what companies do you think can become IDMs?Bro Don't worry from the horse mouth itself CGTN, China complained is SOP since they're specially mention regarding the Chip Bill BUT deep inside there is smugness as in telling the Americans "Go Ahead Punk, Make My Day"...lol

China's IDM enterprises confident of achieving chip self-sufficiency

By Zhao Chenchen, Zhao Yuxiang

Editor's note: This report focuses on Quanzhou as part of our special series, "Rising Star Cities," about Chinese cities whose annual GDP exceeds 1 trillion yuan ($155 billion). At the end of 2021, there were 24 such cities. Click for more stories on Quanzhou, an ancient trading hub known for its cultural diversity. You can also explore our earlier coverage of , and .

With the recent $280 billion U.S. CHIPS and Science Act signed off by President Joe Biden, the competition between the U.S., China, the European Union, and other East Asian countries to shore up their semiconductor capabilities has become increasingly fierce. After a global chip shortage and amid a scarred post-pandemic economy, the shortages are now spreading from autos to smartphones and displays, elevating semiconductors onto the agendas of governments from Washington to Brussels and Beijing.

The big chip race

Apart from the United States, which allocates $52 billion in funding from the act for its own semiconductor manufacturing, other major economies have also rolled out packages to boost domestic semiconductor production and research.

The European Union outlined a €43-billion ($49 billion) bundle from public and private funding for the sector in February and the Japanese government has approved investment totaling 774 billion yen ($6.8 billion) for its domestic chip industry. South Korea aims to attract roughly $450 billion in private investment to build the world's biggest chipmaking base over the next decade.

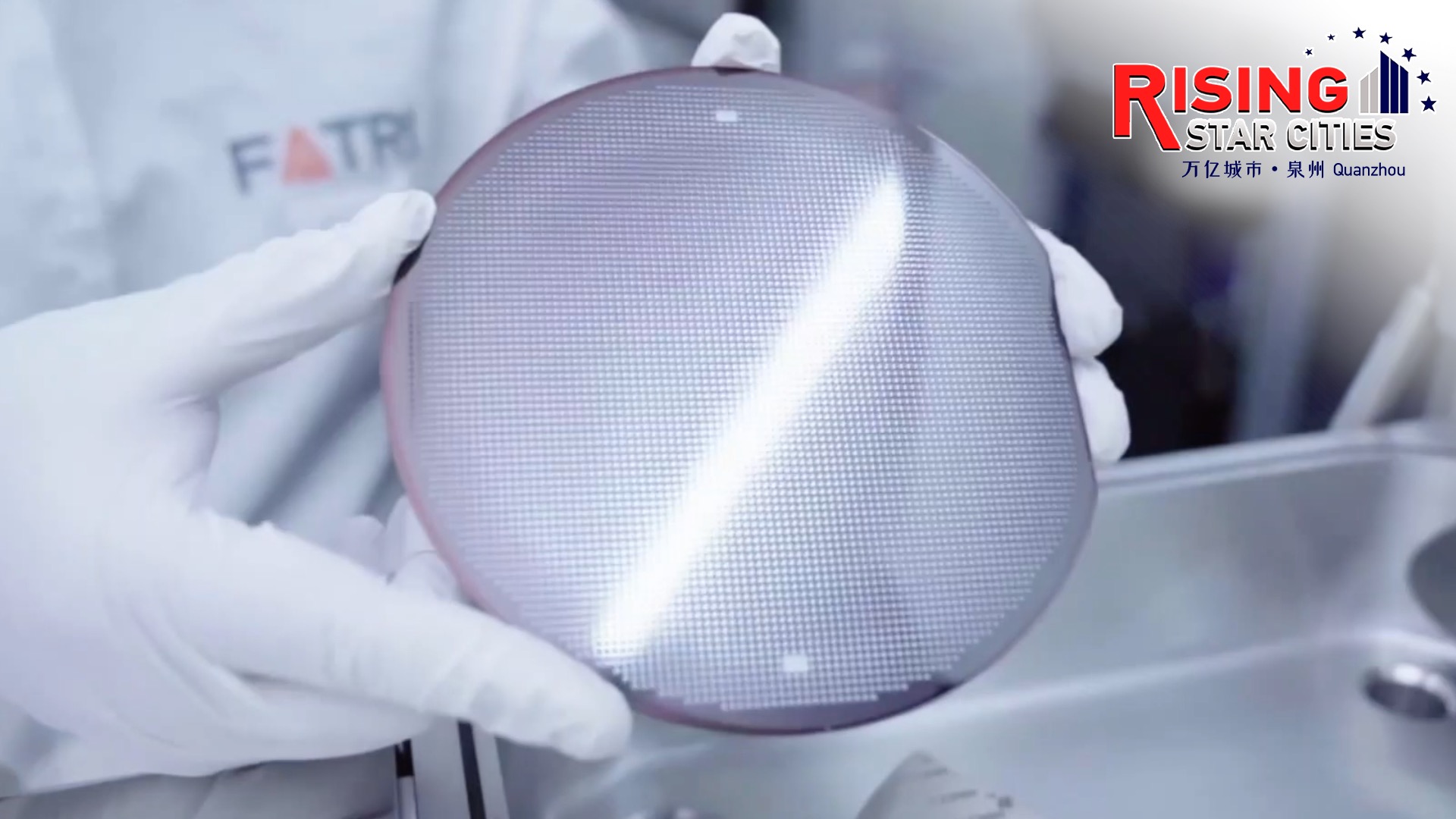

"I think that this is a war for our chip industry," said Nie Yongzhong, CEO of semiconductor company FATRI Group based in Quanzhou, southeast China's Fujian Province.

FATRI, or Future Advanced Technology Research Institute, is an integrated device manufacturer (IDM) for sensor chips with comprehensive capabilities from chip design to manufacturing, packaging, and testing.

Where will China stand?

For now, most chip manufacturers that qualify as IDMs are in the U.S., the EU, and East Asia, but Nie believes that China needs and has the potential to incubate more of them.

"I think our current shortage exists because we need more IDM (enterprises)," he said.

EDA is a software analysis tool crucial used by chip designers across the entire semiconductor chip chain.

On August 12, the U.S. Bureau of Industry and Security announced a new ban on exporting EDA software for making 3nm and more advanced chips to China. The banned EDA software for gate-all-around field effect transistor (GAAFET) is the next-generation semiconductor tech that can help chips achieve a higher frequency and lower power consumption.

It is a highly advanced technology that has only been adopted by Samsung so far, while Intel and Taiwan Semiconductor Manufacturing Company (TSMC) are planning to use it.

An analyst told Chinese business news outlet Caixin that the ban will have a limited effect on China in the short term but will restrain China's development in advanced chip-making.

Foreign firms took 77 percent of the EDA market in China in 2020, according to China's CCID Consulting. However, local EDA providers like Primarius Technologies claimed they had "formed core key tools that can support advanced process nodes such as 7nm, 5nm, and 3nm," according to its company website.

However, Nie thinks the ban would further boost China's capability to achieve chip self-sufficiency as "IDMs can build their own integrated circuit (IC) databases, which will also boost the development of EDA companies."

Nie believes that the advancement of IDMs would also foster the growth of chip design talent, who would, by that time, contribute in building China's own fabrication facilities (fab), or outsourced production companies, with core intellectual property rights.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

First on my list is Huawei, second will be BYD , IF the 2 of them become successful others will follow as like @tphuang once said all Chinese company are competing against each other, with adversarial political climate, everybody wanted to be self sufficient to survive. And with it the growth of domestic suppliers and the cycle will continue, IF you have success in China the ROW is easy picking.what companies do you think can become IDMs?

How about you bro, what's your pick?

BYD is technically an IDM - their fab makes what they design. But then technically Bosch, Medtronics, LG, etc are IDM too because they also have an internal fab... that doesn't make much sense.First on my list is Huawei, second will be BYD , IF the 2 of them become successful others will follow as like @tphuang once said all Chinese company are competing against each other, with adversarial political climate, everybody wanted to be self sufficient to survive. And with it the growth of domestic suppliers and the cycle will continue, IF you have success in China the ROW is easy picking.

How about you bro, what's your pick?

IDMs are typically defined as a fab that sells their products to external customers. By that token, I'd say Huawei is gonna be an IDM. One horse to watch: Tsinghua Unigroup. They have logic designer - UNISOC. They have fab (though not logic): YMTC. Now if they can translate their memory production capability to logic production, they can make UNISOC an IDM.

Is this true? Does this mean domestic EDA alternatives can fully go head to head with Cadence and Synopsis in all spheres? Or only some preliminary breakthroughs have been done similar to the progress in EUV?local EDA providers like Primarius Technologies claimed they had "formed core key tools that can support advanced process nodes such as 7nm, 5nm, and 3nm," according to its company website.

Well my friend with the help of google here's what they provide me,Is this true? Does this mean domestic EDA alternatives can fully go head to head with Cadence and Synopsis in all spheres? Or only some preliminary breakthroughs have been done similar to the progress in EUV?

As a leader in large-scale and high-performance circuit simulation, advanced device modeling and semiconductor parametric testing, Primarius is committed to ...

·

Since its inception, Primarius has been focusing on the independent design and research and development of EDA tools. It has mastered the core EDA technology ...

Primarius delivers innovative EDA solutions to tighten the linkage between advanced process development and high-end chip designs.

Stock Symbol: SSE:688206

Company Type: For Profit

Founders: Zhihong Liu

Contact Email: [email protected]

Primarius Technologies Co., Ltd. develops application products. The Company produces manufacturing electronic design automation tools, design electronic ...

ADDRESS: 9F Building 4 26 Qiuyue Road Zha...

And aside from Primarius Technologies there are about 30 more and I know Huawei itself had develop an EDA for 7nm, so a door close another one open.

According to , China currently has about 30 EDA software firms, including Primarius Technologies, Empyrean Technology, Semitronix, SMIT Holdings, Xpeedic and Xepic Corp. They are specialized in some chip-design procedures but have not yet been able to provide a full range of EDA software.

Founded in 2009, Empyrean Technology on the Shenzhen stock exchange last month with a market cap of 37.5 billion yuan ($5.5 billion). In its listing prospectus, the company said its software could support the design of some, but not all, 5-nm chips.

CCIDnet.com, an IT website owned by China’s Ministry of Industry and Information Technology, said local chip makers’ fundraising activities had significantly increased since 2020, creating more business opportunities for EDA software makers.

3 days ago — According to Yicai.com, China currently has about 30 EDA software firms, including Primarius Technologies, Empyrean Technology, Semitronix, SMIT ...

According to , China currently has about 30 EDA software firms, including Primarius Technologies, Empyrean Technology, Semitronix, SMIT Holdings, Xpeedic and Xepic Corp. They are specialized in some chip-design procedures but have not yet been able to provide a full range of EDA software.

Founded in 2009, Empyrean Technology on the Shenzhen stock exchange last month with a market cap of 37.5 billion yuan ($5.5 billion). In its listing prospectus, the company said its software could support the design of some, but not all, 5-nm chips.

CCIDnet.com, an IT website owned by China’s Ministry of Industry and Information Technology, said local chip makers’ fundraising activities had significantly increased since 2020, creating more business opportunities for EDA software makers.

3 days ago — According to Yicai.com, China currently has about 30 EDA software firms, including Primarius Technologies, Empyrean Technology, Semitronix, SMIT ...

3 days ago — According to Yicai.com, China currently has about 30 EDA software firms, including Primarius Technologies, Empyrean Technology, Semitronix, SMIT ...

Of all the bans, from the Americans trying to subvert Chinese progress in supercomputers, telecommunications, space exploration, and semiconductors, this has to be the worst and dumbest one of all.

All it is, it is software. Just lines and lines of code.

They actually know what that code is suppose to do. Monkey see, monkey do, you know. If Synopsys software has this feature, just code it in.

Problem solved. Where are they gonna find those coders? It's China. Everyone takes math. Lots of geeky computer programmers too. They don't write spaghetti code!

What this software does, it kind of integrates the entire production line. Besides using it to design the chip, the software must work with the equipment. I could be wrong here, since I am not an expert.

It seems like common sense, that if the EDA is capable of doing a 1 billion circuit design, then there has to be a way to interface with the machine to do that in production. No human can do it. It is all machines and software.

The EDA is kind of like the brain of the entire system. It has to work with all parts of it.

At this point, no American EDA means it is completely pointless for Chinese IC companies to try to buy some American machine for IC.

The US government is legislating all US companies IC equipment makers out of the China market with this EDA ban.

Why?

Give it a few months at the most, and they would have pirated or replaced this EDA.

The US government is utterly clueless when it comes to this stuff. Their prized results are:- no more China market, corporate welfare for Intel, and overcapacity.

Like, duh!

Anyone know on how fabs translate EDA output files into a functional product? At my level I can't really see the big picture.

At the simplest, they will recieve a EDA file, then it'll be sent to photomask shop to get the photomasks made. But then what? It looks like the EDA output file doesn't interact with the etch, deposition, clean, develop, etc tools. The fab will just have to arrange the workflow themselves, all the tools know is temperature, gas flow, pressure, time, etc. parameters.

At the simplest, they will recieve a EDA file, then it'll be sent to photomask shop to get the photomasks made. But then what? It looks like the EDA output file doesn't interact with the etch, deposition, clean, develop, etc tools. The fab will just have to arrange the workflow themselves, all the tools know is temperature, gas flow, pressure, time, etc. parameters.

bro The CCP are BRUTAL, they reacted to these ban as IF they are trolling the Americans....lolOf all the bans, from the Americans trying to subvert Chinese progress in supercomputers, telecommunications, space exploration, and semiconductors, this has to be the worst and dumbest one of all.

All it is, it is software. Just lines and lines of code.

They actually know what that code is suppose to do. Monkey see, monkey do, you know. If Synopsys software has this feature, just code it in.

Problem solved. Where are they gonna find those coders? It's China. Everyone takes math. Lots of geeky computer programmers too. They don't write spaghetti code!

What this software does, it kind of integrates the entire production line. Besides using it to design the chip, the software must work with the equipment. I could be wrong here, since I am not an expert.

It seems like common sense, that if the EDA is capable of doing a 1 billion circuit design, then there has to be a way to interface with the machine to do that in production. No human can do it. It is all machines and software.

The EDA is kind of like the brain of the entire system. It has to work with all parts of it.

At this point, no American EDA means it is completely pointless for Chinese IC companies to try to buy some American machine for IC.

The US government is legislating all US companies IC equipment makers out of the China market with this EDA ban.

Why?

Give it a few months at the most, and they would have pirated or replaced this EDA.

The US government is utterly clueless when it comes to this stuff. Their prized results are:- no more China market, corporate welfare for Intel, and overcapacity.

Like, duh!

The US government is utterly clueless when it comes to this stuff. Their prized results are:- no more China market, corporate welfare for Intel, and overcapacity.

Like, duh!

But ...

There seems to be an even bigger geopolitical risk from this EDA ban, for the United States.

The EDA must work with the machine, directly, or indirectly with another piece of software.

Since this is a mature technology, American EDA works with American machine.

So with this EDA ban, then the Chinese EDA will try to work with other machines, non-American machines.

Chinese EDA has to work with non-American machines.

The American can ask no one to work with Chinese EDA.

And there is the big geopolitical headache for the Americans. This is the exact same situation with regards to Russian energy.

Like duh!

If the Americans are willing to give up on the China market for IC equipment, that does not mean anyone else will.

What, are you crazy?

Who are the biggest buyers of IC equipment? The fabs in Asia right?

For this American ban on EDA to really work, they would need to ban all sales of IC equipment to China. It is like the Americans are asking people to ban all commerce with China. The world's biggest trading nation!

This Liberal cancel culture, it has gone too far!

This is stupid, stupid, stupid.

I can't believe I stayed up the extra 15 minutes to write all this crap!

All about stupidity too!

Guess I am stupid too.

Last edited:

- Status

- Not open for further replies.