You know, now that you've started attacking me personally, let's dig up the evidence and discuss what's been said in the past and whether what I've said has been accurate or not. But first, lets start with your statements.

Act of God pandemic, or negligence of duty? Make up your fucking mind.

People don't give a fuck if it was the local government or the central government that f'd up as they are all part of the same Party. Xi has consolidated so much power that, he's got to own the wins and the losses.

The government totally did not let COVID restrictions loose when people started protesting all over the country.

If anyone here is interested, I've pretty much stuck to this thread as it is my areas of expertise - I spend half my time in China and have visited over 200 companies/factories and about a dozen cities in the past year and half. I challenge anyone else who's done as much on the ground research as I have in this thread to come forward and debate me. Otherwise if your knowledge base consists of a diet of Globaltimes or Guancha then you're really drinking the propaganda coolaid - as much as I think some of the Guancha stuff is decent, there are idiots like Sima Nan, to whom 'patriotism' is simply a business to be monetized and his

Now, if you believe he is more credible, you do you, all the power to you.

Now, with some assessment of your statements out of the way, let me remind you what I've said in this thread and whether I've been correct in my assessments - as it seems you haven't really participated in this thread all that much in the past year or so.

This was one of my first 'predictions' on this thread - you can check the data yourself to see whether I was accurate. 2022 GDP was *exactly* 3% - in the middle of what I said.

The second major prediction I made on this thread was the infamous 8% retail sales growth where I had @vincent say the following to me. The good news is that someone here indeed did bet against me with @AndrewS suggesting retail sales as high as 15% IIRC. Kindergarten math would indicate that 8% is a lot closer to 7.6% than 15%.

And yes, I'm dunking on these two - because they were so wrong and that deserves a dunking if we are having an intellectual pissing contest.

Here's another prediction that was 1.3% too optimistic for 2023.

Considering that retail sales growth in 2023 was 7.6% - meaning that I was overoptimistic; and that @vincent has not come out to offer a mea culpa - I believe that he was, in fact, not ready to face the reality of the situation.

Contingent on an 8% retail sales growth and a slightly negative export growth expectation, I stated that 5.5% GDP growth was my best guess for 2023 - with 2023 growth coming in at 5.2% - yet again I was 'overoptimistic' - but @TK3600 should also remember the way he attacked me for being 'pessimistic' about a 5.5% growth expectation in 2023.

I don't know @Bellum_Romanum seems like I've just been been attacked for...being correct?

But sure, I'm the echo chamber and .

At the same time I do want to commend @Jiang ZeminFanboy for evolving his views as he's appreciated the gravity of the difficulties today.

@Blitzo I do recall you 'questioning the validity' of my sampling - go check what YUMC has been saying about 'traffic' vs. 'ticket' in the past 12 months.

Credibility comes from being accurate about expectations - you of all people should know this.

Finally, this offer stands - thus far nobody has had the stones to actually do this trade with me. Bueller! BUELLER?! If @Bellum_Romanum you are quite confident about this - put your money where your mouth is.

This is good to know - but lack of updated data is certainly...not ideal for tracking purposes.

Act of God pandemic

Act of God pandemic, or negligence of duty? Make up your fucking mind.

People don't give a fuck if it was the local government or the central government that f'd up as they are all part of the same Party. Xi has consolidated so much power that, he's got to own the wins and the losses.

Also, how certain are you that your proposals and or ideas you think will work in China can work without any unforeseen hiccups that can just as easily backfire contrary to what people like you tend to optimistically expect. Considering that Chinese ICU capacities and overall health care is still lacking in comparison to that of most western developed countries what gives you the confidence that the Chinese health care system can more than adequately handle the onslaught considering that in practice most Chinese tend to visit hospitals for all kinds of reasons more so than say their American or European counterparts.

The government totally did not let COVID restrictions loose when people started protesting all over the country.

If anyone here is interested, I've pretty much stuck to this thread as it is my areas of expertise - I spend half my time in China and have visited over 200 companies/factories and about a dozen cities in the past year and half. I challenge anyone else who's done as much on the ground research as I have in this thread to come forward and debate me. Otherwise if your knowledge base consists of a diet of Globaltimes or Guancha then you're really drinking the propaganda coolaid - as much as I think some of the Guancha stuff is decent, there are idiots like Sima Nan, to whom 'patriotism' is simply a business to be monetized and his

Now, if you believe he is more credible, you do you, all the power to you.

Now, with some assessment of your statements out of the way, let me remind you what I've said in this thread and whether I've been correct in my assessments - as it seems you haven't really participated in this thread all that much in the past year or so.

Yes, it has to shrink, but it happens to be 25-30% of GDP. So that is a painful process. Anyone who believes Chinese GDP will grow at 7-8% over the next 5 years are smoking crack. I do not believe IMF/World Bank estimates even incorporate the new reality tbh. I would think if the economy can squeeze out 4-5% over the next few years the transition would be quite successful, but 2022E FY GDP will be 2-4% at best.

This was one of my first 'predictions' on this thread - you can check the data yourself to see whether I was accurate. 2022 GDP was *exactly* 3% - in the middle of what I said.

In short, China is in a bit of a liquidity trap with weak, but notably improving consumer/business confidence. I'm fairly optimistic that 2023 will see some bounce back - but the longer term is not as rosy as it was pre-Shanghai - that really changed the fundamental behaviour/expectations. I've met with some Chinese companies' management teams lately, and we are seeing some green shoots, 2023 should be much better than 2022.

Assuming an 8% retail sales growth

Look, to be clear, 4-6% growth in 2023 for China is amazing compared to the rest of the world. But China is literally the cleanest shirt in a dirty laundry pile in the world - not the shining beacon of global growth it was in 2010s.

The second major prediction I made on this thread was the infamous 8% retail sales growth where I had @vincent say the following to me. The good news is that someone here indeed did bet against me with @AndrewS suggesting retail sales as high as 15% IIRC. Kindergarten math would indicate that 8% is a lot closer to 7.6% than 15%.

And yes, I'm dunking on these two - because they were so wrong and that deserves a dunking if we are having an intellectual pissing contest.

For me, I will stick with my original prediction of 6.5% growth.

Here's another prediction that was 1.3% too optimistic for 2023.

We have heard tunes like yours before. How do you come up with 8% retail growth? Why not 1%? 20%?

Chinese government is pushing for house renovations as the next big consumption.

Considering that retail sales growth in 2023 was 7.6% - meaning that I was overoptimistic; and that @vincent has not come out to offer a mea culpa - I believe that he was, in fact, not ready to face the reality of the situation.

I gave two numbers, 4-5% CAGR is the medium term growth I would expect over the next 5 years. In terms of 2023 specifically, I would expect anywhere in the 4-6% range - probably edging closer to 5.5 than anything else. But honestly even if you had a time machine and knew what it was, what good is it? Literally not going to add any value.

FWIW I have a bet with someone for 500 dollars about retail sales growth for 2023 - my bet was 8% and their bet was 15% - we will be splitting the difference at 11.5% - anything higher I would pay a pro-rata and anything lower I would receive a pro-rata.

I would *love* to be wrong.

The hilarity here is I'm actually personally invested in the success of China - I've yet to see anyone else here put money behind their bold claims.

Contingent on an 8% retail sales growth and a slightly negative export growth expectation, I stated that 5.5% GDP growth was my best guess for 2023 - with 2023 growth coming in at 5.2% - yet again I was 'overoptimistic' - but @TK3600 should also remember the way he attacked me for being 'pessimistic' about a 5.5% growth expectation in 2023.

I don't know @Bellum_Romanum seems like I've just been been attacked for...being correct?

But sure, I'm the echo chamber and .

At the same time I do want to commend @Jiang ZeminFanboy for evolving his views as he's appreciated the gravity of the difficulties today.

As an example, Yum China has over 400 mln members and serve some 700 mln customers in China in over 1000 cities through approx. 15000 stores (KFC/Pizza Hut/Lavazza/Little Sheep/HuangJiHuang). When Joey Wat (CEO of YUMC) tells me that she's seeing consumption downgrade (because ticket size is shrinking), you should know to recognize that it isn't "an anecdote" but rather based on their millions of transactions that they see daily.

@Blitzo I do recall you 'questioning the validity' of my sampling - go check what YUMC has been saying about 'traffic' vs. 'ticket' in the past 12 months.

Credibility comes from being accurate about expectations - you of all people should know this.

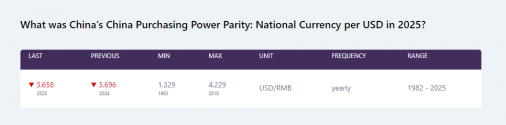

Tell me what you think the USDCNY exchange *should* be based on what you think PPP adjustments should be - and I will happily give you CNY at that exchange for your USD.

Finally, this offer stands - thus far nobody has had the stones to actually do this trade with me. Bueller! BUELLER?! If @Bellum_Romanum you are quite confident about this - put your money where your mouth is.

Due a change in Chinese law in 2021 having reliable VC investment data inside China is not longer possible, the websites were you could be able are either no accessible outside China or stopped updating their data. SemiEngineering used to post China VC investment in semiconductor, which Chinese startups made the majority, they stopped doing so because due "changes in regulations in China" now they mostly post a few Western companies. My guess that companies in that article are just publishing data from the investment of some Western companies.

This is good to know - but lack of updated data is certainly...not ideal for tracking purposes.

Last edited: