Remittances bro remittance. Their number one economic policy is to export themselves out of poverty.Interesting that india has such a large forex reserves(3rd globally) despite running Trade deficits for a while now.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economics Thread

- Thread starter Norfolk

- Start date

A stroll down “Quantum Boulevard” reveals one of the world’s tightest concentrations of bleeding-edge technology firms. Dozens of companies feed a quantum-computing supply chain that did not exist a few years ago. Their wares include some of the most advanced commercialised technology on the planet. The district is hardly a decade old; not long ago the most modern tech in the area was farming equipment. And it is in an unlikely spot: Hefei, the capital of Anhui, one of China’s less fancied provinces.

China’s growth is flagging, but its economic miracle appears alive and well in Hefei. Home to about 9.6m people, the inland city saw its GDP grow by more than 8% a year on average from 2012 to 2022. Once considered backward and poor, Hefei’s residents now enjoy a disposable income that comfortably exceeds China’s urban average (see chart).

The city’s success owes much to what some call the “Hefei model”. A unique combination of local-government investment and private enterprise, the model has been described as state capitalism at its best. It has fostered industries like high-end manufacturing, electric vehicles (EVs), biotech and semiconductors. These so-called strategic, emerging industries now account for over 56% of Hefei’s industrial output, compared with less than 27% in 2013. Whatever local officials have been doing, it appears to be “the right mix of industrial policy and private-sector mojo,” says Robin Xing, an economist at Morgan Stanley and a Hefei local.

This style of growth is precisely how Xi Jinping, China’s leader, envisions the country’s future. Hefei’s technological progress chimes with Mr Xi’s call for an “Industrial Revolution 4.0”, in which China shakes off “low-quality” growth—cheap manufacturing and debt-financed homebuilding—by capturing entirely new industries and their supply chains. This vision reserves special attention for the inland backwaters that have missed out on much of the internet boom in coastal provinces. If Mr Xi has his way, the next decade of development will look more like Hefei than today’s tech hubs of Shenzhen and Hangzhou.

BOE Technology, the world leader in LCD displays, has some of its main factories in Hefei. So does NIO, one of the world’s fastest-growing ev companies. China’s leader in voice-recognition artificial intelligence, iFlyTek, was founded by the local university. Its most advanced DRAM chipmaker, CXTM, was co-founded by the local government.

They will quickly learn the model’s essential ingredients. The first is a large pool of highly educated, motivated people. Hefei is far enough inland—about 470km from Shanghai—to have missed out on the 1990s boom in the Yangzi river delta. But it is close enough to absorb the influence of its better-off neighbours, giving it what Anhui locals say is a scrappy, underdog attitude.

That has made it a hub for advanced technology. USTC has designed China’s most advanced quantum computer. Not far away at the Institute of Physics, scientists are testing one of the world’s most advanced fusion-energy reactors, the Experimental Advanced Superconducting Tokamak. The earliest human trials with CRISPR, a genetic-engineering tool, were conducted at a Hefei hospital in 2015. Since then a thriving biosciences industry has sprung up.

A second ingredient of the Hefei model is the flow of talent. The city government frequently recruits from the engineering and science departments of local universities. It also encourages exchanges between government offices, university departments and companies, building trust and networks. One local cadre spent years at USTC helping researchers identify marketable patents, while holding a government position. Businesspeople in Hefei say officials throughout the local administration can discuss industry topics in depth.

A third factor is the “chain boss” system. The government has created groups of firms in 12 industries, including semiconductors, EVs, quantum sciences and biotechnology. Each group has a “chain boss”: a government official who oversees big-picture planning for the industry. In 2020, for example, Hefei’s Communist Party chief was the chain boss of the city’s integrated-circuits industry. The mayor oversaw the display-screen industry.

These bosses work with a state-appointed “chain leader”, typically the dominant company within an industry. The government passes policy directions to this leader, which shares them with other companies in the supply chain. Companies and officials use this communication channel to discuss the allocation of state capital, the sourcing of materials and potential bottlenecks in supplies, noted Ni Hua, an analyst at East Asia Qianhai Securities, in a report last year.

Before the state invests in a new company, officials consult with all members of a chain to understand how the newcomer will fit in, says an executive at a local quantum-computing firm. One young entrepreneur who recently started a business in Hefei says that breaking into these industry groups is incredibly difficult. There is little scope for ruthless competition within supply chains. Instead the focus is on beating companies in other regions or countries.

The fourth ingredient in the model is state capital. While cities elsewhere in the world fund schools, build sewers or house the poor, Hefei’s administration ploughs money into the most promising companies it can identify. It has been described as a “government of investment bankers”. Its outlays flow mainly through three vehicles. Each has sprawling portfolios spanning hundreds of investments.

Chained melody

These investments give the city government broad reach. Companies such as BOE, the display-maker, and NIO, the ev firm, stand at the centre of vast supply chains. Smaller companies move to Hefei to be closer to them. Most remain privately owned. But if they suit the government’s plan for the supply chain, they will probably attract some state investment. In this way entire supply chains are linked up by just a few state investors that answer to the city government.

For nearly a decade cities and provinces across China have been experimenting with state-backed venture capital, raising as much as $1trn. But many of their investments have yielded mediocre returns at best. China’s venture-capital state has been written off as a cash sink and a prime opportunity for corruption. Last year, for example, anti-corruption authorities rounded up executives at China’s premier state fund, the National Integrated Circuit Fund, in an attempt to weed out graft.

What sets Hefei apart? The city’s state capitalists have clearly benefited from the city’s history and location. Not every inland metropolis can learn from Shanghai without being swamped by it, or provide refuge to a great university. The tight links of the “chain boss” system also ensure that Hefei’s state capitalists do not invest without guidance from industry.

Hefei’s state investors have also been unusually adventurous. Most cities lack the expertise to run private-equity funds. And they do not have incentives to make bets with distant, uncertain pay-offs. Cadres often spend just five years in one location. Even if a long-term investment were to succeed, they would not be around to enjoy their triumph. These short horizons inhibit officials’ investment choices. Many government funds, for example, have put money into chip designers not chipmakers, notes Tilly Zhang, an analyst at Gavekal Dragonomics, a research house. Chip design is less capital-intensive and quicker to show returns.

Hefei’s state capitalists have no such inhibition. The local government’s first big punt was a $5.2bn investment in BOE in 2008. (Officials delayed the construction of a subway system in order to scrape the funds together.) The LCD screen industry was then dominated by South Korea and Japan. Critics noted that it would take years to for Chinese firms to be able to compete. But BOE eventually built several plants in Hefei and has since come to dominate the global industry.

NIO, the electric-car maker, was even riskier. In 2020 the group was on the verge of collapse when Hefei invested 5bn yuan ($700m). nio then moved its China headquarters and some production facilities to the city. In less than two years NIO had recovered and its share price soared. The city made a return of up to 5.5 times its initial investment, according to Bloomberg. Hefei Jiantou, a government fund that invested in both BOE and NIO, has taken in investment income of at least 5bn yuan each year between 2019 and 2021.

For Mr Xi’s economic vision to succeed, the Hefei model will have to spread far beyond its place of origin. Smaller cities will have to sprout big firms in leading industries, such as EVs, solar energy and chips. One quantum boulevard will not be enough.

But experimentation in one city has often provided a template for the rest of the country. The “Shenzhen model” in the 1980s, for example, pioneered the combination of Chinese labour and foreign capital that turned southern China into the workshop of the world. Around the same time the “Wenzhou model”, named after the south-eastern port city, showed that household factories, often financed by family savings, could succeed, with the help of peripatetic sales agents travelling up and down the country.

A stroll down “Quantum Boulevard” reveals one of the world’s tightest concentrations of bleeding-edge technology firms. Dozens of companies feed a quantum-computing supply chain that did not exist a few years ago. Their wares include some of the most advanced commercialised technology on the planet. The district is hardly a decade old; not long ago the most modern tech in the area was farming equipment. And it is in an unlikely spot: Hefei, the capital of Anhui, one of China’s less fancied provinces.

China’s growth is flagging, but its economic miracle appears alive and well in Hefei. Home to about 9.6m people, the inland city saw its GDP grow by more than 8% a year on average from 2012 to 2022. Once considered backward and poor, Hefei’s residents now enjoy a disposable income that comfortably exceeds China’s urban average (see chart).

The city’s success owes much to what some call the “Hefei model”. A unique combination of local-government investment and private enterprise, the model has been described as state capitalism at its best. It has fostered industries like high-end manufacturing, electric vehicles (EVs), biotech and semiconductors. These so-called strategic, emerging industries now account for over 56% of Hefei’s industrial output, compared with less than 27% in 2013. Whatever local officials have been doing, it appears to be “the right mix of industrial policy and private-sector mojo,” says Robin Xing, an economist at Morgan Stanley and a Hefei local.

lol this was hilarious

The fourth ingredient in the model is state capital. While cities elsewhere in the world fund schools, build sewers or house the poor, Hefei’s administration ploughs money into the most promising companies it can identify. It has been described as a “government of investment bankers”. Its outlays flow mainly through three vehicles. Each has sprawling portfolios spanning hundreds of investments.

Hard as it may be to believe, the Hefei government does, in fact, also fund schools, build sewers and house the poor.

meanwhile:

- At least 59 million American adults participated in the gig economy over 2020, roughly to 36% of the U.S. workforce.

FriedRiceNSpice

Major

A second ingredient of the Hefei model is the flow of talent. The city government frequently recruits from the engineering and science departments of local universities. It also encourages exchanges between government offices, university departments and companies, building trust and networks. One local cadre spent years at USTC helping researchers identify marketable patents, while holding a government position. Businesspeople in Hefei say officials throughout the local administration can discuss industry topics in depth.

The fourth ingredient in the model is state capital. While cities elsewhere in the world fund schools, build sewers or house the poor, Hefei’s administration ploughs money into the most promising companies it can identify. It has been described as a “government of investment bankers”. Its outlays flow mainly through three vehicles. Each has sprawling portfolios spanning hundreds of investments.

Great, the article just described China's economic model for the past 20 years. And its named the "Hefei model" because Shenzhen and dozens of other Chinese cities do not exist. The only thing that sets Hefei apart from other well-managed tier 1.5/2++ cities is that it is home to China's equivalent of MIT/Caltech.

It's not a problem in the US since gig workers are just expressing their freedoms by making lifestyle choices. US gig workers all choose to be gig workers since they absolutely love to live paycheck to paycheck while falling into debt working 12 hours a day, whereas Chinese gig workers are actually slaves being forced into it by the CCP.

supercat

Colonel

Chinese has $40 trillion bank deposits. Chinese government needs to find a way to tip into this huge money pit by offering affordable healthcare and better retirement benefits, so people will be willing to invest these on high tech stocks instead.

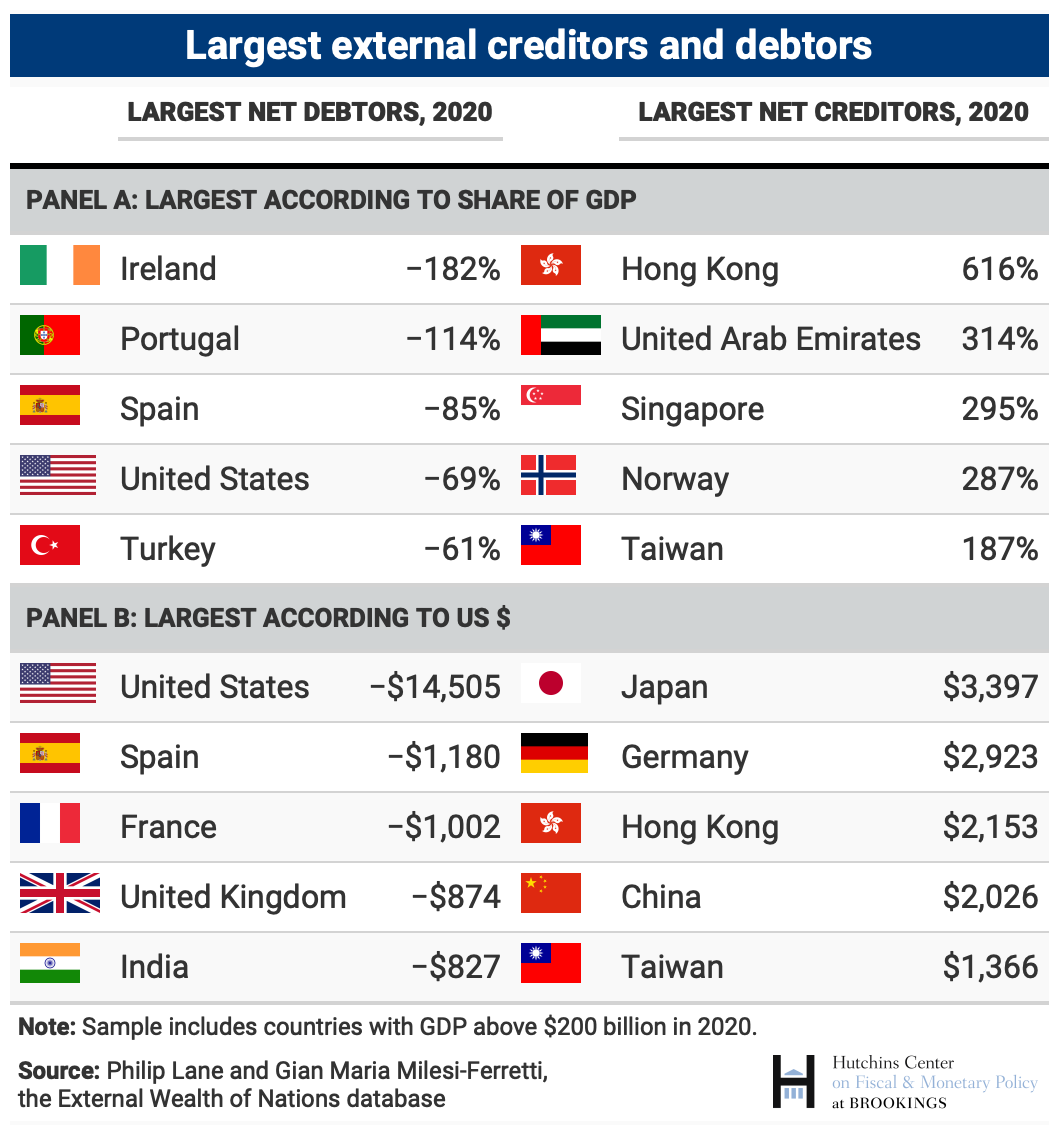

Thought this was relevant for the current "debt problem" Peter Zeihan-level bullshit conversations about China's economy in the zombi-media.

We know this already: with 10 times the population and 5 times bigger economy, today's China is not 1990's Japan.