No. 1 corporation with more than a 30% share of China's etching equipment market, said it has built a portfolio of core process tools needed for HBM manufacturing, including not only etching equipment but also deposition to lay thin films on wafer surfaces and cleaning equipment. Maxwell has developed next-generation hybrid bonding equipment that bundles multiple DRAMs, and U-Precision said it has the equipment needed for HBM packaging.