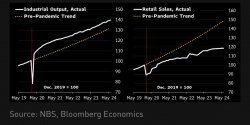

Only 2.0% retail sales growth for June year-to-year. Important

Big fall of property investment and home sales, I don't care

Only 2.0% retail sales growth for June year-to-year. Important

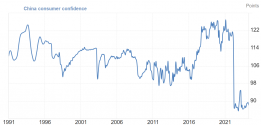

I also think it's about Covid. Don't forget that China didn't provide free cash to the people like the US. So that meant that people had to dig through savings and suchWhy is the Chinese consumer so pessimistic whereas the industry is doing so well? I suspect we're still dealing with the fallout of the real estate crash here. It will take years to sort itself out, probably longer than many are expecting.

it is due to fucking 润人 and 殖人 propaganda. they are economic saboteurs.It's a perception effect. Consumers are puling back because their net worth is declining with the popping of the real estate bubble. If you believe your assets are losing value and that it won't get better, you will naturally spend less because you "feel" worse off financially even if the declining component is not liquid.

And regardless of the positive picture painted by the over all economy, consumer confidence is directly tied to personal financial security. People aren't financially secure when their main investments - 70% of Chinese house hold wealth is tied up in property - are dropping in value.

After people are held hostage for nearly a year due to covid restriction, they obviously want to travel lol. And the outbound tourism is even restricted due to visa and flight issues, otherwise the outflow will be so much bigger.The outbound tourism is booming. They can spend those money domestically rather than going travelling oversea..

U.S 2nd quarter GDP forecast to be 2.0

Well for many people they choose between fancier purchases at home and vacation trips. They've had all the chances to make home purchases during Covid, now it's more prioritised to travel.The outbound tourism is booming. They can spend those money domestically rather than going travelling oversea..

U.S 2nd quarter GDP forecast to be 2.0

Can someone more knowledgeable in economics explain why China doesnt implement stimulus? Just curious

At the National People's Congress this March, Premier Wen Jiabao cautioned, "the biggest problem with China's economy is that the growth is unstable, unbalanced, uncoordinated, and unsustainable."

The unstable matter is that China has an excessively high investment growth rate, excessively large extension of credit, excessive liquidity of the currency, and improper foreign trade and international payment, Wen said.

China has unbalanced development between urban and rural areas, between different regions, and between economic expansion and social progress, the premier said.

The primary, secondary, tertiary industries are not coordinated, investment and consumption are not coordinated, and China's economic growth relies too much on investment and export, said the premier.

The unsustainable issue is that China has failed to address well the issues related to energy saving, emission reduction and environmental protection, he said.

In order to achieve sustainable development, the premier said, China need to boost domestic consumption, push forward reform and opening-up, remove institutional obstacles, encourage intellectual and technological innovation, and make more efforts to conserve energy and reduce emissions.

"The conditions are there, and the most important factor is that we can strive for a peaceful environment for a long period of time to concentrate our resources and energy on economic development," Wen said.

"To achieve the task, although it is very arduous, we have full confidence," Wen said.

Decades of lax regulatory enforcement while the Chinese government focused entirely on rapid economic growth enabled risks and imbalances to fester. Left unresolved, they could spark a crisis and threaten China’s leadership. Since coming to power, Xi has sought to restructure the economic model away from a focus on quantitative growth toward what he calls that is slower but more aligned with Beijing’s strategic interests and, in the CCP’s view, more sustainable in the long term. This growth model is characterized by a focus on technological innovation, high-end manufacturing, supply chain security, and evening out the wealth gap, among other long-term efforts.

This isn’t just Xi’s agenda. The leadership of the Chinese Communist Party recognized the risks inherent in their growth model long before Xi took the helm. But Xi’s consolidation of power and ruthlessness have uniquely enabled him to break through vested interests and institutional roadblocks to change the economy’s trajectory. Many of these efforts hurt businesses and depress growth in the near term, but the party leadership is willing to pay that price in hopes that it will help China escape the and prevent even bigger problems in the future.

"My impression is that the top leadership actually is pretty comfortable with the way things are going," Kroeber of Gavekal Dragonomics said. "We're seeing domestically, a reallocation of capital away from the old sectors from infrastructure into new sectors" such as green energy and semiconductors.

"One of the reasons that you have not seen more fiscal support for the economy is that they don't think it's really necessary. The costs of the current economic policies both domestically and internationally, need to become much, much higher before you see the significant reorientation in Chinese policy."