Ranked second in the world, SMIC's revenue exceeded US$8 billion for the first time!

On the evening of February 11, 2025, SMIC, the leading wafer foundry in mainland China, released its fourth-quarter 2024 financial report. Sales revenue hit a new high of US$2.207 billion, a month-on-month increase of 1.7%. The gross profit margin was 22.6%, an increase of 2.1 percentage points from the previous month. The full-year revenue exceeded the US$8 billion mark for the first time, further consolidating its position as the world's second largest pure-play wafer foundry.

Financial report details

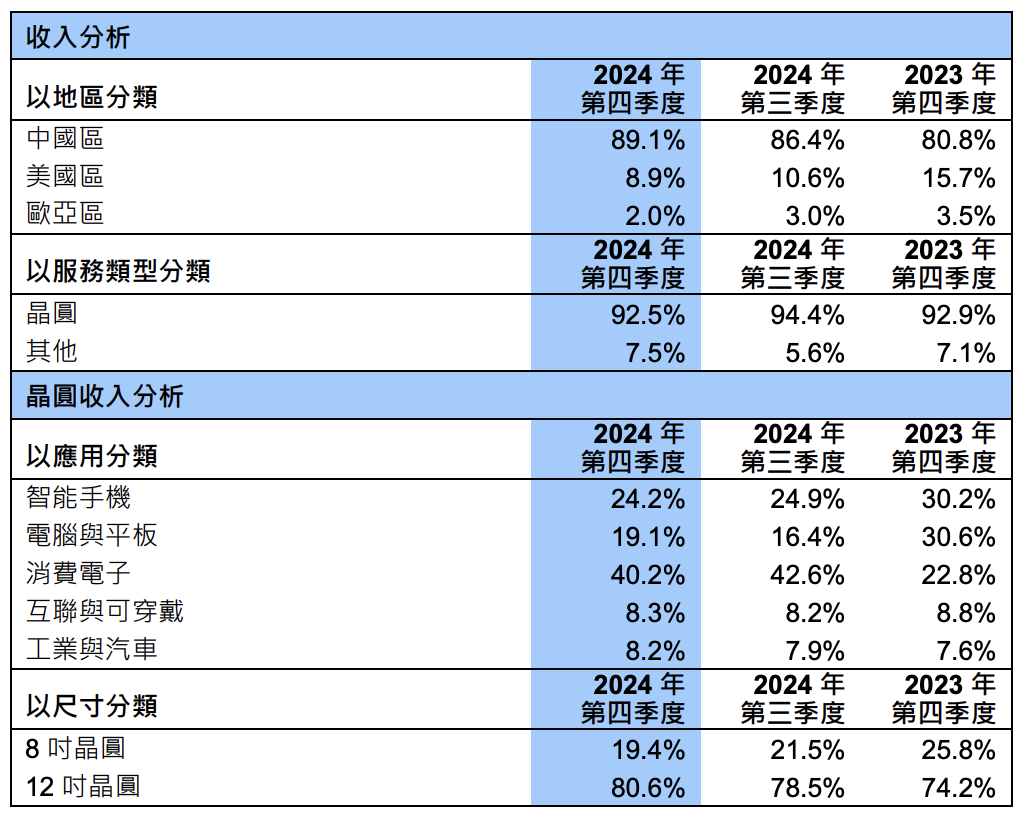

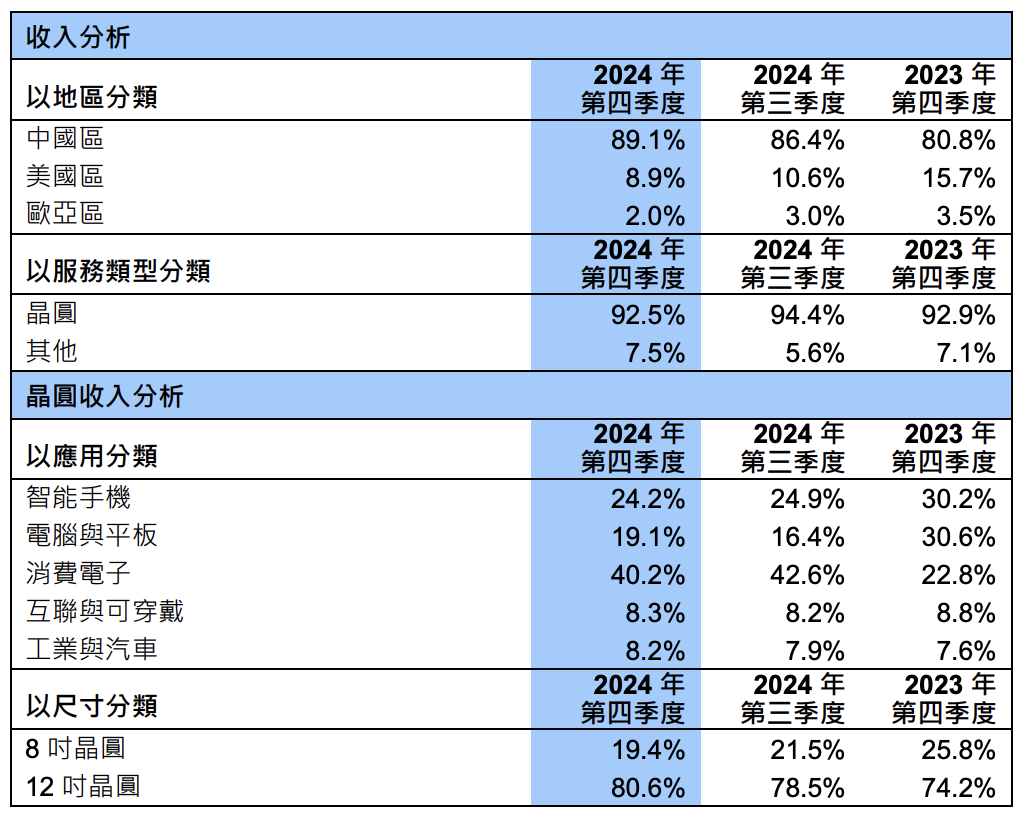

In the fourth quarter, SMIC's revenue by application was divided into: smartphones 24.2%, computers and tablets 19.1%, consumer electronics 40.2%, Internet and wearables 8.3%, industrial and automotive 8.2%. Looking at the revenue contribution of each region, the revenue from China accounted for 89.1%, the US accounted for 8.9%, and the Eurasian region accounted for 2%.

By wafer size, the revenue share of 12-inch wafers in the fourth quarter increased to 80.6%, and the revenue share of 8-inch wafers was 19.4%. In terms of production capacity, SMIC's monthly production capacity increased from 884,250 pieces of 8-inch standard logic in the third quarter of 2024 to 947,625 pieces of 8-inch standard logic in the fourth quarter of 2024. The capacity utilization rate in the fourth quarter continued to be 85.5%, and a total of 1,991,761 pieces of 8-inch standard logic wafers were sold. SMIC's capital expenditure in the fourth quarter of 2024 was US$1.66 billion, and R&D expenditure was US$217 million.

Annual revenue exceeds $8 billion for the first time

SMIC management said that according to unaudited financial data, the company's sales revenue in 2024 will be US$8.03 billion, a year-on-year increase of 27%, and a gross profit margin of 18%. The company's capital expenditure in 2024 will be US$7.33 billion, and the monthly production capacity of 8-inch standard logic will be 948,000 pieces at the end of the year, with a total shipment volume of more than 8 million pieces and an average annual capacity utilization rate of 85.6%.

Financial report details

In the fourth quarter, SMIC's revenue by application was divided into: smartphones 24.2%, computers and tablets 19.1%, consumer electronics 40.2%, Internet and wearables 8.3%, industrial and automotive 8.2%. Looking at the revenue contribution of each region, the revenue from China accounted for 89.1%, the US accounted for 8.9%, and the Eurasian region accounted for 2%.

By wafer size, the revenue share of 12-inch wafers in the fourth quarter increased to 80.6%, and the revenue share of 8-inch wafers was 19.4%. In terms of production capacity, SMIC's monthly production capacity increased from 884,250 pieces of 8-inch standard logic in the third quarter of 2024 to 947,625 pieces of 8-inch standard logic in the fourth quarter of 2024. The capacity utilization rate in the fourth quarter continued to be 85.5%, and a total of 1,991,761 pieces of 8-inch standard logic wafers were sold. SMIC's capital expenditure in the fourth quarter of 2024 was US$1.66 billion, and R&D expenditure was US$217 million.

Annual revenue exceeds $8 billion for the first time

SMIC management said that according to unaudited financial data, the company's sales revenue in 2024 will be US$8.03 billion, a year-on-year increase of 27%, and a gross profit margin of 18%. The company's capital expenditure in 2024 will be US$7.33 billion, and the monthly production capacity of 8-inch standard logic will be 948,000 pieces at the end of the year, with a total shipment volume of more than 8 million pieces and an average annual capacity utilization rate of 85.6%.