This thinking is absurdly black and white. You can have power while still having to reckon with real costs of using that power in certain ways. That doesn't make the power itself invalid. You speak as if the only way the central government could have power and control over the economy is if they can do whatever they want completely cost free and anything short of that means they simply lack the ability to affect change. That is not how governance works.There was so much power and control involved that.....this is now the biggest problem on the Central Government's hands. Yes, they have so much control that this debt pile is exactly what they planned for. Got it. You're making a lot of sense here.

They could give stocks a big and sustained boost. There would be substantial costs of doing so, so they choose not to. What about this is so hard to understand?

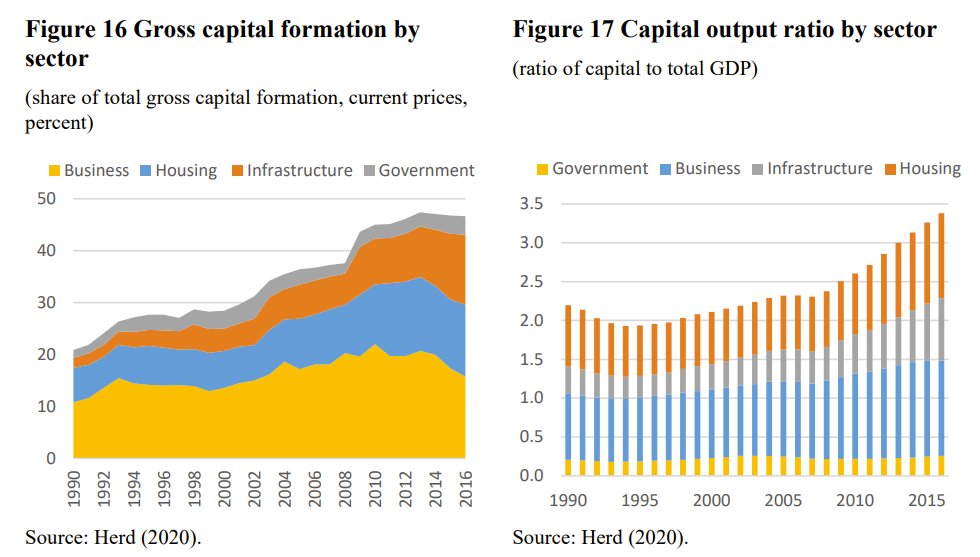

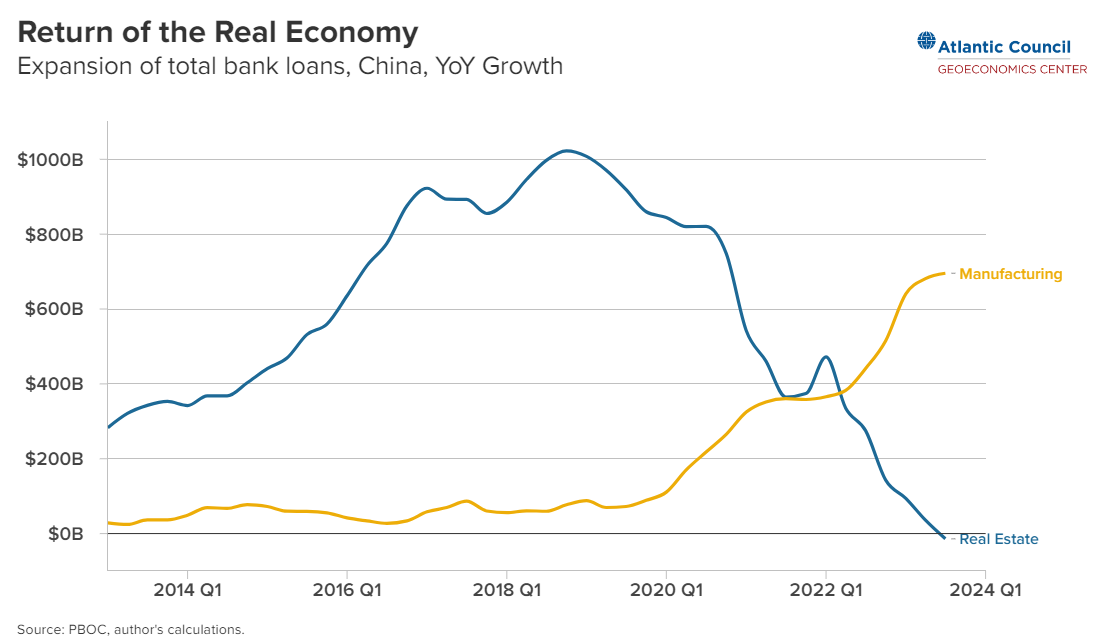

Doing any of these things successfully is contingent on first stopping the growth of the debt pile itself. It doesn't matter how much bad debt you settle into a long term repayment plan or force developers to liquidate their assets to repay if new bad debt is constantly coming into the system. And China growing out of its existing post-2008 debt pile is dependent on it diversifying its economy away from real estate and establishing a system of government borrowing based on public bonds instead of land sales and unpublicized bank loans. Those things must happen first before the stock market can serve the role that beijing eventually wants it to, hence it choosing to prioritize them over boosting the market.There are many ways to deleverage a debt bubble - namely - you can pay down the debt; or you can grow the equity and deleverage by growing yourself out of it.

To further explain: beijing must keep borrowing costs relatively high to ensure developers and LGFVs cannot try to halt their deleveraging by rolling over debt, which is bad for stocks because it means a higher discount rate and less overall liquidity laying around to bid up prices.

Last edited: