You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

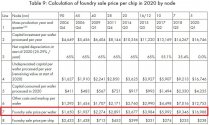

The revenue of SMIC's SN fab in first half of the year is USD 800 million. Assume sales price of single 14nm wafer is USD 4,000, the output estimated is close to 35,000 wafers per month. If we take 7nm into consideration, it safe to say the output is close to 30,000 wafers per month.

Also, the biggest customer of SMIC's 14nm process is Phytium.

@tphuang

Also, the biggest customer of SMIC's 14nm process is Phytium.

@tphuang

Attachments

A Dutch in a Japanese camp? That means he was in Indonesia back then, whoa.Interesting, ASML founder was in a Japanese prison camp as a child.

Well is fair to say that the man got his revenge.

View attachment 98910

SK Hynix and Samsung spared from the brunt of new restrictions on memory chipmakers

"license requests to sell equipment to foreign companies (Samsunk and SK Hynix) making advanced memory chips in China will be reviewed on a case by case basis,"

"They (Samsunk and SK Hynix) still worry, however, that the case-by-case review standard is far from an explicit greenlight for U.S. equipment to be shipped to their Chinese facilities and could result in bickering with regulators over what shipments to approve."

Of course they are worried! And rightly so.

This gives US regulators a tool to blackmail them on possibly totally unrelated stuff, like their investments in US. The obvious final goal of US is to force Samsung and SK to abandon China or at least to stop expanding there. We are still far from that, but that's the direction, so they will move toward that goal step by step.

Us will force all foreign firms to choose side, and it must be the right side!

China cannot count on Korea and Taiwan firms to resist, because they won't. And regarding ASML, it is already a miracle to me that still has not crumbled to pressures. I'm impressed by ASML and Holland government, but how much longer can it go?

After military and space technology, semiconductor manufacturing is the next market where US is pursuing total decoupling. China can only count on itself reaching full and total technology independence as fast as it can, as it did in military and space, but this time the scale is much much bigger and especially the time pressure is hugely bigger. Delaying a space mission or a new aircraft carrier by some years is not so painful, but leaving hundreds of Chinese advanced design and fabless firms without foundry services is life-threatening, firms cannot survive without revenues.

Born in Dutch colony of Batavia (present day Jakarta)A Dutch in a Japanese camp? That means he was in Indonesia back then, whoa.

Bro they are working with ASML, with huge profit why not de Americanized their production in China? use Gigaphoton instead of Cymer I'm talking DUVL of course and of Chinese equipment, we're living in interesting time as always there is an opportunity to those who are brave enough to exploit it. IF they really value its Chinese market, they should invest in Chinese equipment makers, work with them, use their equipment and make some chips, Period!"license requests to sell equipment to foreign companies (Samsunk and SK Hynix) making advanced memory chips in China will be reviewed on a case by case basis,"

"They (Samsunk and SK Hynix) still worry, however, that the case-by-case review standard is far from an explicit greenlight for U.S. equipment to be shipped to their Chinese facilities and could result in bickering with regulators over what shipments to approve."

Of course they are worried! And rightly so.

This gives US regulators a tool to blackmail them on possibly totally unrelated stuff, like their investments in US. The obvious final goal of US is to force Samsung and SK to abandon China or at least to stop expanding there. We are still far from that, but that's the direction, so they will move toward that goal step by step.

Us will force all foreign firms to choose side, and it must be the right side!

China cannot count on Korea and Taiwan firms to resist, because they won't. And regarding ASML, it is already a miracle to me that still has not crumbled to pressures. I'm impressed by ASML and Holland government, but how much longer can it go?

After military and space technology, semiconductor manufacturing is the next market where US is pursuing total decoupling. China can only count on itself reaching full and total technology independence as fast as it can, as it did in military and space, but this time the scale is much much bigger and especially the time pressure is hugely bigger. Delaying a space mission or a new aircraft carrier by some years is not so painful, but leaving hundreds of Chinese advanced design and fabless firms without foundry services is life-threatening, firms cannot survive without revenues.

Memory segments are highly commoditized, are highly sensitive to supply/demand dynamic and thus very cyclical. The last memory down cycle was in 2019, so them hitting down cycle now is not a surprised. But, due some stockpiling, the oversupply situation seems to be a bit worse this time as reflected by the memory bit price.The South Koreans are able to convinced the American to spare them from any restriction to sell the Chinese BECAUSE

1 hour ago — U.S. suppliers seeking to ship equipment to China-based semiconductor firms would not have to seek a license from the Commerce Department if ...

Their business sales are crumbling!

47 minutes ago — Samsung's chip profits suffered from plunging memory chip prices due to weakening demand for consumer electronics, hurt by rising inflation, ...

15 minutes ago — Samsung Electronics Co. reported its first profit drop since 2019, underscoring the depth of a global PC and memory chip downturn.

Meanwhile on the other side of the pond.

while incurring anemic sales with quarterly decrease of nearly 20%

7 days ago — Micron Technology MU ended fiscal 2022 on a disappointing note as fourth-quarter earnings and revenues declined on a year-over-year basis.

So where did they get the confidence? Micron for me is America unwanted child, the US are focus on saving and nurturing Intel and Micron new FAB is a way of getting attention to seek gov't subsidies, they can't compete with the Koreans and with the exemption they're not competitive in the Chinese market with added geopolitics uncertainty.

But, this cyclicality does not impact the long term outlook of the semiconductor industry. With AI & ML accounting for a larger share of investment in servers, this is also very favorable for the memory guys. AI & ML servers requires 2x-3x more memory compare to a "normal" server. Along with the electrification of just about everything, memory and storage class memory are also expected to continue to increase over time. So the long term outlook for the memory guys are very good. I don't see it as a surprise that Micron is making long term investment plan.

Samsung/SK Hynix/Micron had all cut CAPEx for 2023, but this is merely a slowing down of investment or delayed spending. So, shouldn't confuse short term versus long term investment/spending plan.

One other point, the memory segments are cyclical, but this is not as much of a case with MPU (Intel) & the foundries. Their business are not immune to a global recession, but the swing is not as big as with the DRAM or 3D-NAND guys. Any pull-back in revenue or profit, especially for the big guys, is not as pronounced. While we see/expect all the memory guys to have less than stellar quarterly report, I think tsmc will report another record quarterly performance in a few weeks.

I am concerned that your sources are revealing too much information. I'm OK with public info, but some of this is shining a light on targets for America to attack. For example, the CAA FET DRAM briefly mentioned appeared to be still in research until you mentioned Swaysure actually working on what sounds like at least prototypes of this. If this CAA FET IGZO DRAM is a thing, it would catapult Huawei into the DRAM market with competitive density, power and performance. It's proprietary tech that would normally only be known about from industrial espionage. Be mindful of what should and shouldn't be said.Bro from @Oldschool (I hope he rejoin this forum)

@Oldschool shared with me news that Huawei will be getting wafers from PXW, JHICC, and Huawei’s Ningbo fabs. He also mentioned Huawei is asking JHICC to switch to Logic manufacturing.

And one more from one of our esteem member.

since I first share info in Shenzhen fabs with you, I learned SMIC was a bit upset that Shenzhen government transfer some resources originally intended for SMIC to PXW/PXX. So some in SMIC camp are not bullish on PXW. So I was incorrect to assume PXW will receive 14/7nm technology from SMIC.

there’s another DRAM fab called Swaysure that’s also working close with Huawei. Swaysure is the one pursuing the IGZO memory (the tech that @tokenanalyst shared yesterday). This fab’s wafer is intended for Huawei.

Your source is revealing connections to Huawei and basically making targets for the Americans to attack. Everybody knows America has gone full kamakazi. Let's at least not help them while they are at it. Reveal only public info, or reveal new info after it no longer matters.all these fabs are actively recruiting. My customers and myself included were all recruited and from the exchange it’s clear all these outfit are either Huawei incognito, backed by Huawei, or at the very least with main purpose on supporting Huawei. The connection to Huawei is undeniable and significant.

with their relationship to Huawei coming to light, I don’t know how this will impact their existing effort to procure western equipments. That’s a concern.

This is why I don't link some companies that make niche components. Better safe than sorry to prove a point.I am concerned that your sources are revealing too much information.

antiterror13

Brigadier

A Dutch in a Japanese camp? That means he was in Indonesia back then, whoa.

Yes, he was born in Batavia (now Jakarta, the capital of Indonesia)

- Status

- Not open for further replies.