Bro to add on your post from Tom's Hardware.The chip market is giving signs it is heading towards a serious glut: Intel's news of laying 20k personnel is a serious indicative of this glut. China is increasing its manufacturing capacities, rightly so, because it is replacing imported chips. China can increase considerably its manufacturing capacity without running of of market for those chips. It simply substitutes foreign made chips.

What on earth is TSMC doing building new factories in US and thinking of building new factories in EU and Japan.

Are they stupid?

Apple's Chip Purchase from Arizona Might Be Marketing Trick: Report

Bypublished about 1 hour ago

Apple's dependence on Taiwanese chips will hardly end any time soon.

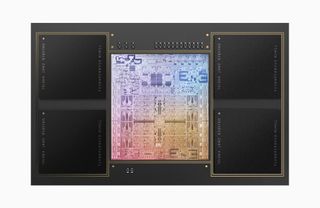

(Image credit: Apple)

While Apple is expected to buy chips from in Arizona in a bid to lower its reliance on manufacturing in Asia in general, it does not look like the company will ever truly rely itself from Taiwanese chipmaking. As such, our colleagues from believe that the , which yet has to be officially announced, is more of a marketing gimmick rather than a decision based on necessity.

But while Apple is yet to confirm the plan to use TSMC's fab in Arizona, which is set to come online in 2024, let us analyze what Apple might need two years from now and what TSMC is going to offer the mighty company in a couple of years. What you have to bear in mind is that we know about Apple's supposed intention to use the fab in Arizona only from a report. We assume that the information is accurate as Bloomberg is very reputable source, but we cannot verify it.

Apple's Needs

TSMC's fab in Arizona will produce chips using the company's N5 (5nm class) family of process technology, which includes N5, N5P, N4, N4P, and N4X. At present Apple uses N5, N5P, and N4 for various system-on-chips used for smartphones, PCs, and consumer electronics. Meanwhile, from reports, we know that Apple, being TSMC's alpha customer for leading-edge process technologies, is the first company to use TSMC's N3 (3nm class) node for at least one of its SoCs.But designing chips for a leading-edge process technology (we are looking at a ~$600 million just for physical implementation and embedded software) and producing them on a leading-edge node is expensive. Apple uses its N4-based A16 Bionic SoC only for its premium iPhone 14 Pro, which sells from $999. Meanwhile, the more mainstream vanilla iPhone 14 (from $799) still uses the N5P-based A15 Bionic SoC from 2021.

Perhaps a more colorful example would be Nvidia's launch of its 4N (a customized version of N4 with significant performance enhancements) graphics processors based on the Ada Lovelace architecture. The AD102 and the AD103 GPUs are used exclusive for the company's flagship GeForce RTX 4090 and the RTX 4080 graphics boards that carry a $1,599 and a $1,199 price tags respectively (and these are the available today, so to speak). By contrast, AMD's range-topping Radeon RX 7900 XT and RX 7900 XTX (based on the Navi 31 GPU) use TSMC's N5 technology and will retail for $999, and $899, respectively, starting December 13.

But while the new process is expensive, Apple needs leading-edge production nodes not only for flagship smartphones, but also for its PCs. The company's M1-based Macs smashed some performance records and clearly exceeded expectations. Meanwhile, the Apple's M1 Max with its 57 billion transistors — one of the most complex chips ever designed — implemented on TSMC's N5P process demonstrates that the company's ambitions for performance are high to put it mildly.

TSMC's Capabilites

While we think we know some vectors of Apple's SoC development, we need to analyze them in context with TSMC's plans and capabilities. And they, perhaps, will give some additional food for thoughts.Back in October, TSMC cut its 2022 CapEx by $4 billion for the second time this year citing slowing demand for chips in the medium-term future as well as availability of wafer fab equipment (WFE). The reduced CapEx will not have an immediate effect on the company's business, but lowered spendings and prolonged lead time for fab tools could have an impact on TSMC over the next few years. In fact, WFE availability seems to be a major problem for the semiconductor industry in general.

TSMC's move to cut down its CapEx from $40 billion to $36 billion was a little bit surprising as the company's revenue and profits set all-time records in the third quarter of 2022. The company's earnings reached $20.33 billion, a 35.9% year-over-year increase and an 11.4% quarter-over-quarter increase. The company's net income in Q3 2022 totaled $8.717 billion, up from $4.849 billion in Q3 2021.

TSMC's main profitability driver these days is aggressive adoption of its advanced fabrication technologies, N7 and N5 (5 nm and 7 nm-class, respectively) by its customers in general and Apple — TSMC's largest client — in particular. In the third quarter TSMC's N5 family of production nodes became the largest revenue contributor as it accounted for 28% of the company's revenue (up from 18% in Q3 2021), which is not particularly surprising as the company ramped up production of multiple high-profile products from high-profile clients like Apple (M2, A16), AMD (Zen 4 CCDs), Nvidia (H100, AD102, AD103, AD104), and Qualcomm (Snapdragon 8+ Gen 1). Meanwhile, N7 manufacturing technologies (and Apple still uses it to male its A16 Bionic SoCs) accounted for 26% of TSMC's earnings (down from 34% in Q3 2021). As it turns out, 54% of the world's No.1 foundry revenue was contributed by its advanced nodes (up from 52% in Q3 2021).

Nonetheless, TSMC cut down its capital expenditure from $40 billion to $36 billion citing mid-term outlook and WFE availability, but not citing U.S. sanctions against Chinese supercomputer and semiconductor industries.

Indeed, demand for PCs and smartphones is dropping and some say that the bottom is yet to be reached. Meanwhile, high-performance computing products (i.e, a vague term that TSMC uses for products for PCs, HPC, and other performance-hungry applications) now account for 39% of TSMC's revenue, representing a slow yet stable growth. Meanwhile, as , HPC contribution to TSMC's revenue is also expected to decrease, which will reduce utilization of the foundry's N7 capacity to around 70% in Q4 2022 and 1H 2023, according to analysts from .

Slowing Down Capacity Expansion and How It Affects Macs

Analysts believe that TSMC's CapEx reductions will slowdown capacity expansion for TSMC's N6/N7 production nodes, one the company's most important revenue contributors today. Meanwhile, since the foundry will have spare N7-capable capacities in the coming quarters, it will redeploy some of these production lines to make advanced chips on its N4/N5 nodes.

"TSMC will redeploy some N6/N7 idle capacity for N4/N5 and slow Fab 22 expansion (built for N7/N28)," wrote analyst Szeho Ng in a note to clients.

While the company said nothing about slowing down capacity expansion for N5 family of fabrication processes, it said that it expects N6/N7 demand to pick up in the second half of 2023, which is when utilization rates of N7-capable product lines increases.

Meanwhile, it is unclear how the CapEx cut will affect ramp up of the company's N3 (3 nm-class) family of fabrication technologies. And this is where it concerns Apple: we have no idea what it produces at N3. Apple may use N3 for its PC-bound processors. Those Macs may well not end up in in the popular things like Mac Mini, MBA, or MBP 13 Pro, but there are expensive Mac Studio and MacBook 14/16 machines that could absorb the cost. Yet the thing is, nobody knows what Apple plans to do. All we know is based on comments from the China Renaissance financial analyst firm which tends to be accurate, but it is not an official source.

"We expect 2023 CapEx to be flat," wrote the analyst. "We expect 2023 CapEx focus will be to get ready for future N4/N5 demand waves with Qualcomm/Nvidia planning moves from [Samsung Foundry]. The pace of TSMC's N3 buildout plans is more muted, behind N5/N7 expansion pace at similar stages of ramp-up given an initial concentrated clientele and cost concerns.