they launched 28nm measuring device in June.... they are also working on EUV... expect good news from themOur guys from Jinhua still fighting and getting their goods. They have bought lot of CD and thin film measurement equipment, they used to get those from KLA i think now is Shanghai Jingce the ones supplying those.

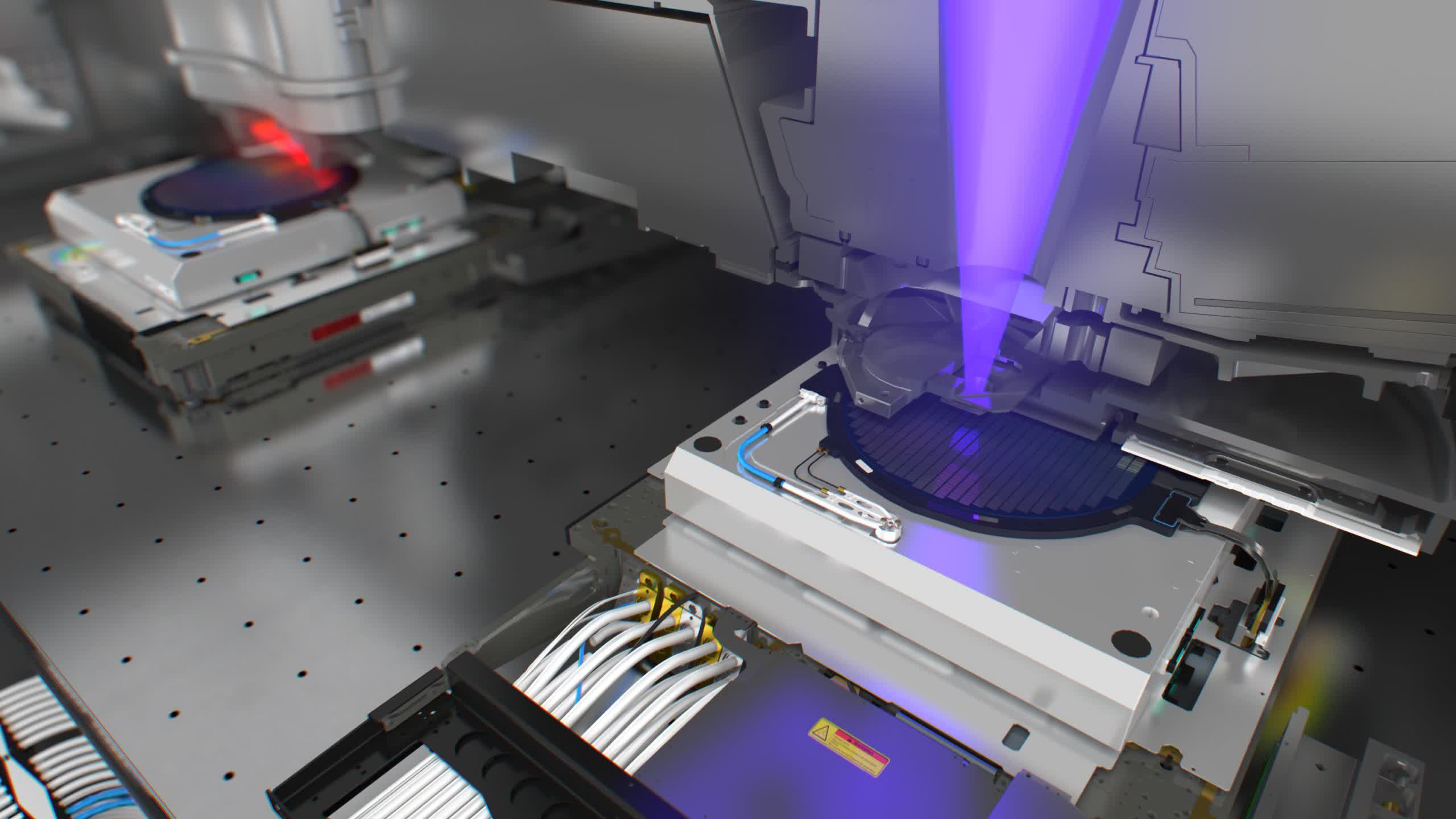

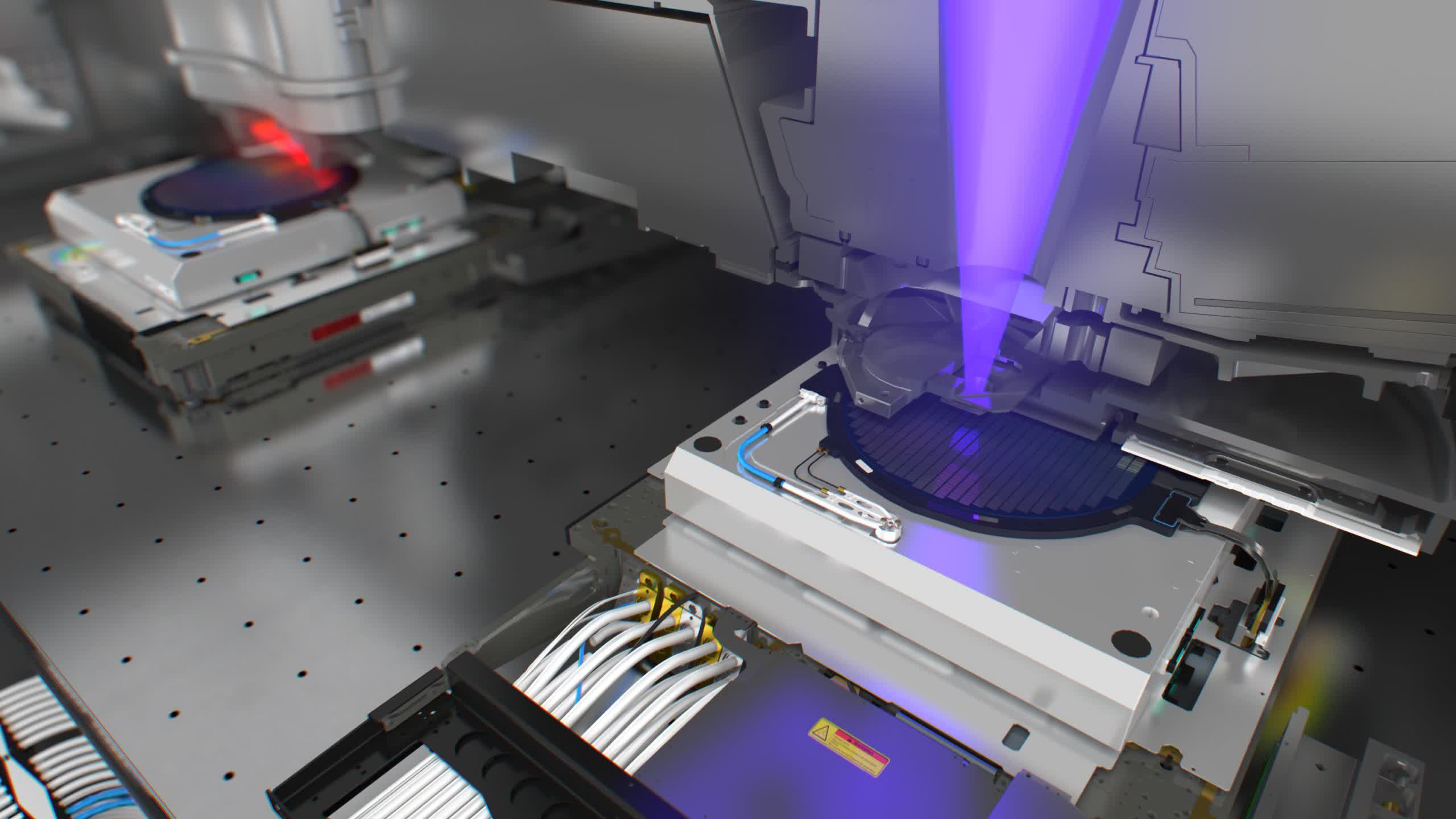

View attachment 97938

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

Bro a major Tsunami is when Huawei officially announce the launching of its 14nm 3D chiplet or better a 7nm chip, Let's see the reaction of American official, maybe they will sanction the word Huawei or the letter H...lolJinhua will be a living testament to how far the SEM indigenization drive would go, because they would have to use all domestic equipment.

12nm chiplet+3DIC... but I'm not sure about it.Bro a major Tsunami is when Huawei officially announce the launching of its 14nm 3D chiplet or better a 7nm chip, Let's see the reaction of American official, maybe they will sanction the word Huawei or the letter H...lol

I think they can still buy from TEL, but that company is warning tale to Chinese companies about the risk of complacency and leaving the fate of your company at the mercy of the ideologues in the White House. There are engineers and managers in China, especially Taiwanese, that prefer to use mainstream tools and software and they push back against any localization, but is still a risk.Jinhua will be a living testament to how far the SEM indigenization drive would go, because they would have to use all domestic equipment.

Sometimes is better to do two step back to do a jump forward than directly doing the jump forward and ending up falling.

The Biden Administration are the moderates, if Trump wins in 2024 is going to be pandemonium in the semiconductor industry.I think they can still buy from TEL, but that company is warning tale to Chinese companies about the risk of complacency and leaving the fate of your company at the mercy of the ideologues in the White House. That there are engineers and managers in China, especially Taiwanese, that prefer to use mainstream tools and software and they push back against any localization, but is still a risk.

Sometimes is better to do two step back to do a jump forward than directly doing the jump forward and ending up falling.

Yup some members post about the US Sanction Policy without any reverse gear, well there are many enlightened American pundits that are questioning the effectiveness of such policy BUT they are in the minority cause the issue is more about PRIDE than rational thinking.

Why it matters: Earlier this month, the US government the sale of specific chips to anyone in China. We see this as an important change by the government in the tactics they are deploying. The United States has gone from blocking specific companies in China, to blocking all companies and focusing on specific products. This is a big change, and opens up the question -- what exactly are they hoping to achieve? This matters obviously in that it can help us predict the outcome, but we increasingly hold the view that the government may not have entirely thought through how this will ultimately play out.

Some background. The US has been against China's trade practices, going back to the late Obama administration, with a marked escalation by his successor. The Biden administration appears to be maintaining that path, albeit with some rethinking of the tactics.

Until just recently, the US government had largely relied on its "Entity List" (), for those keeping score at home, there are 183 Huawei entities on the list. This blocks specific companies from purchasing products exported from the US, or produced by US companies and/or IP.

Editor's Note:

Guest author is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

The entity list process is unlikely to be remembered for its success. As soon as a large number of large Chinese companies started appearing on this list around 2017-2018, US companies dispatched teams of lawyers and lobbyists to poke as many loopholes as they could.

From the Chinese perspective, the entity list appeared terrifyingly random. True, was a primary target, but many other companies ended up on the list for reasons not entirely clear to them. We have spoken with many people at Chinese companies who have grown incredibly wary of doing business with anyone in the US for fear that they will somehow end up on the list. This has created a high degree of uncertainty and a rush for alternatives, a topic which we will return to below.

Late last month, the US government added to the list, and judging from those names we have to question who is compiling this list. These latest additions all appear to be involved with aerospace matters, and while they have academic connections, the fact that all seven have Unit number designations seems to indicate that these are military affiliates, if not outright units of the People's Liberation Army (PLA).

We are now six years into this process, how are these units just now being added to the list? Judging by what came next, we have to think that the people putting the list together realized they faced a hopeless task. Chinese companies have become incredibly adept at creating , making tracking their affiliations close to impossible. Our guess is that someone in the government realized the futility of this approach and made the decision to instead switch to banning shipments of specific products.

The latest approach targets high-end chips used for . These are the kinds of chips that can be used to create AI enhancements for search algorithms and finding users who want to watch dancing kitten videos. They are also the kinds of chips that can be used to simulate missile trajectories and nuclear explosions.

From what we can tell, the US government, in all of this, is trying to limit the ability of the PLA and its many affiliates from accessing the latest in US technology. The war in Ukraine has highlighted the US' military advantage rests largely on its access to the most advanced technology. Of course, there is more to it, but this is something that the US military relies on heavily. Seeing China's military as an increasing threat, it makes sense that the US does not want to do anything to help China dilute this advantage.

So in our opinion, the latest switch to banning products marks a meaningful expansion of the US government's efforts. Will this work any better than the entity list?

We are skeptical.

First, as noted above, the biggest force working to dilute past efforts was US companies themselves. Nvidia's shares fell on the latest news, and they warned of a $400 million revenue shortfall resulting from the ban. Maybe this will work for these specific chips, but we think further expansion will meet with stiff resistance from the home front.

Secondly, how will this work in a modern supply chain? Let's say a US company wants to buy a few million dollars worth of banned Nvidia chips. Who will then assemble the chips into working systems, inserting the chips onto motherboards and installing those in server racks? Today, most of that work is done by Taiwanese companies' factories in China. Can Nvidia ship those chips to China? Technically, we think the answer is yes, but it is easy to see how this process can get easily derailed.

Third, this is a short-term move, but it has long term consequences. As we noted above, every Chinese company buying parts from US vendors is now busy looking for domestic alternatives. We have written a lot about the fabless firms, including a host of companies producing GPUs not too dissimilar from what the US government just banned (not the same, but getting closer all the time). The US government's actions are directly leading to interest in a sea of aspiring Nvidia competitors. , the US government's actions are a major boost.

And those are just the first order effects. Stratechery recently , noting that one of Nvidia's biggest advantages in the market for AI chips is its CUDA software. It is now highly unclear what the status of this software is in China. This will certainly increase interest in open source alternatives to CUDA. So not only is Nvidia losing out in direct sales, it now risks seeing its competitive advantage being worn away.

This also extends beyond the GPU/AI semiconductor space, it applies to all US semis, what we would call third order effects. All Chinese companies, even those with absolutely no ties to China's military now have to look for alternative vendors. This is not patriotism, it is just rational commercial contingency planning. The effects are most likely to be felt first in industrial and automotive semis -- i.e. far away from leading edge GPUs, as this is the area where China's aspiring chip companies look most competitive today. We are going to keep an eye on companies like Texas Instruments and On semi's comments about China in coming quarters.

So while we understand the US government's interest in curbing the supply of high technology to a potential long-term adversary, we have to wonder if over that long-term this works to China's advantage. There are no simple answers to this problem. That said, the US government needs to think very strategically here. Is the goal to limit specific Chinese military projects? Is it to cripple the entire Chinese semis complex? Is there even an end goal? From what we can tell right now, that does not seem to be the case.

US-China semiconductor battle: Second and third order consequences

Not so obvious ripple effects

By Today 1:27 PM

Why it matters: Earlier this month, the US government the sale of specific chips to anyone in China. We see this as an important change by the government in the tactics they are deploying. The United States has gone from blocking specific companies in China, to blocking all companies and focusing on specific products. This is a big change, and opens up the question -- what exactly are they hoping to achieve? This matters obviously in that it can help us predict the outcome, but we increasingly hold the view that the government may not have entirely thought through how this will ultimately play out.

Some background. The US has been against China's trade practices, going back to the late Obama administration, with a marked escalation by his successor. The Biden administration appears to be maintaining that path, albeit with some rethinking of the tactics.

Until just recently, the US government had largely relied on its "Entity List" (), for those keeping score at home, there are 183 Huawei entities on the list. This blocks specific companies from purchasing products exported from the US, or produced by US companies and/or IP.

Editor's Note:

Guest author is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

The entity list process is unlikely to be remembered for its success. As soon as a large number of large Chinese companies started appearing on this list around 2017-2018, US companies dispatched teams of lawyers and lobbyists to poke as many loopholes as they could.

From the Chinese perspective, the entity list appeared terrifyingly random. True, was a primary target, but many other companies ended up on the list for reasons not entirely clear to them. We have spoken with many people at Chinese companies who have grown incredibly wary of doing business with anyone in the US for fear that they will somehow end up on the list. This has created a high degree of uncertainty and a rush for alternatives, a topic which we will return to below.

Late last month, the US government added to the list, and judging from those names we have to question who is compiling this list. These latest additions all appear to be involved with aerospace matters, and while they have academic connections, the fact that all seven have Unit number designations seems to indicate that these are military affiliates, if not outright units of the People's Liberation Army (PLA).

We are now six years into this process, how are these units just now being added to the list? Judging by what came next, we have to think that the people putting the list together realized they faced a hopeless task. Chinese companies have become incredibly adept at creating , making tracking their affiliations close to impossible. Our guess is that someone in the government realized the futility of this approach and made the decision to instead switch to banning shipments of specific products.

The latest approach targets high-end chips used for . These are the kinds of chips that can be used to create AI enhancements for search algorithms and finding users who want to watch dancing kitten videos. They are also the kinds of chips that can be used to simulate missile trajectories and nuclear explosions.

From what we can tell, the US government, in all of this, is trying to limit the ability of the PLA and its many affiliates from accessing the latest in US technology. The war in Ukraine has highlighted the US' military advantage rests largely on its access to the most advanced technology. Of course, there is more to it, but this is something that the US military relies on heavily. Seeing China's military as an increasing threat, it makes sense that the US does not want to do anything to help China dilute this advantage.

So in our opinion, the latest switch to banning products marks a meaningful expansion of the US government's efforts. Will this work any better than the entity list?

We are skeptical.

First, as noted above, the biggest force working to dilute past efforts was US companies themselves. Nvidia's shares fell on the latest news, and they warned of a $400 million revenue shortfall resulting from the ban. Maybe this will work for these specific chips, but we think further expansion will meet with stiff resistance from the home front.

Secondly, how will this work in a modern supply chain? Let's say a US company wants to buy a few million dollars worth of banned Nvidia chips. Who will then assemble the chips into working systems, inserting the chips onto motherboards and installing those in server racks? Today, most of that work is done by Taiwanese companies' factories in China. Can Nvidia ship those chips to China? Technically, we think the answer is yes, but it is easy to see how this process can get easily derailed.

Third, this is a short-term move, but it has long term consequences. As we noted above, every Chinese company buying parts from US vendors is now busy looking for domestic alternatives. We have written a lot about the fabless firms, including a host of companies producing GPUs not too dissimilar from what the US government just banned (not the same, but getting closer all the time). The US government's actions are directly leading to interest in a sea of aspiring Nvidia competitors. , the US government's actions are a major boost.

And those are just the first order effects. Stratechery recently , noting that one of Nvidia's biggest advantages in the market for AI chips is its CUDA software. It is now highly unclear what the status of this software is in China. This will certainly increase interest in open source alternatives to CUDA. So not only is Nvidia losing out in direct sales, it now risks seeing its competitive advantage being worn away.

This also extends beyond the GPU/AI semiconductor space, it applies to all US semis, what we would call third order effects. All Chinese companies, even those with absolutely no ties to China's military now have to look for alternative vendors. This is not patriotism, it is just rational commercial contingency planning. The effects are most likely to be felt first in industrial and automotive semis -- i.e. far away from leading edge GPUs, as this is the area where China's aspiring chip companies look most competitive today. We are going to keep an eye on companies like Texas Instruments and On semi's comments about China in coming quarters.

So while we understand the US government's interest in curbing the supply of high technology to a potential long-term adversary, we have to wonder if over that long-term this works to China's advantage. There are no simple answers to this problem. That said, the US government needs to think very strategically here. Is the goal to limit specific Chinese military projects? Is it to cripple the entire Chinese semis complex? Is there even an end goal? From what we can tell right now, that does not seem to be the case.

Last edited:

China is using a strategy of taking 1 step back, 10 steps forward, they let Huawei be destroyed so that Huawei can be the "core" for China... and China does not respond to apple at this time, which is very right for Apple's investment capital. into domestic supply chains is helping China a lot...and the chip supply chain needs time to mature. I used to war on weibo, twitter about this.... they said China was weak..because China doesn't pay back apple.

Given Huawei is still one of the largest R&D spenders in the world (working on 6G among many other important things), a major cloud service provider (like AWS), we will soon have mate 50 pro, honor got spun off, and harmonyOS is likely going into all Chinese android phones (huge blow to Google), it's a little too soon to say anything about Huawei's fate. They have mostly moved out of the B2C space and into the B2B space, so their visibility (or lack thereof) on store shelves does not reflect their size, success, or importance.

I use harmonyOS 2.0 and it beats the shit out of both iOS and Android. Not to mention mate 50 pro will be 3.0

I use harmonyOS 2.0 and it beats the shit out of both iOS and Android. Not to mention mate 50 pro will be 3.0

Bro you misunderstand what @olalavn post meant, by letting Huawei "Suffer", they have become the Vanguard of China Tech development. The Chinese had the weaker hand and to overcome they need to be rationale and creative, being emotion is the worst thing to be in cause it only harm yourself with delusionary goal to justify your angst.Given Huawei is still one of the largest R&D spenders in the world (working on 6G among many other important things), a major cloud service provider (like AWS), we will soon have mate 50 pro, honor got spun off, and harmonyOS is likely going into all Chinese android phones (huge blow to Google), it's a little too soon to say anything about Huawei's fate. They have mostly moved out of the B2C space and into the B2B space, so their visibility (or lack thereof) on store shelves does not reflect their size, success, or importance.

I use harmonyOS 2.0 and it beats the shit out of both iOS and Android. Not to mention mate 50 pro will be 3.0

And rightly so the CCP behind the scene is helping Huawei by all means possible and usually a cornered prey will fight back and fight back hard.

Please, let's stop with this self pity about Huawei. They are certainly not the vanguard of Chinese tech development.Bro you misunderstand what @olalavn post meant, by letting Huawei "Suffer", they have become the Vanguard of China Tech development. The Chinese had the weaker hand and to overcome they need to be rationale and creative, being emotion is the worst thing to be in cause it only harm yourself with delusionary goal to justify your angst.

And rightly so the CCP behind the scene is helping Huawei by all means possible and usually a cornered prey will fight back and fight back hard.

China has plenty of well run companies that are doing great development work. Just in IC, what SMIC has done with no access to EUV and limited access to sub-14 nm machines have been very impressive. What Biren Technology just managed to achieve in 3 years is quite astonishing. There are no shortage of great stories in Chinese IC industry. Huawei is just a cog in the IC industry. Let's see if they can get the chip/OS into the desktop replacement program first.

- Status

- Not open for further replies.