Hendrik_2000

Lieutenant General

Without overal trade deficit how can China provide dollars for international trade?

If you remove the US trade deficit, and say the US running trade surpluss then there is no money in the international trade to run trade surplusses, or even to facilitate the current level of international trade.

Means if China wants to replace the US as world hegemon then it needs a persistent overall trade deficit.

all those talk about trade imbalance are bogus infact the China trade surplus has been declining years after years if you include China trade with the rest of the world. It is now less than 2% of GDP

If US has trade imbalance it is with Germany and not with China

The bilateral imbalance is a non-issue

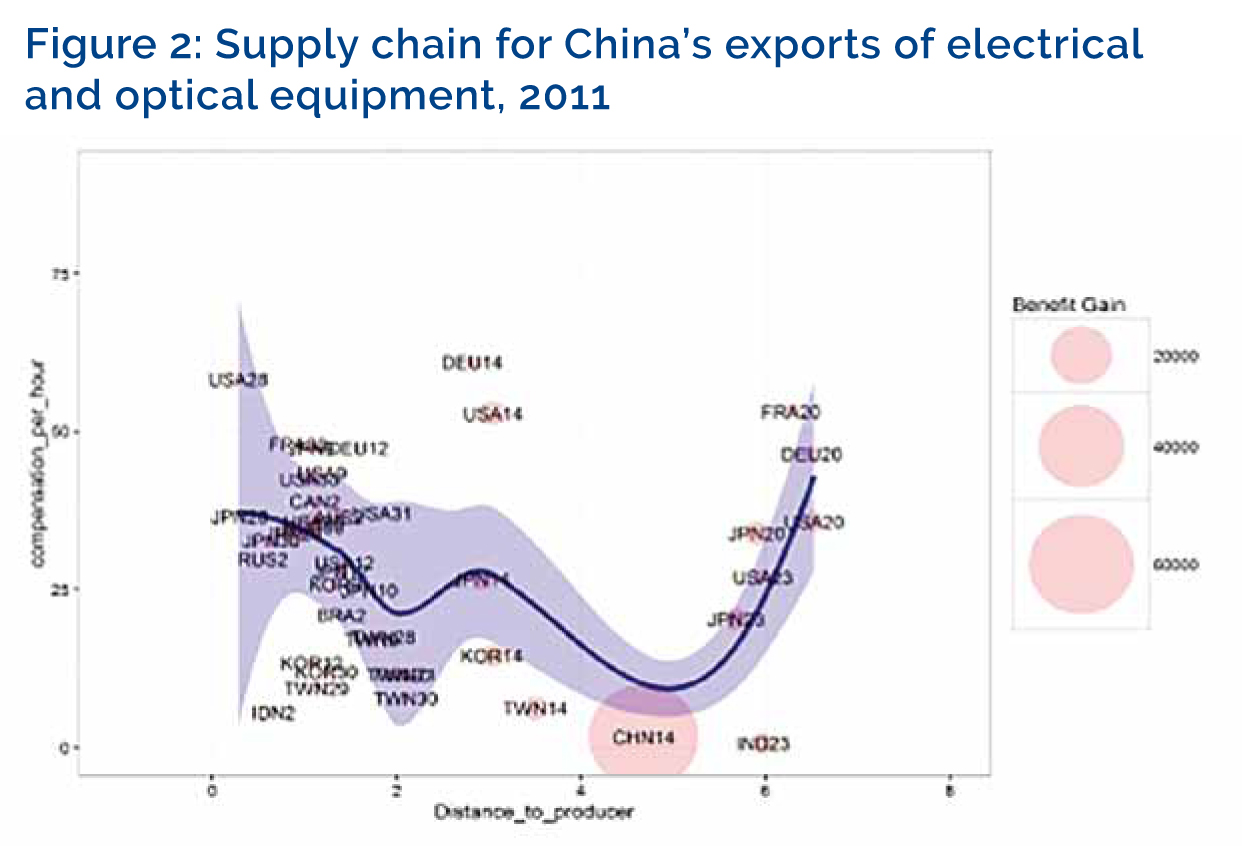

China imports a lot of goods and services from upstream producers and then generally gets credit for the whole export when it is sent to the U.S. or Europe. For China’s exports as a whole, a bit more than half of the final cost is Chinese value added. It is possible to recalculate bilateral imbalances in terms of the value added traded among countries. This adjustment cuts the U.S.-China bilateral imbalance in half, while increasing imbalances with some of the upstream economies such as Japan, South Korea and Taiwan. China is moving up the value chain so some of the labor-intensive assembly is shifting to Vietnam and other low-wage countries, with China starting to provide more sophisticated parts. This shift, other things equal, will reduce the bilateral imbalance between the U.S. and China, but nothing of importance will have happened in trade relations. This is one reason why economists do not view bilateral imbalances as useful metrics.

China’s overall surplus has come down

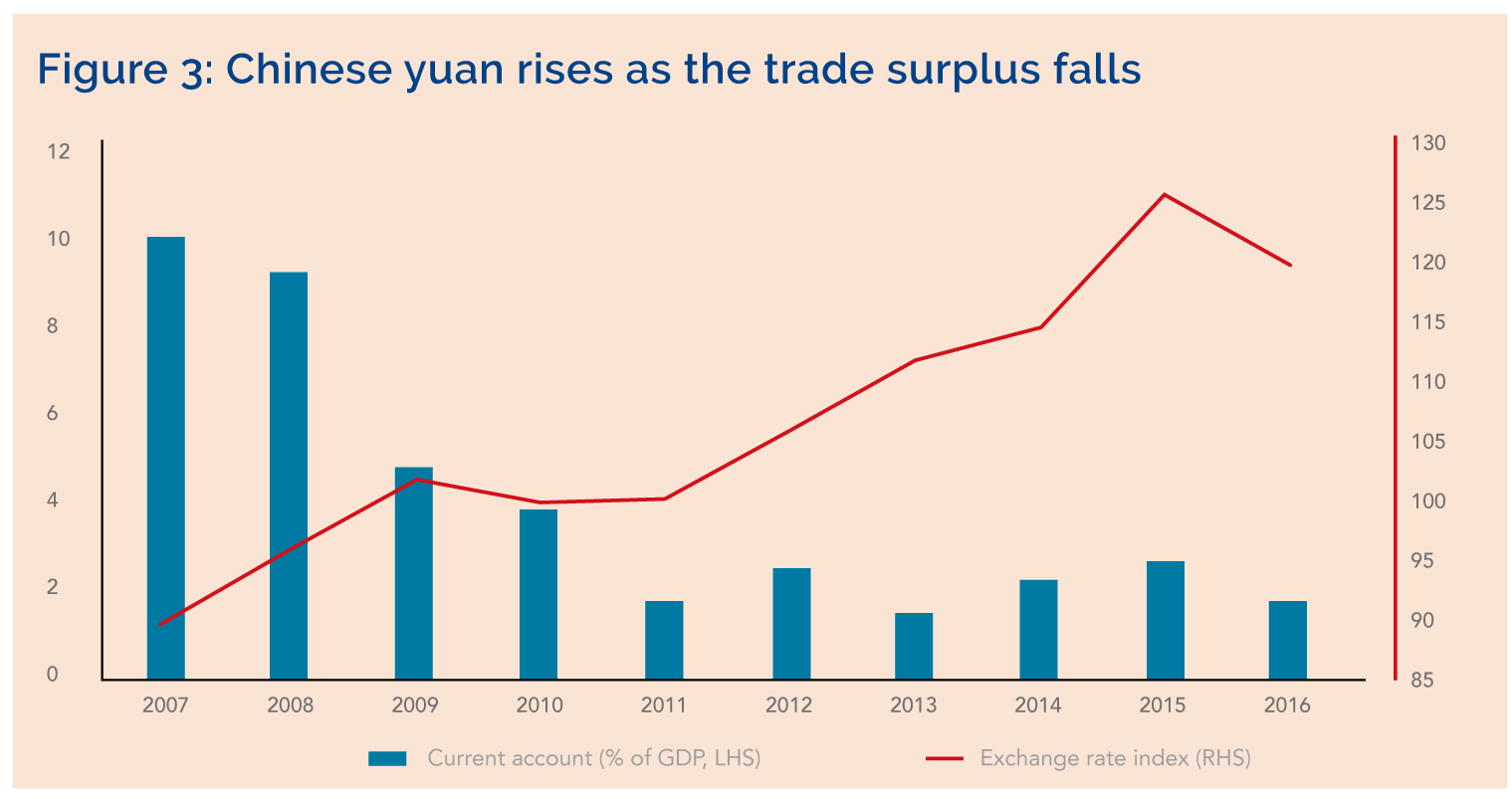

Unlike bilateral imbalances, overall trade balances are important economic variables. A deficit is not necessarily a bad thing, and a surplus, not necessarily a good thing. But overall imbalances indicate whether a country is a net borrower from the rest of the world, or a net lender. I view large imbalances as a bad thing because they are inherently unsustainable, which means there will have to be large adjustments in exchange rates and trade patterns at some point. Large adjustments tend to be costly and disruptive. Ten years ago the U.S. and China had fallen into a bad pattern in which China had an unsustainable trade surplus above 10% of GDP and the U.S. had a unsustainable deficit of about 6% of GDP. These large imbalances were a contributing factor to the global financial crisis.

As a result of the crisis China’s trade surplus dropped sharply.

The U.S. trade deficit came down after the global financial crisis but now it is rising again. If the U.S. deficit is rising then someone else’s surplus has to be on the rise as well. In this case it is Germany and other parts of Europe that are starting to run very large surpluses, above 8% of GDP in Germany’s case. It should also be noted that the U.S. deficit is largely determined by the country’s own macroeconomic policies. So far this year the U.S. deficit is up more than 9% over 2016. President Trump has trumpeted that his policies, including a large promised tax cut for corporations, are pushing up the stock market and attracting capital inflows. The counterpart to those inflows is a larger trade deficit. If the U.S. follows through with the tax cut, it will increase the fiscal deficit, drive up interest rates and the dollar, and widen the trade deficit. As this happens it would be inaccurate to blame China.

Last edited: