I mean, are we sure we need to deleverage? Deflation makes the company sentiment in China atrocious. The real estate has already fallen to about 18% of GDP from 25% and we don't need any more deleveraging in real estate. The floor sold is below the replacement level, so it will grow a bit higher anyway when the prices stop falling. And if we do stimulus we don't need to put it in real estate.Look at his cartoons. He is advocating higher deficit spending and more debt. He doesn't really know what he wants.

I understand what he is asking for though. He wants a government stimulus to push consumption. Which is this Western trope over the past three years. But that is directly opposite to incurring less debt.

Years before I was advocating that more public debt is bad along with the Austrian School of Economics thought etc. however when I started reading more and more about the MMT theory and looked at its results, I said, damn, how the heck it's working, and the real-life show that's its working. If its working then do it.

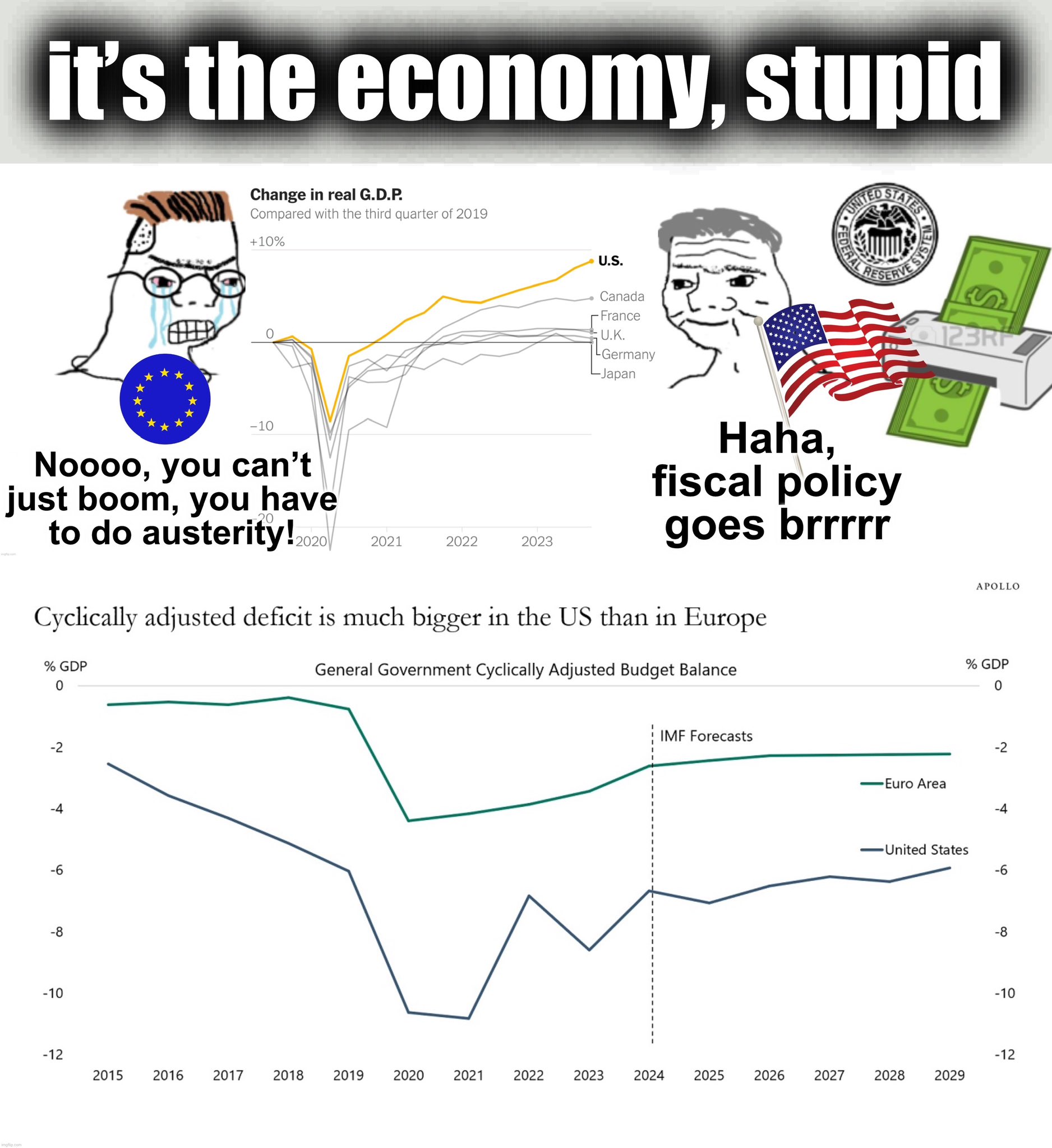

Europe went with Austerity and its results are atrocious, The USA goes with "dollars go brr" and even though total debt is growing, as a debt percent of GDP is falling or staying the same.

My conclusion is that fiscal Austerity is not a good answer for China.