US Inflation Rate Falls Less Than Expected

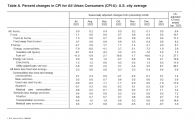

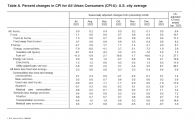

The annual inflation rate in the US slowed only slightly to 6.4% in January of 2023 from 6.5% in December, less than market forecasts of 6.2%. Still, it is the lowest reading since October of 2021. A slowdown was seen in food prices (10.1% vs 10.4%) while cost of used cars and trucks continued to decline (-11.6% vs -8.8%). In contrast, the cost of shelter increased faster (7.9% vs 7.5%) as well as energy (8.7% vs 7.3%), with gasoline prices rising 1.5%, reversing from a 1.5% decline in December. On the other hand, both fuel oil (27.7% vs 41.5%) and electricity prices slowed (11.9% vs 14.3%). Although inflation has shown signs of peaking at 9.1% in June last year, it remains more than three times above the Fed's 2% target and continues to point to a broad-based advance on the general price level, particularly services and housing. Compared to December, the CPI rose 0.5%, the most in three months, mostly due to the higher cost of shelter, food, gasoline, and natural gas. source: U.S. Bureau of Labor Statistics

It's better to post the full report, which is

.

Key graphs to look at.

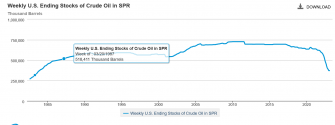

It'll be interesting to see how the Fed will react to stabilizing energy prices. Which are the categories of most interest to me? I think Shelter's stubborn refusal to go down is probably the most notable. Prices continue to stubbornly increase despite ever-rising interest rates.

On the one hand, wage growth

, but on the other, interest rates are making it considerably more expensive to service new loans/debt. Logically, this should result in prices stagnating or dropping, which is visible to some

, but the price hasn't really moved in the direction that I personally would like to see. I.E. prices have largely stopped growing on single-family housing, but the rise in interest rates make these home more expensive to buy, even if the price is slightly lower.

Rents have also started to stagnate, but really, we have to keep in mind that development and re-development has also slowed. So what we are seeing, is a

in both supply and demand, which doesn't make things better. What we want to see, is an expansion in housing supply.

All in all, inflation is continuing to stabilize. It's significantly lower than it was months ago, but the puzzle of America's housing is no close to being solved.