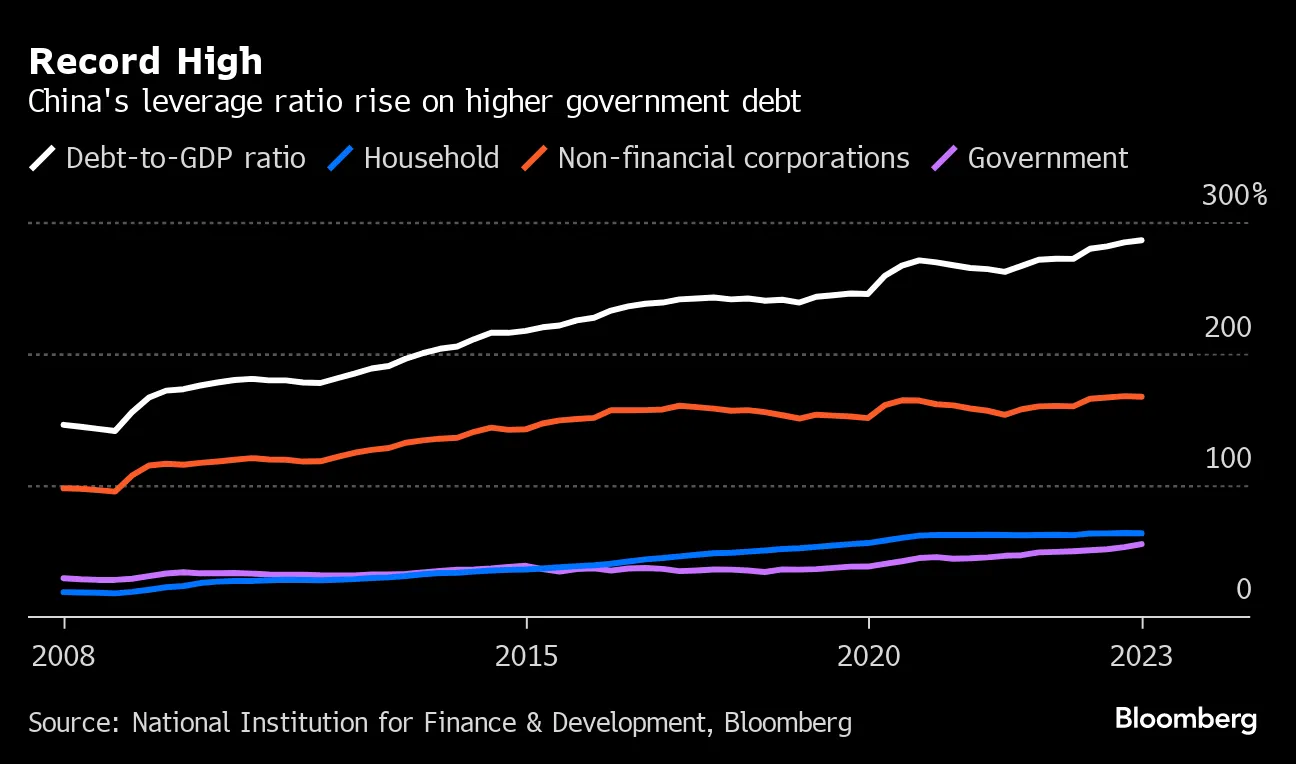

I agree that the change in % of GDP going from real estate to other sectors is structural and in the end good thing, but again what deleveraging? Property sector sales just crashed, and with it defaulted many developeres, I don't see any delevaraging going(reduced debt). Debt to GDP is still growing.

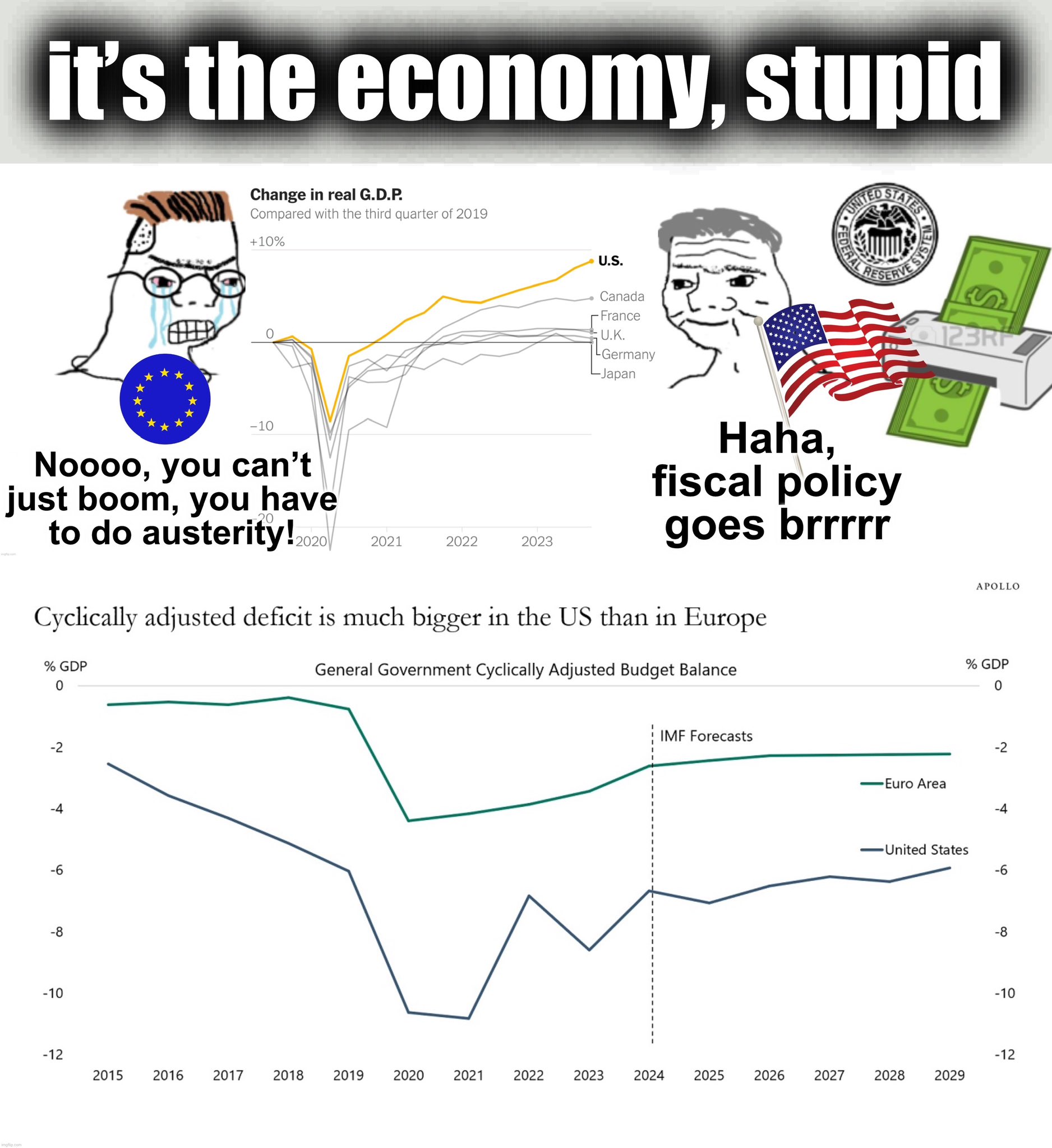

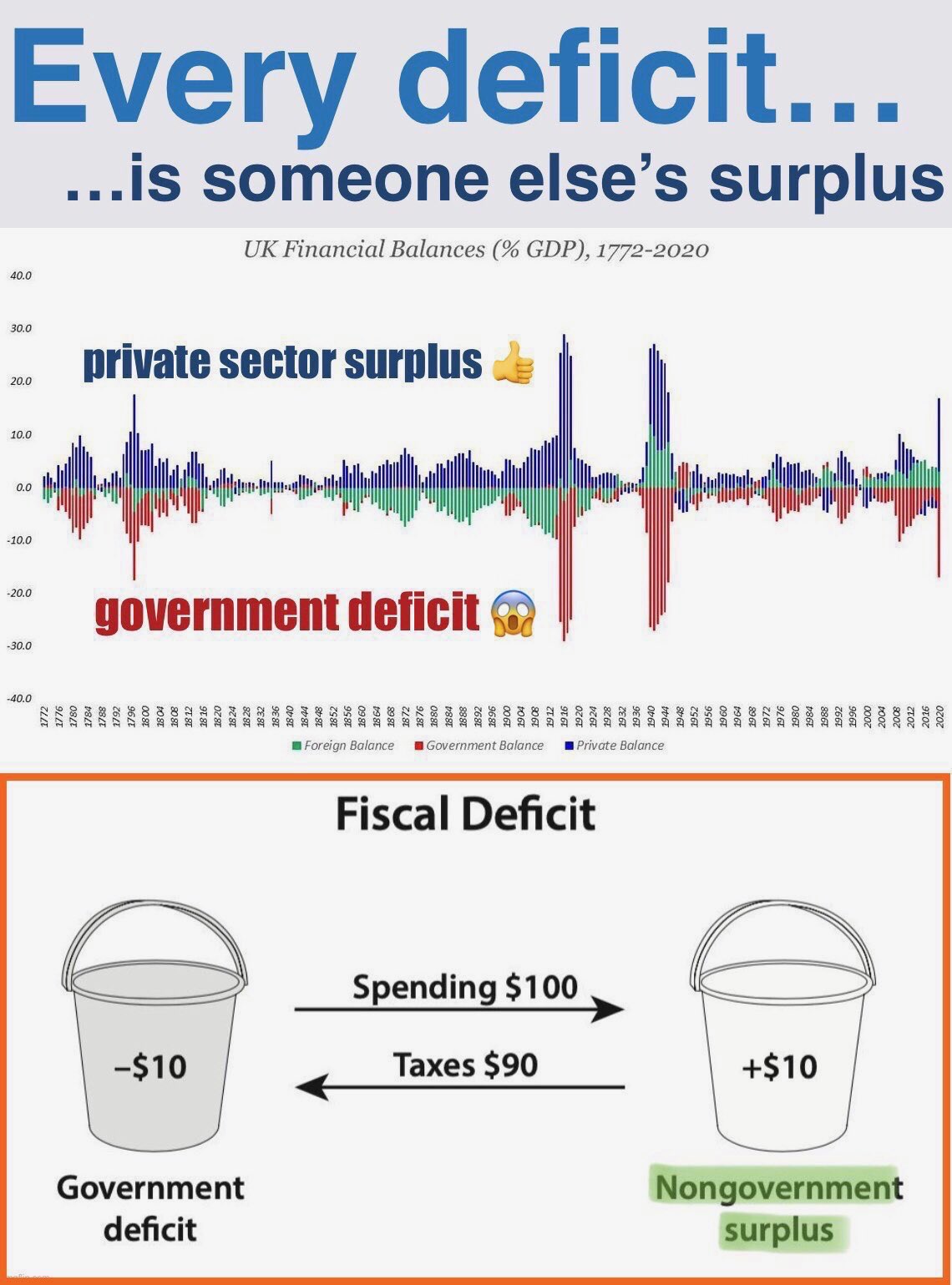

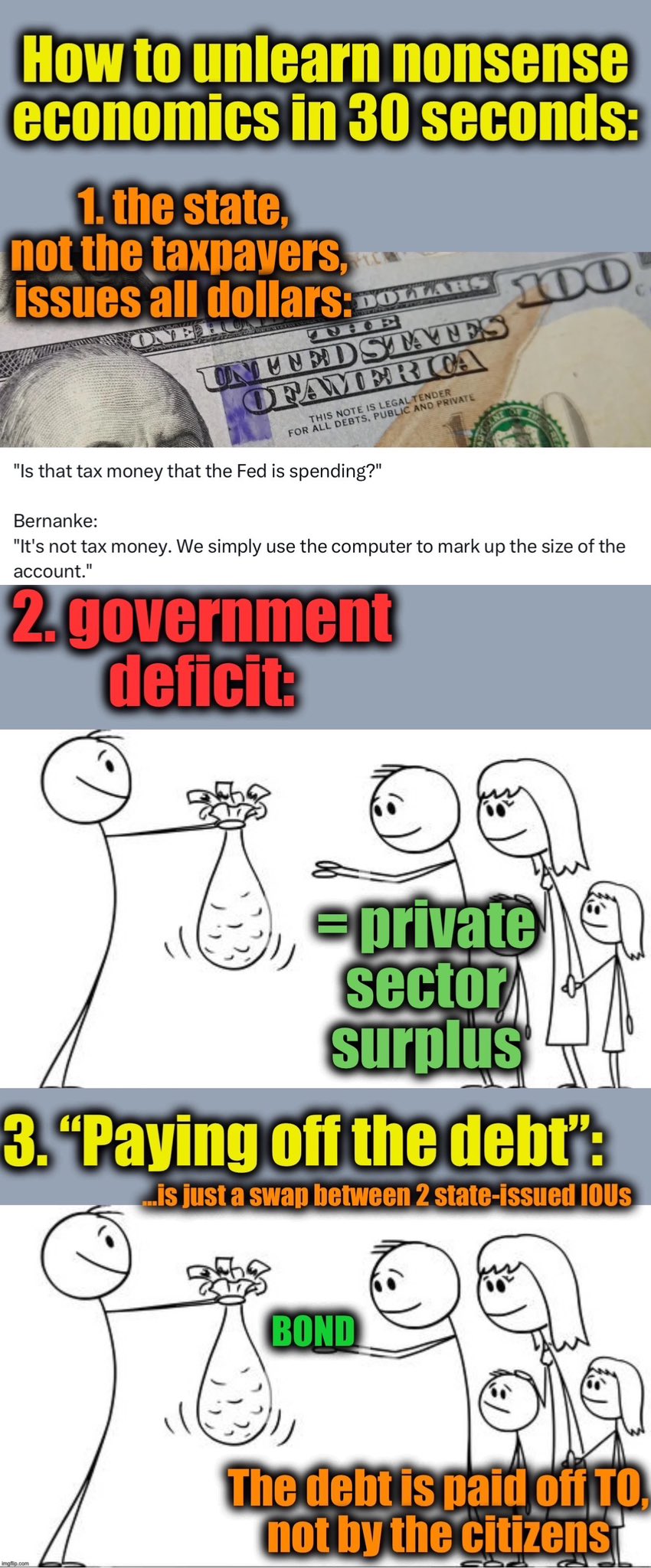

Instead of hobbling growth with weak fiscal support, do the support and give the cash e.g. for kids. It's a good thing that first salvo was fired, I mean monetary support with the lower interest rates.

You make little sense. You want overall de-leveraging but at the same time you want a stimulus.

ALL stimulus involves incurring debt. China tried that in 2008 which got us into the property issue in the first place.

What China is doing now is de-leveraging RE and investing in sectors that can provide growth and return in the future. Instead of a short term stimulus that will simply be saved in the bank anyways.

Again, this economy is still growing during a massive RE bubble pop. I suggest you look at what happened to the US during the sub-prime property bubble pop. The US stock market halved, electricity usage dropped 4% and the US gov had to save American industry with trillions in "quantitative easing."

Since the engineered RE de-leveraging in August 2020, with Covid 19 and a lockdown in top of that, China still grew its electricity demand 7% every year with new industries coming onboard and expanding.

I, and everyone else, knows that an economy will be hit by a RE bubble burst. Even without a RE crisis, a fundamental structural change in a major economy that massively transfers investment from one sector to another is bound to create mis-alignments and other issues during transition. With both of them going on at the same time, you have to expect contraction to be perfectly honest.

But unlike the US (and EU) in 2009 which was a fucking full blown recession, China is still growing and grew every year since this RE de-leveraging started in 2020.

Look, all countries would reach for stimulus if things are bad. In fact, it is the easiest thing to do to just print money and hand it off. Like what the US had done for the past four years to the tune of $5T -- bigger than the goddam GDP of India ($3.5T.)

The fact that China hadn't is because it sees things nowhere as bad as you and the Western narrative is trying sell and is restructuring calmly for the future.