It would be fine to look at total debt / GDP as a sign of a weakening economy IF that debt is mainly serviced by fiscal revenue like in the US.

This is because the fiscal revenue/taxes are highly correlated to GDP.

However asset-backed debt can be driven by other factors not necessarily related to the growth in GDP (at least in the short term).

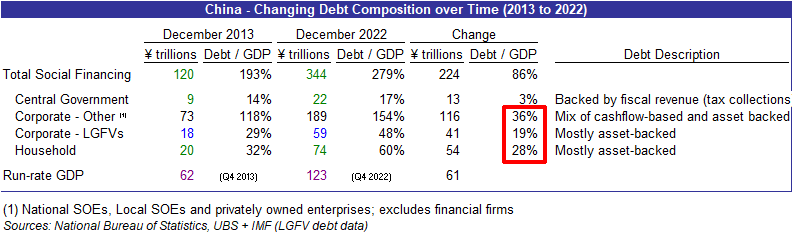

If we examine the changing composition of Chinese debt over the last decade,

Debt backed by tangible assets has driven the vast majority of the debt increase in China.

Central gov't debt has only driven a 3% increase in the debt/GDP ratio, while the other categories accounted for an 83% increase in the debt/GDP ratio from 2013 to 2022.

And for asset-backed debt, we should look at the utilization rates/value of those assets, not the value of GDP, for debt-carrying capacity.

We only need to look at appropriate asset-level metrics to determine asset value.

Only from here can one determine the value of the debt and equity in a liquidation waterfall scenario.

For real estate, these would be metrics like vacancy rates and secondary-market values.

For infrastructure like HSR, it would be metrics like ridership and capacity utilization.

If $1T of debt-funded investment is created: Assets that are worth $2T - That's good vs Assets worth $500B - that's bad.

Simple as that. It ultimately boils down to analyzing asset quality, not how they were funded.

It's not unproductive short-term government consumption debt like the US, in this case - In the Chinese case the money just goes into the other side of the balance sheet.

And if those assets created are worth more than the debt they utilized to create it, then it's nothing to worry about.

Because that debt is productive and it's backed by those productive tangible things, the economy doesn't lose in the case of liquidation.

Disclaimer, most of this stuff I got from this Twitter account above, I didn't come up with it personally. He also goes into debt into more technical and maths stuff, like evaluating different assets in China, like HSR for example, going into various asset-specific metrics to determine its valuations and comparing it with other countries, also explaining how assets like infrastructure have lower depreciation rates and how they last for very long times and different rarely discussed specific ways about how those assets tend to get utilized and are worth more on the longer time horizons and why is that, he also lists various non-monetary values that they tend to create for society as a whole. Recommend checking it.