@Topazchen In a way it may help the Collective West in other areas like wages as supply will outstrip demand, as China is known to provide higher financial packages. Even IF they're able to match the Chinese offer inflation alone will nullify any benefits. So kudos to Ms Tsai for a virgin her China fetish is insurmountable.It's not poaching but recruitment when they move to the US or Japan or South Korea.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

Why has South Korea been so content for all these decades with merely being a maker of IC chips, especially memory chips, while importing the vast majority of the high end equipment and certain materials and substances necessary to make chips, instead of attempting comprehensively to encompass the entire product value chain with regards to semiconductors, starting from the smelting of silica to form silicon, through to refining of silicon and production of silicon ingots, and unto the production of lithographic and etching equipment?Looks like Samsung and SK Hynix will become customers of SMEE

Do you remember in 2019 when Japan decided to punish South Korea for South Korea's stance on the compensation of victims and families of the victims of labour abuse by colonial era Japanese companies, Japan doing so by placing certain restrictions and removing South Korea from a list of countries exempt from necessary licenses to purchase such Japanese substances used to produce IC chips as photoresists, hydrogen fluoride etching gases, and fluorinated polyamides?

Even though subsequent to such action by Japan the then Moon Administration decided to invest heavily in the production of domestic alternatives for such substances and produce more semiconductor manufacturing equipment itself (not necessarily lithographic equipment), it will take a long time for South Korea to be able to produce replacements of quality comparable to those that it sources chiefly from Japan...

The same reason China was content with merely being a chipmaker/back end packager despite semiconductors being designated crucial technology all the way back in 2000 under Jiang. There was no business sense in purchasing unproven SME equipment from domestic companies, let alone expending ridiculous amounts of R&D to replicate the supply chain yourself, so everyone just imported from Japan/US/Europe. At the end of the day the only thing a private company is loyal to is its bottom line, not the national interest, and this is true everywhere around the world.Why has South Korea been so content for all these decades with merely being a maker of IC chips, especially memory chips, while importing the vast majority of the high end equipment and certain materials and substances necessary to make chips, instead of attempting comprehensively to encompass the entire product value chain with regards to semiconductors, starting from the smelting of silica to form silicon, through to refining of silicon and production of silicon ingots, and unto the production of lithographic and etching equipment?

Do you remember in 2019 when Japan decided to punish South Korea for South Korea's stance on the compensation of victims and families of the victims of labour abuse by colonial era Japanese companies, Japan doing so by placing certain restrictions and removing South Korea from a list of countries exempt from necessary licenses to purchase such Japanese substances used to produce IC chips as photoresists, hydrogen fluoride etching gases, and fluorinated polyamides?

Even though subsequent to such action by Japan the then Moon Administration decided to invest heavily in the production of domestic alternatives for such substances and produce more semiconductor manufacturing equipment itself (not necessarily lithographic equipment), it will take a long time for South Korea to be able to produce replacements of quality comparable to those that it sources chiefly from Japan...

This has obviously changed after Trump, who managed to do what no Chinese leader has been able to: galvanize the private sector. Trump showed Chinese companies that business cannot be separated from geopolitics - that their bottom line was at the whim of policy makers in Washington. Since then we have seen unprecedented investment from within the private sector into the industry, all of which is of course happily supported by Beijing through its various research institutes and universities (CAS, C9 League). An industry as complex, R&D heavy, and with as many moving parts as semiconductors requires both public and private investment to succeed, and China in 2022 reflects that environment.

Rapid growth in EDA tool revenue

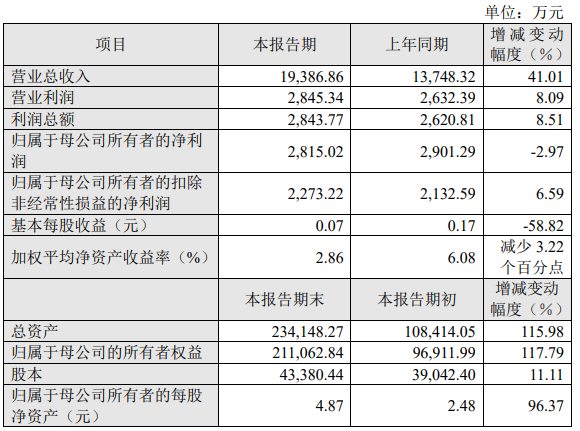

Jiwei.com reported that on April 14, Gelun Electronics (Primarius EDA) released a performance report saying that in 2021, the company's operating income will be 194 million yuan, a year-on-year increase of 41.01%; the net profit attributable to shareholders of the listed company is 281.502 billion yuan, a year-on-year decrease of 2.97%. %.

Gelun Electronics said that during the reporting period, the company increased investment in research and development and gradually promoted the DTCO strategy, and both domestic and overseas revenue achieved rapid growth. Design EDA tools, testing instruments and manufacturing EDA tools have achieved relatively rapid growth. increase. During the reporting period, the company achieved operating income of 193.8686 million yuan, a year-on-year increase of 41.01%.

The net profit attributable to owners of the parent company was 28.1502 million yuan, down 2.97% year-on-year, mainly because the company continued to increase investment in research and development and market expansion, and with the continuous expansion of scale, management and operational support were also strengthened. This led to an increase in various expenses; in addition, non-recurring gains and losses such as government subsidies and wealth management product income in 2020 were relatively high.

According to the data, Gelun Electronics is an EDA enterprise with international market competitiveness. It has leading EDA key core technologies, is committed to improving the overall technical level and market value of the integrated circuit industry, and provides professional and efficient EDA process and tool support. Through EDA methodological innovation, the company promotes the in-depth linkage of integrated circuit design and manufacturing, accelerates the process development and chip design process, improves the yield and performance of integrated circuit products, and enhances the overall market competitiveness of integrated circuit enterprises.

At present, Gelun Electronics has three core technologies of manufacturing EDA technology, design EDA technology, semiconductor device characteristic testing technology and nearly 20 corresponding subdivided products and services.

The EDA tools manufactured by GLOON have the leading technology in the international market and can support advanced process nodes such as 7nm/5nm/3nm and various semiconductor process routes such as FinFET and FD-SOI. These tools have long been used on various process platforms by leading global fabs such as TSMC, Samsung Electronics, UMC, GlobalFoundries, and SMIC, and occupy an important position in their related standard manufacturing processes. The device models generated by these tools are provided to their integrated circuit designers around the world through the above-mentioned international leading fabs, and their comprehensiveness, accuracy and quality have been verified and widely recognized by the industry for a long time.

Patent revenue soared by 242.72%, VeriSilicon achieved a turnaround in Q1

Jiwei Net News (Text / Chen Wei) On April 14, VeriSilicon released the first quarter performance forecast of 2022, saying that the company expects to achieve operating income of 561 million yuan in the first quarter of 2022, a year-on-year increase of 68.72%; The net profit of the owner of the parent company was 3.2837 million yuan, a year-on-year turnaround, an increase of 71.5289 million yuan compared with the same period of the previous year; net profit after deducting non-recurring gains and losses was -3.3341 million yuan, compared with the same period of the previous year, The amount of loss narrowed to 78.7158 million yuan, a decrease of 95.94% compared with the same period last year.

Regarding the change in performance, VeriSilicon stated that the main reason is that in the first quarter of 2022, the company's operating income has achieved rapid growth, with an expected year-on-year increase of 68.72%, of which intellectual property licensing fee income has increased by 242.72% year-on-year, and royalty income has increased year-on-year. 55.50%, and the revenue of mass production business increased by 33.44% year-on-year.

VeriSilicon said that the company currently owns six types of processor IP, including GPU, NPU, VPU, DSP, ISP, and Display Processor, and more than 1,400 digital-analog hybrid IP and RF IP. In 2021, the company's semiconductor IP licensing business revenue will be 706 million yuan, accounting for 33.01% of the main business revenue. Whether the company's future semiconductor IP licensing business can continue to grow depends not only on whether it can successfully expand new customers and continue to maintain cooperation with existing customers, but also on whether the semiconductor IP owned by the company and to be developed in the future can meet customer needs in terms of performance and use. .

I did not know VeriSilicon had bought Vivante. That was a nice acquisition. Vivante had limited success but they have the kind of low power 3D chipset which you can still use for industrial and embedded applications. You could use this for car entertainment systems, smart TVs, etc.

Also there is relatively extensive software support for it.

Between Vivante and PowerVR I think China managed these GPU technology acquisitions quite well. Compare to the fuss the US made about the FPGA acquisition of Lattice several years back these are a coup really.

PS: Now I see the R&D for Vivante was done in Shanghai despite the HQ being in the US. So it was basically a Chinese company to begin with. Nice move.

Also there is relatively extensive software support for it.

Between Vivante and PowerVR I think China managed these GPU technology acquisitions quite well. Compare to the fuss the US made about the FPGA acquisition of Lattice several years back these are a coup really.

PS: Now I see the R&D for Vivante was done in Shanghai despite the HQ being in the US. So it was basically a Chinese company to begin with. Nice move.

Semicores's CMP moved in SMIC’ FAB7 T3

A few days ago, the CMP developed by Beijing Shuoke Jingwei Electronic Equipment Co., Ltd. (hereinafter referred to as "Shuoke Jingwei"), as the first equipment of SMIC FAB7 T3, was successfully Move in. This is the first time that SMIC has selected domestic equipment as the first equipment to move in, which means that the performance and quality of domestic CMP equipment have reached the advanced level of similar foreign countries, and the pace of domestic substitution has been further accelerated.

The SMIC (Tianjin) FAB 7 T3 production line is a continuation of the T2 production line. It is expected that the total production capacity of FAB in July will reach 180,000-200,000 pieces, and it will become the world's largest 8-inch wafer production base. The T3 production line chose the 8-inch CMP equipment developed and manufactured by Shuoke Microelectronics as the first moving equipment, which is not only an affirmation of the company's equipment quality and overall scientific research strength, but also a trust in the follow-up long-term cooperation.

CMP equipment is one of the seven key equipments for integrated circuit manufacturing and is used for planarization process and copper interconnection process. With the support of the national major science and technology project of "very large-scale integrated circuit manufacturing equipment and complete sets of technology", Shuoke Micro broke the technical blockade, achieved a breakthrough from 0 to 1 in 2017, and successfully developed my country's first machine with completely independent intellectual property rights. 8-inch CMP equipment. Since then, Shuoke Micro has been committed to promoting the self-reliance and self-improvement of domestic CMP equipment, establishing a sound and scientific management system, forming a stable and reliable spare parts system and a timely and effective after-sales service system, breaking through the industrialization bottleneck from 1 to 100, and independently developed CMP equipment meets all complex planarization process requirements in IC manufacturing, and covers 8-inch and 12-inch production lines. It occupies an important share in the domestic CMP market and has successively won the "Best Supplier" of SMIC and the "Excellent Supplier" of the Integrated Circuit Industry Alliance. Supplier" etc. Since November 2017, the shipment of Shuoke Micro CMP has exceeded 100 units.

Funds are in a hurry, projects are delayed, and efficiency is low, and quarantined companies have "difficulty breathing"

Many companies have been working remotely for more than a month since Shanghai advocated working from home due to the intensified community spread of the novel coronavirus Omicron variant. At present, the regional traffic interruption caused by different control measures in various places has seriously affected the normal operation of production-oriented enterprises. In "Channel", the difficulties encountered by production-oriented enterprises have been recorded, opening up the logistics links and ensuring smooth transportation are the necessary conditions for the current production-oriented enterprises to maintain the operation of production lines.

Usually, compared with production-oriented enterprises, production lines need to run 24 hours a day, which consumes a lot of materials. R&D-oriented enterprises represented by chip design companies do not produce their own production, so they are less dependent on logistics. However, with the increasing traffic congestion, logistics is blocked. The impact on R&D enterprises has also begun to appear. Xu Jia, the founder of a radio frequency chip company in Shanghai, told Discovery Technology (ID: techsugar) that because the express delivery was cut off and the wafers could not come in, the project progress had been greatly delayed.

Yang Ying, head of another RF chip company, also said that logistics costs have increased enormously. She said: "The impact of logistics is particularly great. Now everyone is trying to find ways to increase the price of delivery. I asked SF Express in the morning, and they replied that they can charter a car, 40,000 yuan per car." Lv Pingliang, senior R&D manager of an analog chip company, expressed the information on the high freight He confirmed that SF Express's 40,000 yuan chartered car is not expensive. He provided information on the Internet that the current freight rate for a 30-ton truck from Nanjing to Shanghai has risen from less than 4,000 yuan per trip before the epidemic to more than 50,000 yuan. This is mainly because Because the driver has to isolate for 14 days after returning from Shanghai, he could make 30 trips a month before, but now he can only make two trips. The information shows that "the 15-fold increase in shipping costs is just the cost, and the isolation fee is not counted."

In addition to the rising costs brought about by logistical obstacles, working from home has lowered the office efficiency of R&D enterprises. Especially for those who work from home in Shanghai, due to the problem of the supply of living materials some time ago, many people have to participate in group purchases during office hours to "grab food" to maintain the supply of basic household materials. There are many jokes about group purchases and grabbing vegetables circulating on the Internet Although there are exaggerated elements, the inability to guarantee basic living materials has undoubtedly seriously affected the efficiency of home office.

The suspension of offline teaching has forced many home office workers to work in the same area as their children, and their efficiency has also been affected.

However, many Shanghai chip companies have reached out to help their employees after learning about the difficulties in purchasing living materials for their employees at home, and prepared gift packages of anti-epidemic materials for employees, which alleviated the living difficulties of employees at home to a certain extent and helped improve office efficiency.

Another serious impact of working from home on chip design companies is that the company’s instruments and equipment cannot be used at home for development and testing. Most of the instruments used in the development of chip products are expensive and difficult for individuals to purchase. They are only equipped in corporate laboratories or offices. People who are isolated at home cannot leave the community, and it is undoubtedly difficult to carry out research and development work that requires the use of equipment. Xu Jia told Exploration Technology (ID: techsugar): "We make RF chips, at least half of the time is in the laboratory, without testing and debugging, we don't know how to do the circuit, (in this situation) we can only do as much as we can. How many."

Yang Ying also said that many R&D debugging and testing cannot be carried out at home because there are no instruments. Moreover, even if some work does not require equipment, it still requires coordination by many people, and the efficiency of working from home will be particularly low.

Wei Ming, the market leader of a communication chip company in Shanghai, estimated that the project was delayed for at least 2 months, and the cooperation project with customers was affected and cancelled. He was worried: "Under the epidemic, the primary task at home is to follow various groups. The work efficiency is too low, many things will be broken, and the reserves are not enough."

Production disruptions in the supply chain will also affect R&D companies. Since the outbreak of the epidemic in Kunshan, the five-day "quiet period" has been extended twice in a row, which has a great impact on the production of enterprises. It is understood that larger enterprises in Kunshan City, such as Luxshare Precision, Weimeng Electronics, etc., can also rely on government assistance, their own strength and plans to maintain production lines, and adopt closed management in which employees do not leave the dormitory. However, for most small and medium-sized enterprises In other words, if there are no production conditions in the factory, silence means stop production. Kunshan is an important city in the electronics manufacturing industry, with many world-class foundries and many PCB factories. The output value of the electronic information manufacturing industry will exceed 550 billion yuan in 2021. The silence of Kunshan City will definitely affect the upstream and downstream of the industrial chain.

Projects are delayed, materials can’t come in, products can’t go out, shipping costs skyrocket, companies are in an “idling” state, and employee salaries and social security cannot be stopped. Some companies’ cash flow is already in a hurry. If the macro situation does not improve, it is not in the policy Within the scope of rescue, it is likely that this wave of Omicron epidemic will not survive.

Feng Yuezhuo, general manager of a chip company, said that the current salary is still paid, but since April, the performance that can be seen has been greatly reduced, because the client is greatly affected. If the epidemic cannot be controlled in May, only layoffs will be made. .

Among the chip manufacturers interviewed by Discovery Technology (ID: techsugar), most of them are struggling to support, but "idling" is rapidly consuming the vitality of enterprises. If they cannot be replenished in time, these enterprises will inevitably experience "difficulty breathing."

For the bailout policy, getting through the logistics is the first demand of the enterprise, and the lack of logistics is already the first killer that threatens the survival of the enterprise.

In addition, how to maintain the continuous cash flow of enterprises is also extremely important. Social security expenditures are currently a heavy burden for enterprises. Respondents from several enterprises expressed their expectation that the government will introduce policies to reduce or postpone the payment of social security, and some enterprises hope to receive direct financial subsidies. or low-interest loans.

Tax relief and rent relief are also areas that companies hope the government's short-term relief policies can cover.

On April 13, the Small and Medium Enterprises Bureau of the Ministry of Industry and Information Technology released the "Questionnaire on the Impact of the New Round of Epidemic on Small and Medium-sized Enterprises" to collect the problems encountered by small and medium-sized enterprises from the society. Although the power of each of us is negligible, the survey is the correct way to deal with the current epidemic, but it is the correct way to deal with the current epidemic by truthfully feeding back current problems and providing policy makers with a more accurate decision-making basis.

- Status

- Not open for further replies.