Legendary investor Mark Mobius: Don't listen to naysayers; buy China — it's not passe

Bryan Borzykowski, special to CNBC.com

October 26, 2016

If there's one emerging market that investors continue to be worried about, it's

. Growth has slowed over the last few years, its banking sector is mired in debt, and its once mighty investment returns have weakened — the MSCI China index

(MSCI:.MICN0000NGUS)is down about 0.4 percent over the last 12 months.

One legendary emerging markets investor, though, says now is not the time to abandon the Red Giant. In fact, it could be the time to buy in.

Mark Mobius, executive chairman of the Templeton Emerging Markets Group, which has $25 billion in assets under management, has been investing in developing nations since 1987 and

.

Mobius, who in 2006 was named by

Asiamoneyas one of the Top 100 Most Powerful and Influential People and one of the Top 10 Money Managers of the 20th Century by Carson Group in 1999, oversees the Templeton Developing Markets Trust, which has returned 22.39 percent year-to-date. An investor who invested $10,000 in the fund at inception in 1991 would have about $42,500 today, according to Morningstar.

At the moment, he has 21.9 percent of his fund invested in China.

"Sentiment has been very negative towards the country, which is not justified on the ground," he said. "It continues to grow at a very high rate for an economy at that size."

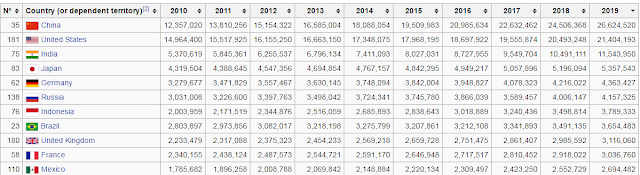

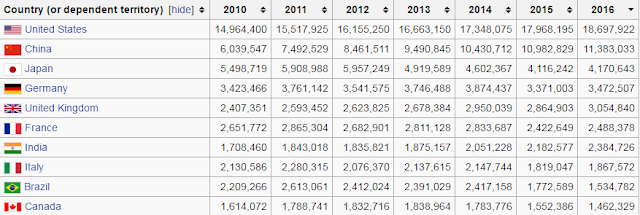

While its GDP isn't expanding at the 10.6 percent rate that it was in 2010, it's still growing far faster than many other countries. On Oct. 18 the National Bureau of Statistics in China revealed that it grew by 6.7 percent year-over-year in the third quarter, which was in line with analyst expectations.

As well, it still has a population of 1.4 billion people, many of whom are now starting to seeing their incomes grow.

"Don't forget that," he said to the many naysayers who think China is passé.

More from Global Investing Hot Spots:

One main concern is around bad debts in China's banking-sector debt, which Fitch says could be 10 times higher than official estimates. However, he says that most of the banks are state-owned enterprises, and the government won't allow its institutions to run into the same kinds of problems that American banks did during the recession.

As well, a number of banks are starting to get those debts off their books by packaging and selling them as asset-backed securities, while others, like China CITIC Bank, are raising money through the bond market to help replenish falling Tier-1 capital.

Going forward, he likes the fact that the country is focusing increasingly more on domestic consumption and that its income per capita is rising — according to

,China's disposable income per capita has climbed from $11,759 to $31,195 over the last decade. That matters because the more money people have, the more they'll spend.

He points to Alibaba

(), a large Hangzhou-based Amazon-like company, as proof that domestic demand is increasing. On Singles Day in 2015 — China's Black Friday, which happens on Nov. 11 — the company made $14.3 billion in sales, or about $10 billion more than every U.S. e-commerce site made on last year's Black Friday combined.

"There's tremendous consumer growth taking place here," he said.

This growth is going to continue, he says, and tells investors that despite what others may say, it's still one of the most attractive emerging markets.

Mobius isn't just bullish on China. Many other emerging markets are also growing rapidly, and witnessing strong domestic growth. He's keen on Vietnam, the Philippines and India, which are all seeing strong economic gains — their GDPs grew by 6.6 percent, 5.8 percent and 7.5 percent, respectively, in 2015.

Many emerging markets in general are also undertaking pro-business reforms, and most have low debt-to-GDP ratios, neither of which was the case when he started investing in these markets nearly 40 years ago.

As well, its citizenry have more influence on their political systems than ever before, he says. With more people connected to the internet — 70 percent of smartphone sales will be in emerging markets this year, said Mobius — they're starting to see how people in other countries live and how their own nations are being treated.