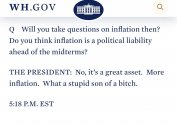

But they would not be able to boast about fake inflation-driven growth in nominal terms if that happens. Considering that Biden's popularity is tanking day-by-day and there is going to be an election in 2022 where Republicans have good chances to gain the majority, I think Biden is going exert maximum pressure on Powell to stop tapering and continue the QE policy until after elections at minimum.The answer to inflation is to pump less money into the economy and higher interest rates to reduce disposable income.

It's a Catch-22

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

American Economics Thread

- Thread starter Bernard

- Start date

@Tyler bro do you believed that? they need China to tame inflation BUT China is decoupling and not buying T-bills is one of them.But they are now tapering. Where will the money come from to deal with inflation?

Stocks are off to a . The tech-heavy is already in a , a more than 10% drop. And if one the most influential hedge fund managers is to be believed, this could be only the beginning of a very painful time for investors.

Jeremy Grantham, co-founder and chief investment strategist of Grantham, Mayo, & van Otterloo (GMO) said in a report called that stocks are now in the midst of a "superbubble," that it won't end well.

Grantham, who has been running the firm's investments since it was started in 1977, was similarly bearish at market tops in 2000, and during the Great Financial Crisis of 2008.

"Good luck! We'll all need it," said Grantham, whose firm manages about $65 billion in assets.

He noted that have experienced two such "superbubbles" before: 1929, a market fall that led to the Great Depression, and again in 2000, when the dot-com bubble burst. He also said the US housing market was a "superbubble" in 2006 and that the 1989 Japanese stock and housing markets were both "superbubbles."

"All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average," Grantham wrote.

Many investors don't want to believe that the stock market is overdue for a broader pullback, Grantham argues, especially since the market fell into bear territory -- albeit briefly -- in March 2020 at the pandemic's start.

"In a bubble, no one wants to hear the bear case. It is the worst kind of party-pooping," Grantham wrote. "For bubbles, especially superbubbles where we are now, are often the most exhilarating financial experiences of a lifetime."

Grantham believes that the Federal Reserve's moves to cut rates to zero -- and then keep them there for nearly two years -- is a main cause for the market's current frothiness. The Fed is widely expected to begin raising rates at its March meeting.

"One of the main reasons I deplore superbubbles -- and resent the Fed and other financial authorities for allowing and facilitating them -- is the under-recognized damage that bubbles cause as they deflate and mark down our wealth," he wrote.

Grantham added that "as bubbles form, they give us a ludicrously overstated view of our real wealth, which encourages us to spend accordingly. Then, as bubbles break, they crush most of those dreams and accelerate the negative economic forces on the way down."

"To allow bubbles, let alone help them along, is simply bad economic policy," Grantham wrote, adding that he's concerned about "the terrible increase in inequality that goes with higher prices of assets, which many simply do not own."

This isn't the first time Grantham has issued such a doom and gloom call on the markets. He made a similar proclamation about the end of the bull market , calling stocks an "epic bubble." The market and with its third straight year of gains.

Rate hikes will deflate a lot of the market's hot air

Other investing experts share some, but not all, of Grantham's concerns. Jordan Kahn, president and chief investment officer of ACM Funds, which has a portfolio that both buys stocks and short sells ones that it thinks are overvalued, said there are definitely more opportunities on the short side of the market right now.Kahn told CNN Business that his long-short fund is only invested about 30% in bullish positions that it expects to go up. He is also worried about what will happen to stocks as rates go up.

"When rates are at zero for a long time, it's easy to justify almost any valuation, and coming out of 2020 we saw ridiculous prices for stocks," he said, something he hadn't seen since 1999. "But as soon as inflation started people question valuations."

Still, Kahn isn't as bearish as Grantham. Rather than an epic crash, he foresees a series of what he calls "bubble-ettes," mini manias in corners of the market such as crytpocurrencies and speculative, unprofitable tech stocks.

"There has been a lot of blind faith," Kahn said. "There are areas where there has been a lot of speculation and there will be pain there."

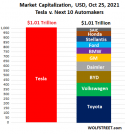

American Tech companies and the likes of Tesla are definitely going to lose a lot of their current valuation which was based on fake money.

Stocks are off to a . The tech-heavy is already in a , a more than 10% drop. And if one the most influential hedge fund managers is to be believed, this could be only the beginning of a very painful time for investors.

Jeremy Grantham, co-founder and chief investment strategist of Grantham, Mayo, & van Otterloo (GMO) said in a report called that stocks are now in the midst of a "superbubble," that it won't end well.

Grantham, who has been running the firm's investments since it was started in 1977, was similarly bearish at market tops in 2000, and during the Great Financial Crisis of 2008.

"Good luck! We'll all need it," said Grantham, whose firm manages about $65 billion in assets.

He noted that have experienced two such "superbubbles" before: 1929, a market fall that led to the Great Depression, and again in 2000, when the dot-com bubble burst. He also said the US housing market was a "superbubble" in 2006 and that the 1989 Japanese stock and housing markets were both "superbubbles."

"All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average," Grantham wrote.

Many investors don't want to believe that the stock market is overdue for a broader pullback, Grantham argues, especially since the market fell into bear territory -- albeit briefly -- in March 2020 at the pandemic's start.

"In a bubble, no one wants to hear the bear case. It is the worst kind of party-pooping," Grantham wrote. "For bubbles, especially superbubbles where we are now, are often the most exhilarating financial experiences of a lifetime."

Grantham believes that the Federal Reserve's moves to cut rates to zero -- and then keep them there for nearly two years -- is a main cause for the market's current frothiness. The Fed is widely expected to begin raising rates at its March meeting.

"One of the main reasons I deplore superbubbles -- and resent the Fed and other financial authorities for allowing and facilitating them -- is the under-recognized damage that bubbles cause as they deflate and mark down our wealth," he wrote.

Grantham added that "as bubbles form, they give us a ludicrously overstated view of our real wealth, which encourages us to spend accordingly. Then, as bubbles break, they crush most of those dreams and accelerate the negative economic forces on the way down."

"To allow bubbles, let alone help them along, is simply bad economic policy," Grantham wrote, adding that he's concerned about "the terrible increase in inequality that goes with higher prices of assets, which many simply do not own."

This isn't the first time Grantham has issued such a doom and gloom call on the markets. He made a similar proclamation about the end of the bull market , calling stocks an "epic bubble." The market and with its third straight year of gains.

Rate hikes will deflate a lot of the market's hot air

Other investing experts share some, but not all, of Grantham's concerns. Jordan Kahn, president and chief investment officer of ACM Funds, which has a portfolio that both buys stocks and short sells ones that it thinks are overvalued, said there are definitely more opportunities on the short side of the market right now.

Kahn told CNN Business that his long-short fund is only invested about 30% in bullish positions that it expects to go up. He is also worried about what will happen to stocks as rates go up.

"When rates are at zero for a long time, it's easy to justify almost any valuation, and coming out of 2020 we saw ridiculous prices for stocks," he said, something he hadn't seen since 1999. "But as soon as inflation started people question valuations."

Still, Kahn isn't as bearish as Grantham. Rather than an epic crash, he foresees a series of what he calls "bubble-ettes," mini manias in corners of the market such as crytpocurrencies and speculative, unprofitable tech stocks.

"There has been a lot of blind faith," Kahn said. "There are areas where there has been a lot of speculation and there will be pain there."

Totally not a bubble..

View attachment 81782

I don't believe it is a bubble.

What we have learned from tech, it seems always that winner takes all.

Micro$oft, Amazon, Google, Facebook, even Netficks.

They were first, they got bigger (while losing money), before we know it, they are a monopoly.

TELSA just seems to be following the same playbook.

After all, we really cannot be certain about the other auto makers.

How many times have Government Motors gone bankrupt? Ford?

Monopoly doesn't mean it makes money though. Monopolies make money if marginal profit to provide a product or service is positive with fixed operation cost so you can recoup the operation cost through forcing a high volume.I don't believe it is a bubble.

What we have learned from tech, it seems always that winner takes all.

Micro$oft, Amazon, Google, Facebook, even Netficks.

They were first, they got bigger (while losing money), before we know it, they are a monopoly.

TELSA just seems to be following the same playbook.

After all, we really cannot be certain about the other auto makers.

How many times have Government Motors gone bankrupt? Ford?

If marginal profit is 0 or negative then a monopoly still doesn't make money.

See Uber.

These are softwre companies.I don't believe it is a bubble.

What we have learned from tech, it seems always that winner takes all.

Micro$oft, Amazon, Google, Facebook, even Netficks.

There is close to 0 cost difference to sell the Facebook to 10000 or 1000 000 000 humans.

That is not true for making cars.

Monopoly doesn't mean it makes money though. Monopolies make money if marginal profit to provide a product or service is positive with fixed operation cost so you can recoup the operation cost through forcing a high volume.

If marginal profit is 0 or negative then a monopoly still doesn't make money.

See Uber.

Uber is not a monopoly.

To this day, no one really knows what Uber is doing.