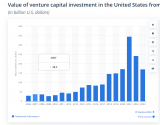

Oh no, no VCs means no one is starting bizness in China!

Oh no, too many Chinese startups in new tech!

You know what? Tens of thousands of Chinese startups in just the fucking chips and EV eco-systems alone are driving these twin opposing idiotic narratives from the West.

1) China collapsing

2) China building overcapacity

If it is collapsing, there is no money for the second. It is that simple.

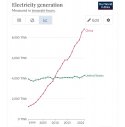

What collapsing economy engages in capital intensive high tech, high value supply chains that spans the whole spectrum?

Without doubt the RE unwinding has impacted China. But unlike 2008 in the US, this Chinese economy is still growing and is at the same time pivoting from the old RE driven model.

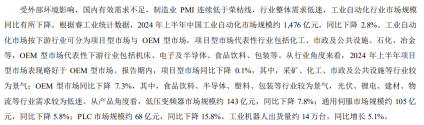

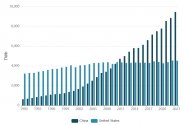

There is a lot of money going into firms right now. Basically everything we saw going into RE at its height are being poured into high value sectors:

It is already paying off with EVs overtaking ICE.

Economies that are stagnant do not attack and lead in practically every new and high value technology like China.

Oh no, too many Chinese startups in new tech!

You know what? Tens of thousands of Chinese startups in just the fucking chips and EV eco-systems alone are driving these twin opposing idiotic narratives from the West.

1) China collapsing

2) China building overcapacity

If it is collapsing, there is no money for the second. It is that simple.

What collapsing economy engages in capital intensive high tech, high value supply chains that spans the whole spectrum?

Without doubt the RE unwinding has impacted China. But unlike 2008 in the US, this Chinese economy is still growing and is at the same time pivoting from the old RE driven model.

There is a lot of money going into firms right now. Basically everything we saw going into RE at its height are being poured into high value sectors:

It is already paying off with EVs overtaking ICE.

Economies that are stagnant do not attack and lead in practically every new and high value technology like China.